Mr RayLiang

liked and commented on

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

Translated

3

1

Mr RayLiang

liked and commented on

$Tesla(TSLA.US$

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

Translated

9

3

Mr RayLiang

liked and commented on

$iShares China Large-Cap ETF(FXI.US$

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

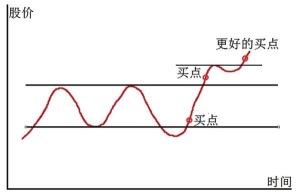

When they see a rise in stock, they want to catch up; when they see a decline, they panic; or they buy it after listening to a recommendation from a friend or Big V, and have made a happy profit, but have lost money because they are frustrated but don't know why. I'm sure many of you have experienced this. Greed and fear are human instincts. It is said that the hardest thing about investing is to overcome human nature. If you want to maintain a good mindset, you can't just rely on strong and excellent psychological qualities to fight against human weaknesses; you also need to have a perfect trading system of your own. So how do you do that?

1. First, you need to understand your investment style

1. Appropriate investment cycle. Are you good at short-term investments or long-term investments?

2. Type of investment. What is the expected return and the maximum acceptable loss, conservative, or aggressive?

3. Investment preferences. Are there any industries or fields you are familiar with; and when selecting specific stocks, do you refer to fundamentals or technical aspects?

Understanding these issues can better help us build a trading system that matches our own style

2. Establishing a trading system means that you should understand these issues before buying stocks, including:

1. Why buy it? What is the basis and criteria for selection? (Select target)...

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

When they see a rise in stock, they want to catch up; when they see a decline, they panic; or they buy it after listening to a recommendation from a friend or Big V, and have made a happy profit, but have lost money because they are frustrated but don't know why. I'm sure many of you have experienced this. Greed and fear are human instincts. It is said that the hardest thing about investing is to overcome human nature. If you want to maintain a good mindset, you can't just rely on strong and excellent psychological qualities to fight against human weaknesses; you also need to have a perfect trading system of your own. So how do you do that?

1. First, you need to understand your investment style

1. Appropriate investment cycle. Are you good at short-term investments or long-term investments?

2. Type of investment. What is the expected return and the maximum acceptable loss, conservative, or aggressive?

3. Investment preferences. Are there any industries or fields you are familiar with; and when selecting specific stocks, do you refer to fundamentals or technical aspects?

Understanding these issues can better help us build a trading system that matches our own style

2. Establishing a trading system means that you should understand these issues before buying stocks, including:

1. Why buy it? What is the basis and criteria for selection? (Select target)...

Translated

10

6

Mr RayLiang

liked and commented on

$Invesco QQQ Trust(QQQ.US$

$Tesla(TSLA.US$

$Netflix(NFLX.US$

$NIO Inc(NIO.US$

The market continued to rise today after a slight adjustment yesterday, and the major indexes rose across the board today. QQQ, for example, has closed six positive lines since it rebounded to 359.65, approaching the range of its strongest pressure level. After the market reaches this point, many short sellers will unexpectedly participate in shorting, so in this position we should pay attention to protect profits, gradually reduce positions, lock profits to leave. In the current closing position, I feel that it should not be aggressive to do long, do not short, simply stop and do not operate. At the same time, you should calm down and learn about stocks. I still concentrate on following the video of my mentor's reading notes to learn the legendary experience of Wall Street stock guru Jesse Livermore to increase my judgment and technical analysis ability. Friends who are interested in reading can search the financial and economic reading notes about Jesse Livermore on the Internet. I believe you will also have a lot of gains. Maybe I can find the mentor I follow!

$Tesla(TSLA.US$

$Netflix(NFLX.US$

$NIO Inc(NIO.US$

The market continued to rise today after a slight adjustment yesterday, and the major indexes rose across the board today. QQQ, for example, has closed six positive lines since it rebounded to 359.65, approaching the range of its strongest pressure level. After the market reaches this point, many short sellers will unexpectedly participate in shorting, so in this position we should pay attention to protect profits, gradually reduce positions, lock profits to leave. In the current closing position, I feel that it should not be aggressive to do long, do not short, simply stop and do not operate. At the same time, you should calm down and learn about stocks. I still concentrate on following the video of my mentor's reading notes to learn the legendary experience of Wall Street stock guru Jesse Livermore to increase my judgment and technical analysis ability. Friends who are interested in reading can search the financial and economic reading notes about Jesse Livermore on the Internet. I believe you will also have a lot of gains. Maybe I can find the mentor I follow!

