Latest

Hot

Time flies!![]() You have completed another journey forCo-Wise: What push you to press the "trade" button?Thank you for all your participation. In this topic, 77% mooers chose to usefundamentalanalysis to "trade" stocks, 13% focused ontechnicalanalysis, while 10% relied onnews. @Marsnbsp;Mooosaid it's a game, just like the Squid Game. @mooboosaid that inflation made him trade. For more high-quality views from other mooers, let's take a look.

You have completed another journey forCo-Wise: What push you to press the "trade" button?Thank you for all your participation. In this topic, 77% mooers chose to usefundamentalanalysis to "trade" stocks, 13% focused ontechnicalanalysis, while 10% relied onnews. @Marsnbsp;Mooosaid it's a game, just like the Squid Game. @mooboosaid that inflation made him trade. For more high-quality views from other mooers, let's take a look.![]()

Here comes the reward for your hard work: 5 best postswill be rewarded with 1 specific stock respectively,5 outstanding postswill be rewarded with moomoo mascots, and other posts with a minimum of 30 words will be rewarded with88 points. Congratulations to all the winners!![]()

![]()

![]()

(*The following collection is sorted according to the first letter of the mooers' nicknames, which doesn't constitute a recommendation ranking)

*You will receive your rewards within 15 working days.

Part Ⅰ: High-Quality Article Collection

![]() Author: @GreatOracle

Author: @GreatOracle

Title:swing daily trader only use 20% fundamentals data

Opinion: I rely more on the technical stats. Checking: 1. MA 5, 10 and 20. 2. Williams %R (I only entry when the chart start to go over -20%) 3. MCD chart at Golden Cross. 4. Stochastic showing uptrend. 5. Check earnings date so it have time to rally up then try to sell 3 days before earnings date at peak price.

![]() Author: @GT1982

Author: @GT1982

Title:When Do I Press the Buy Button?

Opinion: I set several target prices to enter based on support/resistance levels over several time frames. When the price alert is triggered, I will not press the buy button straightaway. Rather, I treat it as a fluid figure which I will sit up and place closer attention to when hit.

![]() Author: @HopeAlways

Author: @HopeAlways

Title:Fundamental Analysis

Opinion: I would mainly use financial metrics to decide if a stock is attractively priced before I press the "trade" button. Learning how to interpret financial metrics help me to value a stock. The cornerstone financial metric to value a business is the price-to-earnings ratio or better known as P/E ratio.

![]() Author: @Moonbsp;tonbsp;Moonnbsp;FTW

Author: @Moonbsp;tonbsp;Moonnbsp;FTW

Title:What’s your beliefs and what’s your risk appetite?

Opinion: There can be many methods/indicators – be it theoretical, practical or luck (maybe)? In my opinion, I’m more of the 40-30-20-10. 40%: Research on the Company/Stock and anything related to it. 30%: The theoretical analysis. 20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market. 10%: Luck!

![]() Author: @Mamanbsp;Cass

Author: @Mamanbsp;Cass

Title:Aha Fundamental Trade Button Motivators

Opinion: Does this company provide a product or service that I will use in ANY economy? If the answer is "no", then I don't care how pretty they are on paper, I'm out. If the answer is "yes" then I'm jumping up and down on that Trade button! Never invest in a business you can't understand.

![]() Author: @Marsnbsp;Mooo

Author: @Marsnbsp;Mooo

Title:This is just a game

Opinion: As for me, pressing the trade button is more of like a game, just like the television series, Squid Game, which is now streaming in NFLX. In Squid Game, players does not only uses their skills, they also relies on information (or news) and luck in order to be alive for the next game.

![]() Author: @NANA123

Author: @NANA123

Title:Which strategy prompted you to press the "trade" button?

Opinion: I think we should figure out what the trading model is before confirming our stock picking ideas. I only participate in those stocks whose daily line has just broken through the half-year line or the annual line, use a standard to define the trend, and then filter out all the stocks that don't have a trend.

![]() Author: @Powerhouse

Author: @Powerhouse

Title:Money and cash return will drive you to trade now!

