yo5swZ8f6A

liked

VitroX's net profit continued to decline by 4 quarters, and YOY continued to decline by 5 quarters. Vitrox's revenue and net profit for the quarter reached RM119.6mil and RM17.2mil. The main reason why net profit for the quarter fell by RM15.7 mil (47.8%) compared to the same period last year was due to a decline in demand for Automated Board Inspection (“ABI”). Management revealed that demand for the Machine Vision System (“MVS”) is beginning to recover, and management is also actively doing research and development to develop more new products.

Vitrox also currently enjoys Pioneer status, so it will pay less than the normal 24% of taxes. Know 2025. Management remains optimistic about the upcoming needs of the global semiconductor industry. They are also optimistic about the future growing demand for artificial intelligence (AI), telecommunications, and automotive industries.

The performance this time is relatively poor; PE has reached 64. $VITROX(0097.MY$

Vitrox also currently enjoys Pioneer status, so it will pay less than the normal 24% of taxes. Know 2025. Management remains optimistic about the upcoming needs of the global semiconductor industry. They are also optimistic about the future growing demand for artificial intelligence (AI), telecommunications, and automotive industries.

The performance this time is relatively poor; PE has reached 64. $VITROX(0097.MY$

Translated

28

yo5swZ8f6A

liked

$Tesla(TSLA.US$ Quick summary:

- Elon announced an affordable model by early 2025 (possibly end 2024).

- Q1 profit, revenue, and margins drop way below forecasts.

- Global vehicle inventory increases to 28 days (from 15 days).

- TSLA rallied upon optimism on new models, despite an underwhelming quarter.

Tesla recently reported a significant 55% drop in Q1 profits and a 9% decline in revenue, and it caused mixed emotions within investors. However, during the earnin...

- Elon announced an affordable model by early 2025 (possibly end 2024).

- Q1 profit, revenue, and margins drop way below forecasts.

- Global vehicle inventory increases to 28 days (from 15 days).

- TSLA rallied upon optimism on new models, despite an underwhelming quarter.

Tesla recently reported a significant 55% drop in Q1 profits and a 9% decline in revenue, and it caused mixed emotions within investors. However, during the earnin...

62

4

yo5swZ8f6A

liked

yo5swZ8f6A

liked

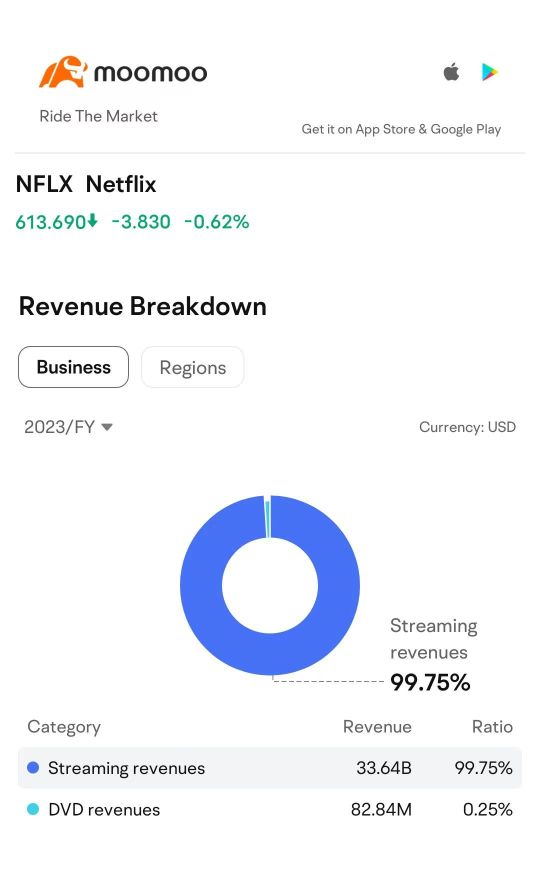

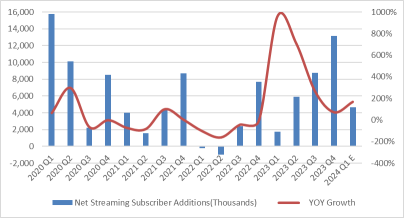

$Netflix(NFLX.US$ is set to release its earnings report after the market closes on April 18, Eastern Time. In the previous two quarters, Netflix's stock price surged impressively by 16.1% and 10.7%, respectively, following their earnings announcements. Since the beginning of the year, Netflix's share price has risen by 26.83%, outperforming the S&P 500 index and reaching a new high for the first time in nearly two...

