Wugui27

voted

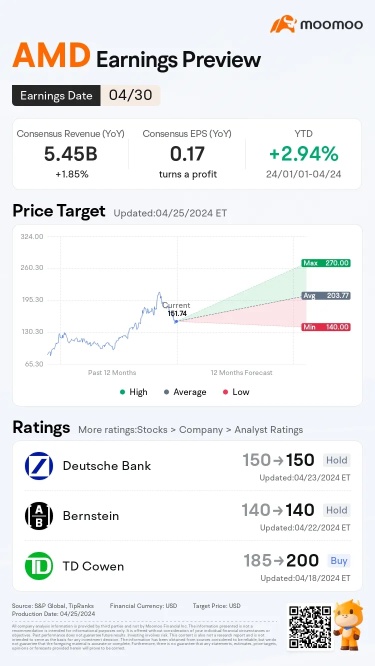

AMD and Amazon are releasing their Q1 earnings after the market closes on April 30. Who will please the market more, the e-commerce giant or the AI darling? Make your prediction to grab point rewards!

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the winner who makes the biggest gains in Wednesday's intraday trading (e.g., If 50 mooers make a correct guess, each of them will get 100 points.)

(Vote will close at 9:3...

51

48

Wugui27

voted

Dear mooers,

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

There are only a few days before the New Year's bell rings. New year, new hope!

For most investors, 2022 is a roller coaster ride. As we approach the end of 2022, all three major US stock indexes are on track to break their 3-year winning streaks and have their worst year since 2008. Let's look at the performance of the —an indicator of US stock performance this year:

* S&P 500 index focuses on the larg...

119

483

Wugui27

liked

After a slow and somewhat painful Monday, the stock markets burst higher on Tuesday, rallying on impressive upside breadth. With that in mind, let's look at a few top stock trades as we push through the holiday-shortened trading week. ![]()

![]()

![]()

![]() Top stock trades for today No. 1: The Ark Innovation Fund

Top stock trades for today No. 1: The Ark Innovation Fund![]()

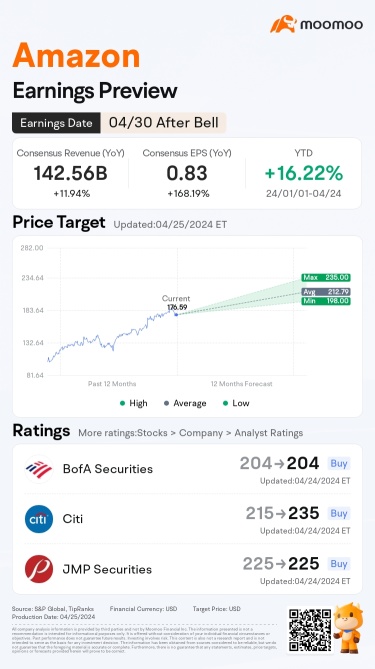

The $ARK Innovation ETF(ARKK.US$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.![]()

![]()

![]()

However, a break of this week's low flashes some rather bright caution signs, in my view.

![]() Top stock trades for today No. 2: Pfizer

Top stock trades for today No. 2: Pfizer![]()

$Pfizer(PFE.US$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.![]()

![]()

![]()

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.![]()

![]()

![]()

![]() Top trades for today No. 3: Rite Aid

Top trades for today No. 3: Rite Aid![]()

$Rite Aid(RAD.US$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.![]()

![]()

![]()

Source: InvestorPlace

The $ARK Innovation ETF(ARKK.US$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.

However, a break of this week's low flashes some rather bright caution signs, in my view.

$Pfizer(PFE.US$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.

$Rite Aid(RAD.US$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.

