It’s the Magnificent Seven’s Market. The Other Stocks Are Just Living in It.

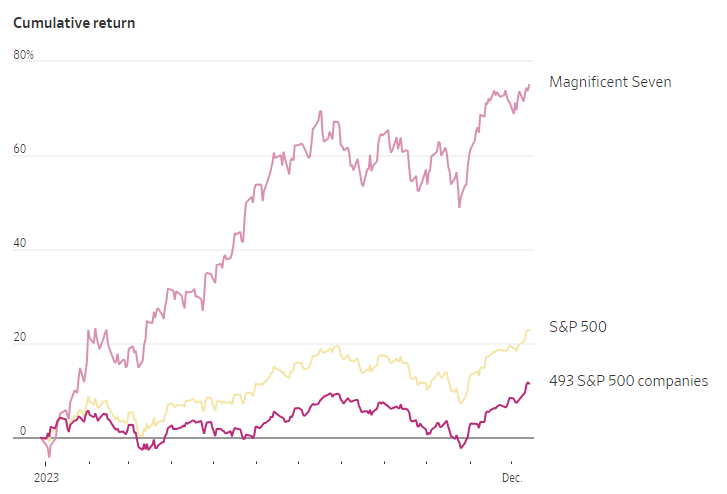

Outperformance of the Magnificent Seven: $Apple(AAPL.US$ , $Microsoft(MSFT.US$ , $Alphabet-A(GOOGL.US$ , $Amazon(AMZN.US$ , $NVIDIA(NVDA.US$ , $Tesla(TSLA.US$ , and $Meta Platforms(META.US$ collectively surged 75% in 2023, overshadowing the remaining 493 companies in the S&P 500, which rose only 12%.

Market Concentration Concerns: The Magnificent Seven now represents about 30% of the S&P 500’s market value, approaching historic highs for such concentration, raising concerns about market vulnerability.

Global Impact: Globally, these tech stocks' combined weighting in the MSCI All Country World Index surpasses the total stocks of Japan, France, China, and the U.K., underlining their global influence.

Market Concentration Risks: Concentration in a few stocks raises concerns about market resilience, especially if a downturn occurs and these heavyweight stocks decline.

Tech Stocks Resurgence: In 2022, big tech stocks faced a decline of 40%, losing $4.7 trillion in combined market value. However, in 2023, they staged a strong comeback, driven by AI optimism and economic data suggesting easing inflation and peaking interest rates.

Earnings Growth Contribution: The Magnificent Seven not only led in stock performance but also contributed significantly to the market’s overall earnings growth. Without them, S&P 500 earnings would be on track to fall by 4%.

Blockbuster Gains: Microsoft, Apple, and Nvidia experienced substantial gains in 2023 due to AI optimism, strong economic data, and easing inflation.

Market Dynamics: While the S&P 500 is near its 2022 record, only 23% of its stocks are within 10% of their record highs, suggesting a lack of broad-based market strength.

Future Outlook: Some analysts expect the dominance of tech stocks to wane, with potential outperformance in beaten-down sectors like industrials, materials, and transportation.

Investor Caution: Investors, cautious about tech stocks, added about $4.1 billion to tech-focused equity funds through November 2023, compared to $7.9 billion pulled during the same period in 2022.

Interest Rates Impact: Higher interest rates have benefited tech stocks, enabling them to earn yields on cash, strengthen balance sheets, and generate higher profits.

Valuation Concerns: Tech stocks still appear expensive compared to the broader market, with Nvidia, Microsoft, and Apple trading at multiples higher than the S&P 500.

Tech Stocks' Value: Despite high valuations, some argue that tech stocks are worth the investment, given their potential to outperform during periods of higher interest rates.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment