Wishing all of my moomoo community members a prosperous and healthy year of tiger, especially to @HopeAlways @NANA123 @Mars Mooo @Mcsnacks H Tupack @AlfonsoDex @HuatLady

May all your memories come true.

Sharing with you my favorite poem

More money, less, closer to home

Sleep until you wake up naturally every day

High rank, weight, light responsibility

More bonuses come to the car

May all your memories come true.

Sharing with you my favorite poem

More money, less, closer to home

Sleep until you wake up naturally every day

High rank, weight, light responsibility

More bonuses come to the car

Translated

8

6

3

1

When do I take profit?

Why do I hang on to losses?

Why do I follow the crowd to buy $GameStop(GME.US$

Before we talk about how to attain a proper psychological mindset, we should look what is really playing with our brain.

The experts called it Behavioural Finance. Investment theories tend to assume that people are rational decision makers. Reality is often very different. Decision making is influenced by emotion, biases, social factors and cognitive biases. We...

Why do I hang on to losses?

Why do I follow the crowd to buy $GameStop(GME.US$

Before we talk about how to attain a proper psychological mindset, we should look what is really playing with our brain.

The experts called it Behavioural Finance. Investment theories tend to assume that people are rational decision makers. Reality is often very different. Decision making is influenced by emotion, biases, social factors and cognitive biases. We...

24

15

The exact quote by Warren Buffett is

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”. Mr Buffett is no doubt the best long term investor in the stock market and he is my inspiration when it comes to long term investment. For me, long term investment means a time frame of more than 5 years.

Why do I like long term investment?

1. Buying a stock of a company is owning a part of the company. When you think like a owner, you focus on the business and not the stock price. It is therefore critical to think long term. You do not sell your company when it does not do well in a week, you would try to make it work. It is the same in long term investment. Once you have selected the company to invest, you stick to the plan unless the fundamentals change.

2. I like the process of selecting and researching the companies to invest in. As a long term investor, in order to have a peace of mind when you invest, you need to do your due diligence. As a start, you need to know the following:

* What does the company do?

* How do they earn their revenue?

* How are their financials? For eg. Look at their financial ratios, price to earning, price to sales, free cash flow, debt level.

* Who are the management? Can they execute the plan and the vision?

* Who are their competitors?

I make a checklist and score the shortlisted companies. If they make the score, I will start a position in the company.

3. Long term investment eliminates emotions roller coaster and sleepless night.

In the stock market, there can be a lot of noise. The stock price goes up and down. By focusing on the business, I can take away the emotions roller coaster.

That does not means that I just ignore my investment. I would keep myself up to date on the company development during the quarterly results update. During the quarterly update, pay attention to the financial results and especially the CEO update. Reading the transcript is important.

4. Long term investment can bring massive return.Everyone dream to have a 100 bagger. Only long term investment can bring a 100 bagger. If we let go of a winner too early, we would not be able to have a 100 bagger.

$Amazon(AMZN.US$ , $Berkshire Hathaway-A(BRK.A.US$ , $Apple(AAPL.US$

So does it means that long term investment is a sure win?

Unfortunately no. All investment carry risk. There are cases whereby the company did not keep up with the times and get replaced. For eg. Blockbuster. In those cases, the investment can go to zero no matter how long you hold it. So we need to do risk management. For me, that is portfolio allocation and dollar cost averaging.

Ultimately, all roads lead to Rome. Find the investment strategy that you are most comfortable with so that you can strive from it. It can be long term investment, day trade or options trading. There are many experts in the Moomoo community that you can learn from for the different strategies.

@Mcsnacks H Tupack @HopeAlways @Mars Mooo

May the market be with you.

Merry Christmas 🎄!

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”. Mr Buffett is no doubt the best long term investor in the stock market and he is my inspiration when it comes to long term investment. For me, long term investment means a time frame of more than 5 years.

Why do I like long term investment?

1. Buying a stock of a company is owning a part of the company. When you think like a owner, you focus on the business and not the stock price. It is therefore critical to think long term. You do not sell your company when it does not do well in a week, you would try to make it work. It is the same in long term investment. Once you have selected the company to invest, you stick to the plan unless the fundamentals change.

2. I like the process of selecting and researching the companies to invest in. As a long term investor, in order to have a peace of mind when you invest, you need to do your due diligence. As a start, you need to know the following:

* What does the company do?

* How do they earn their revenue?

