Apple’s iPhone Reveals Are Often a Dip Buyer’s Dream

$Apple(AAPL.US$ ’s iPhone debuts have historically been a sell-the-news event for the stock, but the weeks following often provide an even better opportunity to buy the dip.

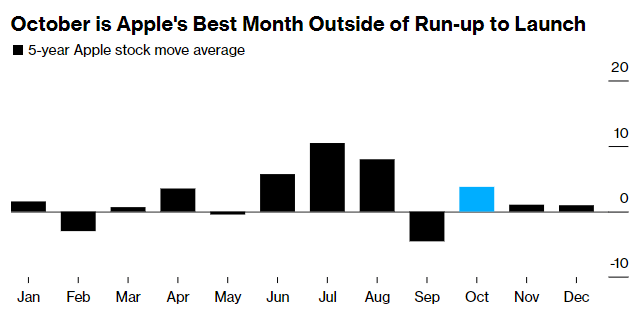

Over the past five years, September has been the worst month of the year for Apple, with the shares averaging a decline of 4.5%, compared with a drop of 3.2% for the S&P 500. At the same time, October has been among the best, with an average gain for Apple of 3.8% over the same period.

Over the past five years, September has been the worst month of the year for Apple, with the shares averaging a decline of 4.5%, compared with a drop of 3.2% for the S&P 500. At the same time, October has been among the best, with an average gain for Apple of 3.8% over the same period.

While the stock has usually risen in the months ahead of the event, this year’s lead up has been troubled. Apple shares slumped in August after a disappointing earnings report and the slide has continued this month amid concerns about government restrictions on iPhones in China, its biggest international market. In total, Apple has lost nearly $300 billion in market value since closing at a record on July 31.

Apple’s event is scheduled to kick off on Tuesday at 10 a.m. in California and feature the iPhone 15 line, along with next-generation watches and AirPods. The iPhone lineup will include two-entry level models and two high-end models, Bloomberg News has reported.

Of course, Apple isn’t the only megacap stock under pressure. The Nasdaq 100 Stock Index has fallen more than 2% from a high in July amid rising Treasury yields and signs that the Federal Reserve is poised to keep interest rates higher for longer. Tesla Inc. and Microsoft Inc. have fallen more than 5% since the July 18 peak. Even chipmaker Nvidia Corp. is down 4.9%.

Despite the pullback, Apple shares remain up 38% this year. The stock is priced at 27 times projected profits, down from a high of 30 times in July but well above an average of 18 times over the past decade.

Apple is in need of a boost after three consecutive quarters of revenue declines.

Despite the pullback, Apple shares remain up 38% this year. The stock is priced at 27 times projected profits, down from a high of 30 times in July but well above an average of 18 times over the past decade.

Apple is in need of a boost after three consecutive quarters of revenue declines.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Chak : Yea man always buy the hype sell the news , but if you bought this time it was already down