Looks Like October's Bullishness is Over

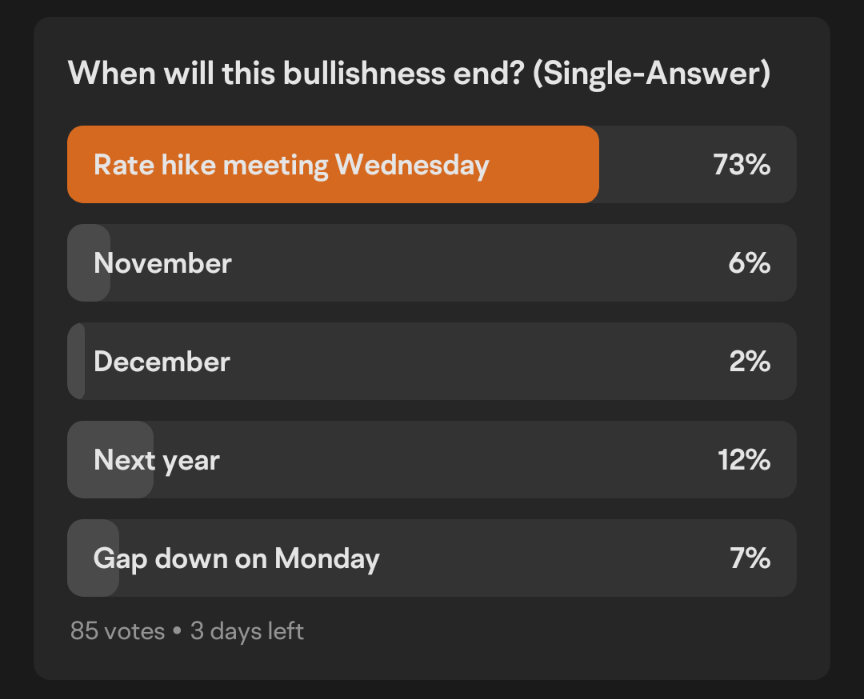

Federal reserve comments typically move markets. Today was no exception. There was over a 3% drop from the highs of day until close due to the Fed's comments. It appears that the bullishness that lasted throughout October is over. Moo'ers saw this coming. You can see that in the poll below.

Check out this short video to see the markets reaction to the interest rate decision. Click the link below.

Below you can see the markets reaction to the release of the Federal Reserve's interest rate report and it's reaction to Jerome Powell's comments 30 minutes after the report was released.

The Initial reaction to the interest rate report was very bullish for equities.

The Fed raised interest rates by 75 basis points, in line with market expectations. The resolution states that interest rates need to continue to be raised until they are "substantially restrictive."

The Fed hinted that it might slow the pace of raising interest rates.

After the Fed announced a 75 basis point increase in interest rates, the three major US stock indexes rose in the short term, with the Dow up 1%, the Nasdaq up 0.35% and the S & P 500 up 0.6%.

Fed FOMC statement: job growth is strong and the unemployment rate remains low. Interest rates need to continue to rise until they reach sufficiently restrictive levels. Cumulative austerity and lag effects will be taken into account.

Fed mouthpiece Nick Timiraos comments on Fed interest rate resolution: new words in the FOMC statement indicate that interest rates will rise further, but suggest that they may rise slightly.

After the Fed raised interest rates by 75 basis points, the White House said the Fed's actions helped reduce inflation.

After the Fed raised interest rates by 75 basis points, the White House said the Fed's actions helped reduce inflation.

When the report of the interest rate decision was released the immediate reaction was very bullish. This was a false rip to weed out the paper hands and liquidate premiums of the options holders. The turning point came after these comments by Jarome Powell.

Powell, chairman of the Federal Reserve: a strong commitment to bring down US inflation to the 2 per cent inflation target.

The labor market is extremely tight.

The slowdown in output growth also puts pressure on corporate fixed investment.

Inflation is still well above our target.

We believe that a sustained increase in interest rates will be appropriate to make interest rates sufficiently restrictive

Terminal interest rates will be higher than previously expected.

