JewelHand

liked

We are in a bifurcated market where there are opportunities in either long or short direction since Nov.

Many growth stocks like $Sea(SE.US$, $Twilio(TWLO.US$, $Unity Software(U.US$, $CrowdStrike(CRWD.US$ $Affirm Holdings(AFRM.US$ $Fiverr International(FVRR.US$ $Roku Inc(ROKU.US$ $MercadoLibre(MELI.US$ $DocuSign(DOCU.US$ $PayPal(PYPL.US$ are deeply oversold (30-60%).

Or as per Cathie Wood, they are in deep value zone.

Some of them showed relative strength against the $S&P 500 Index(.SPX.US$ and near the support. There are some entry setups with decent reward to risk.

Possible to ride the overdued short term up swing after oversold with the current or aka the coming Santa Claus rally.

Many growth stocks like $Sea(SE.US$, $Twilio(TWLO.US$, $Unity Software(U.US$, $CrowdStrike(CRWD.US$ $Affirm Holdings(AFRM.US$ $Fiverr International(FVRR.US$ $Roku Inc(ROKU.US$ $MercadoLibre(MELI.US$ $DocuSign(DOCU.US$ $PayPal(PYPL.US$ are deeply oversold (30-60%).

Or as per Cathie Wood, they are in deep value zone.

Some of them showed relative strength against the $S&P 500 Index(.SPX.US$ and near the support. There are some entry setups with decent reward to risk.

Possible to ride the overdued short term up swing after oversold with the current or aka the coming Santa Claus rally.

38

3

JewelHand

liked

JewelHand

liked

$Micron Technology(MU.US$ Micron shares moved higher. The memory chip maker reported much better-than-expected earnings last quarter and gave bullish guidance. The company forecast earnings of $1.95, plus or minus 10 cents, for the period, above the consensus analyst estimate of $1.84.

Other chipmakers like $KLA Corp(KLAC.US$ and $NVIDIA(NVDA.US$ were generally higher.

Other chipmakers like $KLA Corp(KLAC.US$ and $NVIDIA(NVDA.US$ were generally higher.

25

1

JewelHand

liked

$Farmmi(FAMI.US$ Good entry point.

32

3

JewelHand

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

JewelHand

liked

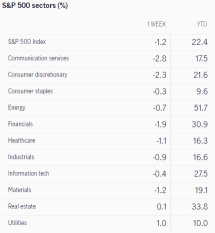

Weekly market recap

S&P 500 futures were higher even after a losing week on Wall Street as investors ditched equities amid concerns over the new omicron Covid variant and the Federal Reserve's move to tighten policy.

Nasdaq stock futures were the underperformer on Sunday following a big drop in bitcoin over the weekend and as investors continued to rethink owning tech stocks with high valuations.

Futures contracts tied to the $Dow Jones Industrial Average(.DJI.US$ gained 163 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures were 0.35% higher. $NASDAQ 100 Index(.NDX.US$ futures hovered around the flatline.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Meme stock darling GameStop headlines next week's earnings report lineup. The videogame retailer reports results after the market closes on Wednesday. AutoZone, Casey's General Stores, and Toll Brothers report earnings on Tuesday, followed by Brown-Forman and Campbell Soup on Wednesday. Broadcom, Costco Wholesale, and Hormel Foods round things out on Thursday.

On Monday, Union Pacific will hold a conference call to discuss its climate action plan. McKesson and Southwest Airlines host their 2021 investor days on Wednesday, followed by CVS Health and Tyson Foods on Thursday.

The Federal Reserve's report on consumer credit data for October will be released on Tuesday. On Thursday, the U.S. Labor Department reports initial jobless claims for the week ending on Dec. 4.

The Bureau of Labor Statistics releases the consumer price index for November on Friday. The consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously.

Monday 12/6

$Union Pacific(UNP.US$ holds a conference call to discuss its climate action plan.

Tuesday 12/7

$AutoZone(AZO.US$ , $Caseys General Stores(CASY.US$, and $Toll Brothers(TOL.US$ announce quarterly results.

The Federal Reserve reports on consumer credit data for October. After falling slightly last year, total outstanding consumer debt has risen an average of $20 billion a month through September, and stands at a record $4.37 trillion.

Wednesday 12/8

The BLS releases the Job Openings and Labor Turnover Survey. Economists forecast 10.5 million job openings on the last business day of October, only 600,000 less than the record high of 11.1 million in July.

$Brown-Forman-A(BF.A.US$, $Campbell Soup(CPB.US$, and $GameStop(GME.US$ report earnings.

$McKesson(MCK.US$ and $Southwest Airlines(LUV.US$ host their 2021 investor days.

$Edwards Lifesciences(EW.US$ holds an investor conference in Irvine, Calif. The company will discuss its product pipeline as well as its financial outlook for 2022.

The Bank of Canada announces its monetary-policy decision. The central bank is expected to keep its key short-term interest rate unchanged at 0.25%. At its late-October meeting, the bank ended its quantitative-easing program and signaled that its first interest-rate hike would be earlier in 2022 than had been expected.

