$Tesla(TSLA.US$

$Apple(AAPL.US$

$The Mosaic(MOS.US$

The first step in investing is to protect your capital, and the second step is to make money.

For most people, the fault tolerance rate in investing is actually very low. The reason is simple: the principal amount is limited. If you don't do risk control or position management to protect it, then losing the principal may be gone.

Therefore, ensuring capital safety is our primary goal so that we can survive in the market for a long time and obtain stable profits. If you trade for a long time, there will inevitably be times when you make mistakes in judgment, so how can you control risk to keep losses within a relatively small range? In addition to learning basic technical analysis methods, you can also apply the following trading strategies:

1. Entry: You must prepare a trading plan in advance and strictly implement it, and set reminders for entry prices and stop-loss prices;

2. Bottom plow: Use a small position to hit the bottom first (for example, if you want to buy 1000 of this stock, buy 200 to test the bottom)

3. Increase positions: After the overall general trend comes out, gradually increase positions along the way, so that profits can be maximized;

4. Stop loss: Once you fall below the stop-loss level, it must be strictly enforced, including opening below the stop-loss level. Remember to stop loss! (The key points all have strong support; once they fall, institutions will go short on the trend)

5. Stop Profit: When the Profit Is in Your Hand...

$Apple(AAPL.US$

$The Mosaic(MOS.US$

The first step in investing is to protect your capital, and the second step is to make money.

For most people, the fault tolerance rate in investing is actually very low. The reason is simple: the principal amount is limited. If you don't do risk control or position management to protect it, then losing the principal may be gone.

Therefore, ensuring capital safety is our primary goal so that we can survive in the market for a long time and obtain stable profits. If you trade for a long time, there will inevitably be times when you make mistakes in judgment, so how can you control risk to keep losses within a relatively small range? In addition to learning basic technical analysis methods, you can also apply the following trading strategies:

1. Entry: You must prepare a trading plan in advance and strictly implement it, and set reminders for entry prices and stop-loss prices;

2. Bottom plow: Use a small position to hit the bottom first (for example, if you want to buy 1000 of this stock, buy 200 to test the bottom)

3. Increase positions: After the overall general trend comes out, gradually increase positions along the way, so that profits can be maximized;

4. Stop loss: Once you fall below the stop-loss level, it must be strictly enforced, including opening below the stop-loss level. Remember to stop loss! (The key points all have strong support; once they fall, institutions will go short on the trend)

5. Stop Profit: When the Profit Is in Your Hand...

Translated

$SPDR S&P 500 ETF(SPY.US$

$iShares China Large-Cap ETF(FXI.US$

$Tesla(TSLA.US$

To trade US stocks, ETFs are a must-know stock trading tool. It has a wide range of applications and is flexible in use, and once you master it, it will be a very good tool to make money.

For new entrants or newcomers to the stock market, what is difficult is not how to select stocks, but how to avoid risk or minimize risk. Many times, stocks in every sector rise and fall, and we can't guarantee that the individual stock selected is the one that is rising in the sector. When we chose a stock, the risks we faced weighed on that stock. However, when choosing an ETF sector, the risk of individual stocks will be relatively offset, thereby reducing the risk of holding, the return will not be less than if we chose to hold individual stocks, and the risk of holding a single stock can also be relatively reduced. Judging from historical data, the return rate of fixed investment in SPY or QQQ market indices can reach 8% every year, which is also quite impressive in the long run. In addition to this, if you want to choose other EFT to hold in the short to medium term or long term, or find strong sectors through EFT, it is also a viable method. However, there are also many ways to choose an ETF; it is entirely determined by screening based on personal judgment. Recently, the video blogger Wolf King US Stock, which I watch every day, added weekly ETF analysis and analysis...

$iShares China Large-Cap ETF(FXI.US$

$Tesla(TSLA.US$

To trade US stocks, ETFs are a must-know stock trading tool. It has a wide range of applications and is flexible in use, and once you master it, it will be a very good tool to make money.