Opinion: There is no 100% right or wrong as to when to click trade for a stock but rather, the best use of information at that moment to make the best decision. The sooner you get in, the better. Don't wait to buy stocks. Buy stocks and wait. Time in the market beats timing the market.

![]() Author: @Panda2102

Author: @Panda2102

Title:Best time to press the trade button

Opinion: After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company.

![]() Author: @Qwinbie

Author: @Qwinbie

Title:What Push You to Press The Trade Button?

Opinion: After selecting a bundle of high-quality stocks in the stock screener, I will have five shortlisted stocks. I will see the GMMA indicator of all the 5 stocks and decide which one has the most suitable price to buy. Once the analysis is done, I will press the “trade button” based on my monthly budget.

After reading these wonderful posts, mooers might say "Time in the market is much better than timing the market." Most mooers follow the advice given by great Warren Buffets and have their own trading systems.![]() If you want to view more, please click the topic again:What push you to press the "trade" button?And you can find some writing inspiration from @moomoo Academy:How to quickly select position stocks from your watchlists?Share your thoughts and join the discussion. Don't forget to leave your comment and tell mooers about what you have learned.

If you want to view more, please click the topic again:What push you to press the "trade" button?And you can find some writing inspiration from @moomoo Academy:How to quickly select position stocks from your watchlists?Share your thoughts and join the discussion. Don't forget to leave your comment and tell mooers about what you have learned.![]()

Part Ⅱ: Vote for "Mentor Moo"

It's voting time again. Now let's choose the Mentor Moo for this topic. Whose ideas do you think are the best and how can you learn more from him/her?![]()

The selection rules will take into account the following factors: logical and practical content, type setting and pictures, and interaction with other mooers.

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!![]() Come and support your favorite tutor, your vote means a lot to them.

Come and support your favorite tutor, your vote means a lot to them.

A systematic framework for decision making can help simplify the process and maximize returns. Tell us what you gained from this topic in the comments section. In three days, our new "Mentor Moo" will be published. Let's see who can get the majority's support and gain this glory. If you want to be honored too, please join in the next topic! Looking forward to your views.![]()

Disclaimer:All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Here comes the reward for your hard work: 5 best postswill be rewarded with 1 specific stock respectively,5 outstanding postswill be rewarded with moomoo mascots, and other posts with a minimum of 30 words will be rewarded with88 points. Congratulations to all the winners!

(*The following collection is sorted according to the first letter of the mooers' nicknames, which doesn't constitute a recommendation ranking)

*You will receive your rewards within 15 working days.

Part Ⅰ: High-Quality Article Collection

Title:swing daily trader only use 20% fundamentals data

Opinion: I rely more on the technical stats. Checking: 1. MA 5, 10 and 20. 2. Williams %R (I only entry when the chart start to go over -20%) 3. MCD chart at Golden Cross. 4. Stochastic showing uptrend. 5. Check earnings date so it have time to rally up then try to sell 3 days before earnings date at peak price.

Title:When Do I Press the Buy Button?

Opinion: I set several target prices to enter based on support/resistance levels over several time frames. When the price alert is triggered, I will not press the buy button straightaway. Rather, I treat it as a fluid figure which I will sit up and place closer attention to when hit.

Title:Fundamental Analysis

Opinion: I would mainly use financial metrics to decide if a stock is attractively priced before I press the "trade" button. Learning how to interpret financial metrics help me to value a stock. The cornerstone financial metric to value a business is the price-to-earnings ratio or better known as P/E ratio.

Title:What’s your beliefs and what’s your risk appetite?

Opinion: There can be many methods/indicators – be it theoretical, practical or luck (maybe)? In my opinion, I’m more of the 40-30-20-10. 40%: Research on the Company/Stock and anything related to it. 30%: The theoretical analysis. 20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market. 10%: Luck!

Title:Aha Fundamental Trade Button Motivators

Opinion: Does this company provide a product or service that I will use in ANY economy? If the answer is "no", then I don't care how pretty they are on paper, I'm out. If the answer is "yes" then I'm jumping up and down on that Trade button! Never invest in a business you can't understand.

