Random thoughts on semis:

1) There’s plenty of bad news within $Intel(INTC.US$ 's report, and recent news/reports about competitors ( $Taiwan Semiconductor(TSM.US$ 's A16 commentary, reported demand for $NVIDIA(NVDA.US$ 's Arm-powered GB200, reported IPC gains for $Advanced Micro Devices(AMD.US$ 's Zen 5) don’t help matters either. But with the EV down to ~$170B, maybe we’re at the point where the stock could work again on an SOTP basis, at least for a trade, given the value of Intel’s assets/IP, somewhat better execution and CHIPS Act support. No position for now, but it does look semi-interesting again (pardon the pun).

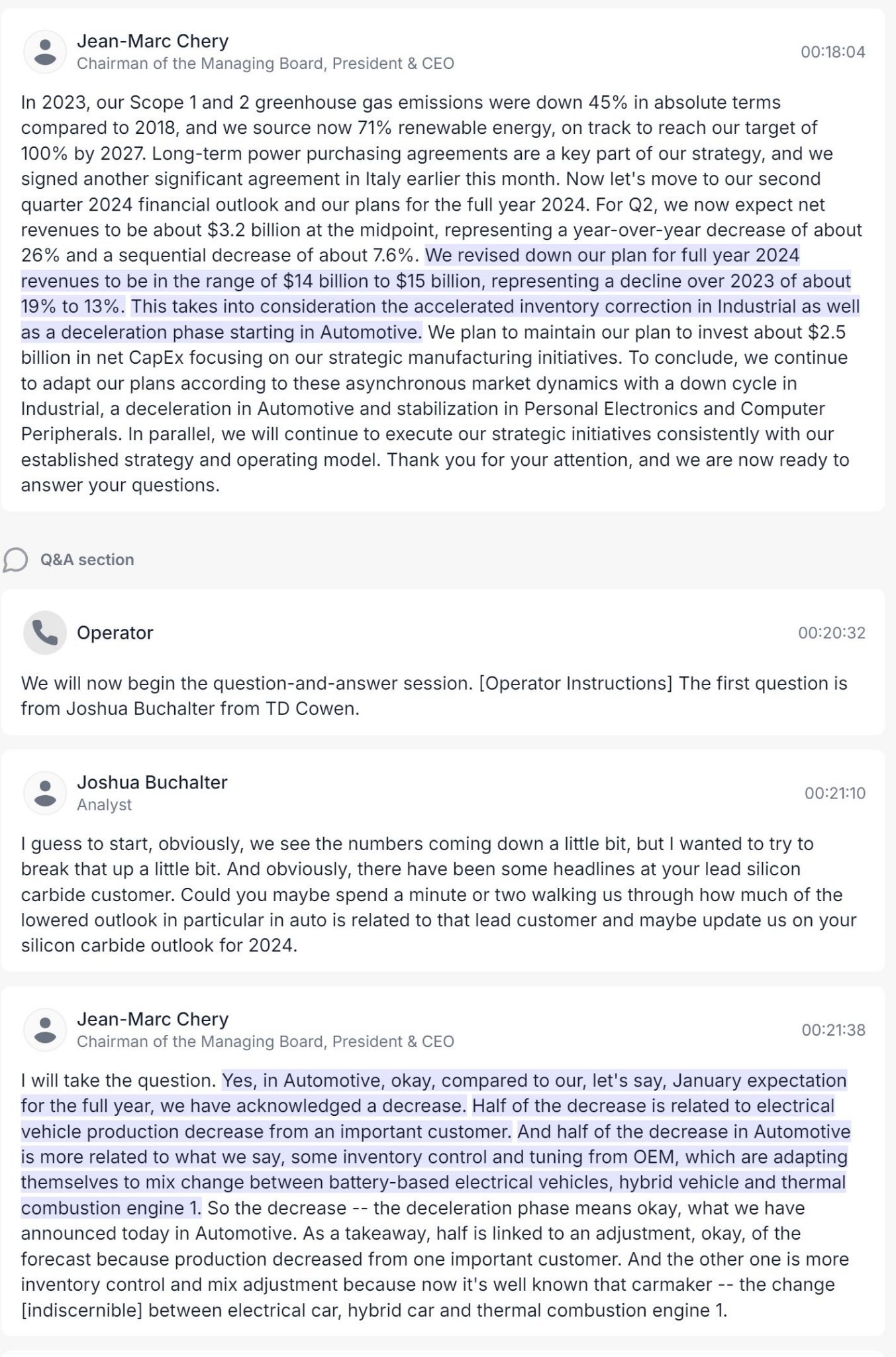

2) $STMicroelectronics(STM.US$ 's report/call were more downbeat than $Texas Instruments(TXN.US$ 's (see the first screenshot below). I could look past auto headwinds if they were the only issue – EV demand should eventually pick up as prices keep dropping and chargers proliferate, and other secular tailwinds such as ADAS and cabin electronics remain – but the combo of auto weakness, ongoing industrial softness and China pressures (both in terms of new capacity and the government pressuring firms to buy local) makes me think analog/MCU firms could tread water for a little longer.

3) After going through $KLA Corp(KLAC.US$ 's call (see the second screenshot), I’m kicking myself for not buying a bunch of semicaps when semis were tanking earlier this week (am long $Applied Materials(AMAT.US$ , but wish I'd also bought some others). Not keen to chase here, but the stars really seem to be aligning across memory and leading-edge foundry/logic. China’s trailing-edge spend eventually dropping is a risk, but with Beijing fine with subsidizing excess capacity, this seems more of a problem for now for analog/MCU suppliers and trailing-edge foundries than semicaps.

4) $Microsoft(MSFT.US$ 's capex commentary might be a positive for $Applied Optoelectronics(AAOI.US$ , which counts Microsoft as a major client, trades for 1.7x forward EV/sales, has seen a few insider buys this year and has a quarter of its float shorted. As a second-tier optics firm, this is a more speculative name (please do your own research before taking a position), but I think there’s some squeeze potential if good news arrives. Earnings are on 5/9.

5) It’s probably too soon to place bets on this, but recent predictions (from Zuck and others) about the spread of AI agents that can handle far more complex tasks than chatbots might eventually spark a mood change regarding AI’s impact on server CPU spend. Whereas chatbot compute tends to be very GPU/inference-centric, agents would probably require a lot of inference and a lot of traditional compute. Something to watch.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment