KentanoMonies77

liked

loading...

27

1

KentanoMonies77

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

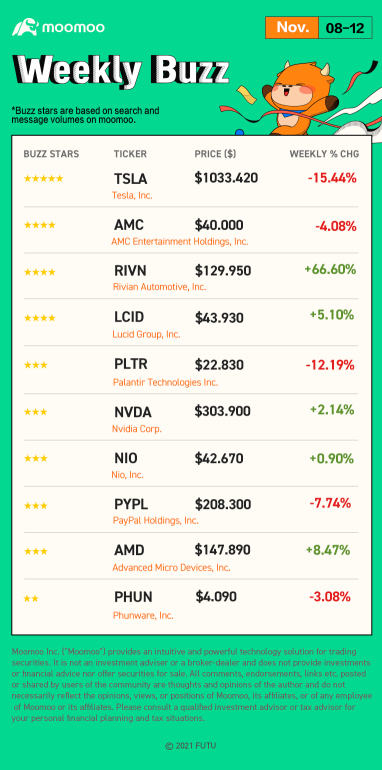

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Tesla CEO Elon Musk’s trust sold about $1.2 billion in Tesla stock, Tesla stock declined 15.4% for the week, marking the company’s worst one-week performance in 20 months.

● Mooers comment

@Daniel Acret:

There's a New Kid in Town

Everybody's talking

'bout the New Kid in town

They will never forget TSLA

till Rivian comes around

Everybody's talking

'bout the new coin in town

they won't forget BitCoin

till Ethereum comes along.

@DayleyTrades: ⭐⭐⭐⭐

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

With the CEO of AMC selling more than a million shares, AMC's stock price closed at $40.000 with a weekly decrease of 4.08%. The good news is that AMC theaters have joined the crypto bandwagon and the company’s customers can do the online payment via them.

● Mooers comment

@Smoke-A-Shotgun: $AMC Entertainment(AMC.US$

@Coffee Drip: $AMC Entertainment(AMC.US$ if you are freaking out over this drop.. You haven't been here long. Lol take a break go eat some toast and watch Netflix or go get some fresh air and calm down. This is not that bad. I've been in amc since like the 2.00 days and even before that. I watched covid almost take out AMC and held on and bought more. Stocks go up and down.

3. RIVN - Buzzing Stars: ⭐⭐⭐⭐

Rivian Automotive has made a strong start in the market, trading at more than 30% above its IPO price and with a market cap of about $100 billion. Its stock price closed at $129.950, with a weekly rise of 66.60%.

● Mooers comment

@GetMeABeerDude: how I feel about this stock right now

$Rivian Automotive(RIVN.US$

@Palmyra: Rivian IPO: 5 things to know about the Amazon-backed electric-vehicle maker

$Rivian Automotive(RIVN.US$ Losses have mounted as the business grows. Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business. Read more...

4. LCID - Buzzing Stars: ⭐⭐⭐⭐

LCID stock closed at $43.930 last Friday with a weekly rise of 5.10%, despite almost doubling in selling price over the past month.

● Mooers comment

@101505797

$Lucid Group(LCID.US$

5. PLTR - Buzzing Stars: ⭐⭐⭐

RBC Capital has downgraded Palantir's stock from sector performance to underperform and lowered its share price projection from $25 to $19. The shares of PLTR lost 12.19% last week and finally closed at $22.830.

● Mooers comment

@FiveHundredCents: Cathie Wood Rushes To Load Up $36M In Palantir As Its Stock Crashes 9%

Cathie Wood’s money managing firm Ark Invest on Tuesday bought 1.48 million shares— estimated to be worth $35.98 million— in $Palantir(PLTR.US$ on the dip and after months of booking profit in the stock.Shares of the Peter Thiel-backed company closed 9.35% lower at $24.25 a share on Tuesday. Read more...

6. NVDA - Buzzing Stars: ⭐⭐⭐

Analysts from four different institutions have raised their estimations of Nvidia's intrinsic value, ranging from $340 to $360 per share. Its stock price closed at $303.900, with a weekly rise of 2.14%.

● Mooers comment

@efficentupup: The Biggest Beneficiary Of The Meta Universe?

On November 9th, NVIDIA announced at the 2021 GPU Technology Conference (GTC 2021) that it would upgrade its product route to a "three-core" strategy of "GPU+CPU+DPU". "(Omniverse) platform is positioned as "engineer's meta-universe". Read more...

7. NIO - Buzzing Stars: ⭐⭐⭐

In China, demand for electric vehicles continues strong, with Nio reporting record bookings in October. NIO stock was up 0.90% to $42.670 last week.

● Mooers comment

@Sourav Pan: Nio rallies after Citi boosts price target on positive view of market share $NIO Inc(NIO.US$ is up 3.25% in early trading to cut into the post-earnings decline. Citi boosts its price target on Nio to $87 from $70 on its expectation that the Chinese EV player will nab more market share. Read more...

8. PYPL - Buzzing Stars: ⭐⭐⭐

PYPL stock price close at $208.300 with a weekly decrease of 7.74%. PayPal Holdings' stock plummeted a day after the company released third-quarter results and predictions that fell short of Wall Street expectations on several fronts.

● Mooers comment

@Deezy_McCheezy

$PayPal(PYPL.US$

It’s really quite simple.

Buy the dip.

If it does dip more buy some more.

Hold for a minimum of 12-18 months and double your money.

9. AMD - Buzzing Stars: ⭐⭐⭐

AMD stock increased 8.47% to $147.890 over the past week. Meta Platforms has announced a major push into data centers as part of its mission to build a metaverse.

● Mooers comment

@Handy_:

Advanced Micro Devices $Advanced Micro Devices(AMD.US$ is about to enter the metaverse.

The chip giant said its EPYC chips were selected by Meta (formerly known as Facebook) to help power its data centers at its virtual Accelerated Data Center Premiere event Monday. Read more...

10. PHUN - Buzzing Stars: ⭐⭐

PHUN shares were down 3.08% to $4.090 last week with the extreme volatility of the PHUN stock in October, investors have decided that the asset's fundamental value is far less essential than the observable demand increase.

● Mooers comment

@勇者无惧的亚希伯恩:

$Phunware(PHUN.US$

Phunware is scheduled to announce Q3 earnings results on Thursday, November 11th, after market close.The consensus EPS Estimate is -$0.04(+78.9% Y/Y) and the consensus Revenue Estimate is $2.27M (-27.5% Y/Y).Over the last 3 months, EPS estimates have seen 2 upward revisions and 2 downward. Read more...

![]() Thanks for your reading!

Thanks for your reading!

![]() Awarding Moment

Awarding Moment

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@GratefulPanda @makankaki @Jia Yung @Syuee @HopeAlways @Dadacai

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"Does deciding to invest mean taking a gamble?"

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "My first investment in the stock market."

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved lower last week. Here is the weekly buzzing stock list of last week:

1. TSLA - Buzzing Stars: ⭐⭐⭐⭐⭐

Tesla CEO Elon Musk’s trust sold about $1.2 billion in Tesla stock, Tesla stock declined 15.4% for the week, marking the company’s worst one-week performance in 20 months.

● Mooers comment

@Daniel Acret:

There's a New Kid in Town

Everybody's talking

'bout the New Kid in town

They will never forget TSLA

till Rivian comes around

Everybody's talking

'bout the new coin in town

they won't forget BitCoin

till Ethereum comes along.

@DayleyTrades: ⭐⭐⭐⭐

2. AMC - Buzzing Stars: ⭐⭐⭐⭐

With the CEO of AMC selling more than a million shares, AMC's stock price closed at $40.000 with a weekly decrease of 4.08%. The good news is that AMC theaters have joined the crypto bandwagon and the company’s customers can do the online payment via them.

● Mooers comment

@Smoke-A-Shotgun: $AMC Entertainment(AMC.US$

@Coffee Drip: $AMC Entertainment(AMC.US$ if you are freaking out over this drop.. You haven't been here long. Lol take a break go eat some toast and watch Netflix or go get some fresh air and calm down. This is not that bad. I've been in amc since like the 2.00 days and even before that. I watched covid almost take out AMC and held on and bought more. Stocks go up and down.

3. RIVN - Buzzing Stars: ⭐⭐⭐⭐

Rivian Automotive has made a strong start in the market, trading at more than 30% above its IPO price and with a market cap of about $100 billion. Its stock price closed at $129.950, with a weekly rise of 66.60%.

● Mooers comment

@GetMeABeerDude: how I feel about this stock right now

$Rivian Automotive(RIVN.US$

@Palmyra: Rivian IPO: 5 things to know about the Amazon-backed electric-vehicle maker

$Rivian Automotive(RIVN.US$ Losses have mounted as the business grows. Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business. Read more...

4. LCID - Buzzing Stars: ⭐⭐⭐⭐

LCID stock closed at $43.930 last Friday with a weekly rise of 5.10%, despite almost doubling in selling price over the past month.

● Mooers comment

@101505797

$Lucid Group(LCID.US$

5. PLTR - Buzzing Stars: ⭐⭐⭐

RBC Capital has downgraded Palantir's stock from sector performance to underperform and lowered its share price projection from $25 to $19. The shares of PLTR lost 12.19% last week and finally closed at $22.830.

● Mooers comment

@FiveHundredCents: Cathie Wood Rushes To Load Up $36M In Palantir As Its Stock Crashes 9%

Cathie Wood’s money managing firm Ark Invest on Tuesday bought 1.48 million shares— estimated to be worth $35.98 million— in $Palantir(PLTR.US$ on the dip and after months of booking profit in the stock.Shares of the Peter Thiel-backed company closed 9.35% lower at $24.25 a share on Tuesday. Read more...

6. NVDA - Buzzing Stars: ⭐⭐⭐

Analysts from four different institutions have raised their estimations of Nvidia's intrinsic value, ranging from $340 to $360 per share. Its stock price closed at $303.900, with a weekly rise of 2.14%.

● Mooers comment

@efficentupup: The Biggest Beneficiary Of The Meta Universe?

On November 9th, NVIDIA announced at the 2021 GPU Technology Conference (GTC 2021) that it would upgrade its product route to a "three-core" strategy of "GPU+CPU+DPU". "(Omniverse) platform is positioned as "engineer's meta-universe". Read more...

7. NIO - Buzzing Stars: ⭐⭐⭐

In China, demand for electric vehicles continues strong, with Nio reporting record bookings in October. NIO stock was up 0.90% to $42.670 last week.

● Mooers comment

@Sourav Pan: Nio rallies after Citi boosts price target on positive view of market share $NIO Inc(NIO.US$ is up 3.25% in early trading to cut into the post-earnings decline. Citi boosts its price target on Nio to $87 from $70 on its expectation that the Chinese EV player will nab more market share. Read more...

8. PYPL - Buzzing Stars: ⭐⭐⭐

PYPL stock price close at $208.300 with a weekly decrease of 7.74%. PayPal Holdings' stock plummeted a day after the company released third-quarter results and predictions that fell short of Wall Street expectations on several fronts.

● Mooers comment

@Deezy_McCheezy

$PayPal(PYPL.US$

It’s really quite simple.

Buy the dip.

If it does dip more buy some more.

Hold for a minimum of 12-18 months and double your money.

9. AMD - Buzzing Stars: ⭐⭐⭐

AMD stock increased 8.47% to $147.890 over the past week. Meta Platforms has announced a major push into data centers as part of its mission to build a metaverse.

● Mooers comment

@Handy_:

Advanced Micro Devices $Advanced Micro Devices(AMD.US$ is about to enter the metaverse.

The chip giant said its EPYC chips were selected by Meta (formerly known as Facebook) to help power its data centers at its virtual Accelerated Data Center Premiere event Monday. Read more...

10. PHUN - Buzzing Stars: ⭐⭐

PHUN shares were down 3.08% to $4.090 last week with the extreme volatility of the PHUN stock in October, investors have decided that the asset's fundamental value is far less essential than the observable demand increase.

● Mooers comment

@勇者无惧的亚希伯恩:

$Phunware(PHUN.US$

Phunware is scheduled to announce Q3 earnings results on Thursday, November 11th, after market close.The consensus EPS Estimate is -$0.04(+78.9% Y/Y) and the consensus Revenue Estimate is $2.27M (-27.5% Y/Y).Over the last 3 months, EPS estimates have seen 2 upward revisions and 2 downward. Read more...

Before moving on to part three, congrats to the following mooers whose comments were selected as the top comments last week!

