renzhicu

liked

$MSP Recovery(LIFW.US$ This could be its week to run to over 3.00.

$Aclarion(ACON.US$ New number one highest borrow rate.

$Aclarion(ACON.US$ New number one highest borrow rate.

9

5

renzhicu

liked

$GoDaddy(GDDY.US$ A wave of upward trends fell below 10MA for the first time. Yesterday, there was already a long red candle warning of a large trading volume. This is not a good sign. Following the stock's own feedback, they chose to close their positions with a decent profit. 🙂

Translated

7

1

renzhicu

liked

As the economy is struggling and the stock market is rising, I have recently been quite fearful. If I don't buy it, I'm afraid to go short. Buy it, I'm afraid to take over. Cash has been released on short-term treasury bonds for a long time. Interest rates have now begun to decline, and my long-term target is not a 5% profit, so I must increase some higher-yield investments.

Currently, out of the seven major technologies, $Tesla(TSLA.US$ We still have to wait to choose the direction; you can't gamble at this time. $Alphabet-C(GOOG.US$ It is only possible to increase small positions gradually; the risk of heavy positions is too high. I can't buy anything else. It's really too expensive, and it's all foam even when it rises.

I thought about it carefully and replanned it a bit:

1. I'm currently in a heavy position $iShares 20+ Year Treasury Bond ETF(TLT.US$ 。 If the economy actually collapses, as long as other countries are worse than the US, then the US can release a lot of water and take the opportunity to explore other countries' high-quality assets in order to resolve its own debt crisis. Then the TLT will skyrocket.

2. If the economy has a soft landing, or if the recession is slight, then the stock market will never plummet; a decline is also an opportunity for bottoming out. Currently, among all sectors in the stock market, the sector that can maintain growth and has a reasonable current valuation is health care. $The Health Care Select Sector SPDR® Fund(XLV.US$ , I'm already in a heavy position. Since 2008, the medical sector has been...

Currently, out of the seven major technologies, $Tesla(TSLA.US$ We still have to wait to choose the direction; you can't gamble at this time. $Alphabet-C(GOOG.US$ It is only possible to increase small positions gradually; the risk of heavy positions is too high. I can't buy anything else. It's really too expensive, and it's all foam even when it rises.

I thought about it carefully and replanned it a bit:

1. I'm currently in a heavy position $iShares 20+ Year Treasury Bond ETF(TLT.US$ 。 If the economy actually collapses, as long as other countries are worse than the US, then the US can release a lot of water and take the opportunity to explore other countries' high-quality assets in order to resolve its own debt crisis. Then the TLT will skyrocket.

2. If the economy has a soft landing, or if the recession is slight, then the stock market will never plummet; a decline is also an opportunity for bottoming out. Currently, among all sectors in the stock market, the sector that can maintain growth and has a reasonable current valuation is health care. $The Health Care Select Sector SPDR® Fund(XLV.US$ , I'm already in a heavy position. Since 2008, the medical sector has been...

Translated

17

11

renzhicu

liked

The long-term earnings of the stock market depend on two points: 1. The country's economy, 2. Will economic growth be fed back to the stock market. Regarding the second point, US stocks should be the best stock market in the world, so the long-term trend of US stocks depends entirely on the US economy.

However, when it comes to short-term trends, such as swing trading over a period of several months, the game between long and short sides plays a critical role. Since it's a game, are there any sports that are very similar to the stock market?

As the title says, I found that American Football 🏉 is really similar to US stocks.

Even if you don't watch rugby in the US, most of them know how to play football, because rugby is so popular and the most watched sporting event. For friends who aren't in the US, you probably don't know much. Rugby scores mainly by bringing the ball to the opponent's bottom line. Break the opponent's bottom line and score six points. In each round of offensive power, the attacking side has four chances to advance 10 yards. If they succeed, they will gain a new round of offensive rights again, and there will still be four chances to advance by 10 yards.

In other words, if you make great strides along the way, you can score points directly at the opponent's bottom line, which is very impressive.

However, conversely, if they fail on the fourth attempt, they will immediately lose their right to attack and defend in exchange.

