AIP/DCA is always a good tool of investment

andytay12

liked

$Netflix(NFLX.US$

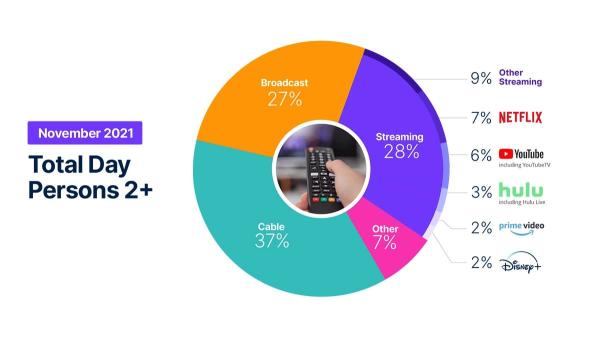

Broadcast television used the fall season to grow its share of total television viewing for the past couple of months, pulling even with streaming. But while a holiday month meant more TV time in general, it also meant lots of students spending time at home - and more time playing games.

Broadcast TV shed a point of share in November, and that point went to the "Other" usage category that includes videogames, according to "The Gauge" from Nielsen, its monthly macro look at TV delivery platforms.

Streaming had been tied with broadcast at 28% share, but broadcast drops back to 27%, and "Other" (including uses like watching video discs along with gaming) moves up to 7%. Cable share remained flat at 37%:

Broadcast television used the fall season to grow its share of total television viewing for the past couple of months, pulling even with streaming. But while a holiday month meant more TV time in general, it also meant lots of students spending time at home - and more time playing games.

Broadcast TV shed a point of share in November, and that point went to the "Other" usage category that includes videogames, according to "The Gauge" from Nielsen, its monthly macro look at TV delivery platforms.

Streaming had been tied with broadcast at 28% share, but broadcast drops back to 27%, and "Other" (including uses like watching video discs along with gaming) moves up to 7%. Cable share remained flat at 37%:

41

andytay12

liked

andytay12

liked

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

andytay12

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

andytay12

liked

Renowned private equity firm TPG has submitted paperwork for an initial public offering in the United States, according to a regulatory filing on Thursday. The firm expects to list on the Nasdaq under the symbol "TPG."

It didn't reveal the number of shares it plans to sell or the indicative price range, but knowledgeable sources told The Wall Street Journal in June that it could be valued at $10 billion.

J.P. Morgan, Goldman Sachs, Morgan Stanley, TPG Capital BD LLC and BofA Securities are the lead underwriters for the offering.

Founded in 1992 by David Bonderman and Jim Coulter, TPG was launched as Texas Pacific Group in Mill valley, California and is known for its leveraged buyouts.

The firm is an early investor in businesses such as Uber Technologies Inc. and Airbnb Inc. According to its SEC filing, it had $109 billion in assets under management as of Sept. 30.

TPG is one of the last big private equity firms to join the stock market. Its main peers have gone public already, including Apollo Global Management (AINV) , Blackstone (BX) , Carlyle Group (CG) and KKR (KKR) . Their stocks have skyrocketed this year, which have risen between 43% and 94% so far this year.

Overall, TPG has investments in more than 280 companies. The firmhas invested across sectors from retail to healthcare. Its first major investment was in the then bankrupt Continental Airlines in 1993. Its portfolio includes Airbnb Inc (ABNB.O), Burger King, Uber Technologies Inc (UBER.N) and Spotify Technology SA (SPOT.N).

TPG has also launched several sector and region focused funds, including TPG Biotech and a growth equity platform which invested in online survey company SurveyMonkey (MNTV.O).

The company’s entertainment investments have included CAA, DirecTV, Entertainment Partners, Fandom, Spotify, STX Entertainment, Univision and Vice Media. CAA, for its part, in September announced plans to acquire ICM Partners.

TPG was also among the first private equity firms to invest in China, its website showed.

TPG generated revenue of $659.08 million and $685.12million in the nine months ended September 30, 2020 and 2021, respectively, representing year-over-year growth of 4%.

Fees and other revenues decreased by $148.5 million or 14% during thefiscal year 2019 ended December 31 and 2020. The decrease primarily consists of reductions in management fees and incentive fees, which was partially offset by an increase in transaction fees.

Click to view the prospectus

$TPG Inc(TPG.US$ $Blackstone(BX.US$ $The Carlyle Group(CG.US$ $KKR & Co(KKR.US$ $Uber Technologies(UBER.US$ $Airbnb(ABNB.US$ $Spotify Technology(SPOT.US$ $Momentive Global(MNTV.US$

It didn't reveal the number of shares it plans to sell or the indicative price range, but knowledgeable sources told The Wall Street Journal in June that it could be valued at $10 billion.

J.P. Morgan, Goldman Sachs, Morgan Stanley, TPG Capital BD LLC and BofA Securities are the lead underwriters for the offering.

Founded in 1992 by David Bonderman and Jim Coulter, TPG was launched as Texas Pacific Group in Mill valley, California and is known for its leveraged buyouts.

The firm is an early investor in businesses such as Uber Technologies Inc. and Airbnb Inc. According to its SEC filing, it had $109 billion in assets under management as of Sept. 30.

TPG is one of the last big private equity firms to join the stock market. Its main peers have gone public already, including Apollo Global Management (AINV) , Blackstone (BX) , Carlyle Group (CG) and KKR (KKR) . Their stocks have skyrocketed this year, which have risen between 43% and 94% so far this year.

Overall, TPG has investments in more than 280 companies. The firmhas invested across sectors from retail to healthcare. Its first major investment was in the then bankrupt Continental Airlines in 1993. Its portfolio includes Airbnb Inc (ABNB.O), Burger King, Uber Technologies Inc (UBER.N) and Spotify Technology SA (SPOT.N).

TPG has also launched several sector and region focused funds, including TPG Biotech and a growth equity platform which invested in online survey company SurveyMonkey (MNTV.O).

The company’s entertainment investments have included CAA, DirecTV, Entertainment Partners, Fandom, Spotify, STX Entertainment, Univision and Vice Media. CAA, for its part, in September announced plans to acquire ICM Partners.

TPG was also among the first private equity firms to invest in China, its website showed.

TPG generated revenue of $659.08 million and $685.12million in the nine months ended September 30, 2020 and 2021, respectively, representing year-over-year growth of 4%.

Fees and other revenues decreased by $148.5 million or 14% during thefiscal year 2019 ended December 31 and 2020. The decrease primarily consists of reductions in management fees and incentive fees, which was partially offset by an increase in transaction fees.

Click to view the prospectus

$TPG Inc(TPG.US$ $Blackstone(BX.US$ $The Carlyle Group(CG.US$ $KKR & Co(KKR.US$ $Uber Technologies(UBER.US$ $Airbnb(ABNB.US$ $Spotify Technology(SPOT.US$ $Momentive Global(MNTV.US$

+3

74

10

andytay12

liked

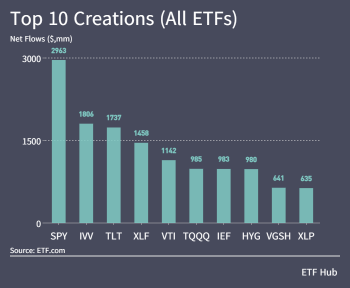

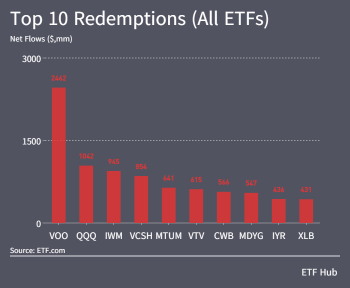

U.S.-listed ETFs fell off slightly in inflows compared to the previous week, but still maintained a healthy inflow of about $18.1 billion in new assets between Dec. 3 and Dec. 9.

Mix Of Risk-On, Risk-Off Inflows

The top of the flows board featured the stalwarts $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$, at $2.9 billion and $1.8 billion in inflows, respectively.

However, the rest of the leaderboard was split between defensive and growt...

Mix Of Risk-On, Risk-Off Inflows

The top of the flows board featured the stalwarts $SPDR S&P 500 ETF(SPY.US$ and $iShares Core S&P 500 ETF(IVV.US$, at $2.9 billion and $1.8 billion in inflows, respectively.

However, the rest of the leaderboard was split between defensive and growt...

92

6

andytay12

liked

$Uber Technologies(UBER.US$ place your bets. Someone thinks uber is going to give back all its gains

16

1

andytay12

liked

$Apple(AAPL.US$ Been enjoying scalping Apple for small profit as the ticker was strong long. Entered on the dip, not my favourite set-up but the stock was still higher than prior day High, hence decided to take the plunge. Took my profit with "Limit when Touched" sell at 181.80 as the upside move was a bit draggy.

Learning Point: Took some risk to enter into imperfect set-up. Maintain discipline to exit quickly with Limit Sell set-up with small profit. Could be worse after market sell-off.

Learning Point: Took some risk to enter into imperfect set-up. Maintain discipline to exit quickly with Limit Sell set-up with small profit. Could be worse after market sell-off.

38

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)