Translated

8

5

$S&P 500 Index(.SPX.US$ $Invesco QQQ Trust(QQQ.US$ $iShares Russell 2000 ETF(IWM.US$

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

Translated

4

1

Mr RayLiang

liked and commented on

$iShares China Large-Cap ETF(FXI.US$

$Direxion Daily FTSE China Bull 3X Shares ETF(YINN.US$

$Tesla(TSLA.US$

$NIO Inc(NIO.US$

After a slight rebound yesterday, the China Securities Market jumped high and rose sharply today, making it a dazzling star stock in today's market. Today, FXI is up 21%, and YINN is up 64%. Seeing this kind of increase, many people wonder, is this a reversal in the market? If so, if we don't catch up now, wouldn't we miss out on a perfect surge opportunity? How can you tolerate being tormented by this fear of missed deals? In fact, calm down and think about issues such as whether to chase, how to chase, what are the risks of chasing, etc., you still have to set your mind, analyze them carefully, and then make a decision. Instead of blindly following up and going long just by watching the market rise. Judging from the fact that Tencent and the Hang Seng Index have now fallen below their strongest long-term support, the current rise in China Securities should be a rebound rather than a reversal. Therefore, since the opening of the market today, according to the plan, FXI and YINN have been reduced in batches as they have rebounded. The reason is that although FXI recently broke through the GMMA 2-hour pressure range, it is still in a downward trend, and its strongest pressure level is around 37. I have personally experienced that in the process of rising stocks, we gradually reduce our positions, in fact...

$Direxion Daily FTSE China Bull 3X Shares ETF(YINN.US$

$Tesla(TSLA.US$

$NIO Inc(NIO.US$

After a slight rebound yesterday, the China Securities Market jumped high and rose sharply today, making it a dazzling star stock in today's market. Today, FXI is up 21%, and YINN is up 64%. Seeing this kind of increase, many people wonder, is this a reversal in the market? If so, if we don't catch up now, wouldn't we miss out on a perfect surge opportunity? How can you tolerate being tormented by this fear of missed deals? In fact, calm down and think about issues such as whether to chase, how to chase, what are the risks of chasing, etc., you still have to set your mind, analyze them carefully, and then make a decision. Instead of blindly following up and going long just by watching the market rise. Judging from the fact that Tencent and the Hang Seng Index have now fallen below their strongest long-term support, the current rise in China Securities should be a rebound rather than a reversal. Therefore, since the opening of the market today, according to the plan, FXI and YINN have been reduced in batches as they have rebounded. The reason is that although FXI recently broke through the GMMA 2-hour pressure range, it is still in a downward trend, and its strongest pressure level is around 37. I have personally experienced that in the process of rising stocks, we gradually reduce our positions, in fact...

Translated

7

5

Mr RayLiang

liked and commented on

$iShares China Large-Cap ETF(FXI.US$ $Direxion Daily FTSE China Bull 3X Shares ETF(YINN.US$ $Tencent(TCEHY.US$ $S&P 500 Index(.SPX.US$

Recently, Chinese stocks have entered a state of overfall, drawing a line for FXI with Wolf God GMMA. From the monthly line level, the next support level may be in the range of 26.2-27.8. After entering this range as scheduled on Monday, the small positions were laid out a few hands. It rebounded as scheduled on Tuesday and the market is expected on Wednesday, but it is important to remember that it is only a rebound, not a reversal! For the Chinese stocks in hand, every rebound at this time is either an opportunity to escape or an opportunity to stop making a profit.

Why would you say that? You can also see from Tencent's weekly GMMA that Tencent has never fallen below the support of the GMMA weekly long-term moving average group since August 2004, but now it does fall below the support of the weekly GMMA long-term moving average group. What does this mean? This shows that Tencent has fallen below the trend of nearly 20 years! In this case, do not have any illusions that China-listed stocks will soon return to the upward trend, so there will be a rebound, but not a reversal. If I enter the market on the left, I will only suck on bargain and sell on sale.

It is not easy for the stock market to do this year, the trend of the bull market has fallen below, and it is not clear whether the bear market will come. Me.

Recently, Chinese stocks have entered a state of overfall, drawing a line for FXI with Wolf God GMMA. From the monthly line level, the next support level may be in the range of 26.2-27.8. After entering this range as scheduled on Monday, the small positions were laid out a few hands. It rebounded as scheduled on Tuesday and the market is expected on Wednesday, but it is important to remember that it is only a rebound, not a reversal! For the Chinese stocks in hand, every rebound at this time is either an opportunity to escape or an opportunity to stop making a profit.

Why would you say that? You can also see from Tencent's weekly GMMA that Tencent has never fallen below the support of the GMMA weekly long-term moving average group since August 2004, but now it does fall below the support of the weekly GMMA long-term moving average group. What does this mean? This shows that Tencent has fallen below the trend of nearly 20 years! In this case, do not have any illusions that China-listed stocks will soon return to the upward trend, so there will be a rebound, but not a reversal. If I enter the market on the left, I will only suck on bargain and sell on sale.

It is not easy for the stock market to do this year, the trend of the bull market has fallen below, and it is not clear whether the bear market will come. Me.

Translated

3

5

$S&P 500 Index(.SPX.US$ $SPDR S&P 500 ETF(SPY.US$

Today, I found a perfect trend, but I didn't overcome my own demons, didn't abide by trading discipline, made a small profit, but missed out on big fish.