Source: InvestorPlace

27

2

Wugui27

reacted to

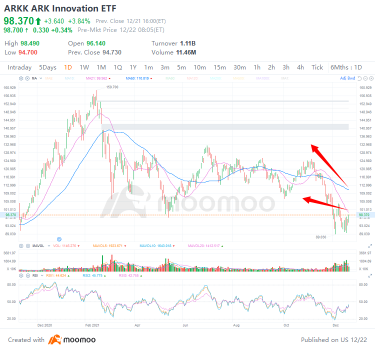

Are you always missing out on great opportunities? Try moomoo's AI Monitor feature. Our system will automatically monitor the market sentiment and alert you on the stocks you may find interesting.

![]() What is AI Monitor

What is AI Monitor

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

202

8

Wugui27

liked

Hi, mooers,![]()

Welcome back to Mooers' Stories! In this session, we are going to share the following topic: What's the biggest mistake you've made while trading?![]()

![]()

We are all human beings, and making mistakes is human nature. When trading stocks, we are either driven by emotions, especially greed and fear, or we keep very high-profit expectations.![]() Many stock traders enter the market at full speed, but they soon realize that it isn't that easy to keep making money. The prospects of making money lure people into this trading area, but the reality of losses may quickly bring deterrence and frustration.

Many stock traders enter the market at full speed, but they soon realize that it isn't that easy to keep making money. The prospects of making money lure people into this trading area, but the reality of losses may quickly bring deterrence and frustration. ![]() Therefore, as investors, you must understand that making mistakes is not uncommon. Even professionals in the stock market have made many trading mistakes. The key to their ultimate success is to learn from them and minimize them in the future.

Therefore, as investors, you must understand that making mistakes is not uncommon. Even professionals in the stock market have made many trading mistakes. The key to their ultimate success is to learn from them and minimize them in the future.![]()

![]()

Making mistakes is part of the learning process when it comes to trading or investing. While some trading mistakes are unavoidable, it is important that you don’t make a habit of them and learn from the unsuccessful experience. With that in mind, what's the biggest mistake you made? How much did it cost you? What lesson did you learn from it? Click to join the topic discussion now! --What's the biggest mistake you made?

![]()

![]() Rewards

Rewards![]()

![]()

Featured Stories:

3 mooers will get 1,888 points;

10 mooers will get 888 points.

Participation Reward:

All relevant posts with more than 30 words will get 66 points!

*Note: one can only get one reward out of the three mentioned above.

![]()

![]()

![]() Selection criteria

Selection criteria![]()

![]()

1. Content quality: authentic personal story.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

Event Duration: Now–December 28th, 11:59 pm ET

Click here to join now! What's the biggest mistake you made?

Write your own ideas: Plagiarism or cheating is not acceptable on moomoo in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

Check here “Mooers' Stories" for more stories in the previous sessions.

Welcome back to Mooers' Stories! In this session, we are going to share the following topic: What's the biggest mistake you've made while trading?

We are all human beings, and making mistakes is human nature. When trading stocks, we are either driven by emotions, especially greed and fear, or we keep very high-profit expectations.

Making mistakes is part of the learning process when it comes to trading or investing. While some trading mistakes are unavoidable, it is important that you don’t make a habit of them and learn from the unsuccessful experience. With that in mind, what's the biggest mistake you made? How much did it cost you? What lesson did you learn from it? Click to join the topic discussion now! --What's the biggest mistake you made?

Featured Stories:

3 mooers will get 1,888 points;

10 mooers will get 888 points.

Participation Reward:

All relevant posts with more than 30 words will get 66 points!

*Note: one can only get one reward out of the three mentioned above.

1. Content quality: authentic personal story.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

Event Duration: Now–December 28th, 11:59 pm ET

Click here to join now! What's the biggest mistake you made?

Write your own ideas: Plagiarism or cheating is not acceptable on moomoo in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

Check here “Mooers' Stories" for more stories in the previous sessions.