History strongly warns not to loosen policy prematurely.

We need to see a significant drop in inflation.

Federal Reserve Chairman Powell: falling inflation is not a condition for us to slow down the pace of interest rate hikes

Federal Reserve Chairman Powell: we will determine the level of restrictions by assessing financial conditions, data and policy lag.

The data show that we may eventually raise interest rates higher than we expected at the September meeting.

We are not raising interest rates too much.

Long-term inflation expectations have fallen.

The rise in short-term inflation expectations is "very worrying."

I take a neutral position and carefully observe the economic situation.

It's too early to consider suspending interest rate hikes.

We have been looking for signs of a gradual recovery in the labor market and a slowdown in the economy, But these signs are not obvious yet.

A strong dollar is a challenge for some countries. We take global problems into account in the model.

Traders seem to be concerned about the Fed's final interest rate, that is, how high the Fed will eventually raise interest rates before suspending rate hikes or cutting rates again. When Powell, chairman of the Federal Reserve, warned at a news conference that "terminal interest rates will be higher than previously expected", investors saw it as a sign that terminal interest rates could be higher than those predicted by Fed officials at the September meeting. At the time, Fed officials expected the median terminal interest rate to be about 4.6%. Recently, some economists and analysts said they expected interest rates to eventually rise to 5% or more.

Powell: the housing market is cooling. During the outbreak, the US housing market was very overheated. It is necessary to (re) achieve the balance between supply and demand.

I haven't seen any signs of a real weakness in the labor market.

We have been looking for signs of a gradual recovery in the labor market and a slowdown in the economy, but these signs are not obvious yet.

A strong dollar is a challenge for some countries. We take global problems into account in the model.

Powell, chairman of the Federal Reserve: the US labor market is still "out of balance between supply and demand"

The Initial reaction to the interest rate report was very bullish for equities.

The Fed raised interest rates by 75 basis points, in line with market expectations. The resolution states that interest rates need to continue to be raised until they are "substantially restrictive."

The Fed hinted that it might slow the pace of raising interest rates.

After the Fed announced a 75 basis point increase in interest rates, the three major US stock indexes rose in the short term, with the Dow up 1%, the Nasdaq up 0.35% and the S & P 500 up 0.6%.

Fed FOMC statement: job growth is strong and the unemployment rate remains low. Interest rates need to continue to rise until they reach sufficiently restrictive levels. Cumulative austerity and lag effects will be taken into account.

Fed mouthpiece Nick Timiraos comments on Fed interest rate resolution: new words in the FOMC statement indicate that interest rates will rise further, but suggest that they may rise slightly.

After the Fed raised interest rates by 75 basis points, the White House said the Fed's actions helped reduce inflation.

After the Fed raised interest rates by 75 basis points, the White House said the Fed's actions helped reduce inflation.

When the report of the interest rate decision was released the immediate reaction was very bullish. This was a false rip to weed out the paper hands and liquidate premiums of the options holders. The turning point came after these comments by Jarome Powell.

Powell, chairman of the Federal Reserve: a strong commitment to bring down US inflation to the 2 per cent inflation target.

The labor market is extremely tight.

The slowdown in output growth also puts pressure on corporate fixed investment.

Inflation is still well above our target.

We believe that a sustained increase in interest rates will be appropriate to make interest rates sufficiently restrictive

Terminal interest rates will be higher than previously expected.

History strongly warns not to loosen policy prematurely.

We need to see a significant drop in inflation.

Federal Reserve Chairman Powell: falling inflation is not a condition for us to slow down the pace of interest rate hikes

Federal Reserve Chairman Powell: we will determine the level of restrictions by assessing financial conditions, data and policy lag.

The data show that we may eventually raise interest rates higher than we expected at the September meeting.

We are not raising interest rates too much.

Long-term inflation expectations have fallen.

The rise in short-term inflation expectations is "very worrying."

I take a neutral position and carefully observe the economic situation.

It's too early to consider suspending interest rate hikes.

