slayer123

voted

Post your learning results by taping the discussion: TA Challenge: Breakout? Reversals? How to use Bollinger Bands?

Hi, mooers!

Congratulations! You've arrived at the 2nd TA Challenge!

Created by John Bollinger in the 1980s, Bollinger Bands (BB)...

+6

69

42

slayer123

voted

General Motors Co. unveiled a new electric Chevrolet Silverado pickup Wednesday, a much-anticipated introduction that comes as buzz is growing for the truck’s future rival: Ford Motor Co. ’s F-150 Lightning.

GM unveils Silverado EV as electric

$General Motors(GM.US$ General Motors CEO Mary Barra unveiled the automaker's new electric truck at this year's CES event in Las Vegas on Wednesday, calling the Chevy Silverad...

GM unveils Silverado EV as electric

$General Motors(GM.US$ General Motors CEO Mary Barra unveiled the automaker's new electric truck at this year's CES event in Las Vegas on Wednesday, calling the Chevy Silverad...

11

5

slayer123

liked

In the time of facing abnormal market trend, more opportunities are available for money making because there will be more windows of oversold and over bought. In such a market, the setup plan is ever more important and better achieved when one's mind is calm and clear. The other important factor is how fast one can get and interpret the market sentiment, funds flow and big volume transactions. This is where moomoo AI has made the job easier, more efficient in detecting the market signal. That is why I like both the features of funds flow and AI in moomoo's platform.

72

4

slayer123

liked

$Tesla(TSLA.US$ today will go to 1050

3

2

slayer123

liked

ColumnsMarket temperature (12/13)

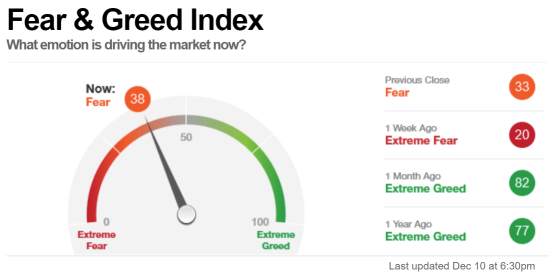

The fear and greed index was developed by CNNMoney to measure two of the primary emotions that influence how much investors are willing to pay for stocks.

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

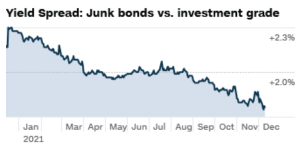

Junk Bond Demand: Extreme Greed

Investors in low quality junk bonds are accepting 1.80 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically high, it is sharply lower than recent prices and suggests that investors are pursuing higher risk strategies.

Last changed Dec 3 from a Greed rating.

Market Momentum: Extreme Greed

The S&P 500 is 5.48% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Dec 9 from a Neutral rating.

Market Volatility: Neutral

The CBOE Volatility Index (VIX) is at 18.69. This is a neutral reading and indicates that market risks appear low.

Last changed Dec 6 from an Extreme Fear rating.

Source: CNNmoney

$S&P 500 Index(.SPX.US$ $Tesla(TSLA.US$ $Apple(AAPL.US$

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Junk Bond Demand: Extreme Greed

Investors in low quality junk bonds are accepting 1.80 percentage points in additional yield over safer investment grade corporate bonds. While this spread is historically high, it is sharply lower than recent prices and suggests that investors are pursuing higher risk strategies.

Last changed Dec 3 from a Greed rating.

Market Momentum: Extreme Greed

The S&P 500 is 5.48% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Dec 9 from a Neutral rating.

Market Volatility: Neutral

The CBOE Volatility Index (VIX) is at 18.69. This is a neutral reading and indicates that market risks appear low.

Last changed Dec 6 from an Extreme Fear rating.

Source: CNNmoney

$S&P 500 Index(.SPX.US$ $Tesla(TSLA.US$ $Apple(AAPL.US$

+1

17

1

slayer123

liked

Recently, I'm learning day trading strategies. And I want to share some points with mooers, also want masters to give me some advice.![]() @Dadacai @GratefulPanda @HopeAlways @Mars Mooo @Syuee @Mcsnacks H Tupack

@Dadacai @GratefulPanda @HopeAlways @Mars Mooo @Syuee @Mcsnacks H Tupack

The most important rules are Granville's 8 Rules, which principle is to use the resistance and support from MA to find out the best entry position points for trend trading investments.![]()

1. Four buying signals

Breakout Buy - It is a buying signal when the price rises from the bottom and breaks the MA of tendency level.

Call-back Buy - When the price goes beyond the MA, and the call-back does not fall below the MA can be considered as a buying signal.

Fake Breakout Buy - The price falls below the MA. However, if the MA is still rising and the short-term price goes back upon the MA, it is a buying signal.

Off-buy - When the price keeps falling and accumulates specific declines, and it begins to deviate from the moving average, it is a buying signal.

$AMC Entertainment(AMC.US$ $Apple(AAPL.US$ $NVIDIA(NVDA.US$

2. Four selling signals

Breakout Sell - It is a selling signal when the price falls from above and breaks the MA of tendency level.

Bounce Sell - When the price goes below the MA and rebounds but does not exceed the MA, it is a selling signal.

Fake Breakout Sell - The price rises and breaks the MA. However, the MA is still falling, and the short-term price falls below the MA. It is a selling signal.

Off-sell - When the price keeps rising and accumulates specific increases and starts deviating from the MA, it is a selling signal.