109

30

Wugui27

liked

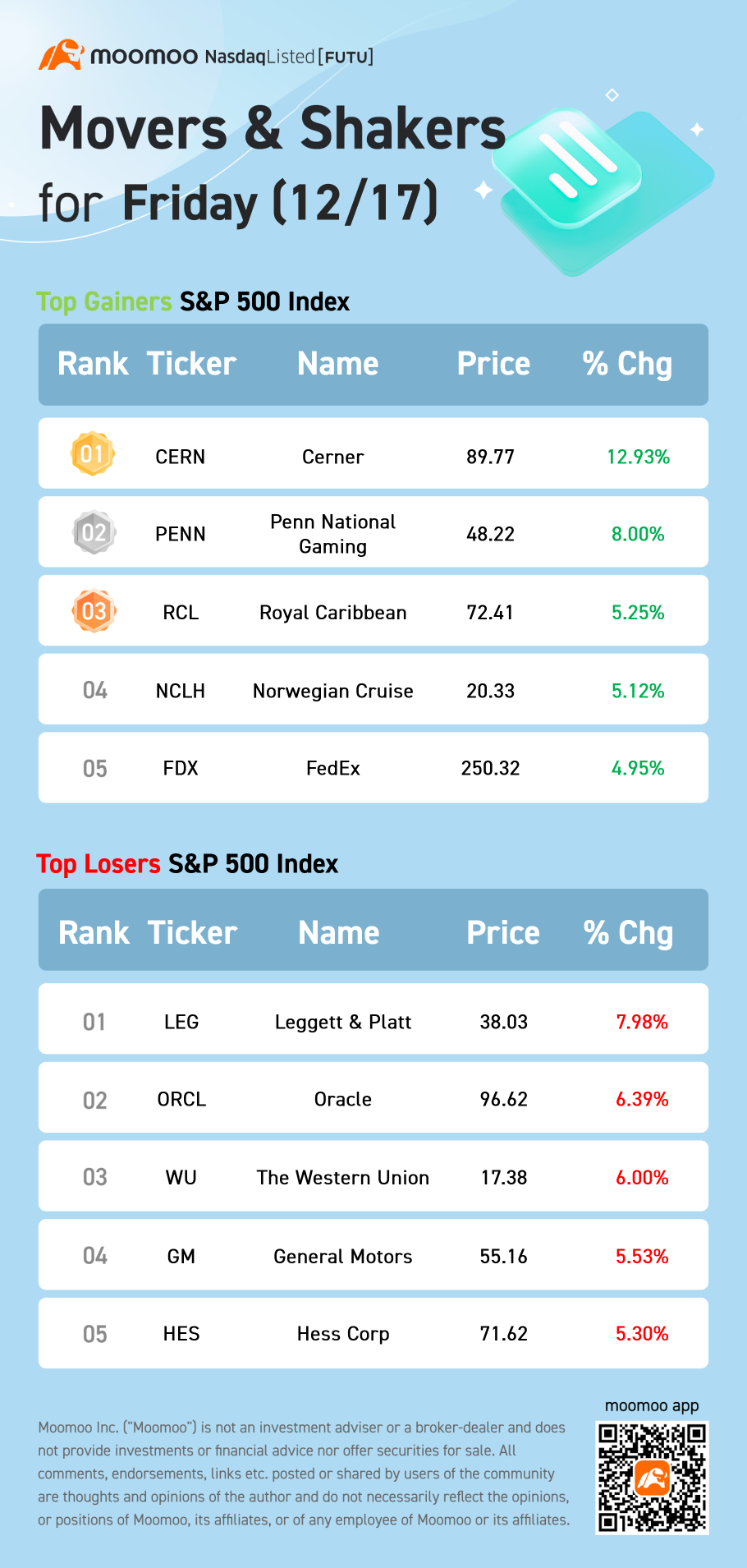

U.S. stocks came under pressure again in Friday's volatile session amid worries about tighter monetary policy and the ongoing pandemic, leading to a losing week for the major averages.

