ZakaZulu

liked

$Amazon(AMZN.US$ I think you're seeing just a rotation of money between money leaving Amazon going into Apple and money leaving Amazon going into Nvidia. clearly there's nothing wrong with Amazon they had a stellar quarter the Ford projections are outstanding I think this just goes back to a big percentage of hedge fund money and institutional money chases velocity chases movement Amazon had it Spike now you're getting consolidation and rather than these institutional investors being patient th...

3

6

ZakaZulu

commented on

$Tesla(TSLA.US$ Nvidia Ceo says Tesla is Way ahead in self driving cars and tbat every car will be autonomous in the future.

4

3

ZakaZulu

voted

Rewards

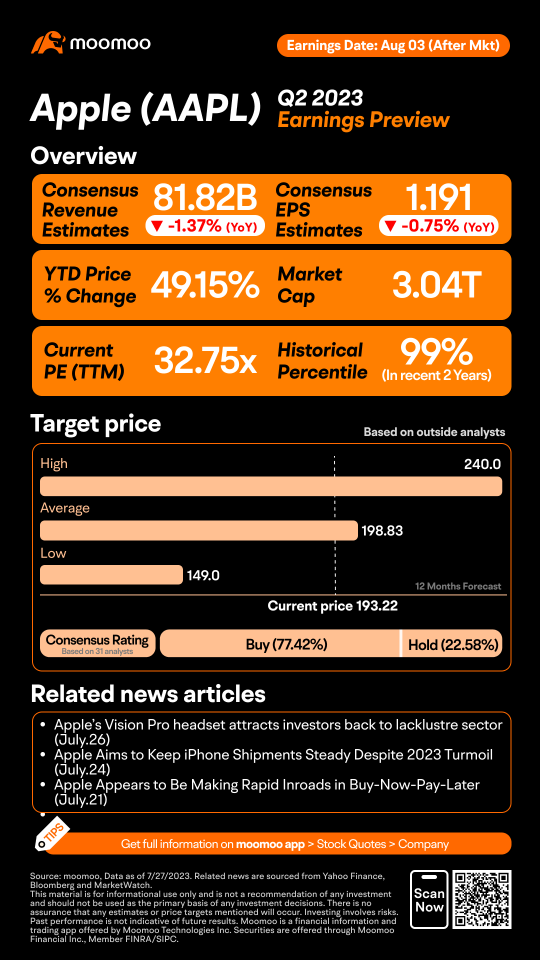

● An equal share of 1,000 points: For mooers who correctly guess AAPL's closing price range on August 4 ET by 2:30 PM, August 4 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing Apple's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewa...

● An equal share of 1,000 points: For mooers who correctly guess AAPL's closing price range on August 4 ET by 2:30 PM, August 4 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing Apple's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewa...

90

105

ZakaZulu

voted

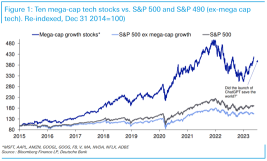

A return to Big Tech stocks while has helped the broader market through the year.

The $SPDR S&P 500 ETF(SPY.US$ is up nearly 10%, while the equal-weighted S&P has gained a little more than 1%.

The Big Tech really has enjoyed the enthusiasm for AI, especially with the quick use of ChatGPT.

"The SPX seems increasingly divorced from decelerating consumer trends and other major indices (except the $Invesco QQQ Trust(QQQ.US$ ) due to ...

The $SPDR S&P 500 ETF(SPY.US$ is up nearly 10%, while the equal-weighted S&P has gained a little more than 1%.

The Big Tech really has enjoyed the enthusiasm for AI, especially with the quick use of ChatGPT.

"The SPX seems increasingly divorced from decelerating consumer trends and other major indices (except the $Invesco QQQ Trust(QQQ.US$ ) due to ...

9

ZakaZulu

voted

$Tesla(TSLA.US$ stock dropped more than 5% in the extended session Wednesday after the electric-vehicle maker narrowly missed quarterly expectations for its revenue and saw adjusted profit margins drop as it cut its EV prices.

Facing this volatile market and constantly having the urge to "buy the dip"?

If you come across $Tesla(TSLA.US$ that could potentially drop to $160, would you place a buy orde...

Facing this volatile market and constantly having the urge to "buy the dip"?

If you come across $Tesla(TSLA.US$ that could potentially drop to $160, would you place a buy orde...