$RLX Technology(RLX.US$ $Alibaba(BABA.US$ $BABA-SW(09988.HK$

I found that the intraday market rebounded quickly when the trending fell sharply. If you buy at a low point, you can significantly profit from the rebound. If you make an excellent stop-loss, the profit-loss ratio should be good. I will back-test $Tesla(TSLA.US$ 's intraday trends to see its effectiveness. Here I use the five-minute bar for trading, and the corresponding moving average is VWAP.

We can see that $Tesla(TSLA.US$ 's historical trend is in line with falling below the moving average at a rapid rate and then quickly rebounding back to the MA. It can be found that at the relatively lowest point, the needle-shaped k-line has been released and closed, and the angle of the downward movement below the moving average is enormous at the beginning. It looks very effective!![]()

But in actual combat, I don't know the success rate, so you still need to set a stop loss just in case. The buying point of this kind of disk shape is when it falls below the intraday moving average. After a period of rapid decline at a large angle, a heavy volume is accompanied by a needle-shaped k-line is the buying point, and the selling point is to rebound to the moving average. Nearby, the stop loss point is the lowest buying point k-line.

![]() I want to win $American Airlines(AAL.US$ stock

I want to win $American Airlines(AAL.US$ stock![]() Please like my post and follow my account

Please like my post and follow my account![]()

![]()

![]()

The most important rules are Granville's 8 Rules, which principle is to use the resistance and support from MA to find out the best entry position points for trend trading investments.

1. Four buying signals

Breakout Buy - It is a buying signal when the price rises from the bottom and breaks the MA of tendency level.

Call-back Buy - When the price goes beyond the MA, and the call-back does not fall below the MA can be considered as a buying signal.

Fake Breakout Buy - The price falls below the MA. However, if the MA is still rising and the short-term price goes back upon the MA, it is a buying signal.

Off-buy - When the price keeps falling and accumulates specific declines, and it begins to deviate from the moving average, it is a buying signal.

$AMC Entertainment(AMC.US$ $Apple(AAPL.US$ $NVIDIA(NVDA.US$

2. Four selling signals

Breakout Sell - It is a selling signal when the price falls from above and breaks the MA of tendency level.

Bounce Sell - When the price goes below the MA and rebounds but does not exceed the MA, it is a selling signal.

Fake Breakout Sell - The price rises and breaks the MA. However, the MA is still falling, and the short-term price falls below the MA. It is a selling signal.

Off-sell - When the price keeps rising and accumulates specific increases and starts deviating from the MA, it is a selling signal.

$RLX Technology(RLX.US$ $Alibaba(BABA.US$ $BABA-SW(09988.HK$

I found that the intraday market rebounded quickly when the trending fell sharply. If you buy at a low point, you can significantly profit from the rebound. If you make an excellent stop-loss, the profit-loss ratio should be good. I will back-test $Tesla(TSLA.US$ 's intraday trends to see its effectiveness. Here I use the five-minute bar for trading, and the corresponding moving average is VWAP.

We can see that $Tesla(TSLA.US$ 's historical trend is in line with falling below the moving average at a rapid rate and then quickly rebounding back to the MA. It can be found that at the relatively lowest point, the needle-shaped k-line has been released and closed, and the angle of the downward movement below the moving average is enormous at the beginning. It looks very effective!

But in actual combat, I don't know the success rate, so you still need to set a stop loss just in case. The buying point of this kind of disk shape is when it falls below the intraday moving average. After a period of rapid decline at a large angle, a heavy volume is accompanied by a needle-shaped k-line is the buying point, and the selling point is to rebound to the moving average. Nearby, the stop loss point is the lowest buying point k-line.

+2

178

28

slayer123

liked

$Tesla(TSLA.US$ often upgrades its vehicles, routinely sending free software updates to owners to improve vehicles whenever necessary, not waiting for a new model year.

The first is in cabin radar. While Tesla has removed radar from the exterior of its vehicles, it looks like a new high precision radar is making its way inside. This interior radar could sense children who may be accidentally left in the car and also assist in an anti-theft system.

Also listed is a new connectivity card. While Tesla's current vehicles can utilize 3G and 4G cellular signals to download updates, browse the web or get traffic data, this new card could allow vehicles to connect to 5G high-speed mobile networks.

Another change to a core piece of the vehicle is a “super horn,” which is listed as a 3-in-1 horn, alarm and loudspeaker. This sounds similar to Tesla's sentry mode security system, which not only blows the horn in the event the car is broken into but turns up the vehicle's in-car stereo system to the maximum volume to draw more attention to the vehicle.

As we've seen out of Gigafactory Shanghai, Tesla is also updating newer vehicles with an $Advanced Micro Devices(AMD.US$ processor for faster loading and being able to support more graphically demanding games.

The first is in cabin radar. While Tesla has removed radar from the exterior of its vehicles, it looks like a new high precision radar is making its way inside. This interior radar could sense children who may be accidentally left in the car and also assist in an anti-theft system.

Also listed is a new connectivity card. While Tesla's current vehicles can utilize 3G and 4G cellular signals to download updates, browse the web or get traffic data, this new card could allow vehicles to connect to 5G high-speed mobile networks.

Another change to a core piece of the vehicle is a “super horn,” which is listed as a 3-in-1 horn, alarm and loudspeaker. This sounds similar to Tesla's sentry mode security system, which not only blows the horn in the event the car is broken into but turns up the vehicle's in-car stereo system to the maximum volume to draw more attention to the vehicle.

As we've seen out of Gigafactory Shanghai, Tesla is also updating newer vehicles with an $Advanced Micro Devices(AMD.US$ processor for faster loading and being able to support more graphically demanding games.

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)