Title:This is just a game

Opinion: As for me, pressing the trade button is more of like a game, just like the television series, Squid Game, which is now streaming in NFLX. In Squid Game, players does not only uses their skills, they also relies on information (or news) and luck in order to be alive for the next game.

Title:Which strategy prompted you to press the "trade" button?

Opinion: I think we should figure out what the trading model is before confirming our stock picking ideas. I only participate in those stocks whose daily line has just broken through the half-year line or the annual line, use a standard to define the trend, and then filter out all the stocks that don't have a trend.

Title:Money and cash return will drive you to trade now!

Opinion: There is no 100% right or wrong as to when to click trade for a stock but rather, the best use of information at that moment to make the best decision. The sooner you get in, the better. Don't wait to buy stocks. Buy stocks and wait. Time in the market beats timing the market.

Title:Best time to press the trade button

Opinion: After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company.

Title:What Push You to Press The Trade Button?

Opinion: After selecting a bundle of high-quality stocks in the stock screener, I will have five shortlisted stocks. I will see the GMMA indicator of all the 5 stocks and decide which one has the most suitable price to buy. Once the analysis is done, I will press the “trade button” based on my monthly budget.

After reading these wonderful posts, mooers might say "Time in the market is much better than timing the market." Most mooers follow the advice given by great Warren Buffets and have their own trading systems.

Part Ⅱ: Vote for "Mentor Moo"

It's voting time again. Now let's choose the Mentor Moo for this topic. Whose ideas do you think are the best and how can you learn more from him/her?

The selection rules will take into account the following factors: logical and practical content, type setting and pictures, and interaction with other mooers.

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!

A systematic framework for decision making can help simplify the process and maximize returns. Tell us what you gained from this topic in the comments section. In three days, our new "Mentor Moo" will be published. Let's see who can get the majority's support and gain this glory. If you want to be honored too, please join in the next topic! Looking forward to your views.

Disclaimer:All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

139

59

i will press the trade button when the shares in my watchlist reached the price I’m expecting. If bullish, will sell to secure profits. but sometimes also impulsive buys which makes me press the trade button

1

fundamentals of the company are key to long term gains I think.

media is important only to get a sense of hype and public hype and intrigue are key to huge gains (though volatile)

political environment is very important as well, when considering that any given policy can essentially wipe out a business or create a rush of wealth to a company.

lastly don’t chase the run up. Do the research…. does the company have good fundamentals and is there a demand for what the company is selling, what is the “hype” (media and public opinion)

lastly take note on what whales (the rich) are doing aka where and what is the 1% putting their money into.

media is important only to get a sense of hype and public hype and intrigue are key to huge gains (though volatile)

political environment is very important as well, when considering that any given policy can essentially wipe out a business or create a rush of wealth to a company.

lastly don’t chase the run up. Do the research…. does the company have good fundamentals and is there a demand for what the company is selling, what is the “hype” (media and public opinion)

lastly take note on what whales (the rich) are doing aka where and what is the 1% putting their money into.

1

What I like to do... is click a group of stocks (tech, entertainment, memes)

Then I'll go down the list clicking each one and check out the volume.... if it's way higher than the average and the price isn't moving... I'll snag some and hold... usually by next Friday it's up pretty big.... I first noticed it with. CEO...

Then I'll go down the list clicking each one and check out the volume.... if it's way higher than the average and the price isn't moving... I'll snag some and hold... usually by next Friday it's up pretty big.... I first noticed it with. CEO...

1

blessed i work for home depot .thought about investing .

1

I will screen through the good fundamental companies and study its technical and fundamental indicators. Upon meeting the criteria and when it is at the support level, I will push the trade button to “buy”, and when it has rise to the resistant level, I will press the trade button to “sell” to lock in profit.

Many of us may wish to know what is the urge that wants us to start trading? For me of cos it’s financial freedom. But how ? Saying is easy but how and where we start ? We can’t just trade blindly without knowing facts and financial information of a company’s IPO

Worry not in this app there’s trading tutorials to teach us how to get started. But of cos we still need to get more information via websites, for me I prefer going Google news. On the web page to look at more insights on the company performance. Then coming back to the MooMoo app and go to the stock, clicking on Quotes : we will be able to view from the top tabs ; News, Analysis, Options. Viewing on the News we get recent info for the companies. Analysis will give us information for the company’s profits and liabilities.

