Is Tencent Making a Bull Flag?

One of the best companies to own in china, in my opinion, is Tencent. Fundamentally and financially speaking, the company is very sound. The stock price has been in a very long-term uptrend. Tencent is consistently making tens of billions of dollars every month. The Chinese economy is one of the biggest economies in the world, and it still has more room to grow.

What is scary about Tencent is that its share price has been on a downward trajectory for over 2 years. So where will the share price for this chinese bohemouth go next?

Ultra Long-Term Picture

The chart below illustrates Tencent's uptrend that the stock has been experiencing for over 20 years. Over the past couple of years the share price has been falling. Recently, on the monthly candles, the price action formed a lower low than a previous low printed almost 4 years ago.

A lower low in price action has not occurred on Tencent's charts in the past 20 years. This is a bearish development.

Long-Term Picture

In the chart below, you can see the multi-year downtrend highlighted in purple. After printing the lower low in price, as mentioned above, the share price quickly rallied into a bullish breakout of this long-term downward price channel.

The chart went from a false breakdown, straight to a bullish breakout. The good old rug pull. It is almost comical. I hate it when this happens, and it happens all of the time.

The chart also shows a potential bull flag that has formed. Which direction will the stock decide to go when exiting this ranging pattern?

Short-Term Picture

Below, you can see the short-term trend. It is a very well-defined price channel, which is the bull flag mentioned in the chart directly above. The price has been coiling up within this range for quite a while and should be ready to exit very soon.

Any regular technical trader like myself might expect the price to return to support soon before deciding which direction to go next.

If the share price does not bounce off of the trending support shown above, then these are the other major support/resistance levels I will be watching for Tencent. Watch for a large volume of buyers or sellers at these levels.

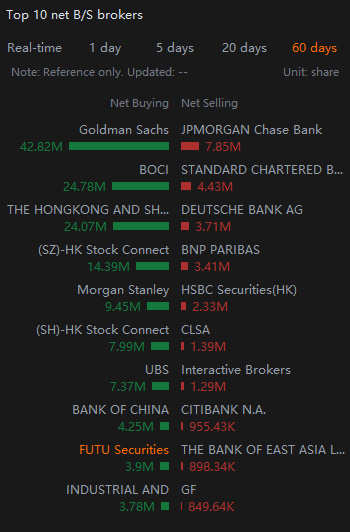

I should point out that over the past 60 days, major investment firms have invested much more capital than those that have divested. This appears to be bullish, in my opinion.

Conclusion

In conclusion, I really want to go long on this company. I really like Tencent. The downtrend over the past 2 years scares me, but this is a great company. Technically speaking, if the price can climb out of this bull flag, then the charts will look a lot more bullish in the shot-term picture. When that happens happens then I might consider a long position. But I would only be swing trading this name for short-term gains until things look more technically bullish in the long-term picture.

As always, this is not investment advice. Good luck trading. Be careful and be patient. Give your investments time. Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. And just follow the trends. A trend is your friend.

$Invesco QQQ Trust(QQQ.US$ $iShares Russell 2000 ETF(IWM.US$ $VIX Index Future Main(SEP2)(VXmain.US$ $SPDR S&P 500 ETF(SPY.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$ $Gold Future Main(DEC2)(GCmain.US$ $E-mini Dow Futures Main(MAR3)(YMmain.US$ $E-mini S&P 500 Futures Main(MAR3)(ESmain.US$ $E-mini NASDAQ 100 Futures Main(MAR3)(NQmain.US$ $E-mini S&P MidCap 400 Futures Main(MAR3)(EMDmain.US$ $E-mini Russell 2000 Index Futures Main(MAR3)(RTYmain.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $VIX Index Futures Main(FEB3)(VXmain.US$

