MMCow1984

讚了

The markets opened higher on Monday and almost immediately moved lower. This week could be choppy and traction-less, with a two-day Federal Reserve meeting on deck and a quadruple-witching expiration on Friday. ![]()

![]()

![]()

Check out today's top stock trades:

Top stock trades for today No.1: Ford![]()

$福特汽車(F.US$ stock made a major breakout on Friday, rallying almost 10% on the day and closing near the highs. On Monday, it was quite the opposite with shares down nearly 5%.

For now, the stock is stuck below the $20.50 breakout level. I want to see Ford hold above this level.

We saw a dip from the long-term 261.8% extension and for me, that's not too surprising. However, if it can hold above $20.50, I believe bulls will remain in control.

That leaves the $21.25 level in play. Above Friday's high, and the $23 level is on the table. That's the 261.8% extension of the current range.

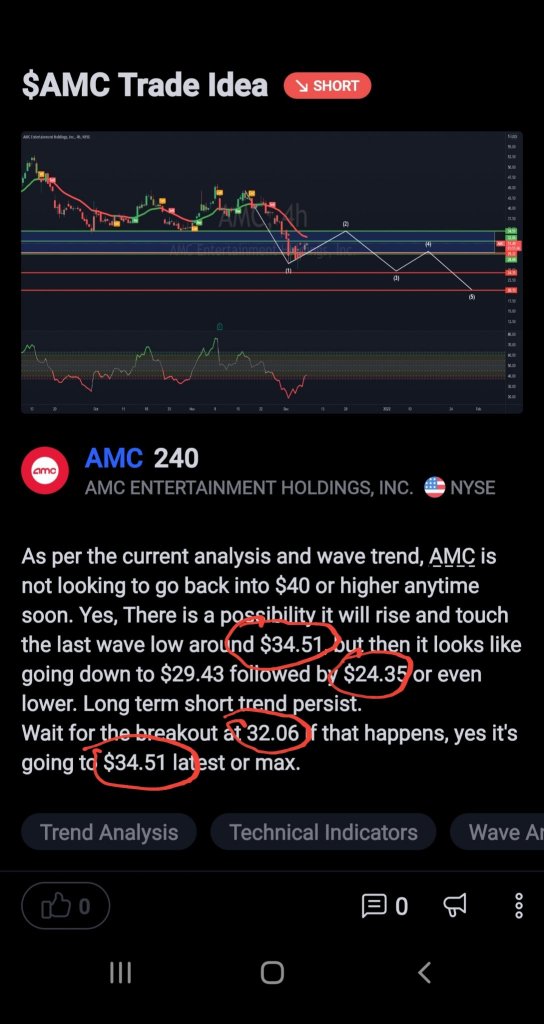

Top stock trades for today No.2: AMC Entertainment![]()

Meme-land is getting crushed today, with $AMC院線(AMC.US$ down more than 15% on the day. $遊戲驛站(GME.US$ didn't fair too well either, falling almost 14% on Monday.

The action in AMC stock is not too surprising. Shares were putting in a series of lower highs over the past few months. Then the $33 to $35 area failed as support, while the 200-day and 10-day moving averages turned to resistance.

Now taking out the recent low, AMC stock is testing down into the monthly VWAP measure. I wouldn't hang a two-week salary on this level holding, but if we get a bounce, see how AMC stock handles the $29 level.

If it continues lower, let's see how that former high near $20 acts. Just a few days ago I said this level could be in play, although it didn't seem like it at the time. Below that could put the 21-month and 50-month moving averages on the table.

Top stock trades for today No.3: GameStop![]()

I'm not much for tooting any horns — particularly my own — but this morning I also noted that GameStop looked vulnerable after last week's close.

Below the third-quarter high now, GME stock is looking to find its footing. If it can reclaim this level, see how it handles $159, which was the prior week's low and the breakdown point in recent trading.

If the mid-$130s doesn't act as support, the 21-month moving average may be up next near $115, followed by a potential test of $100.

Over $159, and GameStop still has its hands full, as a number of moving averages loom overhead.

Source: InvestorPlace

Check out today's top stock trades:

Top stock trades for today No.1: Ford

$福特汽車(F.US$ stock made a major breakout on Friday, rallying almost 10% on the day and closing near the highs. On Monday, it was quite the opposite with shares down nearly 5%.

For now, the stock is stuck below the $20.50 breakout level. I want to see Ford hold above this level.

We saw a dip from the long-term 261.8% extension and for me, that's not too surprising. However, if it can hold above $20.50, I believe bulls will remain in control.

That leaves the $21.25 level in play. Above Friday's high, and the $23 level is on the table. That's the 261.8% extension of the current range.

Top stock trades for today No.2: AMC Entertainment

Meme-land is getting crushed today, with $AMC院線(AMC.US$ down more than 15% on the day. $遊戲驛站(GME.US$ didn't fair too well either, falling almost 14% on Monday.

The action in AMC stock is not too surprising. Shares were putting in a series of lower highs over the past few months. Then the $33 to $35 area failed as support, while the 200-day and 10-day moving averages turned to resistance.

Now taking out the recent low, AMC stock is testing down into the monthly VWAP measure. I wouldn't hang a two-week salary on this level holding, but if we get a bounce, see how AMC stock handles the $29 level.

If it continues lower, let's see how that former high near $20 acts. Just a few days ago I said this level could be in play, although it didn't seem like it at the time. Below that could put the 21-month and 50-month moving averages on the table.

Top stock trades for today No.3: GameStop

I'm not much for tooting any horns — particularly my own — but this morning I also noted that GameStop looked vulnerable after last week's close.

Below the third-quarter high now, GME stock is looking to find its footing. If it can reclaim this level, see how it handles $159, which was the prior week's low and the breakdown point in recent trading.

If the mid-$130s doesn't act as support, the 21-month moving average may be up next near $115, followed by a potential test of $100.

Over $159, and GameStop still has its hands full, as a number of moving averages loom overhead.

Source: InvestorPlace

14

2

MMCow1984

讚了

$Meta Materials(MMAT.US$ 人家說你是垃圾,你就安安靜靜的,哎無語了

已翻譯

16

1

MMCow1984

讚了

美聯儲於 12 月 14 日和 15 日舉行為期兩天的會議。如果美聯儲決定更快地削減債券購買,它也可能開始更快地加息。投資者將密切關注聯邦調查局的新利率預測。

投資者將關注三個主題。

首先, t預計中央銀行將討論加快其債券購買計劃的結束。

ING 說,由於其他美聯儲官員沒有提出反對,儘管 Omicron 變種出現了不確定性,但下週的會議看起來將看到美聯儲宣布加速量化寬松逐漸減少,1 月份減少了 30 億美元(至 600 億美元的購買),並在 2 月進一步減少了 30 億美元。

這意味著美聯儲在 3 月初結束了該計劃,使美聯儲在其資產負債表上留下了 8.8tn 的資產。

其次,投資者將密切關注美聯儲的新利率預測-特別是點圖。

如果美聯儲決定更快地削減債券購買,它也可能開始更快地加息。

「美聯儲的時間不多了,」布朗諮詢公司固定收益負責人湯姆·格拉夫(Tom Graff)在接受電話採訪時說。「這些通貨膨脹讀數需要顯示出明顯的減速,否則他們將在逐漸變細的情況下盡快徒步旅行。」格拉夫表示,他預計美聯儲明年可能會提高其基準利率三倍,可能從 4 月開始。

美國銀行的經濟學家預計,點陣圖將在 2022 年顯示兩次利率上升,在 2023 年和 2024 年則有六個上升。摩根大通首席美國經濟學家邁克爾·費羅利(Michael Feroli)表示,美聯儲可以以更快的速度進行,每年還有一個利率上漲。

(如果您不知道如何分析點圖,可以閱讀我的另一篇文章: 分析點圖和理解如何美聯儲預測

最後但並非最不重要的一點是,投資者會關注鮑威爾所說的話。

隨著傑羅姆·鮑威爾(Jerome Powell)建議對通貨膨脹的「短暫」描述應該「退休」,隨附的聲明也將有其他更改。他們將承認通貨膨脹和更嚴格的就業市場帶來的上行驚喜,但即使消費者調查證據和國庫債券的盈虧平衡通脹率,他們也將保持「長期通脹預期保持在 2%」的線條不太明確。

ps 您可以從 CNBC,雅虎財經,彭博等中找到更多意見。

$道瓊斯指數(.DJI.US$ $納斯達克綜合指數(.IXIC.US$ $標普500指數(.SPX.US$ $納指100ETF-Invesco QQQ Trust(QQQ.US$ $納斯達克100指數(.NDX.US$