All these are the factors which will trigger me to push or not to push the Trade button.

haha above all said , I’m not a financial advisor but I jus follow all the rules I’ve learnt from fellow Mooers and also learning from past mistakes and not to retrigger those silly mistakes I’ve made.

All Mooers new and old , it’s never too late to start and never too early to push Trade, motto of Nike : Just Do It

$AMC Entertainment(AMC.US$ $Apple(AAPL.US$ $Futu Holdings Ltd(FUTU.US$ $GameStop(GME.US$ $Tesla(TSLA.US$

Worry not in this app there’s trading tutorials to teach us how to get started. But of cos we still need to get more information via websites, for me I prefer going Google news. On the web page to look at more insights on the company performance. Then coming back to the MooMoo app and go to the stock, clicking on Quotes : we will be able to view from the top tabs ; News, Analysis, Options. Viewing on the News we get recent info for the companies. Analysis will give us information for the company’s profits and liabilities.

All these are the factors which will trigger me to push or not to push the Trade button.

haha above all said , I’m not a financial advisor but I jus follow all the rules I’ve learnt from fellow Mooers and also learning from past mistakes and not to retrigger those silly mistakes I’ve made.

All Mooers new and old , it’s never too late to start and never too early to push Trade, motto of Nike : Just Do It

$AMC Entertainment(AMC.US$ $Apple(AAPL.US$ $Futu Holdings Ltd(FUTU.US$ $GameStop(GME.US$ $Tesla(TSLA.US$

3

1

There can be many methods/indicators – be it theoretical, practical or luck (maybe)? In my opinion, I’m more of the 40-30-20-10

40%: Research on the Company/Stock and anything related to the it. Basically, it’s questioning yourself – If you have $1mil, will you want to put this amount to invest in the Company? How much confidence do you have?

Taking consideration, if you have $1mil, will you want to invest in $Apple(AAPL.US$, $Alphabet-A(GOOGL.US$ $Amazon(AMZN.US$ - will it be "Hit it right away" or something holding you back?

a. About Company

b. It’s management – leadership, events, how employees feel about working in the Company, etc.

c. Investors

d. CSR

e. How and what clients feel of Company’s product and/or services

30%: The theoretical analysis (numbering is not in order!) – but of course choosing what you are comfortable with.

a. Dollar Cost Averaging

b. Fundamental Analysis

c. Technical Analysis

d. Chart reading

e. Candlestick

20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market:

a. Both sides of stories – good and bad news. Bad news which highly may cause it to dip – you might want to enter during it’s dip and sell when it bulls!

b. Surrounding as in its competitors – it might affect the stock one way or another. Taking an example the current rising trend in EVs (Electric Vehicles) – $Tesla(TSLA.US$ is rising, other companies in this industry is affected. They will feel pressured in many ways – having to beat Tesla in sales, finding ways in obtaining chips which Tesla managed to obtain, winning the hearts of buyers, etc.

However, think of it – there are many other car makers in this industry. If they could be the next 3 companies in managing to resolve the issue, it could benefit their stock value.

c. It could be some big shot influencing the stock to grow – example: meme stocks ( $AMC Entertainment(AMC.US$ , $Twitter (Delisted)(TWTR.US$ ) being influenced by a group of Reddit. Well, meme stock is a stock that captures online attention, mostly from a younger generation of investors on online forums such as Reddit. And ZOOM, it goes viral! However, it is usually not in line with its fundamentals.

10%: Luck!![]() 🍀

🍀

I'm thankful to the someone who mentioned to me - Overall, it depends on your risk appetite. Depending on whether you are you a trader or investor. Indeed, it is important to know clearly what you want your portfolio to be like in order to know when to hit the “Trade” button. You can either buy dip and sell high and the other is to buy high and sell higher. However, are you the risk taker to buy dip and not having to worry the “what-ifs” it dips even deeper? Remember to do the research and study and have a ratio of your own that you are comfortable with being hitting the button!

40%: Research on the Company/Stock and anything related to the it. Basically, it’s questioning yourself – If you have $1mil, will you want to put this amount to invest in the Company? How much confidence do you have?

Taking consideration, if you have $1mil, will you want to invest in $Apple(AAPL.US$, $Alphabet-A(GOOGL.US$ $Amazon(AMZN.US$ - will it be "Hit it right away" or something holding you back?

a. About Company

b. It’s management – leadership, events, how employees feel about working in the Company, etc.

c. Investors

d. CSR

e. How and what clients feel of Company’s product and/or services

30%: The theoretical analysis (numbering is not in order!) – but of course choosing what you are comfortable with.

a. Dollar Cost Averaging

b. Fundamental Analysis

c. Technical Analysis

d. Chart reading

e. Candlestick

20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market:

a. Both sides of stories – good and bad news. Bad news which highly may cause it to dip – you might want to enter during it’s dip and sell when it bulls!

b. Surrounding as in its competitors – it might affect the stock one way or another. Taking an example the current rising trend in EVs (Electric Vehicles) – $Tesla(TSLA.US$ is rising, other companies in this industry is affected. They will feel pressured in many ways – having to beat Tesla in sales, finding ways in obtaining chips which Tesla managed to obtain, winning the hearts of buyers, etc.

However, think of it – there are many other car makers in this industry. If they could be the next 3 companies in managing to resolve the issue, it could benefit their stock value.

c. It could be some big shot influencing the stock to grow – example: meme stocks ( $AMC Entertainment(AMC.US$ , $Twitter (Delisted)(TWTR.US$ ) being influenced by a group of Reddit. Well, meme stock is a stock that captures online attention, mostly from a younger generation of investors on online forums such as Reddit. And ZOOM, it goes viral! However, it is usually not in line with its fundamentals.

10%: Luck!

I'm thankful to the someone who mentioned to me - Overall, it depends on your risk appetite. Depending on whether you are you a trader or investor. Indeed, it is important to know clearly what you want your portfolio to be like in order to know when to hit the “Trade” button. You can either buy dip and sell high and the other is to buy high and sell higher. However, are you the risk taker to buy dip and not having to worry the “what-ifs” it dips even deeper? Remember to do the research and study and have a ratio of your own that you are comfortable with being hitting the button!

12

10

When is the best time to press the trade button?

Every investor has their own process and here’s mine.

After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. Some of the factors include:

Mission statement: Simple, inspirational?

Moat: Does the company has moat?

Is there network effect?

What is the switching cost?

Is there low cost advantage?

Is there optionality?

Financial. How are the numbers. Look at the various financial ratio, PE, PEG, Cash, Debt, Free Cash flow.

Founder: Is the Founder still involved? What is the ownership of the company?

Rank the factors. Assigned a total score.

For me, the moat & the financials are equally important.

Next is the big question - When to press the TRADE button?

You can do all the research on companies such as $Apple(AAPL.US$, $Snowflake(SNOW.US$ etc, but if you do not press the trade button, it is only a paper exercise. So the best time to press the trade button is as soon as you can!

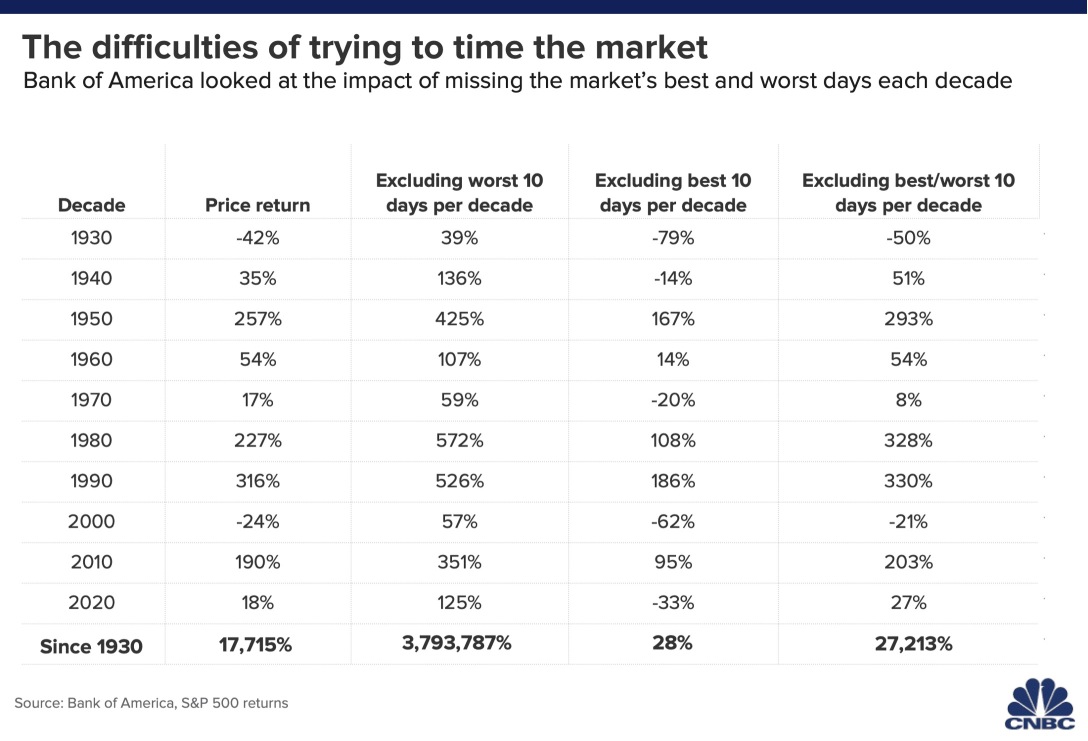

I do not try to time the market. Studies by $Bank of America(BAC.US$ have shown that it is a futile execise to time the market.

Once I have done my research, I would use a Dollar Cost Averaging (DCA) method to buy the company. I would split the purchase into 3 parts. In that way, I would not be timing the

market.

Stay discplined in doing in the DCA. For eg. After the first purchase, if you see that the stocks have dropped 20%, do not panic. Stick to plan. Trust the reserach that you have done.

I also use a portfolio allocation to manage my risk.

Stay invested in the company as long as the thesis remain intact. In the long run, good companies will continue to grow and be reflected in the share price. Focus on the business. Short term volatility is part of the game.

This is my view as a fundamental investor and hope it helps you. Another real master here in the community is

@HopeAlways

$Apple(AAPL.US$

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

Good luck!

Every investor has their own process and here’s mine.

After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. Some of the factors include:

Mission statement: Simple, inspirational?

Moat: Does the company has moat?

Is there network effect?

What is the switching cost?

Is there low cost advantage?

Is there optionality?

Financial. How are the numbers. Look at the various financial ratio, PE, PEG, Cash, Debt, Free Cash flow.

Founder: Is the Founder still involved? What is the ownership of the company?

Rank the factors. Assigned a total score.

For me, the moat & the financials are equally important.

Next is the big question - When to press the TRADE button?

You can do all the research on companies such as $Apple(AAPL.US$, $Snowflake(SNOW.US$ etc, but if you do not press the trade button, it is only a paper exercise. So the best time to press the trade button is as soon as you can!

I do not try to time the market. Studies by $Bank of America(BAC.US$ have shown that it is a futile execise to time the market.

Once I have done my research, I would use a Dollar Cost Averaging (DCA) method to buy the company. I would split the purchase into 3 parts. In that way, I would not be timing the

market.

Stay discplined in doing in the DCA. For eg. After the first purchase, if you see that the stocks have dropped 20%, do not panic. Stick to plan. Trust the reserach that you have done.

I also use a portfolio allocation to manage my risk.

Stay invested in the company as long as the thesis remain intact. In the long run, good companies will continue to grow and be reflected in the share price. Focus on the business. Short term volatility is part of the game.

This is my view as a fundamental investor and hope it helps you. Another real master here in the community is

@HopeAlways

$Apple(AAPL.US$

$Amazon(AMZN.US$

$Alphabet-A(GOOGL.US$

Good luck!

96

8

HopeAlways :

NANA123 HopeAlways:

Mars Mooo :

Mars Mooo :

HopeAlways NANA123:

View more comments...