How to Buy Coca-Cola Shares in Australia [2025]

Oct 24 10:43

Oct 24 10:43Key Takeaways

- Coca-Cola (KO.US) is a globally recognized beverage company, offering diverse non-alcoholic drinks and consistent dividend payouts.

- Australian investors can buy KO stock via US brokerage platforms like moomoo with zero commission and fractional share options.

- Steps to invest include choosing a trading app, opening an account, funding with AUD, converting to USD, and researching KO’s fundamentals.

- Q3 2025 earnings showed strong EPS growth (30.3% YoY), a 6% organic revenue increase, and a stable dividend yield of 2.98%.

- Analysts are bullish with a USD 79.40 price target; key risks include currency headwinds and sugar tax impacts.

Coca-Cola (KO.US) is a global leader in the manufacturing, marketing and distribution of non-alcoholic beverages, including its iconic Coca-Cola soft drinks, bottled water, tea, juice, and sports drinks. Founded in 1886 and headquartered in Atlanta, the company operates across major regions such as North America, EMEA, Asia Pacific and Latin America, serving billions of consumers through its vast franchise bottling operations and renowned brand portfolio.

How to buy Coca-Cola stock in Australia?

If you're an Australia-based employee with limited time but a strong interest in investing in globally recognised companies, buying Coca-Cola stock (KO) could be a smart move. Here's a streamlined step-by-step guide tailored for beginners to help you invest in Coca-Cola shares, one of the most iconic consumer staples stocks traded on the NYSE.

Step 1: Pick the best share trading app for US markets

To buy Coca-Cola stock from Australia, you'll first need access to the US stock markets. Choosing the right share trading platform is essential, especially if you're time-poor and need a simple, intuitive solution. moomoo is a strong option for Australian investors given its zero-commission trading for US shares, real-time financial data, and user-friendly mobile app experience. These features make moomoo a practical choice even for novices juggling work and personal commitments.

When selecting a share trading app, consider factors like brokerage fees, access to live market data, platform ease-of-use, customer support in Australia, and whether it supports fractional shares and different account types.

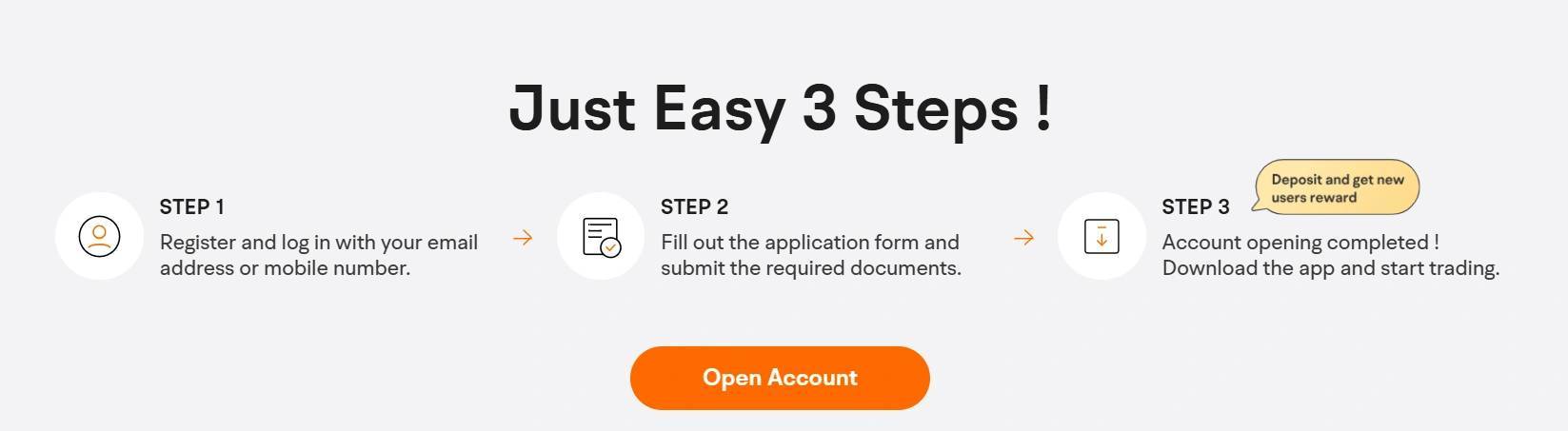

Step 2: Choose the correct account type and open a share trading account

In Australia, there are four main types of brokerage accounts that allow you to trade US stocks like Coca-Cola:

- Individual account: Best for personal investing and quick account setup.

