Are You Bullish or Bearish?

Where Are We in the Cycle?

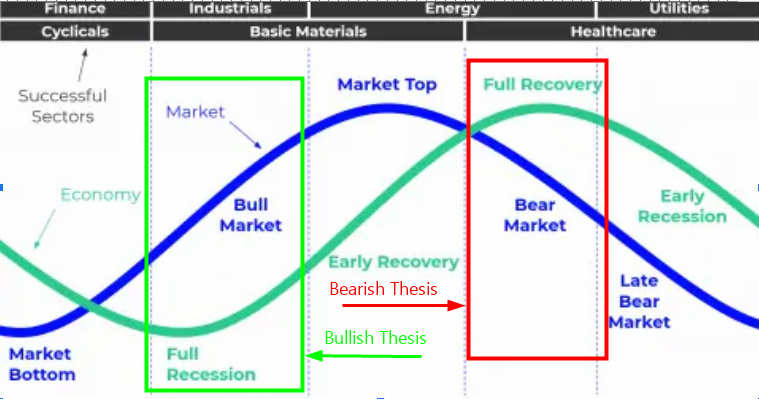

The bulls think that we are at the beginning of a bull market, but the bears think we are near the end of the cycle. Are you bullish or bearish about the economy? Give me your reasons in the comments section.

The recent sell-off in the markets has bolstered the bears viewpoint. The chinese real estate debacle, inflation persisting, the Fed signaling higher for longer, bearish seasonality, the Fitch downgrade, and skyrocketing credit card delinquinces are all adding to the bearish sentiment.

The bulls are seeing the beginning of a new bull market driven by a resilient economy and a tech led AI boom.

Personally, I believe we are experiencing a regular correction before a continuation to the upside. I have highlighted this area in the chart directly above.

I have also highlighted the areas where the bears believe the market is currently.

Are We at the Beginning or the End of the Economic Cycle?

The market experiences regular ups and downs during the mini cycles within the larger economic cycle. The market can only be in one of four stages of the economic cycle. The trough stage, expansion stage, the peak, and the contraction stage.

Where do you believe we are in the current economic cycle?

--ATTENTION ALL MOOERS--

Very soon I will be broadcasting live on the Moomoo platform. I will be giving some of my general insight about options investing through the economic cycle and sector rotation. I would appreciate everyone's viewership, so stay tuned for more details.

As always, this is not investment advice. Good luck trading. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Give your investments time. Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. And just follow the trends. A trend is your friend.

$AMC Entertainment(AMC.US$ $AMC Preferred Equity Unit(APE.US$ $GameStop(GME.US$ $C3.ai(AI.US$ $Palantir(PLTR.US$ $IonQ Inc(IONQ.US$ $Super Micro Computer(SMCI.US$ $Applied Digital(APLD.US$ $Vroom(VRM.US$ $Nikola(NKLA.US$ $American Superconductor(AMSC.US$ $CAVA Group(CAVA.US$ $QuantumScape(QS.US$ $Upstart(UPST.US$ $Carvana(CVNA.US$ $ImmunoGen(IMGN.US$

$Apple(AAPL.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$ $Advanced Micro Devices(AMD.US$ $Amazon(AMZN.US$ $Meta Platforms(META.US$ $Alphabet-C(GOOG.US$ $Alphabet-A(GOOGL.US$ $Netflix(NFLX.US$ $Tesla(TSLA.US$ $UnitedHealth(UNH.US$ $Home Depot(HD.US$ $Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ $Johnson & Johnson(JNJ.US$ $Eli Lilly and Co(LLY.US$ $Visa(V.US$

$Invesco QQQ Trust(QQQ.US$ $iShares Russell 2000 ETF(IWM.US$ $VIX Index Future Main(SEP2)(VXmain.US$ $SPDR S&P 500 ETF(SPY.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$ $Gold Future Main(DEC2)(GCmain.US$ $E-mini Dow Futures Main(MAR3)(YMmain.US$ $E-mini S&P 500 Futures Main(MAR3)(ESmain.US$ $E-mini NASDAQ 100 Futures Main(MAR3)(NQmain.US$ $E-mini S&P MidCap 400 Futures Main(MAR3)(EMDmain.US$ $E-mini Russell 2000 Index Futures Main(MAR3)(RTYmain.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $VIX Index Futures Main(FEB3)(VXmain.US$