投資者將關注三個主題。

首先, t預計中央銀行將討論加快其債券購買計劃的結束。

ING 說,由於其他美聯儲官員沒有提出反對,儘管 Omicron 變種出現了不確定性,但下週的會議看起來將看到美聯儲宣布加速量化寬松逐漸減少,1 月份減少了 30 億美元(至 600 億美元的購買),並在 2 月進一步減少了 30 億美元。

這意味著美聯儲在 3 月初結束了該計劃,使美聯儲在其資產負債表上留下了 8.8tn 的資產。

其次,投資者將密切關注美聯儲的新利率預測-特別是點圖。

如果美聯儲決定更快地削減債券購買,它也可能開始更快地加息。

「美聯儲的時間不多了,」布朗諮詢公司固定收益負責人湯姆·格拉夫(Tom Graff)在接受電話採訪時說。「這些通貨膨脹讀數需要顯示出明顯的減速,否則他們將在逐漸變細的情況下盡快徒步旅行。」格拉夫表示,他預計美聯儲明年可能會提高其基準利率三倍,可能從 4 月開始。

美國銀行的經濟學家預計,點陣圖將在 2022 年顯示兩次利率上升,在 2023 年和 2024 年則有六個上升。摩根大通首席美國經濟學家邁克爾·費羅利(Michael Feroli)表示,美聯儲可以以更快的速度進行,每年還有一個利率上漲。

(如果您不知道如何分析點圖,可以閱讀我的另一篇文章: 分析點圖和理解如何美聯儲預測

最後但並非最不重要的一點是,投資者會關注鮑威爾所說的話。

隨著傑羅姆·鮑威爾(Jerome Powell)建議對通貨膨脹的「短暫」描述應該「退休」,隨附的聲明也將有其他更改。他們將承認通貨膨脹和更嚴格的就業市場帶來的上行驚喜,但即使消費者調查證據和國庫債券的盈虧平衡通脹率,他們也將保持「長期通脹預期保持在 2%」的線條不太明確。

ps 您可以從 CNBC,雅虎財經,彭博等中找到更多意見。

$道瓊斯指數(.DJI.US$ $納斯達克綜合指數(.IXIC.US$ $標普500指數(.SPX.US$ $納指100ETF-Invesco QQQ Trust(QQQ.US$ $納斯達克100指數(.NDX.US$

已翻譯

36

11

MMCow1984

讚了

$阿里巴巴(BABA.US$ $KraneShares中國海外互聯網ETF(KWEB.US$

Baba has closed green today. The sellers had trouble even trying to keep baba in the red with the low volume selling. Buyers are stepping in now and we can already see the demand overpowering supply here with low volume day as there is basically no more supply.

Those who wanted to sell, already sold. Those who wanted to take profit already did. The rest are waiting for higher prices. Past 3 days were signs the sellers were weak and buyers were about to take over. We saw that today and it should continue on Monday as well.

Overall US indices has finished their pullback and now heading to new highs with SPX leading the way today. China has also switched focus to economic growth instead of clampdown and will make economic growth their priority in 2022 after all the regulatory fines in 2021.

This are signs the Kweb etf should start recovering from here which I mentioned 39 should be it's bottom. It has yet to break 43.40 which was the resistance to show the 39 drop was the spring. But it should as soon as next week.

However fomc next week will still be the topic in focus. But it should all already be priced in like today CPI 6.8% data.

As always, trade safe & invest wise!

Do subscribe to my YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/c/investing101channel

Baba has closed green today. The sellers had trouble even trying to keep baba in the red with the low volume selling. Buyers are stepping in now and we can already see the demand overpowering supply here with low volume day as there is basically no more supply.

Those who wanted to sell, already sold. Those who wanted to take profit already did. The rest are waiting for higher prices. Past 3 days were signs the sellers were weak and buyers were about to take over. We saw that today and it should continue on Monday as well.

Overall US indices has finished their pullback and now heading to new highs with SPX leading the way today. China has also switched focus to economic growth instead of clampdown and will make economic growth their priority in 2022 after all the regulatory fines in 2021.

This are signs the Kweb etf should start recovering from here which I mentioned 39 should be it's bottom. It has yet to break 43.40 which was the resistance to show the 39 drop was the spring. But it should as soon as next week.

However fomc next week will still be the topic in focus. But it should all already be priced in like today CPI 6.8% data.

As always, trade safe & invest wise!

Do subscribe to my YouTube channel for your once a week TA and market outlook!

https://www.youtube.com/c/investing101channel

44

10

MMCow1984

讚了

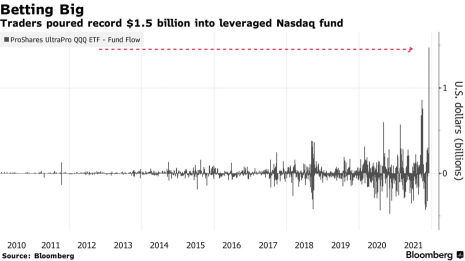

對於交易所買賣基金交易者而言,股市的快速反彈是一個好消息,他們在高點技術投注下跌破紀錄的 1.5 億美元。

搭配 $納斯達克100指數(.NDX.US$ 週二和溫德日激增,這似乎對投資者來說是證明 $3倍做多納指ETF-ProShares(TQQQ.US$ 在星期五戰中大量。

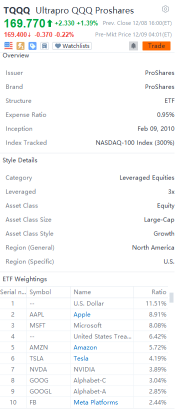

什麼是 TQQQ?

$3倍做多納指ETF-ProShares(TQQQ.US$ 是追蹤最大的槓桿 ETF 之一 $納斯達克100指數(.NDX.US$。該指數專注於科技,醫療保健,工業,消費者自願性和電信領域的大型國際和美國公司。TQQQ 使用衍生產品和債務來提高投資者的回報。

由於美聯儲的鷹傾向和對 omicron 變體的擔憂,該基金使用期權提供基金表現比基準的三倍,因此在上週陷入壓倒後,成為市場領導者之一。

由於基金結算方式,流量數據顯示,由於基金結算方式而延遲一天,顯示投資者在上週末增加了前所未有的 1.47 億美元。TQQQ 超過 13 億美元的股份在該交易時段中轉手,因為它下跌 5%。

較高利率 製作所謂 增長股票不具吸引力 因為它們的大部分價值與潛在的未來收入有關,如果收益率高或上升,這些收益將不那麼吸引力。儘管如此,對科技巨頭投注很少有回報。類似的 $蘋果(AAPL.US$ 和 $微軟(MSFT.US$ 仍然主導他們的行業,而投資者經常在經濟質疑的時候急於尋找巨型股市的安全。

作為槓桿基金,TQQQ 適用於短期交易。然而,大科技的力量就是這樣,一位在過去五年內留下投資者,ETF 的回報將達到近 1,500%。

資料來源:彭博,投資媒體

搭配 $納斯達克100指數(.NDX.US$ 週二和溫德日激增,這似乎對投資者來說是證明 $3倍做多納指ETF-ProShares(TQQQ.US$ 在星期五戰中大量。

什麼是 TQQQ?

$3倍做多納指ETF-ProShares(TQQQ.US$ 是追蹤最大的槓桿 ETF 之一 $納斯達克100指數(.NDX.US$。該指數專注於科技,醫療保健,工業,消費者自願性和電信領域的大型國際和美國公司。TQQQ 使用衍生產品和債務來提高投資者的回報。

由於美聯儲的鷹傾向和對 omicron 變體的擔憂,該基金使用期權提供基金表現比基準的三倍,因此在上週陷入壓倒後,成為市場領導者之一。

由於基金結算方式,流量數據顯示,由於基金結算方式而延遲一天,顯示投資者在上週末增加了前所未有的 1.47 億美元。TQQQ 超過 13 億美元的股份在該交易時段中轉手,因為它下跌 5%。

較高利率 製作所謂 增長股票不具吸引力 因為它們的大部分價值與潛在的未來收入有關,如果收益率高或上升,這些收益將不那麼吸引力。儘管如此,對科技巨頭投注很少有回報。類似的 $蘋果(AAPL.US$ 和 $微軟(MSFT.US$ 仍然主導他們的行業,而投資者經常在經濟質疑的時候急於尋找巨型股市的安全。

作為槓桿基金,TQQQ 適用於短期交易。然而,大科技的力量就是這樣,一位在過去五年內留下投資者,ETF 的回報將達到近 1,500%。

資料來源:彭博,投資媒體

已翻譯

26

4

MMCow1984

讚了

已翻譯

+1

52

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)