- Company account: Ideal for businesses looking to manage investments as part of their strategy.

- Trust account: Suitable if you’re investing via a family or discretionary trust.

- SMSF account: Common for self-managed super funds investing in international markets.

To open an account with a platform like moomoo, you’ll generally need to upload identification documents such as your Australian passport or driver’s licence, provide your TFN (optional, but helps avoid withholding tax), and submit proof of address. For US stock trading, you'll also need to fill in the W-8BEN form to confirm your non-US residency for tax purposes. This form helps reduce potential tax withholding on US dividends from 30% to 15% under the US–Australia tax treaty.

Step 3: Fund your account

After setting up your account, it's time to transfer money into it. Most brokers support local AUD deposits via bank transfers or PayID. Look for platforms that offer competitive foreign exchange rates to convert your AUD into USD efficiently. You can only buy Coca-Cola stock using USD, so make sure your platform simplifies currency conversion.

Step 4: Research Coca-Cola's fundamentals

Before making an investment, it's vital to understand Coca-Cola's financial health and business outlook. With over $12 billion in Q3 revenue and consistent dividend payouts, Coca-Cola remains a reliable income and defensive growth stock. As an Australian investor, you should assess key data including its PE ratio, earnings per share (EPS), dividend yield, and revenue trends across regions such as North America and Asia Pacific. The company’s core earnings growth, diversification in non-soda beverages, and exposure to emerging markets are essential investment drivers.

Step 5: Set a budget for your Coca-Cola stock purchase

As a first-time investor, arrange your budget based on your disposable income and overall portfolio strategy. It's wise to establish an emergency fund before allocating money to stocks. Aim not to overexpose your portfolio to a single company.

If Coca-Cola trades above $60 per share and that feels out of reach, consider platforms like moomoo that support fractional shares, allowing you to invest smaller amounts (such as $50 or $100) without having to buy a full share.

Step 6: Decide when to buy Coca-Cola stock

Market timing can impact entry points, but for long-term investors, time in the market often outweighs timing the market. You might choose to invest after earnings releases or when the stock dips moderately. Be disciplined by using limit orders to control your buying price and avoid market volatility affecting your entry.

Step 7: Monitor your stock portfolio

Once you own Coca-Cola shares, keep track of your portfolio performance. Review quarterly earnings reports, monitor Coke’s global sales trends and dividend announcements, and re-evaluate your allocation regularly. With moomoo's mobile tools and instant alerts, staying informed doesn’t have to interrupt your busy schedule.

What is Coca-Cola?

Coca-Cola (NYSE: KO) is one of the world’s most recognized beverage companies, known for producing and marketing non-alcoholic drinks including soft drinks, waters, teas, coffees, juices, and energy drinks across over 200 countries. Headquartered in Atlanta, Georgia, Coca-Cola’s core product lineup includes iconic global brands such as Coca-Cola, Sprite, Fanta, and Powerade. The company not only develops these beverages but also operates through a global network of bottling partners. Coca-Cola’s global operations are structured around geographical business units and strategic bottling investments, including plans to expand in Africa through Coca-Cola Hellenic. Major shareholders include Warren Buffett’s Berkshire Hathaway (holding over 9% of shares), Vanguard Group, and BlackRock, reflecting strong institutional ownership and investor confidence.

How has Coca-Cola stock price performed?

Over the past year, Coca-Cola’s share price performance has been influenced by a mix of macroeconomic trends, strategic product innovation, and resilient financial execution. The Coca-Cola stock price reached a recent high of USD 71.61 before retracing slightly, reflecting fluctuations on the back of broader market sentiment and earnings momentum. While the stock has seen moderate recovery from its 52-week low, it remains below its peak as investors weigh consumer spending trends and forex pressures affecting multinational revenue streams.

Despite those pressures, Coca-Cola (NYSE: KO) continues to demonstrate strength in its beverages portfolio, with growth in categories like Coca-Cola Zero Sugar contributing to top-line results. A key highlight in its most recent earnings is a 6% increase in organic revenue alongside a notable expansion in operating margin—traits that support long-term investor confidence. Whether you're tracking Coca-Cola stock price action or evaluating dividend stability, the beverage giant stands out as a resilient defensive play amid global market shifts.

Key financial metrics for Coca-Cola

| Metric | Value |

|---|---|

| Latest market close | USD 70.81 |

| Market capitalisation | USD 301.00B |

| PE Ratio (TTM) | 23.16 |

| Earnings per share (EPS) | USD 3.02 |

| Day change | -0.87% |

| 52-week high | USD 74.38 |

| 52-week low | USD 60.62 |

Source: moomoo, data as of 25-10-2025.

Coca-Cola price forecast

Recent analyst sentiment surrounding Coca-Cola’s future price trends remains largely positive. Out of 17 analysts, 94% currently rate the stock a "Buy," with a consensus target price of USD 79.4. The bullish outlook is supported by steady earnings growth, strong cash flow, and continued brand expansion across global markets. Forecasts signal a price upside potential of over 12% from current levels, assuming stable macroeconomic conditions and consistent consumer demand. For investors evaluating the Coca-Cola stock price forecast, these analytics may signal a compelling entry for long-term exposure.

Coca-Cola earnings Q3 2025 analysis

| Item | 2025 Q3 | 2025 Q2 | 2025 Q1 | Q/Q | Y/Y |

|---|---|---|---|---|---|

| Revenue | $12.46 billion | $12.54 billion | $11.13 billion | -0.6% | +5.1% |

| Gross profit rate | 61.49% | 62.39% | 62.59% | -0.9% | +1.4% |

| Operating profit | $4.01 billion | $4.32 billion | $3.72 billion | -7.2% | +14.0% |

| Net profit | $3.68 billion | $3.80 billion | $3.33 billion | -3.2% | +29.2% |

| Diluted earnings per share | $0.86 | $0.88 | $0.77 | -2.3% | +30.3% |

Source: Coca-Cola Financial Statements, data as of 2025-10-23.

The latest Coca-Cola earnings date revealed a resilient Q3 2025 performance despite modest sequential declines, signaling strong core momentum. Net revenue stood at $12.46 billion, slightly down 0.6% from Q2, but up 5.1% year-over-year, underpinned by strategic pricing execution and steady volume growth. With net profit hitting $3.68 billion and diluted EPS at $0.86, the company marked an impressive 30.3% year-on-year increase in earnings per share, reflecting exceptional bottom-line efficiency. The operating margin expanded to 32%, up from 21.2% a year earlier, signaling Coca-Cola's improved cost controls and margin optimization methods.

During the latest Coca-Cola earnings call, management highlighted organic revenue growth of 6%, boosted by robust price/mix gains and strong demand for Coca-Cola Zero Sugar, which soared 14% globally. The call also spotlighted progress in international growth, such as expanding market share in Brazil and North Africa. Imagine Coca-Cola as a finely tuned vending machine: even if you switch products or change the price, it continues delivering value consistently. The earnings call also noted a free cash flow surge to $8.5 billion in Q3, showcasing the business’s cash-generating strength despite currency headwinds. These trends underscore Coca-Cola’s ability to adapt and thrive across diverse markets.

Does Coca-Cola (KO.US) pay dividends?

For income-focused investors in Australia looking to invest in reliable, long-term dividend payers, Coca-Cola (KO.US) continues to stand out as a prominent name. With more than a century of operational history and a stable global distribution network, Coca-Cola has also developed a reputation for consistent dividend payouts—making it a favourite among defensive investors.

The Coca-Cola dividend is an integral part of the company’s shareholder return strategy. The firm has not only maintained, but increased its dividends annually for over six decades, placing it among the most dependable dividend aristocrats on Wall Street. For Australians considering how to buy Coca-Cola stock, understanding its dividend policy can be a key component in long-term portfolio planning, especially under a dividend reinvestment strategy via international brokerage platforms.

Currently, Coca-Cola pays a quarterly dividend of USD 0.51 per share. This equates to an annual cash return of USD 2.04 per share, with a trailing twelve-month dividend yield of 2.98% based on recent share price levels. These figures suggest the stock offers both stability and a predictable income stream, even amid shifting macroeconomic conditions.

Dividend summary of Coca-Cola (KO.US)

| Fiscal Year | Date | Dividend Type | Amount (USD) | Total Annual Dividend (USD) | Dividend Yield TTM |

|---|---|---|---|---|---|

| 2025 | 2025-12-01 | Cash | 0.51 | 2.04 | 2.98% |

| 2025 | 2025-09-15 | Cash | 0.51 | ||

| 2025 | 2025-06-13 | Cash | 0.51 |

Source: Company Data & Moomoo, data as of 2025-10-23.

How Coca-Cola’s dividend performance compares to its peers

Within the global non-alcoholic beverage industry, Coca-Cola holds a leading spot not only in market share but also in terms of dividend credibility. Its trailing dividend yield of 2.98% places it ahead of competitors such as PepsiCo (PEP), which currently yields around 2.7%, and well above Kraft Heinz (KHC), which hovers near 3.5% but lacks the same track record of uninterrupted growth. Even in the broader U.S. consumer staples sector, Coca-Cola's yield remains competitive while offering a lower beta and defensive positioning.

Moreover, Coca-Cola's consistent free cash flow, exceeding $9.5 billion annually, supports its strong payout coverage. Australian investors seeking dividend sustainability and blue-chip consistency will find the KO dividend yield not only appealing but also backed by a resilient business model and a disciplined capital allocation strategy.

When is Coca-Cola stock split?

The most recent Coca-Cola stock split took place on August 13, 2012, when the company implemented a 2-for-1 stock split for its NYSE-listed shares (ticker: KO). This was the 7th time Coca-Cola split its stock since 1968, a strategy often employed to enhance liquidity and make shares more accessible to retail investors. Despite strong financial growth and a recent registration filing with the SEC in October 2025 for potential securities offerings, there has been no official announcement regarding a new Coca-Cola stock split date. Investors in Australia interested in historical KO stock split data can review the split history to better understand patterns in share restructuring.

What ETFs hold KO?

For Australian investors considering exposure to Coca-Cola (KO.US), exchange-traded funds (ETFs) offer a convenient way to access the stock as part of a diversified portfolio. Below are some ETFs that include Coca-Cola as a holding:

- iShares Global Consumer Staples ETF (IXI) – This ETF provides exposure to global consumer staples companies and includes Coca-Cola among its top holdings due to its strong position in the beverage sector.

- SPDR S&P 500 ETF Trust (SPY) – As Coca-Cola is a component of the S&P 500 Index, this widely traded ETF also holds KO shares as part of its diversified U.S. large-cap portfolio.

- Vanguard Consumer Staples ETF (VDC) – Focused on the consumer staples sector, this ETF includes Coca-Cola alongside other major names in the industry.

- iShares MSCI World ETF (URTH) – Designed to track global developed markets, it includes Coca-Cola among its U.S. equity allocations.

Which stocks are similar to KO?

If you're considering investing in Coca-Cola (KO.US), you might also want to explore other stocks in the beverage and consumer staples sector to diversify your exposure. Here are several comparable companies that share similar business characteristics with Coca-Cola:

- PepsiCo (PEP.US) – A major global competitor to Coca-Cola, PepsiCo offers a diversified portfolio of beverages and snack foods, making it a key player in the consumer staples space.

