$S&P 500 Index(.SPX.US$ $Invesco QQQ Trust(QQQ.US$ $iShares Russell 2000 ETF(IWM.US$

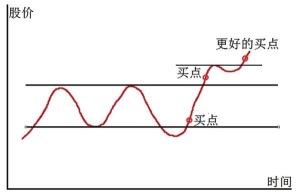

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

Translated

4

1

$S&P 500 Index(.SPX.US$ $SPDR S&P 500 ETF(SPY.US$

Today, I found a perfect trend, but I didn't overcome my own demons, didn't abide by trading discipline, made a small profit, but missed out on big fish.

Trading resumed after yesterday's close, and I think it might fall today. Daishin's video analysis is also declining. Since all indices are basically at pressure levels, today's pullback is likely to occur. Don't be disconvinced! It's just that accurate!

As shown in the figure, trading starts after the points in the three boxes come out. Also, if you don't trade until then, you must control yourself because the trend is not obvious. It's very easy to break into a duvet.

After the three red frame points were determined, all the lines were drawn. Note that all lines were drawn prior to trading. You can modify it later, but you need to have a general direction. If you can't decide the direction, then don't do it!!!

The blue line is bullish support+trend+pressure. The green line is the downward pressure line. The black line is pressure.

I successfully bought SPY 442 CALL at point 1 at the price of 3.18. The plan is to take half profit at point 3. The remaining half is a 50% stop-loss loss if profit falls, and if it continues to rise into the black line pressure zone, then all take-profit is taken. However, they didn't overcome their own demons; they sold all of them at point 2. Price 3.32. I only earned 1 cent 4. The position is OK, I have money for a week's meals...

Today, I found a perfect trend, but I didn't overcome my own demons, didn't abide by trading discipline, made a small profit, but missed out on big fish.

Trading resumed after yesterday's close, and I think it might fall today. Daishin's video analysis is also declining. Since all indices are basically at pressure levels, today's pullback is likely to occur. Don't be disconvinced! It's just that accurate!

As shown in the figure, trading starts after the points in the three boxes come out. Also, if you don't trade until then, you must control yourself because the trend is not obvious. It's very easy to break into a duvet.

After the three red frame points were determined, all the lines were drawn. Note that all lines were drawn prior to trading. You can modify it later, but you need to have a general direction. If you can't decide the direction, then don't do it!!!

The blue line is bullish support+trend+pressure. The green line is the downward pressure line. The black line is pressure.

I successfully bought SPY 442 CALL at point 1 at the price of 3.18. The plan is to take half profit at point 3. The remaining half is a 50% stop-loss loss if profit falls, and if it continues to rise into the black line pressure zone, then all take-profit is taken. However, they didn't overcome their own demons; they sold all of them at point 2. Price 3.32. I only earned 1 cent 4. The position is OK, I have money for a week's meals...

Translated

3

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)