Generally speaking, attackers only try 3 times in a round of attack. The fourth attack was mostly based on defensive strategies, that is, abandoning offense, finding a favorable defensive position for oneself, and defending instead. This is because, for those forced to move from attack to defense, it is better to take the initiative to choose a good battlefield to exchange places.

Back to the stock market. If there's one key...

However, when it comes to short-term trends, such as swing trading over a period of several months, the game between long and short sides plays a critical role. Since it's a game, are there any sports that are very similar to the stock market?

As the title says, I found that American Football 🏉 is really similar to US stocks.

Even if you don't watch rugby in the US, most of them know how to play football, because rugby is so popular and the most watched sporting event. For friends who aren't in the US, you probably don't know much. Rugby scores mainly by bringing the ball to the opponent's bottom line. Break the opponent's bottom line and score six points. In each round of offensive power, the attacking side has four chances to advance 10 yards. If they succeed, they will gain a new round of offensive rights again, and there will still be four chances to advance by 10 yards.

In other words, if you make great strides along the way, you can score points directly at the opponent's bottom line, which is very impressive.

However, conversely, if they fail on the fourth attempt, they will immediately lose their right to attack and defend in exchange.

Generally speaking, attackers only try 3 times in a round of attack. The fourth attack was mostly based on defensive strategies, that is, abandoning offense, finding a favorable defensive position for oneself, and defending instead. This is because, for those forced to move from attack to defense, it is better to take the initiative to choose a good battlefield to exchange places.

Back to the stock market. If there's one key...

Translated

14

2

renzhicu

voted

Every time, big and small non-agricultural data are in the opposite direction. ADP was upset on Wednesday, and today there was an explosion in the agricultural sector of Dafei.

Anyway, I believe in ADP; after all, ADP has no reason to falsify. The layoffs of large companies have spread from the technology industry to various industries, and the economy has reached the brink of recession. However, the expansion of small businesses is fragile, and may turn back at any time.

As for how the stock market is going, I think it has bottomed out and rebounded; the bottom is probably around 4,100 points. As long as the economy does not collapse, it will be difficult for the stock market to fall below 4,000. However, I think an economic collapse is inevitable. It is estimated that by the end of 2024, there will still be another year. It's probably too early to clear the stock market now. But the risk-free benefits are really good. Big money eats interest and protects principal. Play with stocks in small positions to find some excitement. It's not too late to wait until interest rates are cut and wait for an opportunity. If the economy actually collapses by the end of next year, then it will be possible to wait until 2025, when it hits the bottom of the market at 3,000 points.

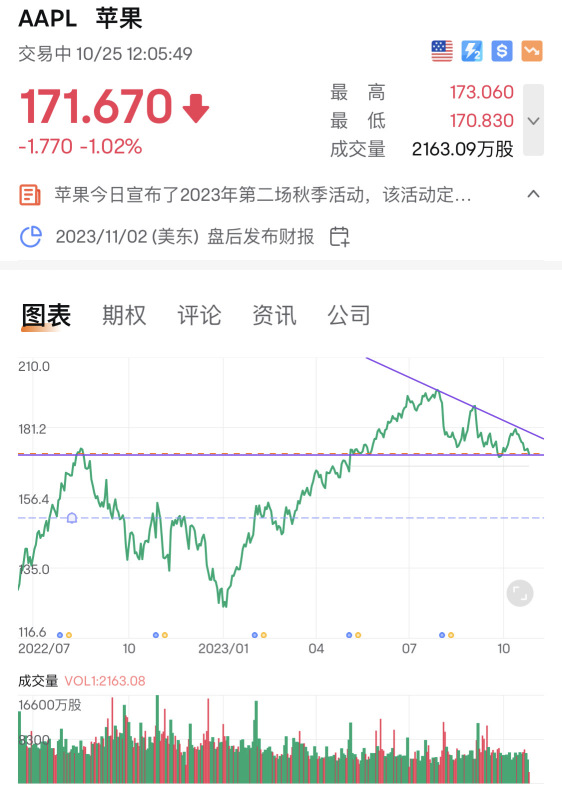

$Tesla(TSLA.US$ I just played around with the high band and lowered my breath; I think another chance to buy would come up. Also, I reduced my position $Alphabet-C(GOOG.US$ , etc $Apple(AAPL.US$ Let's talk about eliminating the risk with DuckDuckGo; let's avoid it first.