For new entrants or newcomers to the stock market, what is difficult is not how to select stocks, but how to avoid risk or minimize risk. Many times, stocks in every sector rise and fall, and we can't guarantee that the individual stock selected is the one that is rising in the sector. When we chose a stock, the risks we faced weighed on that stock. However, when choosing an ETF sector, the risk of individual stocks will be relatively offset, thereby reducing the risk of holding, the return will not be less than if we chose to hold individual stocks, and the risk of holding a single stock can also be relatively reduced. Judging from historical data, the return rate of fixed investment in SPY or QQQ market indices can reach 8% every year, which is also quite impressive in the long run. In addition to this, if you want to choose other EFT to hold in the short to medium term or long term, or find strong sectors through EFT, it is also a viable method. However, there are also many ways to choose an ETF; it is entirely determined by screening based on personal judgment. Recently, the video blogger Wolf King US Stock, which I watch every day, added weekly ETF analysis and analysis...

Translated

1

$Hang Seng Index(800000.HK$

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

I've talked about this before, but I'm nagging about it today. I used to buy mindlessly according to the video blogger's point and then follow the video's point of mindless sales. And I've watched more than one vlogger. The stocks I bought were basically about the same as index funds. My experience was losing money. I don't know if the judges who operate this way have made any money. If they make money, you also approve of this practice, then just stick with it. Maybe this is your trading plan.

However, after reflecting, I found that I had no time to read so many tickets, and it was impossible to know the bloggers' actions the first time. So I can't do this method of copying my homework.

After I met Langwang, I began to try to learn trading techniques and try to make my own plans and trade through what I had learned. Although most of the time his position is an important reference or even my only answer. But I'm still trying to stick to my own plan and trade.

If you take a close look at Langwang's video description section and channel homepage, you'll find that Langwang's channel settings are very careful. Please try it. Why did Langwang put the latest videos at the bottom of the homepage instead of like many bloggers...

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

I've talked about this before, but I'm nagging about it today. I used to buy mindlessly according to the video blogger's point and then follow the video's point of mindless sales. And I've watched more than one vlogger. The stocks I bought were basically about the same as index funds. My experience was losing money. I don't know if the judges who operate this way have made any money. If they make money, you also approve of this practice, then just stick with it. Maybe this is your trading plan.

However, after reflecting, I found that I had no time to read so many tickets, and it was impossible to know the bloggers' actions the first time. So I can't do this method of copying my homework.

After I met Langwang, I began to try to learn trading techniques and try to make my own plans and trade through what I had learned. Although most of the time his position is an important reference or even my only answer. But I'm still trying to stick to my own plan and trade.

If you take a close look at Langwang's video description section and channel homepage, you'll find that Langwang's channel settings are very careful. Please try it. Why did Langwang put the latest videos at the bottom of the homepage instead of like many bloggers...

Translated

1

$FULU HOLDINGS(02101.HK$

$Tesla(TSLA.US$

$Apple(AAPL.US$

Make sure you have a good profit to loss ratio before making a trade. In disguise, this requires thinking about where to take profit and stop loss before trading. You can judge the take-profit and stop-loss here from a fundamental or technical perspective. Or let the fundamentals and technical aspects go hand in hand in judgment. Normally, take-profit, stop-loss points based on fundamentals are just far from the current price. But I'm not saying it's a value investment. If I hold on for a long time, I don't need to stop losing or stop making a profit. Value investing also requires stop-loss.

If you understand the above, you need to think, what kind of profit and loss can you accept? If the 1:10 profit to loss ratio is something you're willing to try, then back to Tesla's 700-950 example, you can enter anytime. The profit and loss ratio of the points given by the bloggers I read was excellent. If you think this profit to loss ratio is too conservative and I can accept a small profit to loss ratio, then you can change points and you're done entering the field.