The $Dow Jones Industrial Average(.DJI.US$ dropped 532.20 points, or 1.5%, to 35,365.44. The $S&P 500 Index(.SPX.US$ fell 1% for a second down day to 4,620.64. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ ended the session less than 0.1% lower at 15,169.68 after briefly trading in the green. At its session low, the Nasdaq dropped about 1.5%.

The major averages posted a negative week with the Nasdaq being the biggest loser. The tech-heavy benchmark declined nearly 3%, while the Dow and the S&P 500 slipped 1.7% and 1.9%, respectively.

$Cerner(CERN.US$ $Penn Entertainment(PENN.US$ $General Motors(GM.US$ $FedEx(FDX.US$ $Oracle(ORCL.US$

The $Dow Jones Industrial Average(.DJI.US$ dropped 532.20 points, or 1.5%, to 35,365.44. The $S&P 500 Index(.SPX.US$ fell 1% for a second down day to 4,620.64. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ ended the session less than 0.1% lower at 15,169.68 after briefly trading in the green. At its session low, the Nasdaq dropped about 1.5%.

The major averages posted a negative week with the Nasdaq being the biggest loser. The tech-heavy benchmark declined nearly 3%, while the Dow and the S&P 500 slipped 1.7% and 1.9%, respectively.

$Cerner(CERN.US$ $Penn Entertainment(PENN.US$ $General Motors(GM.US$ $FedEx(FDX.US$ $Oracle(ORCL.US$

38

Wugui27

liked

Hey mooers![]()

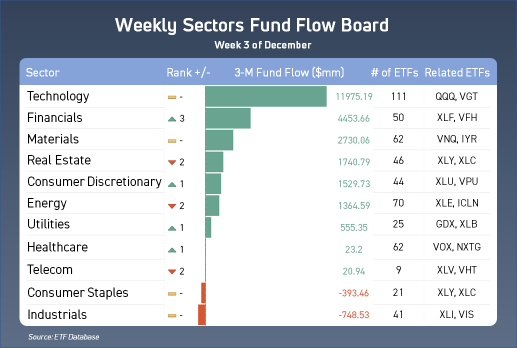

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Update in Premarket on Friday :

*Tech

Technology stocks were declining as the $The Technology Select Sector SPDR® Fund(XLK.US$ dropped 1.3% and the $iShares Semiconductor ETF(SOXX.US$ was off by 1.2%.

$Bottomline Technologies(EPAY.US$ advanced more than 15% after it agreed to be bought by software investment firm Thoma Bravo for $2.6 billion in an all-cash go-private deal.

*Financial

Financial stocks were retreating as the $Financial Select Sector SPDR Fund(XLF.US$ was 0.3% lower in recent trading.

The $Direxion Daily Financial Bull 3X Shares ETF(FAS.US$ declined 1% and its bearish counterpart $Direxion Daily Financial Bear 3X Shares ETF(FAZ.US$ were up 1.5%.

*Consumer

Consumer stocks were mixed ahead of the opening bell on Friday as the $Consumer Staples Select Sector SPDR Fund(XLP.US$ was 0.2% higher while the $Consumer Discretionary Select Sector SPDR Fund(XLY.US$ was recently down 0.8%.

$Rivian Automotive(RIVN.US$ dropped 8% after the electric automaker posted a wider loss in its most recent reporting quarter. The company also unveiled plans to invest $5 billion on a second production facility in Georgia.

*Energy

Energy stocks were declining premarket Friday as the $Energy Select Sector SPDR Fund(XLE.US$ dipped 0.6%.

The $United States Oil Fund LP(USO.US$ was off 0.8% and the $United States Natural Gas(UNG.US$ dropped 1.5%.

Source: MT Newswires

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two sector-realted ETFs with the highest total assets! Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Update in Premarket on Friday :

*Tech

Technology stocks were declining as the $The Technology Select Sector SPDR® Fund(XLK.US$ dropped 1.3% and the $iShares Semiconductor ETF(SOXX.US$ was off by 1.2%.