$USD(USDindex.FX$ $Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund Etf(UUP.US$ $SPDR Gold ETF(GLD.US$ $iShares Silver Trust(SLV.US$ $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$ $Ishares Iboxx $ Investment Grade Corporate Bond Etf(LQD.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$ $Crude Oil Future Main(OCT2)(CLmain.US$ $VanEck Gold Miners ETF(GDX.US$ $VanEck Vectors Junior Gold Miners ETF(GDXJ.US$

$TENCENT(00700.HK$ $SSE Composite Index(000001.SH$ $CSI 300 Index(000300.SH$ $CSI 300 Index(000300.SH$ $FTSE Singapore Straits Time Index(.STI.SG$ $NIO-SW(09866.HK$ $NIO Inc. USD OV(NIO.SG$ $NIO Inc(NIO.US$ $BILIBILI-SW(09626.HK$ $Bilibili(BILI.US$ $Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $XPeng(XPEV.US$ $Li Auto(LI.US$ $BYD COMPANY(01211.HK$ $BYD Company Limited(002594.SZ$ $S&P/ASX 200(.XJO.AU$ $S&P/ASX 100(.XTO.AU$

$Chevron(CVX.US$ $Phillips 66(PSX.US$ $Valero Energy(VLO.US$ $Devon Energy(DVN.US$ $Occidental Petroleum(OXY.US$ $W&T Offshore(WTI.US$ $United States Oil Fund LP(USO.US$ $United Sts Brent Oil Fd Lp Unit(BNO.US$ $Imperial Petroleum(IMPP.US$ $Houston American Energy(HUSA.US$ $Indonesia Energy(INDO.US$ $BP PLC(BP.US$ $Exxon Mobil(XOM.US$

$Bitcoin(BTC.CC$ $Ethereum(ETH.CC$ $ETC(ETC.CC$ $Yearn.finance(YFI.CC$ $Terra(LUNA.CC$ $Litecoin(LTC.CC$ $Stellar(XLM.CC$ $Cardano(ADA.CC$ $Bitcoin SV(BSV.CC$ $Bitcoin Cash(BCH.CC$ $Compound(COMP.CC$ $Polygon(MATIC.CC$ $Dogecoin(DOGE.CC$ $Metaverse ETP(ETP.CC$ $Verge(XVG.CC$ $Orchid(OXT.CC$ $OMG Network(OMG.CC$ $0x(ZRX.CC$ $Qtum(QTUM.CC$ $NEO(NEO.CC$ $Dash(DASH.CC$ $Theta Token(THETA.CC$ $Tezos(XTZ.CC$ $ZEC(ZEC.CC$ $Maker(MKR.CC$ $Decentraland(MANA.CC$ $Cosmos(ATOM.CC$ $ChainLink(LINK.CC$ $Monero(XMR.CC$ $TRON(TRX.CC$ $Polkadot(DOT.CC$ $XRP(XRP.CC$ $Binance Coin(BNB.CC$ $Bitcoin Gold(BTG.CC$ $Uniswap(UNI.CC$

$Communication Services Select Sector Index(.SIXC.US$ $Technology Select Sector Index(.SIXT.US$ $Energy Select Sector Index(.SIXE.US$ $Consumer Discretionary Select Sector Index(.SIXY.US$ $Materials Select Sector Index(.SIXB.US$ $Health Select Sector Index(.SIXV.US$ $Real Estate Select Sector Index(.SIXRE.US$ $Financial Select Sector Index(.SIXM.US$ $Consumer Staples Select Sector Index(.SIXR.US$ $Utilities Select Sector Index(.SIXU.US$ $Industrials Select Sector Index(.SIXI.US$

$Direxion Daily CSI China Internet Index Bull 2x Shares ETF(CWEB.US$ $China Alphadex First Trust(FCA.US$ $Wisdomtree China Ex-State-Owned Enterprises Fund(CXSE.US$ $S&P Asia 50 Index Ishares(AIA.US$ $KRANESHARES SSE STAR MARKET 50 INDEX ETF(KSTR.US$ $RAYLIANT QUANTAMENTAL CHINA EQUITY ETF(RAYC.US$ $iShares China Large-Cap ETF(FXI.US$ $Xtrackers Harvest CSI 300 China A-Shares ETF(ASHR.US$ $Franklin Templeton Etf Tr Ftse China Etf(FLCH.US$ $db X-trackers Harvest CSI 500 China A-Shares Small Cap Fund(ASHS.US$ $iShares MSCI China ETF(MCHI.US$ $KraneShares CSI China Internet ETF(KWEB.US$ $KRANESHARES CICC CHINA 5G AND SEMICONDUCTOR INDEX ETF(KFVG.US$ $Global X Funds Global X Msci China Consumer Staples Etf(CHIS.US$ $Global X FinTech Thematic ETF(FINX.US$ $Global X Fds Msci China Industrials Etf(CHII.US$ $Global X Fds Msci China Energy Etf(CHIE.US$