$USD(USDindex.FX$ $Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund Etf(UUP.US$ $SPDR Gold ETF(GLD.US$ $iShares Silver Trust(SLV.US$ $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$ $Ishares Iboxx $ Investment Grade Corporate Bond Etf(LQD.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$ $Crude Oil Future Main(OCT2)(CLmain.US$ $VanEck Gold Miners ETF(GDX.US$ $VanEck Vectors Junior Gold Miners ETF(GDXJ.US$

$TENCENT(00700.HK$ $SSE Composite Index(000001.SH$ $CSI 300 Index(000300.SH$ $CSI 300 Index(000300.SH$ $FTSE Singapore Straits Time Index(.STI.SG$ $NIO-SW(09866.HK$ $NIO Inc. USD OV(NIO.SG$ $NIO Inc(NIO.US$ $BILIBILI-SW(09626.HK$ $Bilibili(BILI.US$ $Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $XPeng(XPEV.US$ $Li Auto(LI.US$ $BYD COMPANY(01211.HK$ $BYD Company Limited(002594.SZ$ $S&P/ASX 200(.XJO.AU$ $FTSE Singapore Straits Time Index(.STI.SG$

$Chevron(CVX.US$ $Phillips 66(PSX.US$ $Valero Energy(VLO.US$ $Devon Energy(DVN.US$ $Occidental Petroleum(OXY.US$ $W&T Offshore(WTI.US$ $United States Oil Fund LP(USO.US$ $United Sts Brent Oil Fd Lp Unit(BNO.US$ $Imperial Petroleum(IMPP.US$ $Houston American Energy(HUSA.US$ $Indonesia Energy(INDO.US$ $BP PLC(BP.US$ $Exxon Mobil(XOM.US$

$Bitcoin(BTC.CC$ $Ethereum(ETH.CC$ $ETC(ETC.CC$ $Yearn.finance(YFI.CC$ $Terra(LUNA.CC$ $Litecoin(LTC.CC$ $Stellar(XLM.CC$ $Cardano(ADA.CC$ $Bitcoin SV(BSV.CC$ $Bitcoin Cash(BCH.CC$ $Compound(COMP.CC$ $Polygon(MATIC.CC$ $Dogecoin(DOGE.CC$ $Metaverse ETP(ETP.CC$ $Verge(XVG.CC$ $Orchid(OXT.CC$ $OMG Network(OMG.CC$ $0x(ZRX.CC$ $Qtum(QTUM.CC$ $NEO(NEO.CC$ $Dash(DASH.CC$ $Theta Token(THETA.CC$ $Tezos(XTZ.CC$ $ZEC(ZEC.CC$ $Maker(MKR.CC$ $Decentraland(MANA.CC$ $Cosmos(ATOM.CC$ $ChainLink(LINK.CC$ $Monero(XMR.CC$ $TRON(TRX.CC$ $Polkadot(DOT.CC$ $XRP(XRP.CC$ $Binance Coin(BNB.CC$ $Bitcoin Gold(BTG.CC$ $Uniswap(UNI.CC$

$Communication Services Select Sector Index(.SIXC.US$ $Technology Select Sector Index(.SIXT.US$ $Energy Select Sector Index(.SIXE.US$ $Consumer Discretionary Select Sector Index(.SIXY.US$ $Materials Select Sector Index(.SIXB.US$ $Health Select Sector Index(.SIXV.US$ $Real Estate Select Sector Index(.SIXRE.US$ $Financial Select Sector Index(.SIXM.US$ $Consumer Staples Select Sector Index(.SIXR.US$ $Utilities Select Sector Index(.SIXU.US$ $Industrials Select Sector Index(.SIXI.US$

