US stock 24-hour trading

1.What is 24-hour trading?

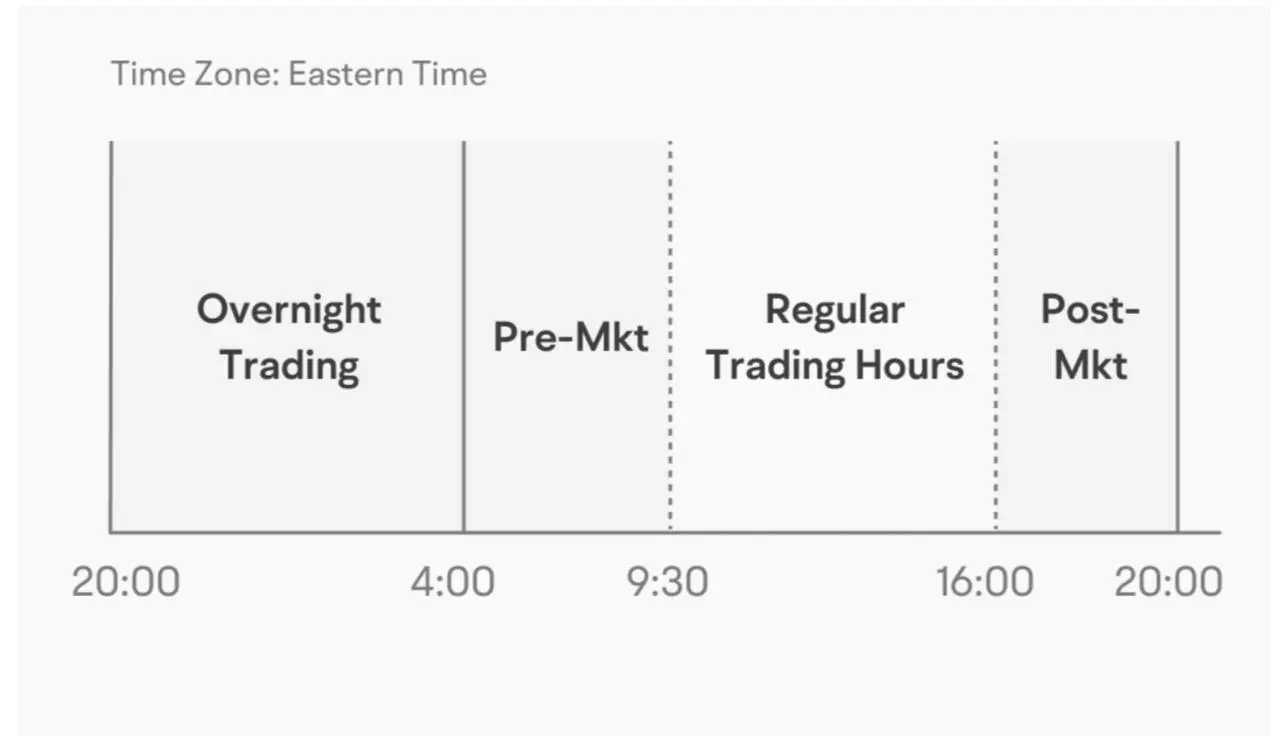

24-hour trading lets you buy and sell stocks around the clock, 5 days a week. It runs from Sunday 8:00 PM to Friday 8:00 PM ET, covering regular trading hours plus pre-market, post-market, and overnight trading sessions. You can place orders anytime during this period.

2.What are the trading fees associated with 24-hour trading?

They are the same as those charged during regular trading hours.

3.How to place a 24-hour order?

Stocks available for 24-hour trading are the same as those available for overnight trading, and you can tell by checking if there is a small "24" icon on the quotes page.

To place a 24-hour trading order, please follow the steps below:

1.Go to the Trade page of a stock.

2.Select 24 Hour Trading in the Session field.

3.Enter the other necessary order parameters and submit the order.

Once submitted, you will be able to find your 24-hour trading orders in the order list.

4.What types of orders can I place for 24-hour trading?

Currently, you can place limit orders only.

5.On which trading day is a 24-hour order recorded?

In the context of 24-hour trading, a trading day runs from 8:00 PM to 8:00 PM ET the next day. Orders are recorded based on the day the trading period ends. For example, an order placed on Monday at 10:00 PM ET will be recorded under Tuesday's trading day.

6.What are the time-in-force options?

You can choose Day, Good-Till-Cancelled (GTC), or Good-Till-Date (GTD) as the time-in-force.

• Day: Valid until the post-market trading session closes (8:00 PM ET) on the current trading day.

• Good-Till-Cancelled (GTC) or Good-Till-Date (GTD): Valid until the post-market trading session closes (8:00 PM ET) on the last trading date.

7.Can I short sell during 24-hour trading?

No. It is not supported.

Important notes

1.When the market transitions between different trading sessions, there may be a brief period, typically lasting several seconds, where open 24-hour orders cannot be executed.

• 24-hour orders that remain open by the end of the overnight session will transition to the pre-market session.

• 24-hour orders that remain open by the end of the post-market session will transition to the next day's overnight session.

2.During the transition from the overnight session to the pre-market session, you may be unable to cancel orders for a brief period, which usually lasts only a few seconds.

Overview

- 1.What is 24-hour trading?

- 2.What are the trading fees associated with 24-hour trading?

- 3.How to place a 24-hour order?

- 4.What types of orders can I place for 24-hour trading?

- 5.On which trading day is a 24-hour order recorded?

- 6.What are the time-in-force options?

- 7.Can I short sell during 24-hour trading?

- Important notes

Market Insights

Star Tech Companies Star Tech Companies

Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy. Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy.

View More

Affordable trading at your fingertips Affordable trading at your fingertips

Warren Buffett Portfolio Warren Buffett Portfolio

Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry. Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry.

No. Symbol 20D % Chg

Log In for the Full List

View More

- No more -