Trading resumed after yesterday's close, and I think it might fall today. Daishin's video analysis is also declining. Since all indices are basically at pressure levels, today's pullback is likely to occur. Don't be disconvinced! It's just that accurate!

As shown in the figure, trading starts after the points in the three boxes come out. Also, if you don't trade until then, you must control yourself because the trend is not obvious. It's very easy to break into a duvet.

After the three red frame points were determined, all the lines were drawn. Note that all lines were drawn prior to trading. You can modify it later, but you need to have a general direction. If you can't decide the direction, then don't do it!!!

The blue line is bullish support+trend+pressure. The green line is the downward pressure line. The black line is pressure.

I successfully bought SPY 442 CALL at point 1 at the price of 3.18. The plan is to take half profit at point 3. The remaining half is a 50% stop-loss loss if profit falls, and if it continues to rise into the black line pressure zone, then all take-profit is taken. However, they didn't overcome their own demons; they sold all of them at point 2. Price 3.32. I only earned 1 cent 4. The position is OK, I have money for a week's meals...

Today, I found a perfect trend, but I didn't overcome my own demons, didn't abide by trading discipline, made a small profit, but missed out on big fish.

Trading resumed after yesterday's close, and I think it might fall today. Daishin's video analysis is also declining. Since all indices are basically at pressure levels, today's pullback is likely to occur. Don't be disconvinced! It's just that accurate!

As shown in the figure, trading starts after the points in the three boxes come out. Also, if you don't trade until then, you must control yourself because the trend is not obvious. It's very easy to break into a duvet.

After the three red frame points were determined, all the lines were drawn. Note that all lines were drawn prior to trading. You can modify it later, but you need to have a general direction. If you can't decide the direction, then don't do it!!!

The blue line is bullish support+trend+pressure. The green line is the downward pressure line. The black line is pressure.

I successfully bought SPY 442 CALL at point 1 at the price of 3.18. The plan is to take half profit at point 3. The remaining half is a 50% stop-loss loss if profit falls, and if it continues to rise into the black line pressure zone, then all take-profit is taken. However, they didn't overcome their own demons; they sold all of them at point 2. Price 3.32. I only earned 1 cent 4. The position is OK, I have money for a week's meals...

Translated

3

3

Mr RayLiang

liked and commented on

$Occidental Petroleum(OXY.US$ $VanEck Gold Miners Equity ETF(GDX.US$

$Tesla(TSLA.US$

$FULU HOLDINGS(02101.HK$

“Through the ultimate technical analysis of US stocks, we will take you to enjoy the joy of speculation and profit”!

It was another day of sharp decline. I am very thankful that I listened to my mentor's advice, made more gold, and made a considerable profit. I'm also very annoyed that I didn't completely follow my mentor's advice and didn't drop all the bulls in this clearance position. Even if it came out at a loss. Now the profit portion of gold is the portion that hedges losses on the underlying stock. It's always better than a tough fight that doesn't earn anything.

In the eyes of qualified traders, trading is so simple, follow the trend and trade. Trade strictly according to the rules. Don't mix in your own subjective assumptions.

If you agree with the views stated above, agree with the theory and trading methods of the technical side. Then please follow the keywords in quotes and search on the world's largest search site, and you'll find my mentor's video. You'll gain from any video.

$Tesla(TSLA.US$

$FULU HOLDINGS(02101.HK$

“Through the ultimate technical analysis of US stocks, we will take you to enjoy the joy of speculation and profit”!

It was another day of sharp decline. I am very thankful that I listened to my mentor's advice, made more gold, and made a considerable profit. I'm also very annoyed that I didn't completely follow my mentor's advice and didn't drop all the bulls in this clearance position. Even if it came out at a loss. Now the profit portion of gold is the portion that hedges losses on the underlying stock. It's always better than a tough fight that doesn't earn anything.

In the eyes of qualified traders, trading is so simple, follow the trend and trade. Trade strictly according to the rules. Don't mix in your own subjective assumptions.

If you agree with the views stated above, agree with the theory and trading methods of the technical side. Then please follow the keywords in quotes and search on the world's largest search site, and you'll find my mentor's video. You'll gain from any video.

Translated

1

1

Mr RayLiang

liked and commented on

Since the US stock market fell below the trend, the stock market volatility has been so intense that in an environment unfriendly to beginners, they have followed the advice of online mentors to reduce operations and focus on learning to improve their technical skills. If you want to buy a small position when you step back on strong stocks, the weak stocks that have fallen deeply will buy according to the entry position given by your mentor, sell the pressure position and never love to fight. Don't always be single-minded! The title of the instructor's video today let me taste it carefully for a long time. Before the loss of money is not in the trend of individual stocks fell, or stubbornly cling to it, or the more falling more and more positions? To change the result, you must first change your thinking and then change your operation strategy.

Translated

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Mr RayLiang : Great article, very worth referring to!