+3

56

11

ZakaZulu

commented on

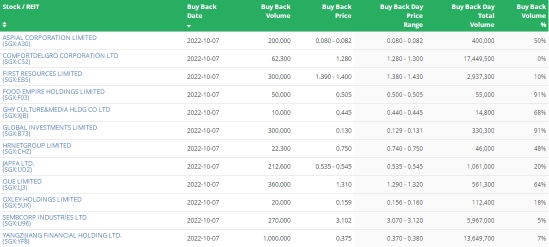

Good morning mooers! Here are things you need to know about today's Singapore:

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

●Singapore shares opened lower on Monday; STI down 1.01%

●Commodities face tough week as Fed angst builds

●Stocks and REITs to watch: Singtel, SPH Reit, Aspen

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened lower on Monday. The $FTSE Singapore Straits Time Index(.STI.SG$ decreased 1.01 per cent to 3,114.16 ...

1443

1387

ZakaZulu

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

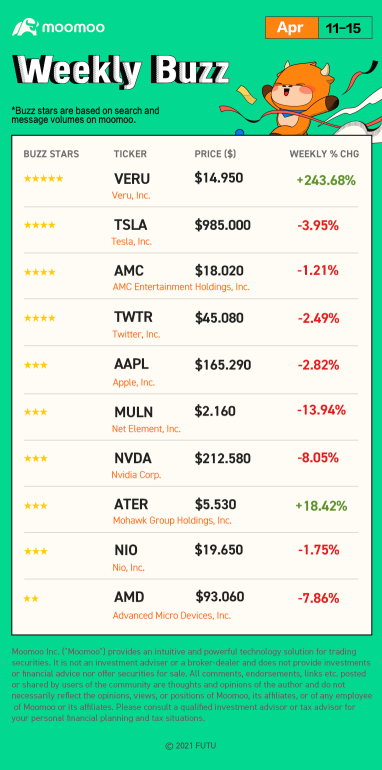

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ Buzzing Stocks List & Mooers Comments

Three major indices moved downward, Russell 2000 Index d...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ Buzzing Stocks List & Mooers Comments

Three major indices moved downward, Russell 2000 Index d...

+2

48

63

ZakaZulu

commented on

New energy & New trend

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

Do you support low-carbon living?

As investors become more environmentally conscious, there is a growing trend in green investing.

Have you ever considered buying a low-carbon ETF to do good for the planet?

![]()

![]()

![]() Take the trading quiz & get prize!

Take the trading quiz & get prize!

Start by learning "What is an ETF?" and then judge if it really does good to your portf...

Countries have advocated low-carbon plans to avoid damaging the environment in recent years.

Do you support low-carbon living?

As investors become more environmentally conscious, there is a growing trend in green investing.

Have you ever considered buying a low-carbon ETF to do good for the planet?

Start by learning "What is an ETF?" and then judge if it really does good to your portf...