* How are their financials? For eg. Look at their financial ratios, price to earning, price to sales, free cash flow, debt level.

* Who are the management? Can they execute the plan and the vision?

* Who are their competitors?

I make a checklist and score the shortlisted companies. If they make the score, I will start a position in the company.

3. Long term investment eliminates emotions roller coaster and sleepless night.

In the stock market, there can be a lot of noise. The stock price goes up and down. By focusing on the business, I can take away the emotions roller coaster.

That does not means that I just ignore my investment. I would keep myself up to date on the company development during the quarterly results update. During the quarterly update, pay attention to the financial results and especially the CEO update. Reading the transcript is important.

4. Long term investment can bring massive return.Everyone dream to have a 100 bagger. Only long term investment can bring a 100 bagger. If we let go of a winner too early, we would not be able to have a 100 bagger.

$Amazon(AMZN.US$ , $Berkshire Hathaway-A(BRK.A.US$ , $Apple(AAPL.US$

So does it means that long term investment is a sure win?

Unfortunately no. All investment carry risk. There are cases whereby the company did not keep up with the times and get replaced. For eg. Blockbuster. In those cases, the investment can go to zero no matter how long you hold it. So we need to do risk management. For me, that is portfolio allocation and dollar cost averaging.

Ultimately, all roads lead to Rome. Find the investment strategy that you are most comfortable with so that you can strive from it. It can be long term investment, day trade or options trading. There are many experts in the Moomoo community that you can learn from for the different strategies.

@Mcsnacks H Tupack @HopeAlways @Mars Mooo

May the market be with you.

Merry Christmas 🎄!

32

7

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GameStop(GME.US$ $AMC Entertainment(AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW(09988.HK$ $TENCENT(00700.HK$

* $Bitcoin(BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms(FB.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $Sea(SE.US$ $Zoom Video Communications(ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $DBS Group Holdings(D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $Pinterest(PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$Apple(AAPL.US$

$Amazon(AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GameStop(GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

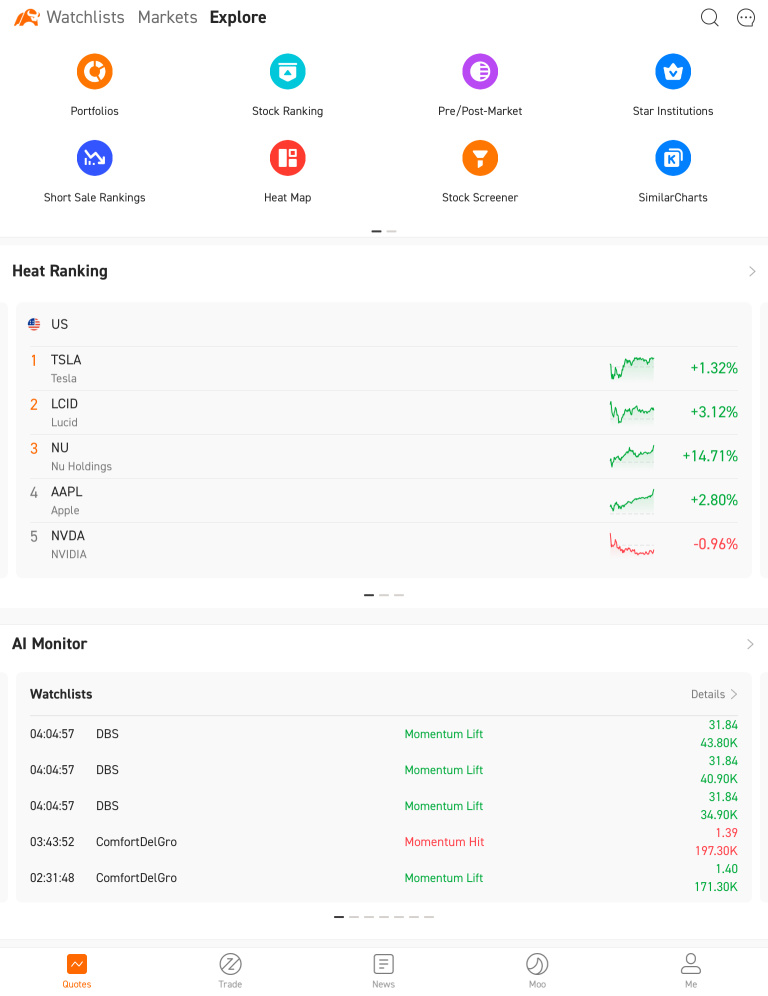

Moomoo's new Star Institution feature allow us to see the latest position data of asset management companies, Institution investors, mutual fund and other financial profession. This is also commonly known as smart money.