Thursday 12/9

$Broadcom(AVGO.US$, $Costco(COST.US$, and $Hormel Foods(HRL.US$ hold conference calls to discuss quarterly results.

$CVS Health(CVS.US$ and $Tyson Foods(TSN.US$ host their annual investor days.

The Department of Labor reports initial jobless claims for the week ending on Dec. 4. Jobless claims averaged 238,750 in November, the lowest since the beginning of the pandemic, and just 24,750 more than in February of 2020.

Friday 12/10

$Archer Daniels Midland(ADM.US$ holds its global investor day.

$Centene(CNC.US$ holds an investor meeting and will provide financial guidance for 2022.

The Bureau of Labor Statistics releases the consumer price index for November. Consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously. October's 6.2% increase was the hottest the CPI has run in more than 30 years, and this past week Federal Reserve Chairman Jerome Powell finally ditched "transitory" when discussing inflation before the Senate Banking Committee.

The University of Michigan releases its Consumer Sentiment index for December. Economists forecast a 66 reading, slightly less than the November data.

Source: CNBC, Dow Jones Newswires, jhinvestments

S&P 500 futures were higher even after a losing week on Wall Street as investors ditched equities amid concerns over the new omicron Covid variant and the Federal Reserve's move to tighten policy.

Nasdaq stock futures were the underperformer on Sunday following a big drop in bitcoin over the weekend and as investors continued to rethink owning tech stocks with high valuations.

Futures contracts tied to the $Dow Jones Industrial Average(.DJI.US$ gained 163 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures were 0.35% higher. $NASDAQ 100 Index(.NDX.US$ futures hovered around the flatline.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Meme stock darling GameStop headlines next week's earnings report lineup. The videogame retailer reports results after the market closes on Wednesday. AutoZone, Casey's General Stores, and Toll Brothers report earnings on Tuesday, followed by Brown-Forman and Campbell Soup on Wednesday. Broadcom, Costco Wholesale, and Hormel Foods round things out on Thursday.

On Monday, Union Pacific will hold a conference call to discuss its climate action plan. McKesson and Southwest Airlines host their 2021 investor days on Wednesday, followed by CVS Health and Tyson Foods on Thursday.

The Federal Reserve's report on consumer credit data for October will be released on Tuesday. On Thursday, the U.S. Labor Department reports initial jobless claims for the week ending on Dec. 4.

The Bureau of Labor Statistics releases the consumer price index for November on Friday. The consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously.

Monday 12/6

$Union Pacific(UNP.US$ holds a conference call to discuss its climate action plan.

Tuesday 12/7

$AutoZone(AZO.US$ , $Caseys General Stores(CASY.US$, and $Toll Brothers(TOL.US$ announce quarterly results.

The Federal Reserve reports on consumer credit data for October. After falling slightly last year, total outstanding consumer debt has risen an average of $20 billion a month through September, and stands at a record $4.37 trillion.

Wednesday 12/8

The BLS releases the Job Openings and Labor Turnover Survey. Economists forecast 10.5 million job openings on the last business day of October, only 600,000 less than the record high of 11.1 million in July.

$Brown-Forman-A(BF.A.US$, $Campbell Soup(CPB.US$, and $GameStop(GME.US$ report earnings.

$McKesson(MCK.US$ and $Southwest Airlines(LUV.US$ host their 2021 investor days.

$Edwards Lifesciences(EW.US$ holds an investor conference in Irvine, Calif. The company will discuss its product pipeline as well as its financial outlook for 2022.

The Bank of Canada announces its monetary-policy decision. The central bank is expected to keep its key short-term interest rate unchanged at 0.25%. At its late-October meeting, the bank ended its quantitative-easing program and signaled that its first interest-rate hike would be earlier in 2022 than had been expected.

Thursday 12/9

$Broadcom(AVGO.US$, $Costco(COST.US$, and $Hormel Foods(HRL.US$ hold conference calls to discuss quarterly results.

$CVS Health(CVS.US$ and $Tyson Foods(TSN.US$ host their annual investor days.

The Department of Labor reports initial jobless claims for the week ending on Dec. 4. Jobless claims averaged 238,750 in November, the lowest since the beginning of the pandemic, and just 24,750 more than in February of 2020.

Friday 12/10

$Archer Daniels Midland(ADM.US$ holds its global investor day.

$Centene(CNC.US$ holds an investor meeting and will provide financial guidance for 2022.

The Bureau of Labor Statistics releases the consumer price index for November. Consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously. October's 6.2% increase was the hottest the CPI has run in more than 30 years, and this past week Federal Reserve Chairman Jerome Powell finally ditched "transitory" when discussing inflation before the Senate Banking Committee.

The University of Michigan releases its Consumer Sentiment index for December. Economists forecast a 66 reading, slightly less than the November data.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

86

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)