@GratefulPanda @makankaki @Jia Yung @Syuee @HopeAlways @Dadacai

We really appreciate your great insights! Read the top comments last week!

Notice: Reward will be sent to you this week. Please feel free to contact us if there is any problem.

Part Ⅲ: Weekly Topic

Time to be rewarded for your great insights and knowledge!

This week, we'd like to invite you to comment below and share your idea on:

"Does deciding to invest mean taking a gamble?"

We will select 20 TOP COMMENTS by next Monday.

Winners will get 200 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

Top Comment Technique:

● Fundamental / Technical / Capital Analyses

● Personal Trading Experience

● Any bright insights or knowledge

Previous of WeeklyBuzz

Weekly Buzz: "My first investment in the stock market."

Weekly Buzz: "What is Metaverse?"

Weekly Buzz: "Have some PHUN."

Disclaimer: Comments below are made available for informational purposes only. Before investing, please consult a licensed professional.

+5

96

57

KentanoMonies77

liked

3

1

KentanoMonies77

liked and commented on

"Fly High, Fly to the Moon", that's my sentiments for Singapore Airlines (SIA) shares all along. As expected, SIA stocks soared up to 9.6% after the announcement of Singapore government's decision to open up of borders to 11 countries worldwide including those in Europe and North America. As of today, SIA shares nose dived down to $5.26 despite of the easing of the travelling curbs.

The question is whether SIA can sustain this decline. Next, is of course should SIA continue to under perform, would the investors be alarmed and apply a "stop-loss " principle on $SIA(C6L.SG$ or $SATS(S58.SG$ stocks. Personally, I hope not because this blue chip business has solid fiancial back up. Moreover, SIA

has past experiences of facing more adverse situations without faltering.

Currently, I am holding some portions of the losing $SIA(C6L.SG$ shares but I am not unduly worried. I have pulled the trigger off for those shares but I will not sell them either, because SIA will remain s strong, reliable company for long term investments.

$SIA(C6L.SG$ shares' prices have been negatively impacted since mid 2019 when Covid 19 pandemic emerged, and travelling was hazardous internationally.

Pre Covid time, our National aircraft was faring extremely well. Travellers worldwide opt to travel in SIA flights because they are awared that when they fly in SIA, they are embarking on a journey of safety and luxurious comfort. Being a prestigious 5 stars aircraft, SIA offers stella service. This aviation service operates 3% of the 10 current longest flights in the world. The inclusion of more countries VTL (vaccinated travel lanes) will ultimately usher in tourist and business locations from UK, US and Italy which are vital long hauls in markets for SIA.

Moving forward, SIA shares will continue to face some challenges in the early Q4 phase. In hindsight however, investors should focus more on the outlook over the next 2 years. I believe by year end, situation will improve, as more people are vaccinated globally and air travel becomes more flexible. By then more travellers are willing to splurge on the next trip.

Once again we can envision SIA flying high to the Moon. Along with this increase trend in travelling, the other travel-related stocks to gain momentum are:

$SATS(S58.SG$

$Genting Sing(G13.SG$

$Air Transport Services(ATSG.US$

$Shangri-La HKD(S07.SG$

$Marriott International(MAR.US$

$Las Vegas Sands(LVS.US$

The question is whether SIA can sustain this decline. Next, is of course should SIA continue to under perform, would the investors be alarmed and apply a "stop-loss " principle on $SIA(C6L.SG$ or $SATS(S58.SG$ stocks. Personally, I hope not because this blue chip business has solid fiancial back up. Moreover, SIA

has past experiences of facing more adverse situations without faltering.

Currently, I am holding some portions of the losing $SIA(C6L.SG$ shares but I am not unduly worried. I have pulled the trigger off for those shares but I will not sell them either, because SIA will remain s strong, reliable company for long term investments.

$SIA(C6L.SG$ shares' prices have been negatively impacted since mid 2019 when Covid 19 pandemic emerged, and travelling was hazardous internationally.

Pre Covid time, our National aircraft was faring extremely well. Travellers worldwide opt to travel in SIA flights because they are awared that when they fly in SIA, they are embarking on a journey of safety and luxurious comfort. Being a prestigious 5 stars aircraft, SIA offers stella service. This aviation service operates 3% of the 10 current longest flights in the world. The inclusion of more countries VTL (vaccinated travel lanes) will ultimately usher in tourist and business locations from UK, US and Italy which are vital long hauls in markets for SIA.

