股 股 叫

commented on

$Unity Software(U.US$

I just bought a few days ago and it cost 25. The duvet was immediately covered. Luckily I only bought a few. With this thing and PLTR, you really can't open big positions.

But that's fine; when everyone is caught, there's no pressure![]() After all, the U company still doesn't have any problems of principle, and there is no risk of bankruptcy. After falling 22 the first few times, they all went up, so if they came, they settled down; on the contrary, no one would cut meat at this time.

After all, the U company still doesn't have any problems of principle, and there is no risk of bankruptcy. After falling 22 the first few times, they all went up, so if they came, they settled down; on the contrary, no one would cut meat at this time.

However, if there is another negative gap and the volume falls below 22, then it really is a bottomless hole![]()

Just a comment. After all, today's stock holdings $Taiwan Semiconductor(TSM.US$ It skyrocketed by 5%, and the one that just added a position $NVIDIA(NVDA.US$ It has also risen a bit, which should confirm that the breakthrough was successful. $Utilities Select Sector SPDR Fund(XLU.US$ It's been good lately, $iShares Bitcoin Trust(IBIT.US$ Yesterday, I also confessed to cutting meat and waited until it fell before buying it back. Anyway, I'm in a good mood, I can enjoy a nice weekend![]()

I just bought a few days ago and it cost 25. The duvet was immediately covered. Luckily I only bought a few. With this thing and PLTR, you really can't open big positions.

But that's fine; when everyone is caught, there's no pressure

However, if there is another negative gap and the volume falls below 22, then it really is a bottomless hole

Just a comment. After all, today's stock holdings $Taiwan Semiconductor(TSM.US$ It skyrocketed by 5%, and the one that just added a position $NVIDIA(NVDA.US$ It has also risen a bit, which should confirm that the breakthrough was successful. $Utilities Select Sector SPDR Fund(XLU.US$ It's been good lately, $iShares Bitcoin Trust(IBIT.US$ Yesterday, I also confessed to cutting meat and waited until it fell before buying it back. Anyway, I'm in a good mood, I can enjoy a nice weekend

Translated

7

7

股 股 叫

liked

$Tesla(TSLA.US$

不到一周时间,特斯拉又抢头条了。

如果我那张160的call没有卖,现在已经不是火锅钱了![]()

![]()

![]()

不过无所谓,这种钱,普通人是赚不到的,就算赚到也是因为运气。

fsd如果能在中国顺利批准,肯定是好事,但我很好奇具体会有多少付费用户。中国的路况比美国复杂多了,拥堵的道路,激进的驾驶风格,严重缺乏的礼让精神,以及大量的违规非机动车,对fsd也是一个不小的挑战。不过话说回来,我虽然也是老司机了,但本人是真的不敢在中国开车。回国如需自驾的话,我可能真的需要租一辆有fsd的特斯拉才行![]()

言归正传。我对特斯拉目前的看法:在180附近,大概率是160-200之间,进行宽幅震荡,不断消化上方的套牢盘。把筹码集中在180附近,然后选择一个方向去突破。这个方向不仅取决于特斯拉本身,还取决于宏观环境和中美关系。目前无法预测。但如果届时选择上涨,涨幅不会低于50%。

喜欢波段的话,现阶段小仓位高抛低吸,可以玩。不喜欢的话,就等待之后的突破,重仓一波大的。

不到一周时间,特斯拉又抢头条了。

如果我那张160的call没有卖,现在已经不是火锅钱了

不过无所谓,这种钱,普通人是赚不到的,就算赚到也是因为运气。

fsd如果能在中国顺利批准,肯定是好事,但我很好奇具体会有多少付费用户。中国的路况比美国复杂多了,拥堵的道路,激进的驾驶风格,严重缺乏的礼让精神,以及大量的违规非机动车,对fsd也是一个不小的挑战。不过话说回来,我虽然也是老司机了,但本人是真的不敢在中国开车。回国如需自驾的话,我可能真的需要租一辆有fsd的特斯拉才行

言归正传。我对特斯拉目前的看法:在180附近,大概率是160-200之间,进行宽幅震荡,不断消化上方的套牢盘。把筹码集中在180附近,然后选择一个方向去突破。这个方向不仅取决于特斯拉本身,还取决于宏观环境和中美关系。目前无法预测。但如果届时选择上涨,涨幅不会低于50%。

喜欢波段的话,现阶段小仓位高抛低吸,可以玩。不喜欢的话,就等待之后的突破,重仓一波大的。

3

6

股 股 叫

liked

$Alphabet-C(GOOG.US$

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

Translated

10

13

股 股 叫

voted

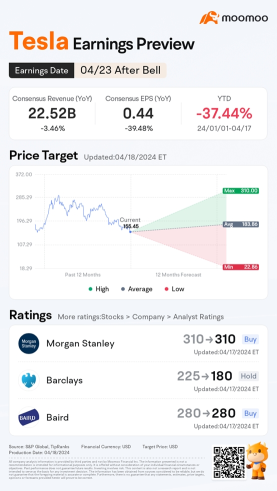

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

133

370

股 股 叫

liked

$iShares Bitcoin Trust(IBIT.US$

Possibility 1: If today's sharp decline was due to the risk of a war in the Middle East and a rational sell-off caused by safe-haven demand, then I probably wouldn't have stopped losing at 38. I personally believe that war does not pose a systemic risk to Bitcoin; on the contrary, Bitcoin has safe-haven properties. At the end of February 2022, Russia and Ukraine started, and Bitcoin did not fall. Instead, interest rates were raised later, and liquidity tightened, which led to a sharp decline.

Evidence supporting this view: TLT bucked the trend. However, gold and crude oil have not risen, so this reason is not sufficient for the time being. TLT is probably just an overrun rebound; one-day data is not enough to prove that it is a safe-haven purchase. $iShares 20+ Year Treasury Bond ETF(TLT.US$

Possibility 2: Expectations of interest rate cuts have fallen short. The strengthening of the US dollar supports this view, but it is also a bit far-fetched. After all, TLT is still rising![]() Also, two days have passed since the CPI; this reflection arc is probably a bit too long. If this is the reason, a stop-loss must be executed. The tightening of liquidity and the strengthening of the USD will definitely suppress the price of Bitcoin.

Also, two days have passed since the CPI; this reflection arc is probably a bit too long. If this is the reason, a stop-loss must be executed. The tightening of liquidity and the strengthening of the USD will definitely suppress the price of Bitcoin.

Possibility 3: Irrational panic, including irrational selling due to the risk of war. After all, apart from Apple bucking the trend and rising slightly today, TLT overfell and rebounded. The entire market basically fell across the board, and the panic index VIX also soared. If this is the reason, for an irrational decline, there is no need to stop loss; instead, it is a position that attracts funds...

Possibility 1: If today's sharp decline was due to the risk of a war in the Middle East and a rational sell-off caused by safe-haven demand, then I probably wouldn't have stopped losing at 38. I personally believe that war does not pose a systemic risk to Bitcoin; on the contrary, Bitcoin has safe-haven properties. At the end of February 2022, Russia and Ukraine started, and Bitcoin did not fall. Instead, interest rates were raised later, and liquidity tightened, which led to a sharp decline.

Evidence supporting this view: TLT bucked the trend. However, gold and crude oil have not risen, so this reason is not sufficient for the time being. TLT is probably just an overrun rebound; one-day data is not enough to prove that it is a safe-haven purchase. $iShares 20+ Year Treasury Bond ETF(TLT.US$

Possibility 2: Expectations of interest rate cuts have fallen short. The strengthening of the US dollar supports this view, but it is also a bit far-fetched. After all, TLT is still rising

Possibility 3: Irrational panic, including irrational selling due to the risk of war. After all, apart from Apple bucking the trend and rising slightly today, TLT overfell and rebounded. The entire market basically fell across the board, and the panic index VIX also soared. If this is the reason, for an irrational decline, there is no need to stop loss; instead, it is a position that attracts funds...