Go to Explore > Star Institution

On the other hand, retail investor like me are labelled as dumb money. (Do not get offended, it is coined by media to capture the eyeball).

So with this new feature, how do we follow the smart money?

* Use the Star Institution as a reference to study what they have done. Usually it would be delayed because the 13F is not "live" and it will difficult to follow it to a tee. It would be good as a reference or stock idea.

* Pay more attention to those smart money which have similar investing philosophy as you. Not all hedge funds or fund managers are the same. Some are well known to be shorting the market.

There are disadvantages of following the smart money blindly.

Firstly, they do not always make a profit, they have losses too.

Secondly, we may not understand their trade parameter, time horizon or mindset. So following blindly may need to a disaster. In fact, one of the greatest advantage we have as dumb money is patience. We can hold on to a position, ignoring the short term noise as long as the fundamental remain intact. This is how we can find the 100 baggers in the market.![]()

![]()

![]()

$Shopify(SHOP.US$

$Berkshire Hathaway 13F(BK2999.US$

$Amazon(AMZN.US$

Go to Explore > Star Institution

On the other hand, retail investor like me are labelled as dumb money. (Do not get offended, it is coined by media to capture the eyeball).

So with this new feature, how do we follow the smart money?

* Use the Star Institution as a reference to study what they have done. Usually it would be delayed because the 13F is not "live" and it will difficult to follow it to a tee. It would be good as a reference or stock idea.

* Pay more attention to those smart money which have similar investing philosophy as you. Not all hedge funds or fund managers are the same. Some are well known to be shorting the market.

There are disadvantages of following the smart money blindly.

Firstly, they do not always make a profit, they have losses too.

Secondly, we may not understand their trade parameter, time horizon or mindset. So following blindly may need to a disaster. In fact, one of the greatest advantage we have as dumb money is patience. We can hold on to a position, ignoring the short term noise as long as the fundamental remain intact. This is how we can find the 100 baggers in the market.

$Shopify(SHOP.US$

$Berkshire Hathaway 13F(BK2999.US$

$Amazon(AMZN.US$

5

2

Drawing inspiration from the book 7 Habits of Highly Effective People by Stephen Covey, I present to you the 7 habits of highly effective investors/traders.

1. Begin with an end in mind.

Define clear measures and a plan to achieve them.

Before you start your investment journey, be clear what is your objective and your plan.

Are you in the market for a day trade, a swing trade or are you in for a long term trade?

Are you investing for accumulate wealth, protect your wealth or in for a quick buck?

2. Do your research.

Study in depth the company that you want to invest in.

Read their financial report, 10K, quarterly report and ceo interviews.

Use various sources to do your research so that you are not overly dependent on one source.

Have a checklist to evaluate the company.

At the end of the research, you should have a thesis and you need to know why you want to own the stock. This forms your conviction,