Moving forward, SIA shares will continue to face some challenges in the early Q4 phase. In hindsight however, investors should focus more on the outlook over the next 2 years. I believe by year end, situation will improve, as more people are vaccinated globally and air travel becomes more flexible. By then more travellers are willing to splurge on the next trip.

Once again we can envision SIA flying high to the Moon. Along with this increase trend in travelling, the other travel-related stocks to gain momentum are:

$SATS(S58.SG$

$Genting Sing(G13.SG$

$Air Transport Services(ATSG.US$

$Shangri-La HKD(S07.SG$

$Marriott International(MAR.US$

$Las Vegas Sands(LVS.US$

57

14

KentanoMonies77

liked

Q&A is a session under a company's earnings conference that institutional and retail investors ask some most-concerned questions to the management. On this page, you can find out some valuable info that might affect the stock price in the following weeks. $Tesla(TSLA.US$

Key Takeaways:

Attitudes: management feel very optimistic in the long term, but there's also a lot of uncertainty right now.

Goals: the company's goal is to grow on an average pace of 50% per year, and ultimately be able to achieve 20 million cars per year.

Products: the company is working on a strategy to increase production rates as quickly as possible. Cybertruck is expected to launch by next year.

Do you still expect to start production of the $25,000 model in 2023. What are the biggest hurdles from now until then?

Yeah, we're working on a strategy to increase our production rates as quickly as possible. We don't want to add any new vehicles to our lineup when we're generally is in a cell constrained world. While there is still more runway to grow these existing products, we are focused on Model Y expansion and also in Berlin, ramping S&X further in Fremont to restore to pass levels, while also growing 3 and Y production in Fremont in Shanghai.

After Model Y in Austin, our next product launch will be Cybertruck. And that's time and course depend on increasing cell capacity and completing our currently full plate of products on the table.

What is Tesla 's goal for vehicle production capacity for the current factories?

Our goal as a Company here is to grow on an average pace of 50% per year. I think that will be a difficult goal, but that's the goal that the internal team has. And they're going to continue to push on that. We're trying to get to 5,000 cars a week as soon as we can. And then we'll continue to push beyond that, potentially even getting to 10,000 cars per week at those factories. And then we will add Cybertruck here in Austin and continue to grow from there. So, our goal is to get to millions of cars per year over the next couple of years. And then ultimately in the long term, be able to achieve 20 million cars per year.

Is Tesla considering any other ideas other than FSD with the real-world AI that can bring additional software revenue to Tesla?

Sure. At AI Day we did talk about potential future where Dojo could be used as a neural net training platform for other companies. It's not a focus of ours today as we are fully subscribed on Dojo with our internal uses, we do expect to continue to improve the in-car experience in the context of FSD

Elon said that we get an update on Cybertruck in November a year ago, but it hasn't happened and we know there are a lot of updates. Will you show off the new and improved Cybertruck?

We get a lot of questions on Cybertruck. We've been busy detailing the Cybertruck to achieve the prototype version we shared with customers awhile back. As you may have seen recently on social media, we've built a number of alphas and are currently testing those to further mature the design. We'll continue to work through the product in the beta stages that we're in now and look to launch that by next year.

You hit low-teens operating margins. That was your medium-term target. You're there now, despite the number of challenges and not full utilization to the plan. How are you thinking about that target now?

we've actually exceeded our long-term guidance on our operating margin target. As full self-driving matures, as take rates increase, if we are to raise pricing on that, there's considerable upside both on gross margins and operating margin as that comes to light, as the business starts to become more of a mix of a hardware-based Company and a software-based Company.

So, we feel optimistic about the journey --very optimistic about the journey as we look over into the long term, just a little bit difficult over the next 4 to 5 quarters. There's just a lot of uncertainty in the world right now.

This article is a script from the Q&A session of Tesla's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: management feel very optimistic in the long term, but there's also a lot of uncertainty right now.

Goals: the company's goal is to grow on an average pace of 50% per year, and ultimately be able to achieve 20 million cars per year.

Products: the company is working on a strategy to increase production rates as quickly as possible. Cybertruck is expected to launch by next year.