We have been looking for signs of a gradual recovery in the labor market and a slowdown in the economy, But these signs are not obvious yet.

A strong dollar is a challenge for some countries. We take global problems into account in the model.

Traders seem to be concerned about the Fed's final interest rate, that is, how high the Fed will eventually raise interest rates before suspending rate hikes or cutting rates again. When Powell, chairman of the Federal Reserve, warned at a news conference that "terminal interest rates will be higher than previously expected", investors saw it as a sign that terminal interest rates could be higher than those predicted by Fed officials at the September meeting. At the time, Fed officials expected the median terminal interest rate to be about 4.6%. Recently, some economists and analysts said they expected interest rates to eventually rise to 5% or more.

Powell: the housing market is cooling. During the outbreak, the US housing market was very overheated. It is necessary to (re) achieve the balance between supply and demand.

I haven't seen any signs of a real weakness in the labor market.

We have been looking for signs of a gradual recovery in the labor market and a slowdown in the economy, but these signs are not obvious yet.

A strong dollar is a challenge for some countries. We take global problems into account in the model.

Powell, chairman of the Federal Reserve: the US labor market is still "out of balance between supply and demand"

Powell, chairman of the Federal Reserve, said he hoped to see a further decline in the number of job openings and resignations and that the US labor market remained "out of balance between supply and demand". We have been looking for signs of a gradual recovery in the labour market and a slowdown in the economy, but these signs are not yet obvious.

Federal Reserve Chairman Powell: if we tighten too much, we have the ability to use powerful tools to support economic activity. On the other hand, if the tightening is not enough, you will realize that inflation is not under control in a year or two.

Federal Reserve Chairman Powell: if we tighten too much, we have the ability to use powerful tools to support economic activity. On the other hand, if the tightening is not enough, you will realize that inflation is not under control in a year or two.

There is no sign that inflation is falling.

Powell, chairman of the Federal Reserve, said: when asked whether wages are the main driver of current inflation, Powell's attitude is very subtle. On the one hand, wage growth is too high to have an inflation rate of only 2%, he said. But he also acknowledges that these measures are not the main driver at a time when inflation is above 8%. All this suggests that if inflation starts to fall rapidly and the labour market remains strong, there will be a very interesting situation in the coming months whether the Fed will still see the latter as a reason to maintain austerity.

Institutional Review Federal Reserve Chairman Powell said: Powell has just overturned his argument on risk management. Before the epidemic, the Fed argued that it would rather keep inflation rising than keep it too low for a long time, arguing that it was easier to deal with inflation than deflation. Today, Powell says the opposite is true. It has the tools to clean up excessive austerity, rather than letting inflation stray from its target for too long. Times have changed.

Federal Reserve Chairman Powell: a soft landing is still possible, but the window is narrowing.

If the Fed tightens too much, it can still support economic activity. If the tightening is not enough, the risk is that inflation will be deeply entrenched.

The Federal Reserve is firmly committed to reducing inflation, a strong commitment to bring down U. S. inflation to the 2% inflation target.

Without price stability, the labor market will not remain strong.

Eric Johnston, an analyst at Cantor Fitzgerald: after the stock market has risen 8% in recent weeks, our team's rating on the US stock market has become neutral. At the current price level of the S & P 500, two things are expected to be bad for the risk and return of holding stocks: the US non-farm payrolls report and CPI data. The market pricing the Fed's terminal interest rate is now above 5%, which is a huge resistance to the stock market

After Powell's speech:

Current 3-month / 18-month forward spreads show a 31 per cent chance of a recession in the US economy over the next 12 months. Us federal fund swap rate futures prices indicate that traders believe the Fed will raise interest rates to a peak of around 5.10% by May 2023.

Treasury yields fell deeper into inversion. The dollar is rallying which is bringing down gold in a big way. The major indices in the equity markets are crashing for the day. It is interesting to see that the Fed's comments didn't bring down oil futures. It appears that investors are not worried about the Fed killing future oil demand through a interest rate induced global recession.

