MORGAN STANLEY: ".. Following $Meta Platforms(META.US$ , $Microsoft(MSFT.US$ & $Alphabet-A(GOOGL.US$ reports last week, [our] 2024 Cloud Capex Tracker now points to +44%y/y growth in 2024 (vs +26%y/y prior) adding >$50B of spend .. the strongest Cloud Capex 'Supercycle' since 2018."

3

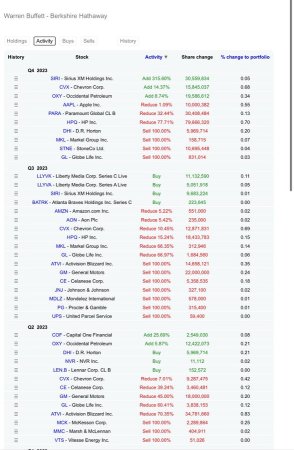

Buffett over the last 12 months has been a net seller.

Buffett is not a technical guy, he focuses solely on fundamentals

When the market is overvalued, he net sells and builds cash, at $168 Billion now

$Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ $Apple(AAPL.US$ $Occidental Petroleum(OXY.US$

Buffett is not a technical guy, he focuses solely on fundamentals

When the market is overvalued, he net sells and builds cash, at $168 Billion now

$Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ $Apple(AAPL.US$ $Occidental Petroleum(OXY.US$

4

1

1) There’s plenty of bad news within $Intel(INTC.US$ 's report, and recent news/reports about competitors ( $Taiwan Semiconductor(TSM.US$ 's A16 commentary, reported demand for $NVIDIA(NVDA.US$ 's Arm-powered GB200, reported IPC gains for $Advanced Micro Devices(AMD.US$ 's Zen 5) don’t help matters either. But with the EV down to ~$170B, maybe we’re at the point where the stock could work again on an SOTP basis, at least for a trade, given the value of Intel’s assets/IP, som...

3

$Microsoft(MSFT.US$ - They make money and do AI things so it will drop -20%

- Bull Case - They lose a lot of money

- Bear Case - They make a lot of money and they're involved in AI

$Alphabet-A(GOOGL.US$ (forgot) - They make money and AI so it will drop -18.75%

- Bull Case - They lose money and search market share shrinks heavily. They have Googler's streak through Pinchia's office for a group sit-in regarding go...

- Bull Case - They lose a lot of money

- Bear Case - They make a lot of money and they're involved in AI

$Alphabet-A(GOOGL.US$ (forgot) - They make money and AI so it will drop -18.75%

- Bull Case - They lose money and search market share shrinks heavily. They have Googler's streak through Pinchia's office for a group sit-in regarding go...

15

5

Google Cloud does not plan to offer AMD AI chips, The Information reports, meaning 2 of the 3 major US cloud providers remain unconvinced AMD’s offerings are a good alternative to Nvidia’s GPUs. It will offer its own TPUs and Nvidia GPUs to customers.

$Alphabet-C(GOOG.US$ $Advanced Micro Devices(AMD.US$ $NVIDIA(NVDA.US$

$Alphabet-C(GOOG.US$ $Advanced Micro Devices(AMD.US$ $NVIDIA(NVDA.US$

3

2

$Morgan Stanley(MS.US$ raises $NVIDIA(NVDA.US$ target to US$1000 from $795, keeps Overweight rating.

- large corporations planning to expand their data centres over the next 3-4 years, signalling enduring demand

- the market is still too focused on the use of chips for large language models, to the detriment of other AI applications

- large corporations planning to expand their data centres over the next 3-4 years, signalling enduring demand

- the market is still too focused on the use of chips for large language models, to the detriment of other AI applications

4

1

$Trump Media & Technology(DJT.US$ It's still vaued at like 6 billion after going down 30%. Could it half to 3 billion? Or even less? What assets does it even have that won't be drained or diluted by Trump? Realistically if Trump loses again what value does he have?

4

5

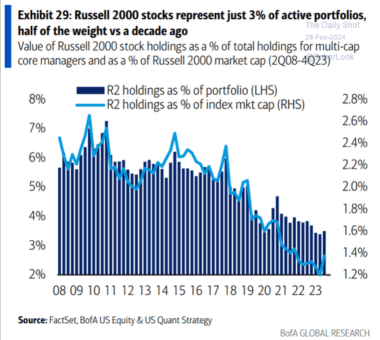

Small caps are breaking out, pretty much as active managers want nothing to do with them.

$Nasdaq Composite Index(.IXIC.US$ $SPDR S&P 500 ETF(SPY.US$

$Nasdaq Composite Index(.IXIC.US$ $SPDR S&P 500 ETF(SPY.US$

3

Part of $NVIDIA(NVDA.US$ 's moat & value-add is its control of the networking for AI data center.

And $Broadcom(AVGO.US$ remains the only alternative chip vendor to it, while $Arista Networks(ANET.US$ served as the end OEM.

$Meta Platforms(META.US$ 's latest two H100 DCs use two different networking infra, one from $NVIDIA(NVDA.US$ 's full stack including Mellanox switch while another uses $Arista Networks(ANET.US$ switch powered by $Broadcom(AVGO.US$ chip, and $Cisco(CSCO.US$ swi...

And $Broadcom(AVGO.US$ remains the only alternative chip vendor to it, while $Arista Networks(ANET.US$ served as the end OEM.

$Meta Platforms(META.US$ 's latest two H100 DCs use two different networking infra, one from $NVIDIA(NVDA.US$ 's full stack including Mellanox switch while another uses $Arista Networks(ANET.US$ switch powered by $Broadcom(AVGO.US$ chip, and $Cisco(CSCO.US$ swi...

3

1

A one pager with all key information of this unique company👇

Main takeaways 📢

• $ASML Holding(ASML.US$ is a one-of-a-kind business with an incredibly strong moat. It plays a crucial role in the modern semiconductor industry

• The business is prone to geopolitical tension and criticality, which is something to be aware of

• Based on its current free cashflow, $ASML is overvalued with a fair price around $675

As of today, I have a 7% position in $ASML at a $539 cost basis...

Main takeaways 📢

• $ASML Holding(ASML.US$ is a one-of-a-kind business with an incredibly strong moat. It plays a crucial role in the modern semiconductor industry

• The business is prone to geopolitical tension and criticality, which is something to be aware of

• Based on its current free cashflow, $ASML is overvalued with a fair price around $675

As of today, I have a 7% position in $ASML at a $539 cost basis...

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)