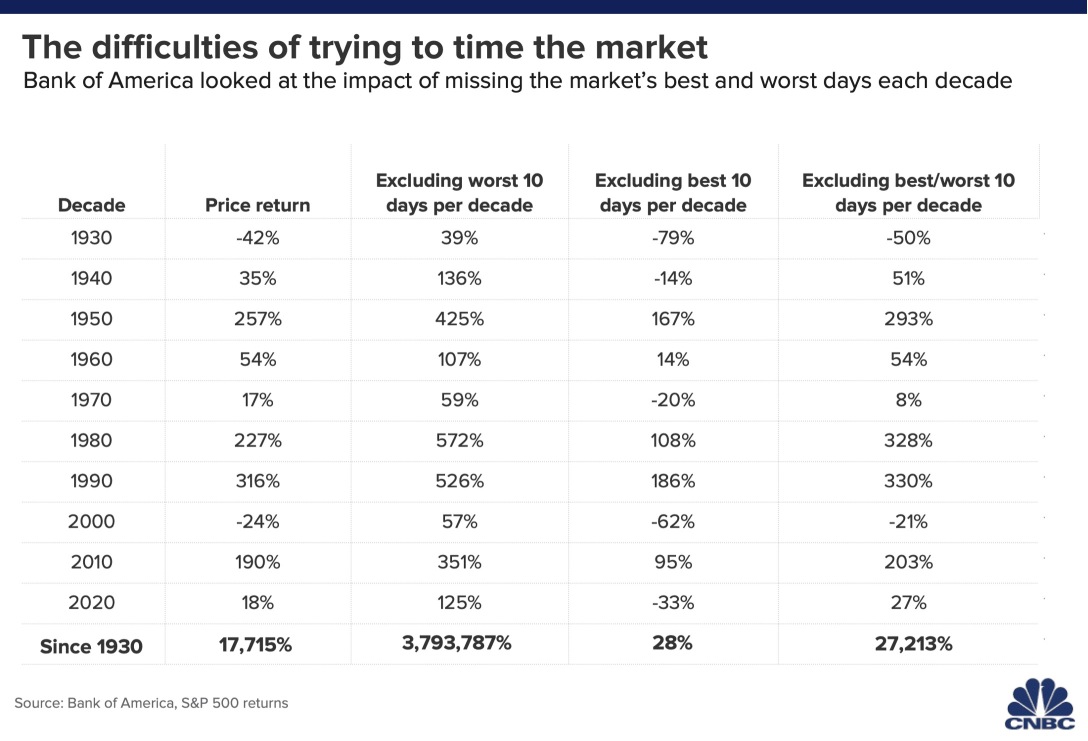

3. Don't time the market.

No one can time the market perfectly. Time in market is better than timing the market.

4. Hold on to your winners.

Sometimes it is tempting to take profit. However, if your thesis is intact and the company continue to grow, you may be letting go a winner too early and miss a 100 bagger.

$Amazon(AMZN.US$, $Tesla(TSLA.US$ .

5. It is ok to be wrong.

We make mistakes. Sometimes it could be because we overlook an important factor or the company did not execute well. When the thesis is wrong, it is ok to admit mistake, sell the stock and move on. This would be better than holding on to them and lose opportunity cost. Capital is precious.

6. Remove emotions

Emotions can cause you to make wrong decisions. I still remember how scary it was in March 2020 when I saw the stock market tumble and my portfolio lost 30% value in a short time. Thank God that i stuck to my research and did not panic sell.

The flip side of panic sell is fear of missing out. Remember early this year when many jumped into $GameStop(GME.US$o $GameStop(GME.US$ due to FOMO?

7. Sharpen the saw

Continuous improvement is important in the investment journey.

To have continuous improvement, it is important that we have enough rest physically and mentally. Devise your plan to rest and relax. It can be exercise, meditation, cycling etc or simply spending time in the nature. It also help to make social and meaningful connection with a like minded community such as @Investing with moomoo @moo_Earnings, @HopeAlways, @Mars Mooo and learning from them.

Research said that a habit takes 21 days to form. So for good habit, it is worth to start now!

1. Begin with an end in mind.

Define clear measures and a plan to achieve them.

Before you start your investment journey, be clear what is your objective and your plan.

Are you in the market for a day trade, a swing trade or are you in for a long term trade?

Are you investing for accumulate wealth, protect your wealth or in for a quick buck?

2. Do your research.

Study in depth the company that you want to invest in.

Read their financial report, 10K, quarterly report and ceo interviews.

Use various sources to do your research so that you are not overly dependent on one source.

Have a checklist to evaluate the company.

At the end of the research, you should have a thesis and you need to know why you want to own the stock. This forms your conviction,

3. Don't time the market.

No one can time the market perfectly. Time in market is better than timing the market.

4. Hold on to your winners.

Sometimes it is tempting to take profit. However, if your thesis is intact and the company continue to grow, you may be letting go a winner too early and miss a 100 bagger.

$Amazon(AMZN.US$, $Tesla(TSLA.US$ .

5. It is ok to be wrong.

We make mistakes. Sometimes it could be because we overlook an important factor or the company did not execute well. When the thesis is wrong, it is ok to admit mistake, sell the stock and move on. This would be better than holding on to them and lose opportunity cost. Capital is precious.

6. Remove emotions

Emotions can cause you to make wrong decisions. I still remember how scary it was in March 2020 when I saw the stock market tumble and my portfolio lost 30% value in a short time. Thank God that i stuck to my research and did not panic sell.

The flip side of panic sell is fear of missing out. Remember early this year when many jumped into $GameStop(GME.US$o $GameStop(GME.US$ due to FOMO?

7. Sharpen the saw

Continuous improvement is important in the investment journey.