95

988

ZakaZulu

voted

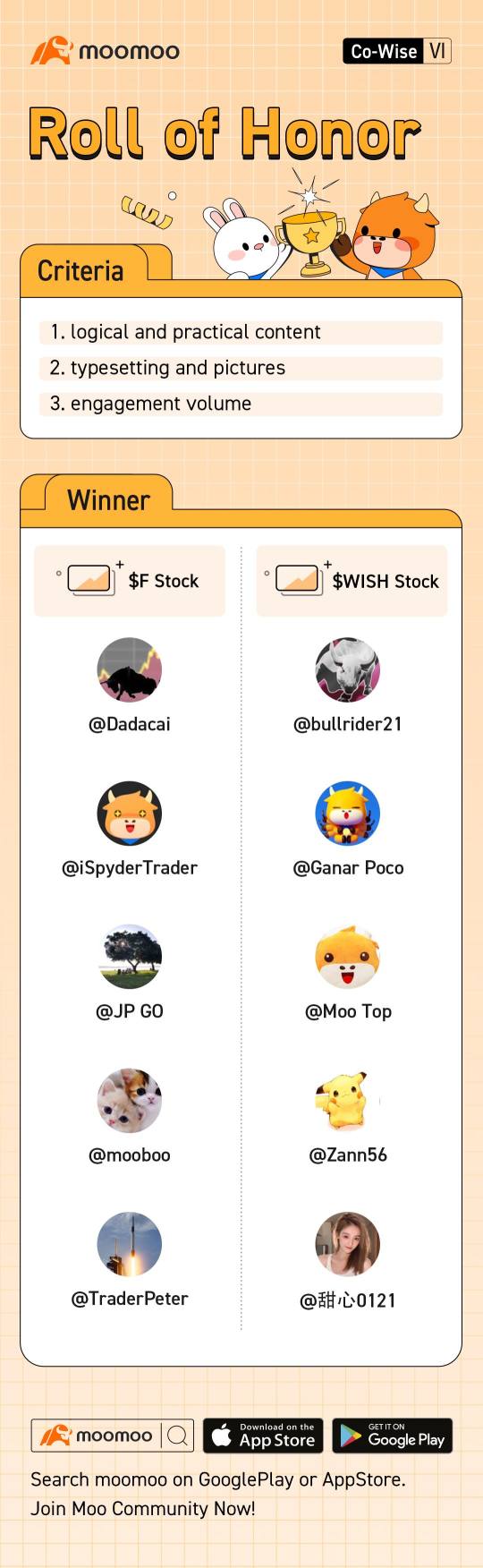

Time flies! You have completed another journey of Co-Wise: What habits help you become a better trader. Thank you all for your participation!![]() In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.

In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.![]()

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.![]() Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

![]()

![]()

![]() Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $Ford Motor(F.US$ and $ContextLogic(WISH.US$ stocks!

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

![]() For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!

For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Expand

Expand 72

29

ZakaZulu

liked

Weekly market recap

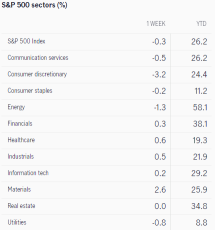

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $Dow Jones Industrial Average(.DJI.US$ dipped 0.6% and the $S&P 500 Index(.SPX.US$ eased 0.3% last week. The tech-focused $Nasdaq Composite Index(.IXIC.US$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$Advance Auto Parts(AAP.US$ , $Lucid Group(LCID.US$ , $Tyson Foods(TSN.US$ , and $Warner Music(WMG.US$ release quarterly results.

$Automatic Data Processing(ADP.US$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$Walmart(WMT.US$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$Home Depot(HD.US$ and $TransDigm(TDG.US$ report earnings.

$Cboe Global Markets(CBOE.US$, $Enphase Energy(ENPH.US$, $Hartford Financial Services(HIG.US$, and $Qualcomm(QCOM.US$ hold their annual investor days.

$Bristol-Myers Squibb(BMY.US$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$Cisco(CSCO.US$ , $Lowe's Companies(LOW.US$ , $NVIDIA(NVDA.US$ , $Target(TGT.US$ , and $TJX Companies(TJX.US$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$Alibaba(BABA.US$ , $Applied Materials(AMAT.US$ , $Intuit(INTU.US$ , $JD.com(JD.US$ , $Ross Stores(ROST.US$ , and $Workday(WDAY.US$ hold conference calls to discuss earnings.

$Cognizant(CTSH.US$ , $Ingersoll Rand(IR.US$ , and $Stryker Corp(SYK.US$ host investor meetings.

$Johnson & Johnson(JNJ.US$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $Charter Communications(CHTR.US$, $Live Nation Entertainment(LYV.US$, and $TripAdvisor(TRIP.US$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$Foot Locker(FL.US$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $Dow Jones Industrial Average(.DJI.US$ dipped 0.6% and the $S&P 500 Index(.SPX.US$ eased 0.3% last week. The tech-focused $Nasdaq Composite Index(.IXIC.US$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$Advance Auto Parts(AAP.US$ , $Lucid Group(LCID.US$ , $Tyson Foods(TSN.US$ , and $Warner Music(WMG.US$ release quarterly results.

$Automatic Data Processing(ADP.US$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$Walmart(WMT.US$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$Home Depot(HD.US$ and $TransDigm(TDG.US$ report earnings.

$Cboe Global Markets(CBOE.US$, $Enphase Energy(ENPH.US$, $Hartford Financial Services(HIG.US$, and $Qualcomm(QCOM.US$ hold their annual investor days.

$Bristol-Myers Squibb(BMY.US$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$Cisco(CSCO.US$ , $Lowe's Companies(LOW.US$ , $NVIDIA(NVDA.US$ , $Target(TGT.US$ , and $TJX Companies(TJX.US$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$Alibaba(BABA.US$ , $Applied Materials(AMAT.US$ , $Intuit(INTU.US$ , $JD.com(JD.US$ , $Ross Stores(ROST.US$ , and $Workday(WDAY.US$ hold conference calls to discuss earnings.

$Cognizant(CTSH.US$ , $Ingersoll Rand(IR.US$ , and $Stryker Corp(SYK.US$ host investor meetings.

$Johnson & Johnson(JNJ.US$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $Charter Communications(CHTR.US$, $Live Nation Entertainment(LYV.US$, and $TripAdvisor(TRIP.US$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$Foot Locker(FL.US$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

167

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)