$Coca-Cola(KO.US$ $PepsiCo(PEP.US$ It suddenly fell apart yesterday. They say it was due to diet pills. I really don't believe this. But I think it's probably too expensive to buy,...

Anyway, I believe in ADP; after all, ADP has no reason to falsify. The layoffs of large companies have spread from the technology industry to various industries, and the economy has reached the brink of recession. However, the expansion of small businesses is fragile, and may turn back at any time.

As for how the stock market is going, I think it has bottomed out and rebounded; the bottom is probably around 4,100 points. As long as the economy does not collapse, it will be difficult for the stock market to fall below 4,000. However, I think an economic collapse is inevitable. It is estimated that by the end of 2024, there will still be another year. It's probably too early to clear the stock market now. But the risk-free benefits are really good. Big money eats interest and protects principal. Play with stocks in small positions to find some excitement. It's not too late to wait until interest rates are cut and wait for an opportunity. If the economy actually collapses by the end of next year, then it will be possible to wait until 2025, when it hits the bottom of the market at 3,000 points.

$Tesla(TSLA.US$ I just played around with the high band and lowered my breath; I think another chance to buy would come up. Also, I reduced my position $Alphabet-C(GOOG.US$ , etc $Apple(AAPL.US$ Let's talk about eliminating the risk with DuckDuckGo; let's avoid it first.

$Coca-Cola(KO.US$ $PepsiCo(PEP.US$ It suddenly fell apart yesterday. They say it was due to diet pills. I really don't believe this. But I think it's probably too expensive to buy,...

Translated

11

4

renzhicu

commented on

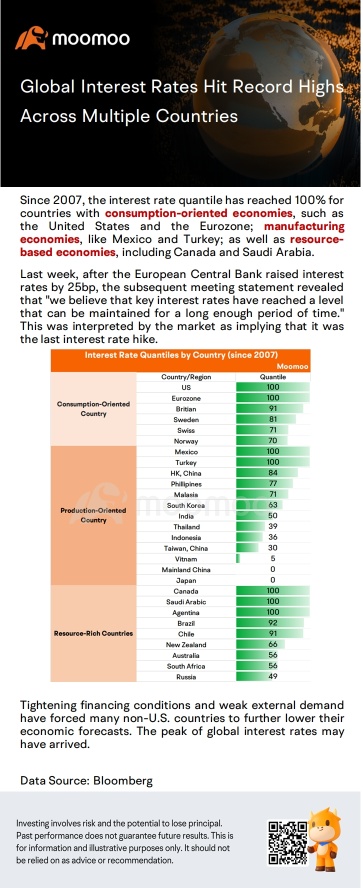

Thrilling! Interest rates on long-term bonds are rapidly approaching 5%. Can tech stocks still work?

$iShares 20+ Year Treasury Bond ETF(TLT.US$

The 30-year treasury bond has broken through 4.9, sprinting towards the 5% target.

My prediction: when it reaches 5%, there will be a rebound, and it won't be that easy to break through all of a sudden. However, the possibility of rushing to 5.5% again later is not ruled out. But right now, it's a short-term low.

My judgment on TLT was to speed up the bottom. The bottom was the 5% interest rate on long-term bonds, which then bottomed out and rebounded. The corresponding TLT price is around 85.

According to the plan, I sold 85 of the put, which expires this Friday. If it were to be exercised, it would be considered a plagiarism. If you don't exercise your power, go to the market on the right and buy the underlying stock to copy the bottom.

Let's see a rebound of 95 for now, unless there are any black swans.

Today's stock debt is bloody. The CNN Fear Greed Index fell below 20 and is currently 17. The market is extremely fearful.

If meat is cut or shorted at this time, it is likely that it will be harvested. The warehouse can be exchanged. I sold half of my energy stocks and stopped losing half $American Airlines(AAL.US$ , I'm considering what to switch to. I haven't thought about it yet.

presently $UnitedHealth(UNH.US$ as well $Consumer Staples Select Sector SPDR Fund(XLP.US$ The position is already very heavy, and TLT has been added to the bond side...