Translated

12

4

股 股 叫

liked

$NVIDIA(NVDA.US$

But I decided to reduce my position. Yesterday we added 3%, today we reduced our positions by 2%, so let's keep half. A day trip. After all, Brother Yu fell below the critical position of 870; today is probably a backdraw.

Continue to take heavy positions and hold high-dividend versions, that is, $Taiwan Semiconductor(TSM.US$

Bitcoin has held a critical position, and the risk has been temporarily mitigated $iShares Bitcoin Trust(IBIT.US$

But I decided to reduce my position. Yesterday we added 3%, today we reduced our positions by 2%, so let's keep half. A day trip. After all, Brother Yu fell below the critical position of 870; today is probably a backdraw.

Continue to take heavy positions and hold high-dividend versions, that is, $Taiwan Semiconductor(TSM.US$

Bitcoin has held a critical position, and the risk has been temporarily mitigated $iShares Bitcoin Trust(IBIT.US$

Translated

3

1

股 股 叫

liked

$iShares Bitcoin Trust(IBIT.US$

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF(TLT.US$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF(TLT.US$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

Translated

9

1

股 股 叫

reacted to and commented on

股 股 叫

liked

$Tesla(TSLA.US$

I wonder how many people have watched the FSD live stream? I've probably watched it, and it feels pretty good; it just takes time to test. I think Tesla will no doubt be the first to commercialize fully automated driving on a large scale. After all, artificial intelligence competes for data. Whoever has more data for training will win this game. I'm optimistic $Alphabet-C(GOOG.US$ This is also the logic.

Although Tesla doesn't have many models, the coverage is good, and they can pull people and goods. Once fully automated driving is achieved, it will greatly boost the development of productivity.

The core logic behind the continued prosperity of US stocks is that there are always excellent companies in the US that drive progress in productivity, and even disrupt many traditional industries. There is nothing wrong with long-term investment grasping this general direction and betting on the most advanced productivity. Even if you don't enter the market right away, you can succeed. For example, when Buffett was heavily involved in Apple, there were several generations of iPhones, but this investment was still a huge success.

Back to business, can Tesla beat so many traditional car companies? That's a great question. So where are the Nokia, Blackberry, and Sony phones? Autonomous driving, can't other brands do it? With so many smartphone brands, is Apple still more than three trillion dollars alone?

If one day in the future, Musk smiles and sells cars at a profit close to zero, then it is likely that it will be the time for Stuart Tesla. The value created by fully automated driving is far from being comparable to a sofa with four wheels...

I wonder how many people have watched the FSD live stream? I've probably watched it, and it feels pretty good; it just takes time to test. I think Tesla will no doubt be the first to commercialize fully automated driving on a large scale. After all, artificial intelligence competes for data. Whoever has more data for training will win this game. I'm optimistic $Alphabet-C(GOOG.US$ This is also the logic.

Although Tesla doesn't have many models, the coverage is good, and they can pull people and goods. Once fully automated driving is achieved, it will greatly boost the development of productivity.

The core logic behind the continued prosperity of US stocks is that there are always excellent companies in the US that drive progress in productivity, and even disrupt many traditional industries. There is nothing wrong with long-term investment grasping this general direction and betting on the most advanced productivity. Even if you don't enter the market right away, you can succeed. For example, when Buffett was heavily involved in Apple, there were several generations of iPhones, but this investment was still a huge success.

Back to business, can Tesla beat so many traditional car companies? That's a great question. So where are the Nokia, Blackberry, and Sony phones? Autonomous driving, can't other brands do it? With so many smartphone brands, is Apple still more than three trillion dollars alone?

If one day in the future, Musk smiles and sells cars at a profit close to zero, then it is likely that it will be the time for Stuart Tesla. The value created by fully automated driving is far from being comparable to a sofa with four wheels...

Translated

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

股 股 叫 : So is U going to go into the bottomless pit now