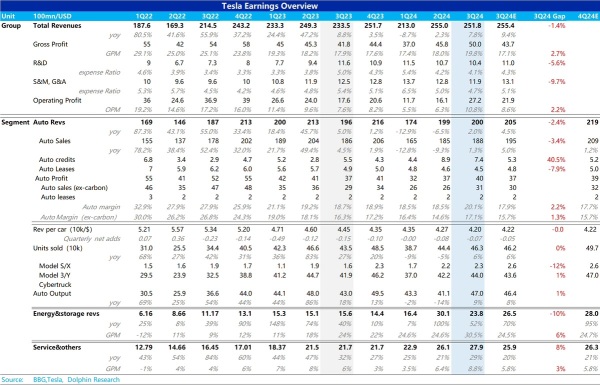

In Tesla's third-quarter earnings unveiling, with a focus on the cornerstone of their performance — the automotive business:

![]() The average selling price of vehicles was slightly below market expectations, but not a significant concern. Although Tesla did not adjust prices for its flagship models, the Model 3/Y, in China and the U.S. during Q3, and even increased the price by 1500 euros for the Model 3 in Europe due...

The average selling price of vehicles was slightly below market expectations, but not a significant concern. Although Tesla did not adjust prices for its flagship models, the Model 3/Y, in China and the U.S. during Q3, and even increased the price by 1500 euros for the Model 3 in Europe due...

6

1

Carla Lee

liked

6

26

Carla Lee

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ It's been grinding for too long, I'm thinking of switching symbols.![]() My patience is limited.

My patience is limited.![]()

Translated

5

Carla Lee

liked

$Inspire Veterinary Partners (IVP.US)$ 🏁🏁🏁 big gains today again, glad i held onto this one long term! didnt shake me out of the play!

8

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)