Powell, chairman of the Federal Reserve, said: when asked whether wages are the main driver of current inflation, Powell's attitude is very subtle. On the one hand, wage growth is too high to have an inflation rate of only 2%, he said. But he also acknowledges that these measures are not the main driver at a time when inflation is above 8%. All this suggests that if inflation starts to fall rapidly and the labour market remains strong, there will be a very interesting situation in the coming months whether the Fed will still see the latter as a reason to maintain austerity.

Institutional Review Federal Reserve Chairman Powell said: Powell has just overturned his argument on risk management. Before the epidemic, the Fed argued that it would rather keep inflation rising than keep it too low for a long time, arguing that it was easier to deal with inflation than deflation. Today, Powell says the opposite is true. It has the tools to clean up excessive austerity, rather than letting inflation stray from its target for too long. Times have changed.

Federal Reserve Chairman Powell: a soft landing is still possible, but the window is narrowing.

If the Fed tightens too much, it can still support economic activity. If the tightening is not enough, the risk is that inflation will be deeply entrenched.

The Federal Reserve is firmly committed to reducing inflation, a strong commitment to bring down U. S. inflation to the 2% inflation target.

Without price stability, the labor market will not remain strong.

Eric Johnston, an analyst at Cantor Fitzgerald: after the stock market has risen 8% in recent weeks, our team's rating on the US stock market has become neutral. At the current price level of the S & P 500, two things are expected to be bad for the risk and return of holding stocks: the US non-farm payrolls report and CPI data. The market pricing the Fed's terminal interest rate is now above 5%, which is a huge resistance to the stock market

After Powell's speech:

Current 3-month / 18-month forward spreads show a 31 per cent chance of a recession in the US economy over the next 12 months. Us federal fund swap rate futures prices indicate that traders believe the Fed will raise interest rates to a peak of around 5.10% by May 2023.

Treasury yields fell deeper into inversion. The dollar is rallying which is bringing down gold in a big way. The major indices in the equity markets are crashing for the day. It is interesting to see that the Fed's comments didn't bring down oil futures. It appears that investors are not worried about the Fed killing future oil demand through a interest rate induced global recession.

It looks like it is back to the old narrative and it is time to be bearish again. Keep an eye on jobs and inflationary data because the Fed is not slowing down yet. They said they would slow down eventually but they do not know when that will be. They also said that inflation is nowhere near where the Fed wants it to be before they can start slowing.

Check out this previous article I posted before the major interest rate hikes started. Before J. Powell started this very steep interest rate hike he provided a bad omen for the incoming "Volker Era." He paid homage to Paul Volkers recent death just before the Fed hiked interest rates in a big way which is what has led to this high interest rate and high inflationary environment, hence the term "Volker Era."

$SPDR Dow Jones Industrial Average Trust(DIA.US$ $Invesco QQQ Trust(QQQ.US$ $SPDR S&P 500 ETF(SPY.US$ $iShares Russell 2000 ETF(IWM.US$ $VIX Index Futures(MAY4)(VXmain.US$ $Gold Futures(JUN4)(GCmain.US$ $Powershares Exchange Traded Fd Tst Db Us Dollar Index Bullish Fund Etf(UUP.US$ $SPDR Gold ETF(GLD.US$ $iShares Silver Trust(SLV.US$ $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$ $Ishares Iboxx $ Investment Grade Corporate Bond Etf(LQD.US$ $iShares 20+ Year Treasury Bond ETF(TLT.US$ $Crude Oil Futures(JUN4)(CLmain.US$

$TENCENT(00700.HK$ $SSE Composite Index(000001.SH$ $CSI 300 Index(000300.SH$ $CSI 300 Index(000300.SH$ $FTSE Singapore Straits Time Index(.STI.SG$ $NIO-SW(09866.HK$ $NIO Inc. USD OV(NIO.SG$ $NIO Inc(NIO.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $XPeng(XPEV.US$ $Li Auto(LI.US$ $BYD COMPANY(01211.HK$ $BYD Company Limited(002594.SZ$ $S&P/ASX 200(.XJO.AU$ $FTSE Singapore Straits Time Index(.STI.SG$