To have continuous improvement, it is important that we have enough rest physically and mentally. Devise your plan to rest and relax. It can be exercise, meditation, cycling etc or simply spending time in the nature. It also help to make social and meaningful connection with a like minded community such as @Investing with moomoo @moo_Earnings, @HopeAlways, @Mars Mooo and learning from them.

Research said that a habit takes 21 days to form. So for good habit, it is worth to start now!

11

4

Non trading days are rest days for me.

During the weekend, i would do actvities to relax the body and the mind. One activity that i enjoy is hiking and bird watching. Spending time in the nature relaxes the brain and hiking strengthen the body. Spotting those birds are harder than catching pokemon!

A clear mind helps you to analyze the market and make better decision.

A chinese idiom has this saying “we rest so that we can travel further”.

Love the non trading days.

During the weekend, i would do actvities to relax the body and the mind. One activity that i enjoy is hiking and bird watching. Spending time in the nature relaxes the brain and hiking strengthen the body. Spotting those birds are harder than catching pokemon!

A clear mind helps you to analyze the market and make better decision.

A chinese idiom has this saying “we rest so that we can travel further”.

Love the non trading days.

3

3

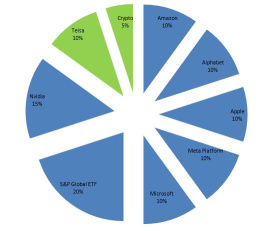

The Barbell strategy is coined by Nassim Taleb. He is a Lebanese-American statistician, investor and writer and is well known for the term “Black Swan”. It refers to unexpected events at a large magnitude, such as Covid19.

The barbell investment strategy advocates pairing two distinctly different portfolio of investment assets – distributing between the two extremes with almost nothing in the middle.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments.

The conservative portfolio should hold asset that can at least beat the inflation.

Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Wealth Accumulation Stage:

The objective is to grow your wealth beyond this $1m windfall.

I would have 85% in the conservative portfolio.

Instead of low risk asset such as cash or short term deposit, I would allocate more into blue chip technology stocks such as

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

$Meta Platforms(FB.US$

$Apple(AAPL.US$

A portion of it will go into etf such as $Vanguard S&P 500 ETF(VOO.US$.

I would also allocate 10% of the conservative portfolio to strong growth stock such as $NVIDIA(NVDA.US$

For the remaining 15% in the Highly aggressive portfolio, 10% will be in $Tesla(TSLA.US$ , 5% in crypto such as $Bitcoin(BTC.CC$ and $Ethereum(ETH.CC$ 1% can even go into meme stock coins such as a Moomoo coin suggested by @Mars Mooo or $Dogecoin(DOGE.CC$ .

This is how the allocation will look like:

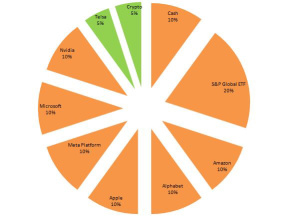

Wealth Preservation Stage:

The objective is to protect this $1m.

I would take a more conservative approach and keep some money as cash. The rest of the allocation will be very similar to the weakth accumulation stage, using a barbell strategy.

The conservative portfolio will be 90% and the aggressive one is 10%.

Quoting @NANA123" There is no best, only the most suitable “ strategy.

How you deploy the $1m totally depends on:

* Your risk appetite

* Your life stage

* Your investing style

* Your objective

I believe that using a barbell strategy can help me to meet the 4 points mentioned. The allocation % can be reviewed and adjusted annually if required. Most importantly, it should help me to sleep soundly at night.

Now…the question is….how should i get this $1m windfall?![]()

Any ideas guys?

@Investing with moomoo @HopeAlways @GratefulPanda @Syuee @Tupack H Mcsnacks

The barbell investment strategy advocates pairing two distinctly different portfolio of investment assets – distributing between the two extremes with almost nothing in the middle.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments.

The conservative portfolio should hold asset that can at least beat the inflation.

Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Wealth Accumulation Stage:

The objective is to grow your wealth beyond this $1m windfall.

I would have 85% in the conservative portfolio.

Instead of low risk asset such as cash or short term deposit, I would allocate more into blue chip technology stocks such as

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

$Meta Platforms(FB.US$

$Apple(AAPL.US$

A portion of it will go into etf such as $Vanguard S&P 500 ETF(VOO.US$.

