Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1820.765

- +29.901+1.67%

- 5D

- 1D

- 1W

- 1M

- 1Q

- 1Y

News

“Qualcom+Arm” VS M3, Microsoft is very confident: this time, we are really better than Apple!

The performance of Microsoft's new Surface devices equipped with Arm architecture surpasses the Apple M3 Mac by 58%, and the battery life for web browsing can reach 16 hours, which is double that of the previous generation Intel-based Surface.

Dell Teams With Nvidia to Offer New Blackwell GPUs in AI Push

This Micron Technology Analyst Is No Longer Bearish; Here Are Top 5 Upgrades For Today

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.Goldman Sac

Nvidia Set For Steady Gains With Software-Centric Shift And Blackwell Transition, Analysts Say

Nvidia Corp (NASDAQ:NVDA) shares are trading higher ahead of this week's earnings report.Rosenblatt analyst Hans Mosesmann maintained a Buy rating on Nvidia with a $1,400 price target.Mosesmann expect

Microsoft Begins 'AI Day' Press Conference; Expected To Reveal A New Version Of Its Surface Pro Tablet And Surface Laptop That Feature Qualcomm Chips Based On Arm Holdings' Architecture

Microsoft Begins 'AI Day' Press Conference; Expected To Reveal A New Version Of Its Surface Pro Tablet And Surface Laptop That Feature Qualcomm Chips Based On Arm Holdings' Architecture

Applied Materials, Micron Lead Chips Higher as Sector Awaits Nvidia's Results

Comments

Apple Event Takeaway:

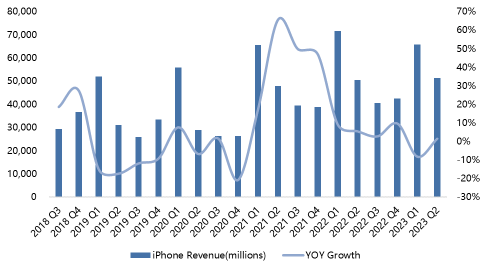

1. The iPhone 15 and iPhone 15 Plus received basic updates, featuring the "Dynamic Island" design, the A16 chip, and an improved main camera with 48 million pixels.

2. The Pro Max models received the most significant updates. In addition to the titanium alloy body, the major highlight is the redesigned A17 PRO chip, and the Pro Max camera system underwent further upgr...

So what's different about the iPhone 15 compared to before? I made a arrangement based on the information on the market:

In terms of exterior design, the iPhone 15 Pro and iPhone 15 Pro Max will choose "titanium" as the new frame material. Lighter, thinner titanium, previously used on the Apple Watch. The addition of the new materi...

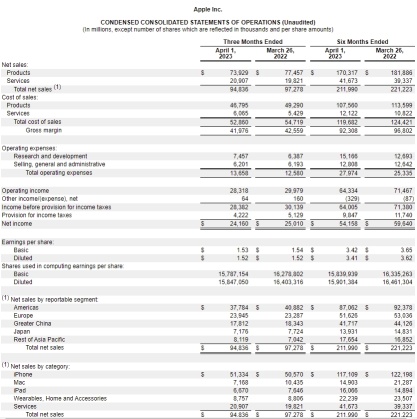

How is Apple's earnings this quarter? What exactly are we buying when we buy AAPL?

1. The company's performance exceeded expectations, and its core business showed a strong ability to resist risks

The core business has demonstrated a strong ability to resist risks. In 23Q1, the company's r...

Does a $5 stock price not deserve a name?

$Apple(AAPL.US$ $Apple Supplier(LIST2437.US$

Which performance do you expect more?

According to the financial report, NIO’s total revenue in the second quarter was 10.2924 billion RMB (about 1.5366 billion U.S. dollars), an increase of 21.8% compared with the second quarter of 2021 and a 3.9% increase compared to the first quarter of 2022. The net loss attributable to NIO ordinary shareholders was 2.745 billion...

Zul Zulkifli : $Tesla (TSLA.US)$