The 30-year treasury bond has broken through 4.9, sprinting towards the 5% target.

My prediction: when it reaches 5%, there will be a rebound, and it won't be that easy to break through all of a sudden. However, the possibility of rushing to 5.5% again later is not ruled out. But right now, it's a short-term low.

My judgment on TLT was to speed up the bottom. The bottom was the 5% interest rate on long-term bonds, which then bottomed out and rebounded. The corresponding TLT price is around 85.

According to the plan, I sold 85 of the put, which expires this Friday. If it were to be exercised, it would be considered a plagiarism. If you don't exercise your power, go to the market on the right and buy the underlying stock to copy the bottom.

Let's see a rebound of 95 for now, unless there are any black swans.

Today's stock debt is bloody. The CNN Fear Greed Index fell below 20 and is currently 17. The market is extremely fearful.

If meat is cut or shorted at this time, it is likely that it will be harvested. The warehouse can be exchanged. I sold half of my energy stocks and stopped losing half $American Airlines(AAL.US$ , I'm considering what to switch to. I haven't thought about it yet.

presently $UnitedHealth(UNH.US$ as well $Consumer Staples Select Sector SPDR Fund(XLP.US$ The position is already very heavy, and TLT has been added to the bond side...

Translated

5

10

renzhicu

voted

Hello Mooers! ![]()

What will be the closing price for $Arm Holdings(ARM.US$ at the end of trading hours on 14 Sep 2023?![]()

*ARM IPO price is USD 51 and will start trading on 14 Sep 2023.![]()

What will be the closing price for $Arm Holdings(ARM.US$ at the end of trading hours on 14 Sep 2023?

*ARM IPO price is USD 51 and will start trading on 14 Sep 2023.

7

renzhicu

liked

First, let me state that what I'm going to write in this article is not an investment strategy; it doesn't help anyone make money. However, after some research and practice, I think that for retail investors, if applied properly, this strategy can greatly ease their fears and greed, and look at the stock market from a new perspective, thereby increasing the success rate of their own investments.

To use this strategy, the following steps are required:

1. The left-right strategy is only suitable for long-term, unleveraged investors who invest in high-quality stocks. The methods of speculating on demon stocks, speculating on options, and highly leveraged operations have nothing to do with this article.

2. Plan your own investment capital and methods. With a fixed initial capital? Or is it a regular fixed investment? Or a combination of the two? However, regardless of the method, the left-right fighting strategy can be applied.

3. Choosing high-quality stocks requires companies that can see a bright future for the next 5-10 years or even longer. Companies with no clear profit prospects should be excluded, companies that are likely to go bankrupt should be excluded, and the sunset industry, which has no growth potential or is even in jeopardy, should be ruled out.

There is a very suitable stock, that is $Tesla(TSLA.US$ . More on that below. If you don't like Tesla, of course, $NVIDIA(NVDA.US$ It's also OK, $Alphabet-C(GOOG.US$ , $Microsoft(MSFT.US$, $Amazon(AMZN.US$ It's also OK....

To use this strategy, the following steps are required:

1. The left-right strategy is only suitable for long-term, unleveraged investors who invest in high-quality stocks. The methods of speculating on demon stocks, speculating on options, and highly leveraged operations have nothing to do with this article.

2. Plan your own investment capital and methods. With a fixed initial capital? Or is it a regular fixed investment? Or a combination of the two? However, regardless of the method, the left-right fighting strategy can be applied.

3. Choosing high-quality stocks requires companies that can see a bright future for the next 5-10 years or even longer. Companies with no clear profit prospects should be excluded, companies that are likely to go bankrupt should be excluded, and the sunset industry, which has no growth potential or is even in jeopardy, should be ruled out.

There is a very suitable stock, that is $Tesla(TSLA.US$ . More on that below. If you don't like Tesla, of course, $NVIDIA(NVDA.US$ It's also OK, $Alphabet-C(GOOG.US$ , $Microsoft(MSFT.US$, $Amazon(AMZN.US$ It's also OK....

Translated

27

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)