$UK FTSE100 Index(.FTSE.GB$ $German DAX30 Index(.GDAXI.DE$ $Italy MIB Index(.FTMIB.IT$ $Belgium BEL20 Index(.BEL20.BE$ $Netherlands AEX Index(.AEX.NL$ $Portugal PSI20 Index(.PSI20.PT$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones U.S. Index(.DJUS.US$ $Dow Jones Industrial Average(.DJI.US$ $S&P 500 index(.SPX.US$ $NASDAQ 100 Index(.NDX.US$

$Activision Blizzard(ATVI.US$ $UBISOFT ENTERTAINMENT UNSP ADR EACH REPR 1/5 ORD(UBSFY.US$ $Sony(SONY.US$ $Take-Two Interactive Software(TTWO.US$ $Electronic Arts Inc(EA.US$ $Microsoft(MSFT.US$ $NetEase(NTES.US$ $CD PROJEKT SA UNSPON ADS EACH REP 0.25 ORD SHS(OTGLY.US$ $Roblox(RBLX.US$ $NINTENDO CO LTD(NTDOY.US$ $Capcom Co., Ltd. Unsponsored ADR(CCOEY.US$ $Square Enix Holdings Co., Ltd. Unsponsored ADR(SQNNY.US$ $KONAMI GROUP CORPORATION UNSPON ADS EACH REP 1/2 ORD SHS(KONMY.US$

$-1X SHORT VIX FUTURES ETF(SVIX.US$ $ProShares Ultra VIX Short-Term Futures ETF(UVXY.US$ $ProShares Short VIX Short-Term Futures ETF(SVXY.US$ $2x Long VIX Futures ETF(UVIX.US$ $DJIA Volatility(.VXD.US$ $NASDAQ 100 Volatility(.VXN.US$ $Cboe VXEEM Ask(.VAEEM.US$ $Cboe Apple VIX(.VXAPL.US$ $Cboe Amazon VIX(.VXAZN.US$ $Cboe IBM VIX(.VXIBM.US$ $Cboe Goldman Sachs VIX(.VXGS.US$ $Cboe 20+ Year Treasury Bond ETF Volatility Index(.VXTLT.US$ $Cboe Gold Volatility Index(.GVZ.US$ $Cboe Crude Oil Volatility Index(.OVX.US$ $S&P/ASX 200 VIX INDEX(.XVI.AU$ $HSI Volatility Index(800125.HK$

$Vanguard Total Bond Market ETF(BND.US$ $USD Emrg Mkts Bond Ishares(EMB.US$ $Short-Treasury Bond Ishares(SHV.US$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF(BIL.US$ $1-3 Year Treasury Bond Ishares(SHY.US$ $3-7 Year Treasury Bond Ishares(IEI.US$ $Ishares 7-10 Year Treasury Bond Etf(IEF.US$ $Ishares Trust 10-20 Year Treasury Bd Etf(TLH.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Revelation 6 : Well, against the popular vote I don’t believe it’s contraction but the peak of a bear market.

A contraction is a period when economic output declines. During this phase, the economy is producing fewer goods and services than it did before.

Our economy hasn’t deteriorated far enough yet. Industrial production is strong and labor is still too good. The economy is still hot and interest rates are being increased to stop inflation. Things are still to good to be in a contraction. Just my opinion though.

SpyderCallOP Revelation 6: Sounds about right to me.

beachlover :

SPGC

SPGC

recent IPO debut last week…tomorrow will be awesome

recent IPO debut last week…tomorrow will be awesome

SPGC

SPGC

SpyderCallOP beachlover: there might some growth potential with this name. But as for a golf equipment company, I don't think this will be another Aaple or Tesla.

THE ANSWER IS : Menstrual Cycle

SpyderCallOP THE ANSWER IS: lots of red candles during that stage of the cyce. I would go with inverse leveraged shares or the vix