Watching other people's videos is always a reference. Before making a deal, make changes based on your own circumstances. If you choose to follow without a brain, then you don't have time to get on the bus, then just mindlessly ignore it, which is fine. In turn, they complain that there's no need for this; if you have this time, it's better to study technology.

$Tesla(TSLA.US$

$Apple(AAPL.US$

Make sure you have a good profit to loss ratio before making a trade. In disguise, this requires thinking about where to take profit and stop loss before trading. You can judge the take-profit and stop-loss here from a fundamental or technical perspective. Or let the fundamentals and technical aspects go hand in hand in judgment. Normally, take-profit, stop-loss points based on fundamentals are just far from the current price. But I'm not saying it's a value investment. If I hold on for a long time, I don't need to stop losing or stop making a profit. Value investing also requires stop-loss.

If you understand the above, you need to think, what kind of profit and loss can you accept? If the 1:10 profit to loss ratio is something you're willing to try, then back to Tesla's 700-950 example, you can enter anytime. The profit and loss ratio of the points given by the bloggers I read was excellent. If you think this profit to loss ratio is too conservative and I can accept a small profit to loss ratio, then you can change points and you're done entering the field.

Watching other people's videos is always a reference. Before making a deal, make changes based on your own circumstances. If you choose to follow without a brain, then you don't have time to get on the bus, then just mindlessly ignore it, which is fine. In turn, they complain that there's no need for this; if you have this time, it's better to study technology.

Translated

$Apple(AAPL.US$

$Tesla(TSLA.US$

$Netflix(NFLX.US$

When you lose money after buying a stock, I personally think most of this depends on your confidence in holding the stock. There are only a few sources of so-called confidence, such as:

1. Perception of the fundamentals of stocks

2. Inferences from technical analysis

3. Or keep holding it because a friend around you holds it

4. I heard that the stock price could triple

5. The ratings given by stock analysts are optimistic about this stock and think they are generally not wrong

6. Because of recommendations from financial bloggers

7. Judging by my instincts, the company's performance is very good and will be ready for the future

Wait...

If you hold any of the above confidently manipulated stocks, you will definitely be swayed by them. Furthermore, these so-called sources of confidence also influence whether we can make correct and rational judgments about the stocks we invest in, so we choose targets rationally, and make rational wins and stop losses. I think some of these so-called sources of confidence can be learned from, and others must be thought about; no one can blindly follow one another. If you want to be able to follow along without blindly, you still need to improve your ability to make judgments about the market. There are many ways to improve, learn on your own, and find the right mentor for you to follow. I've always been interested in technical analysis of stocks, so I chose technical analysis to increase my confidence in holding shares. Almost a year ago, I had the privilege of learning a purely technical analysis method from the blogger Wolf King Finance in a video, benefiting...

$Tesla(TSLA.US$

$Netflix(NFLX.US$

When you lose money after buying a stock, I personally think most of this depends on your confidence in holding the stock. There are only a few sources of so-called confidence, such as:

1. Perception of the fundamentals of stocks

2. Inferences from technical analysis

3. Or keep holding it because a friend around you holds it

4. I heard that the stock price could triple

5. The ratings given by stock analysts are optimistic about this stock and think they are generally not wrong

6. Because of recommendations from financial bloggers

7. Judging by my instincts, the company's performance is very good and will be ready for the future

Wait...

If you hold any of the above confidently manipulated stocks, you will definitely be swayed by them. Furthermore, these so-called sources of confidence also influence whether we can make correct and rational judgments about the stocks we invest in, so we choose targets rationally, and make rational wins and stop losses. I think some of these so-called sources of confidence can be learned from, and others must be thought about; no one can blindly follow one another. If you want to be able to follow along without blindly, you still need to improve your ability to make judgments about the market. There are many ways to improve, learn on your own, and find the right mentor for you to follow. I've always been interested in technical analysis of stocks, so I chose technical analysis to increase my confidence in holding shares. Almost a year ago, I had the privilege of learning a purely technical analysis method from the blogger Wolf King Finance in a video, benefiting...

Translated

2

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

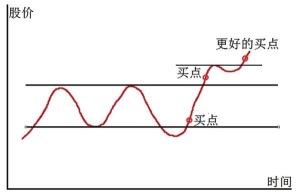

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

Recently, the market is becoming more and more difficult to control, and I don't know whether to go short or go long. Either they can't keep up with the pace of the market, or they're frustrated that they can't get out of it, or FOMO is catching up with the duvet. I don't know the reason why I should do it. After careful thought, I still haven't established an operation strategy that suits me. There are various operating strategies, and what is right for others may not be right for you. I personally think that either left-hand trading or right-side trading is the main one. Just set your own trading strategy and execute it according to the strategy. If left-hand trading is the main focus, wait patiently for lows and opportunities. In actual operation, when judgments are inaccurate, strict implementation of stop-loss can reduce losses. However, if you mainly trade on the right side, don't worry about going short for a while, and wait until the trend is clear before operating. Regardless of the method, there is no such thing as right or wrong. The most important thing is to practice and operate in whichever way suits you. Operation without a trading strategy is easy to be punched in the face by the market. I think I'm still a stock market nob, and I have a lot to learn. My method of learning is to find videos that suit my trading style, which also allowed me to find the right mentors for me to follow. Recently, I've been following his Reading Notes channel to learn the interpretation of Wall Street stock master Jesse Livermore's legendary experience in the stock market, benefiting...

Translated

3

1

$Tesla(TSLA.US$

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

This question has been discussed many times. What is my role in the marketplace? Value investor or trader? Everyone can have a different role. Just like everyone can have several stock accounts. Just do what's right for your character. But be sure to be careful and don't screw it off. It's like a comment in a comment. I think they clearly confused their characters and wrote their comments after coming back to the perspective of God.

Let me first talk about my first thoughts after seeing the reviews. I'm not disappointed; I'm affirming myself. I am very happy that I have not been interrupted by the market. I have stuck to my trading plan, that is, I have not opened a position until the opening range on the left. Chasing breakthroughs is something I don't want to do in the current environment. So I haven't touched Tesla at all.

No matter what type of role you are in, make your own trading plan before you trade. Then try to abide by it. This is a big rule. There is no such principle. If you hear someone say buy today, buy it; if you hear someone say sell tomorrow, sell it. Unless this person is God, if this is the case for a long time, and if I don't lose money, I'd be happy to see why? When it comes to people who complain, I don't want to argue with them, and I don't want to try to make them understand my point of view. I just wanted to use this example...

Translated

9

3

卓管家

liked and commented on

$S&P 500 Index(.SPX.US$ $Invesco QQQ Trust(QQQ.US$ $iShares Russell 2000 ETF(IWM.US$

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

The current market situation either waits until the bullish trend returns and then go long, or wait until it falls to a real support level before bottoming out. Currently, this state of affairs is untenable. Watch more and do less; it's best not to do it. Each of us earns our money through hard work, don't waste it. In the stock market, the most important thing is to protect your capital first, keep in mind the experience of your ancestors, and keep Aoyama there, and not be afraid of running out of firewood. To put it bluntly, at this point, even if it rebounds tomorrow and the market returns to the bull market, you've just missed QQQ 15 points and earned a little less, but your principal amount is not lost. If the trend comes out, there are at least 40 points above for you to do. If the market continues to decline and actually explore a lower position, then you will lose money. If you can't carry it and cut it at the bottom, then you won't have any bullets at the bottom; you can only watch others make money; lose or not lose? I'm afraid it's not about losing money; you probably feel particularly lost in your heart, so how long will it take to correct your mentality? When speculating on stocks, avoid a gambling mentality and an unconvinced mentality. There's no such thing as winning in gambling, even if you...

Translated

4

1

.

.![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)