$Direxion Daily CSI China Internet Index Bull 2x Shares ETF(CWEB.US$ $China Alphadex First Trust(FCA.US$ $Wisdomtree China Ex-State-Owned Enterprises Fund(CXSE.US$ $S&P Asia 50 Index Ishares(AIA.US$ $KRANESHARES SSE STAR MARKET 50 INDEX ETF(KSTR.US$ $RAYLIANT QUANTAMENTAL CHINA EQUITY ETF(RAYC.US$ $iShares China Large-Cap ETF(FXI.US$ $Xtrackers Harvest CSI 300 China A-Shares ETF(ASHR.US$ $Franklin Templeton Etf Tr Ftse China Etf(FLCH.US$ $db X-trackers Harvest CSI 500 China A-Shares Small Cap Fund(ASHS.US$ $iShares MSCI China ETF(MCHI.US$ $KraneShares CSI China Internet ETF(KWEB.US$ $KRANESHARES CICC CHINA 5G AND SEMICONDUCTOR INDEX ETF(KFVG.US$ $Global X Funds Global X Msci China Consumer Staples Etf(CHIS.US$ $Global X FinTech Thematic ETF(FINX.US$ $Global X Fds Msci China Industrials Etf(CHII.US$ $Global X Fds Msci China Energy Etf(CHIE.US$

$UK FTSE100 Index(.FTSE.GB$ $German DAX30 Index(.GDAXI.DE$ $Italy MIB Index(.FTMIB.IT$ $Belgium BEL20 Index(.BEL20.BE$ $Netherlands AEX Index(.AEX.NL$ $Portugal PSI20 Index(.PSI20.PT$ $Nasdaq Composite Index(.IXIC.US$ $Dow Jones U.S. Index(.DJUS.US$ $Dow Jones Industrial Average(.DJI.US$ $S&P 500 index(.SPX.US$ $NASDAQ 100 Index(.NDX.US$

$Activision Blizzard(ATVI.US$ $UBISOFT ENTERTAINMENT UNSP ADR EACH REPR 1/5 ORD(UBSFY.US$ $Sony(SONY.US$ $Take-Two Interactive Software(TTWO.US$ $Electronic Arts Inc(EA.US$ $Microsoft(MSFT.US$ $NetEase(NTES.US$ $CD PROJEKT SA UNSPON ADS EACH REP 0.25 ORD SHS(OTGLY.US$ $Roblox(RBLX.US$ $NINTENDO CO LTD(NTDOY.US$ $Capcom Co., Ltd. Unsponsored ADR(CCOEY.US$ $Square Enix Holdings Co., Ltd. Unsponsored ADR(SQNNY.US$ $KONAMI GROUP CORPORATION UNSPON ADS EACH REP 1/2 ORD SHS(KONMY.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SpyderCallOP : @102640653 check it out

102640653 SpyderCallOP: Thanks . What r your views on the China n hongkong markets. Do u see a bottom here or u see another wave down.

SpyderCallOP 102640653: I wish I had more time to follow the Asian markets more. All I follow is the economic data and the news headlines. I don't know how the economy really is holding up, as I am not in China.

But, the economic data says that China is slowing down. I don't think the Chinese economy will slow down forever. I think this is a very good buying opportunity for a lot of stocks in the Chinese and Hong Kong markets because I think China has more growth in the future. China is the biggest economy and supplies most of the world with more goods and services than any other country. I like China for an ultra long-term play. But right now, I am in sit and wait mode until the technical trend makes an obvious turn to the upside or until the economic data is more exciting

Jet Bomb : do you ever read the news or announcements on the app? meme reversion!

Jet Bomb : cooked

SpyderCallOP Jet Bomb: so you think china is due for a major correction? That could possibly happen if Europe and America fall into a recession

junclj1223 : Why don’t you buy AAPL directly instead of tag AAPL include into your post?

SpyderCallOP junclj1223: I will just stick to my options plays. check this out. big money!!!

I could have made more on this contract also. I sold it, but it is still printing money

I could have made more on this contract also. I sold it, but it is still printing money

SpyderCallOP Jet Bomb: Either way it goes, there is still money to be made. You don't need to like my analysis because it is all pure opinion. But my thesis pays me nicely and often. You stick your memes. I will stick to my options gains.

Jet Bomb : come at me when you get out of PDT

View more comments...