$Bottomline Technologies(EPAY.US$ advanced more than 15% after it agreed to be bought by software investment firm Thoma Bravo for $2.6 billion in an all-cash go-private deal.

*Financial

Financial stocks were retreating as the $Financial Select Sector SPDR Fund(XLF.US$ was 0.3% lower in recent trading.

The $Direxion Daily Financial Bull 3X Shares ETF(FAS.US$ declined 1% and its bearish counterpart $Direxion Daily Financial Bear 3X Shares ETF(FAZ.US$ were up 1.5%.

*Consumer

Consumer stocks were mixed ahead of the opening bell on Friday as the $Consumer Staples Select Sector SPDR Fund(XLP.US$ was 0.2% higher while the $Consumer Discretionary Select Sector SPDR Fund(XLY.US$ was recently down 0.8%.

$Rivian Automotive(RIVN.US$ dropped 8% after the electric automaker posted a wider loss in its most recent reporting quarter. The company also unveiled plans to invest $5 billion on a second production facility in Georgia.

*Energy

Energy stocks were declining premarket Friday as the $Energy Select Sector SPDR Fund(XLE.US$ dipped 0.6%.

The $United States Oil Fund LP(USO.US$ was off 0.8% and the $United States Natural Gas(UNG.US$ dropped 1.5%.

Source: MT Newswires

95

13

Wugui27

liked

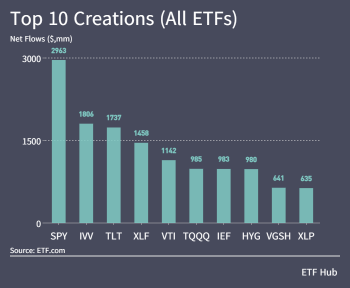

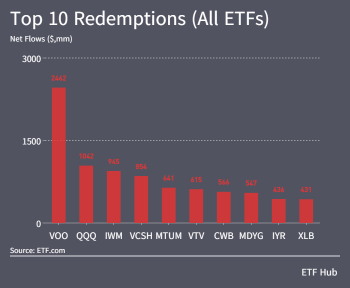

U.S.-listed ETFs fell off slightly in inflows compared to the previous week, but still maintained a healthy inflow of about $18.1 billion in new assets between Dec. 3 and Dec. 9.

Mix Of Risk-On, Risk-Off Inflows

The top of the flows board featured the stalwarts $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$, at $2.9 billion and $1.8 billion in inflows, respectively.

However, the rest of the leaderboard was split between defensive and growt...

Mix Of Risk-On, Risk-Off Inflows

The top of the flows board featured the stalwarts $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$, at $2.9 billion and $1.8 billion in inflows, respectively.

However, the rest of the leaderboard was split between defensive and growt...

92

6

Wugui27

liked

Spoiler:

At the end of this post, there is a chance for you to win points!

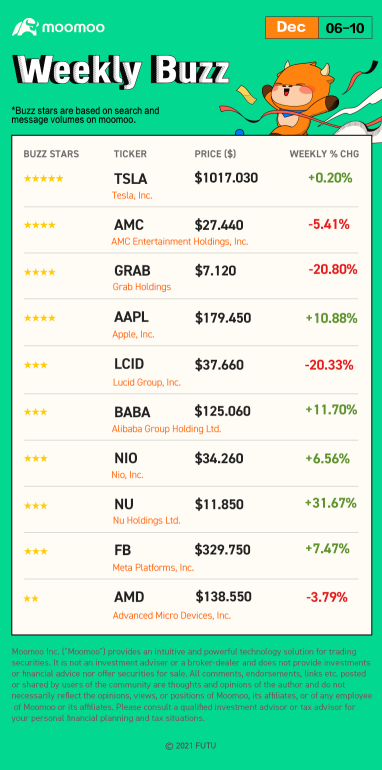

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved upword last week. Her...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved upword last week. Her...

+15

110

61

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)