- Mondelez International (MDLZ.US) – While focused more on snacks than beverages, Mondelez complements consumer habits similar to Coca-Cola with its global presence and brand portfolio.

- Keurig Dr Pepper (KDP.US) – This beverage conglomerate operates in both hot and cold drink categories, offering an alternative within the non-alcoholic beverage space.

- Unilever (UL.US) – A diversified FMCG company with offerings in food, beverages, and personal care, Unilever shares market dynamics associated with global consumer trends.

- Coca-Cola Europacific Partners (CCEP.US) – As a Coca-Cola bottling partner, CCEP focuses on distribution, providing indirect exposure to Coca-Cola’s global reach and volume.

Is it a good time to buy Coca-Cola stock

As of October 23, 2025, Coca-Cola (NYSE: KO) is trading at US$69.99, near its recent highs, having risen over 4% in the past week following strong Q3 results. Earnings per share climbed to US$0.86, up 30% year-on-year, and operating income surged 59%, driven by a 6% organic revenue increase and healthy margins. Technically, indicators like the MACD and RSI suggest strength, with RSI(6) cooling from overbought levels—think of it like a runner catching their breath after a sprint, still strong but less overheated. Analyst sentiment reinforces the bullish tone, with 94% of 17 analysts rating KO a "Buy" and an average price target of US$79.40—around 13% upside from today's price.

That said, investing in any stock—including a global, dividend-paying brand like Coca-Cola—comes with caveats. The effective P/E ratio stands at 23.16 as of today, which is not cheap by industry standards. Moreover, macro risks such as packaging cost inflation or new sugar taxes, particularly in Mexico next year, could bite into profits. Investors should also note currency headwinds may impact full-year earnings. As with any investment, diversification is your seatbelt, and reviewing your risk appetite before investing in KO is as essential as checking your tyres before a road trip.

What is the Coca-Cola outlook for 2025?

Coca-Cola enters 2025 with strong momentum, having delivered a 6% year-over-year organic revenue growth in Q3 and expanding its operating margin to 32%—up from 21.2% a year prior. Analysts continue to show confidence, with a 94% "Strong Buy" consensus and a target price range of USD 72 to 85. Yet, the road ahead isn’t without speed bumps. Like trying to paddle upstream, Coca-Cola must navigate anticipated currency headwinds, with management projecting a potential 5-point impact to 2025 earnings per share.

Beyond macroeconomic currents, Coca-Cola is also facing ripple effects from global sugar taxes, notably in Mexico starting 2026, which could disrupt pricing strategies. At the same time, competition from health-oriented beverage brands—as consumers shift preferences—adds pressure. Despite these headwinds, the company is doubling down on innovation, digital transformation, and strategic franchising moves in Africa and India. Much like renovating a well-loved home, Coca-Cola is modernising its global strategy while preserving the brand equity built over a century, setting the stage for sustainable growth throughout 2025 and beyond.

Final thoughts on how to buy Coca-Cola stock

Buying Coca-Cola stock (KO) from Australia is a straightforward process when you break it down into clear steps. From selecting a reliable trading platform like moomoo, opening an appropriate brokerage account, funding it with AUD for conversion to USD, and doing your research on Coca-Cola’s fundamentals, you're well-prepared to make an informed investment. Whether you're interested in Coca-Cola for its iconic brand, stable dividends, or promising earnings outlook, this globally recognised stock remains a strong contender for any long-term portfolio.

For Australian investors, the key is to start small—especially if you're new to buying US stocks—by taking advantage of fractional shares and setting a budget based on your financial goals. Keep an eye on earnings reports, dividend updates, and market trends to fine-tune your strategy over time. With strong institutional backing, a resilient business model, and consistent dividend payouts, Coca-Cola shares can offer both income and stability in uncertain times. If you're ready to take the next step, open a trading account and begin your journey to buy Coca-Cola stock today.

Moomoo Technologies Inc. is providing this content for information and educational use only. Read more