I would also allocate 10% of the conservative portfolio to strong growth stock such as $NVIDIA(NVDA.US$

For the remaining 15% in the Highly aggressive portfolio, 10% will be in $Tesla(TSLA.US$ , 5% in crypto such as $Bitcoin(BTC.CC$ and $Ethereum(ETH.CC$ 1% can even go into meme stock coins such as a Moomoo coin suggested by @Mars Mooo or $Dogecoin(DOGE.CC$ .

This is how the allocation will look like:

Wealth Preservation Stage:

The objective is to protect this $1m.

I would take a more conservative approach and keep some money as cash. The rest of the allocation will be very similar to the weakth accumulation stage, using a barbell strategy.

The conservative portfolio will be 90% and the aggressive one is 10%.

Quoting @NANA123" There is no best, only the most suitable “ strategy.

How you deploy the $1m totally depends on:

* Your risk appetite

* Your life stage

* Your investing style

* Your objective

I believe that using a barbell strategy can help me to meet the 4 points mentioned. The allocation % can be reviewed and adjusted annually if required. Most importantly, it should help me to sleep soundly at night.

Now…the question is….how should i get this $1m windfall?

Any ideas guys?

@Investing with moomoo @HopeAlways @GratefulPanda @Syuee @Tupack H Mcsnacks

379

33

When is the best time to press the trade button?

Every investor has their own process and here’s mine.

After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. Some of the factors include:

Mission statement: Simple, inspirational?

Moat: Does the company has moat?

Is there network effect?

What is the switching cost?

Is there low cost advantage?

Is there optionality?

Financial. How are the numbers. Look at the various financial ratio, PE, PEG, Cash, Debt, Free Cash flow.

Founder: Is the Founder still involved? What is the ownership of the company?

Rank the factors. Assigned a total score.

For me, the moat & the financials are equally important.

Next is the big question - When to press the TRADE button?

You can do all the research on companies such as $Apple(AAPL.US$, $Snowflake(SNOW.US$ etc, but if you do not press the trade button, it is only a paper exercise. So the best time to press the trade button is as soon as you can!

I do not try to time the market. Studies by $Bank of America(BAC.US$ have shown that it is a futile execise to time the market.

Once I have done my research, I would use a Dollar Cost Averaging (DCA) method to buy the company. I would split the purchase into 3 parts. In that way, I would not be timing the

market.

Stay discplined in doing in the DCA. For eg. After the first purchase, if you see that the stocks have dropped 20%, do not panic. Stick to plan. Trust the reserach that you have done.

I also use a portfolio allocation to manage my risk.

Stay invested in the company as long as the thesis remain intact. In the long run, good companies will continue to grow and be reflected in the share price. Focus on the business. Short term volatility is part of the game.

This is my view as a fundamental investor and hope it helps you. Another real master here in the community is

@HopeAlways

$Apple(AAPL.US$

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

Good luck!

Every investor has their own process and here’s mine.

After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. Some of the factors include:

Mission statement: Simple, inspirational?

Moat: Does the company has moat?

Is there network effect?

What is the switching cost?

Is there low cost advantage?

Is there optionality?

Financial. How are the numbers. Look at the various financial ratio, PE, PEG, Cash, Debt, Free Cash flow.

Founder: Is the Founder still involved? What is the ownership of the company?

Rank the factors. Assigned a total score.

For me, the moat & the financials are equally important.

Next is the big question - When to press the TRADE button?

You can do all the research on companies such as $Apple(AAPL.US$, $Snowflake(SNOW.US$ etc, but if you do not press the trade button, it is only a paper exercise. So the best time to press the trade button is as soon as you can!

I do not try to time the market. Studies by $Bank of America(BAC.US$ have shown that it is a futile execise to time the market.

Once I have done my research, I would use a Dollar Cost Averaging (DCA) method to buy the company. I would split the purchase into 3 parts. In that way, I would not be timing the

market.

Stay discplined in doing in the DCA. For eg. After the first purchase, if you see that the stocks have dropped 20%, do not panic. Stick to plan. Trust the reserach that you have done.

I also use a portfolio allocation to manage my risk.

Stay invested in the company as long as the thesis remain intact. In the long run, good companies will continue to grow and be reflected in the share price. Focus on the business. Short term volatility is part of the game.

This is my view as a fundamental investor and hope it helps you. Another real master here in the community is

@HopeAlways

$Apple(AAPL.US$

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

Good luck!

96

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)