Do you still expect to start production of the $25,000 model in 2023. What are the biggest hurdles from now until then?

Yeah, we're working on a strategy to increase our production rates as quickly as possible. We don't want to add any new vehicles to our lineup when we're generally is in a cell constrained world. While there is still more runway to grow these existing products, we are focused on Model Y expansion and also in Berlin, ramping S&X further in Fremont to restore to pass levels, while also growing 3 and Y production in Fremont in Shanghai.

After Model Y in Austin, our next product launch will be Cybertruck. And that's time and course depend on increasing cell capacity and completing our currently full plate of products on the table.

What is Tesla 's goal for vehicle production capacity for the current factories?

Our goal as a Company here is to grow on an average pace of 50% per year. I think that will be a difficult goal, but that's the goal that the internal team has. And they're going to continue to push on that. We're trying to get to 5,000 cars a week as soon as we can. And then we'll continue to push beyond that, potentially even getting to 10,000 cars per week at those factories. And then we will add Cybertruck here in Austin and continue to grow from there. So, our goal is to get to millions of cars per year over the next couple of years. And then ultimately in the long term, be able to achieve 20 million cars per year.

Is Tesla considering any other ideas other than FSD with the real-world AI that can bring additional software revenue to Tesla?

Sure. At AI Day we did talk about potential future where Dojo could be used as a neural net training platform for other companies. It's not a focus of ours today as we are fully subscribed on Dojo with our internal uses, we do expect to continue to improve the in-car experience in the context of FSD

Elon said that we get an update on Cybertruck in November a year ago, but it hasn't happened and we know there are a lot of updates. Will you show off the new and improved Cybertruck?

We get a lot of questions on Cybertruck. We've been busy detailing the Cybertruck to achieve the prototype version we shared with customers awhile back. As you may have seen recently on social media, we've built a number of alphas and are currently testing those to further mature the design. We'll continue to work through the product in the beta stages that we're in now and look to launch that by next year.

You hit low-teens operating margins. That was your medium-term target. You're there now, despite the number of challenges and not full utilization to the plan. How are you thinking about that target now?

we've actually exceeded our long-term guidance on our operating margin target. As full self-driving matures, as take rates increase, if we are to raise pricing on that, there's considerable upside both on gross margins and operating margin as that comes to light, as the business starts to become more of a mix of a hardware-based Company and a software-based Company.

So, we feel optimistic about the journey --very optimistic about the journey as we look over into the long term, just a little bit difficult over the next 4 to 5 quarters. There's just a lot of uncertainty in the world right now.

This article is a script from the Q&A session of Tesla's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

190

29

KentanoMonies77

liked

Enterprise value (EV) is a measure of a company's total value, often used as a more comprehensive alternative to equity market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. Enterprise value is a popular metric used to value a company for a potential takeover.

Formula and Calculation for EV

EV=MC+Total Debt−C

where:

MC=Market capitalization; equal to the current stockprice multiplied by...

Formula and Calculation for EV

EV=MC+Total Debt−C

where:

MC=Market capitalization; equal to the current stockprice multiplied by...

78

17

Keep it moving...

2

1

KentanoMonies77

liked and commented on

https://youtu.be/x4nTdNMbacc

CHECK OUT THE VIDEO...LINK ABOVE

$AMC Entertainment(AMC.US$ $GameStop(GME.US$ $ARK Innovation ETF(ARKK.US$ $Ocugen(OCGN.US$ $NIO Inc(NIO.US$ $Amazon(AMZN.US$ $Microsoft(MSFT.US$ $Alibaba(BABA.US$ $Boeing(BA.US$ $SSE Composite Index(000001.SH$ $BlackBerry(BB.US$ $Clover Health(CLOV.US$ $Apple(AAPL.US$

CHECK OUT THE VIDEO...LINK ABOVE

$AMC Entertainment(AMC.US$ $GameStop(GME.US$ $ARK Innovation ETF(ARKK.US$ $Ocugen(OCGN.US$ $NIO Inc(NIO.US$ $Amazon(AMZN.US$ $Microsoft(MSFT.US$ $Alibaba(BABA.US$ $Boeing(BA.US$ $SSE Composite Index(000001.SH$ $BlackBerry(BB.US$ $Clover Health(CLOV.US$ $Apple(AAPL.US$

20

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)