$TENCENT(00700.HK$ $SSE Composite Index(000001.SH$ $CSI 300 Index(000300.SH$ $CSI 300 Index(000300.SH$ $FTSE Singapore Straits Time Index(.STI.SG$ $NIO-SW(09866.HK$ $NIO Inc. USD OV(NIO.SG$ $NIO Inc(NIO.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $XPeng(XPEV.US$ $Li Auto(LI.US$ $BYD COMPANY(01211.HK$ $BYD Company Limited(002594.SZ$ $S&P/ASX 200(.XJO.AU$ $FTSE Singapore Straits Time Index(.STI.SG$

$Apple(AAPL.US$ $Tesla(TSLA.US$ $Microsoft(MSFT.US$ $Amazon(AMZN.US$ $NVIDIA(NVDA.US$ $Meta Platforms(META.US$ $Alphabet-C(GOOG.US$

$Chevron(CVX.US$ $Phillips 66(PSX.US$ $Valero Energy(VLO.US$ $Devon Energy(DVN.US$ $Occidental Petroleum(OXY.US$ $W&T Offshore(WTI.US$ $United States Oil Fund LP(USO.US$ $United Sts Brent Oil Fd Lp Unit(BNO.US$ $Imperial Petroleum(IMPP.US$ $Houston American Energy(HUSA.US$ $Indonesia Energy(INDO.US$ $BP PLC(BP.US$ $Exxon Mobil(XOM.US$

$Mullen Automotive(MULN.US$ $Arcimoto(FUV.US$ $Nikola(NKLA.US$ $Fisker(FSR.US$ $Rivian Automotive(RIVN.US$ $Lordstown Motors(RIDE.US$ $Full Truck Alliance(YMM.US$ $Ford Motor(F.US$ $General Motors(GM.US$

$Chevron(CVX.US$ $Phillips 66(PSX.US$ $Valero Energy(VLO.US$ $Devon Energy(DVN.US$ $Occidental Petroleum(OXY.US$ $W&T Offshore(WTI.US$ $United States Oil Fund LP(USO.US$ $United Sts Brent Oil Fd Lp Unit(BNO.US$ $Imperial Petroleum(IMPP.US$ $Houston American Energy(HUSA.US$ $Indonesia Energy(INDO.US$ $BP PLC(BP.US$ $Exxon Mobil(XOM.US$

$Mullen Automotive(MULN.US$ $Arcimoto(FUV.US$ $Nikola(NKLA.US$ $Fisker(FSR.US$ $Rivian Automotive(RIVN.US$ $Lordstown Motors(RIDE.US$ $Full Truck Alliance(YMM.US$ $Ford Motor(F.US$ $General Motors(GM.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

70617193 : Take off ️

️

not-a-cow : "This was a false rip to weed out the paper hands and liquidate premiums of the options holders."

Got more on this than some vague conspiracy theory?

not-a-cow : And federal fund swap rate futures prices are worthless for determining real interest rates.

not-a-cow : Your last sentence also doesn't make sense.

not-a-cow : You also make it sound like gold reacts inversely to the dollar, which is clearly false when looking at the deltas on the weekly.

razo2 : thanks mate. as usual good MOM on the FOMC. I feel he dodge every critical questions to clear the way for the fed rally mid terms as expected. but he also use the open ended December interest rate by saying about the model and economic outlook. so far we don't know what rate he will set as he totally rely on the model and data. but from recent data it doesn't look good, maybe is a temporary pivot with an interest rate hike of 0.75 in place as a safety measures for the mid terms to take place. better than a pivot of 0.5.

not-a-cow : Finally, the so-called "October bulishness" will be soon followed by post-election bulishness.

Giovanni Ayala :

RIPPER not-a-cow:

RIPPER not-a-cow: And I could post a couple dozen of those short 2x, 3x ETFS in just a few mins

View more comments...