PayPal: Value play or value trap?

Once a market darling, PYPL is now down 79% from its all-time highs.

To understand what direction PayPal is heading, we need to look at where they sit in the payments ecosystem.

1.) The "PayPal Button" - Often referred to as Branded Checkout, this is their most important business as it accounts for roughly 1/3rd of all transaction volume and an estimated 2/3rds of gross profit.

This segment includes the standard "Pay with PayPal" solution you see at most online checkouts as well as cross-border transfers. In general, the take-rate PayPal generates on these sorts of transactions are higher than anywhere else in its business. Particularly, when payments are made with the cash from a customer's actual PayPal account.

However, due to the rise of mobile wallets like Apple and Google Pay, the PayPal Button is ceding its share of overall digital transactions.

2.) Unbranded Checkout - PayPal's 2nd most important business is what it calls "Unbranded Checkout". This refers mostly to its Braintree subsidiary which it acquired in 2013.

Braintree is a “full-stack” payments processor that competes with the likes of Stripe and Adyen, and the segment processes ~$400 billion in annual payment volume. For context, Stripe and Adyen are both at about $1 trillion.

This is PayPal's fastest growing segment, however given the competition among processors, it commands a substantially lower take-rate than PayPal's branded checkout business.

3.) Everything Else - PayPal has been highly acquisitive over the years and today roughly 35% of its total payment volume comes from its collection of other subsidiaries. This includes most notably Venmo (their peer-to-peer payments app), but also Xoom, Hyperwallet, Zettle, Honey, and others.

While each of these businesses could potentially help grow volume and earnings a bit, the vast majority of PayPal's earnings power still comes from its branded checkout business.

Value play or value trap? PayPal currently trades at a price to earnings of ~17x.

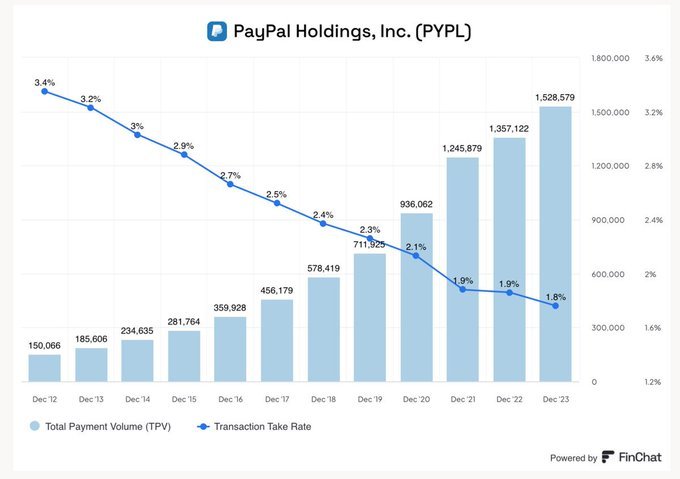

Given its total payment volume has grown at 23.5% annually over the last 5 years, it'd be easy to think that the company's valuation looks quite cheap.

However, given that an increasing percentage of that payment volume is coming from its PSP business, which has a lower take-rate, it doesn't directly equate to growth in earnings power for PayPal.

The more important figure to track over the coming years will be the growth in revenue (and ultimately earnings) from its branded checkout business. If the "PayPal Button" can maintain or even grow its market share, PayPal will likely grow earnings fast enough to generate value for shareholders.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

101625629 : got bid up on empty, now letting out all hot air back to fundamentals. Earnings, growth count. EPS still below 0.99. Smart money play decides.