Latest

Hot

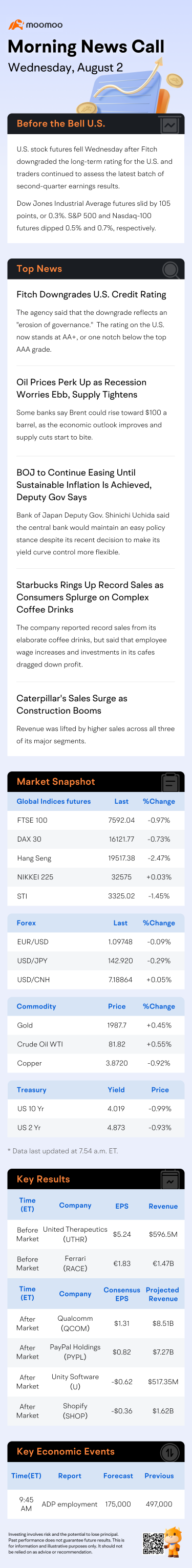

US DEBT FITCH DOWNGRADE

FROM AAA

TO AA+

Downgrades makes it slightly more expensive to borrow money

The last time the US had a downgrade was 2011, due to debt ceiling negotiations

$Advanced Micro Devices(AMD.US$ $Rivian Automotive(RIVN.US$ $Coinbase(COIN.US$ $SPDR S&P 500 ETF(SPY.US$ $Upstart(UPST.US$ $Affirm Holdings(AFRM.US$

FROM AAA

TO AA+

Downgrades makes it slightly more expensive to borrow money

The last time the US had a downgrade was 2011, due to debt ceiling negotiations

$Advanced Micro Devices(AMD.US$ $Rivian Automotive(RIVN.US$ $Coinbase(COIN.US$ $SPDR S&P 500 ETF(SPY.US$ $Upstart(UPST.US$ $Affirm Holdings(AFRM.US$

8

3

Fitch Ratings downgraded US long-term default rating to AA+ from AAA

They shared that “the repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management”.

The last time US had a similar downgrade, the stock market fell quite a fair bit. Let’s see what impact it has on the market now.

US futures opened lower today.

$SPDR S&P 500 ETF(SPY.US$ $S&P 500 Index(.SPX.US$ $Invesco QQQ Trust(QQQ.US$ $ProShares UltraPro QQQ ETF(TQQQ.US$ $ProShares UltraPro Short QQQ ETF(SQQQ.US$ $Dow Jones Industrial Average(.DJI.US$ $NASDAQ 100 Index(.NDX.US$ $Tesla(TSLA.US$ $Apple(AAPL.US$ $Netflix(NFLX.US$ $Amazon(AMZN.US$ $Intel(INTC.US$ $Advanced Micro Devices(AMD.US$ $Meta Platforms(META.US$ $Microsoft(MSFT.US$ $Alphabet-A(GOOGL.US$ $Adobe(ADBE.US$ $NVIDIA(NVDA.US$ $SPDR Portfolio S&P 500 ETF(SPLG.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $USD(USDindex.FX$ $Spotify Technology(SPOT.US$ $Morgan Stanley(MS.US$ $Goldman Sachs(GS.US$ $Jpmorgan Chase & Co.(AMJ.US$ $JPMorgan(JPM.US$ $Enphase Energy(ENPH.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$ $Digital World Acquisition Corp(DWAC.US$

They shared that “the repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management”.

The last time US had a similar downgrade, the stock market fell quite a fair bit. Let’s see what impact it has on the market now.

US futures opened lower today.

$SPDR S&P 500 ETF(SPY.US$ $S&P 500 Index(.SPX.US$ $Invesco QQQ Trust(QQQ.US$ $ProShares UltraPro QQQ ETF(TQQQ.US$ $ProShares UltraPro Short QQQ ETF(SQQQ.US$ $Dow Jones Industrial Average(.DJI.US$ $NASDAQ 100 Index(.NDX.US$ $Tesla(TSLA.US$ $Apple(AAPL.US$ $Netflix(NFLX.US$ $Amazon(AMZN.US$ $Intel(INTC.US$ $Advanced Micro Devices(AMD.US$ $Meta Platforms(META.US$ $Microsoft(MSFT.US$ $Alphabet-A(GOOGL.US$ $Adobe(ADBE.US$ $NVIDIA(NVDA.US$ $SPDR Portfolio S&P 500 ETF(SPLG.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $USD(USDindex.FX$ $Spotify Technology(SPOT.US$ $Morgan Stanley(MS.US$ $Goldman Sachs(GS.US$ $Jpmorgan Chase & Co.(AMJ.US$ $JPMorgan(JPM.US$ $Enphase Energy(ENPH.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$ $Digital World Acquisition Corp(DWAC.US$

6

7

Fitch downgrades the United States' long-term credit rating from AAA to AA+.

Fitch says that "repeated debt-limit political standoffs and last-minute resolutions" are to blame.

They note that debt ceiling standoffs have "eroded" confidence in fiscal management.

Fitch just called the United States fiscally irresponsible.

$Nasdaq Composite Index(.IXIC.US$ $美元指数(USDindex.FX$ $S&P 500 Index(.SPX.US$ $SPDR S&P 500 ETF(SPY.US$ $Dow Jones Industrial Average(.DJI.US$ $Apple(AAPL.US$

Fitch says that "repeated debt-limit political standoffs and last-minute resolutions" are to blame.

They note that debt ceiling standoffs have "eroded" confidence in fiscal management.

Fitch just called the United States fiscally irresponsible.

$Nasdaq Composite Index(.IXIC.US$ $美元指数(USDindex.FX$ $S&P 500 Index(.SPX.US$ $SPDR S&P 500 ETF(SPY.US$ $Dow Jones Industrial Average(.DJI.US$ $Apple(AAPL.US$

7

3

$Biolase(BIOL.US$ Dont get caught sleeping on this one. Blast off is coming today.

6

$NIO Inc(NIO.US$

Market crash due to Fitch cuts US credit rating. Whole US market dip and also affected the HK market. I think…

Perhaps a great shopping day, buy the dip.

Just sharing some thoughts.

Market crash due to Fitch cuts US credit rating. Whole US market dip and also affected the HK market. I think…

Perhaps a great shopping day, buy the dip.

Just sharing some thoughts.

4

1

You can't make this up:

Fitch just downgraded the United States' credit rating and said they lost confidence in the government's "fiscal management."

Fitch basically just called the US fiscally irresponsible.

As we saw in the 2011 debt ceiling crisis, cutting the US credit rating is expensive.

Borrowing costs rise and confidence in the system is lost.

Now, history has repeated itself.

Only this time, the debt ceiling is effectively uncapped until January 1st, 2025.

Meanwhile, spending "unexpecte...

Fitch just downgraded the United States' credit rating and said they lost confidence in the government's "fiscal management."

Fitch basically just called the US fiscally irresponsible.

As we saw in the 2011 debt ceiling crisis, cutting the US credit rating is expensive.

Borrowing costs rise and confidence in the system is lost.

Now, history has repeated itself.

Only this time, the debt ceiling is effectively uncapped until January 1st, 2025.

Meanwhile, spending "unexpecte...

4

1

$E-mini NASDAQ 100 Futures(JUN4)(NQmain.US$

anyone can explain this article ?? who is fitch and why only fitch can downgade usa rating ? need some pro to explain thanks

anyone can explain this article ?? who is fitch and why only fitch can downgade usa rating ? need some pro to explain thanks

1

1

Silverbat : Great buys!

101656455 : Yes

101566315 : good info