+1

38

3

yo5swZ8f6A

liked

US stocks continued to be under pressure this week. The NASDAQ index fell more than 1%, falling for four consecutive days, and the S&P 500 index was not spared. Both fell to their lowest point in nearly two months. Among technology stocks, Google showed outstanding performance, rising against the market, while chip stocks generally suffered setbacks. Nvidia and Asmack fell by nearly 4% and 7%, respectively. Meanwhile, United Airlines surged 17% after its earnings report was released. In the European stock market, the technology sector fell by more than 3%. Despite this, LVMH and Adidas rose nearly 3% and 9% respectively after the earnings report, showing the strong performance of some individual stocks.

In terms of monetary policy, the New York Federal Reserve suggests that the Federal Reserve may stop reducing its balance sheet next year, and the scale is expected to shrink to 6 to 6.5 trillion US dollars. Furthermore, the Federal Reserve's latest Beige Book shows that although inflation is moderating, consumers are still very sensitive to prices. In the US bond market, 20-year bond auctions attracted strong demand, yet bid interest rates were close to the highest level in history. The 10-year US Treasury yield fell significantly from a five-month high, and the US dollar index stopped rising for five consecutive days.

In the commodity market, crude oil prices plummeted by more than 3%, the biggest one-day decline in three months. At the same time, gold also fell from a record high for four consecutive days. In terms of metal prices, the prices of copper and lentine have shown some elasticity, and both have rebounded.

In the Chinese market, despite global market turmoil, the China Securities Index fell for the third day in a row, but Xiaopeng Motors bucked the trend and rose nearly 4%. The offshore renminbi appreciated significantly, exceeding 200 points, reaching a one-week high. China A...

In terms of monetary policy, the New York Federal Reserve suggests that the Federal Reserve may stop reducing its balance sheet next year, and the scale is expected to shrink to 6 to 6.5 trillion US dollars. Furthermore, the Federal Reserve's latest Beige Book shows that although inflation is moderating, consumers are still very sensitive to prices. In the US bond market, 20-year bond auctions attracted strong demand, yet bid interest rates were close to the highest level in history. The 10-year US Treasury yield fell significantly from a five-month high, and the US dollar index stopped rising for five consecutive days.

In the commodity market, crude oil prices plummeted by more than 3%, the biggest one-day decline in three months. At the same time, gold also fell from a record high for four consecutive days. In terms of metal prices, the prices of copper and lentine have shown some elasticity, and both have rebounded.

In the Chinese market, despite global market turmoil, the China Securities Index fell for the third day in a row, but Xiaopeng Motors bucked the trend and rose nearly 4%. The offshore renminbi appreciated significantly, exceeding 200 points, reaching a one-week high. China A...

Translated

24

yo5swZ8f6A

liked and commented on

Meme coin Shiba Inu continues drifting lower from its all-time high of $0.00008 in October as "crypto markets are currently in a risk-off mode following the new highs made by bitcoin and ether [about] two weeks back," blockchain analytics firm Nansen told CoinDesk via written response.

SHIB tokens dip 10% to $0.000038 per coin intra-day.

Shiba's market cap of $20.7B falls from just over $40B towards the end of October, pulling its market cap ranking down to 13th place, with Crypto.com Coin just above at 12th, according to data from CoinMarketCap.

Perhaps the coin's decline is due to a rising number of wallets with substantial holdings that have reduced their SHIB positions recently, possibly due to taking profit, Nansen tells CoinDesk.

So-called whale transaction counts, the number of SHIB transactions valued at more than $100K, have been increasing since the start of November, which could imply a rise in near-term selling pressure, CoinDesk notes, citing data from Santiment.

Meanwhile, $Bitcoin(BTC.CC$ and $Ethereum(ETH.CC$ also drift lower.

$Dogecoin(DOGE.CC$, the 10th largest crypto, extends losses and is down nearly 9% this week.

Previously, (Nov. 22) Shiba Inu tokens extend losses as retail frenzy eases.

SHIB tokens dip 10% to $0.000038 per coin intra-day.

Shiba's market cap of $20.7B falls from just over $40B towards the end of October, pulling its market cap ranking down to 13th place, with Crypto.com Coin just above at 12th, according to data from CoinMarketCap.

Perhaps the coin's decline is due to a rising number of wallets with substantial holdings that have reduced their SHIB positions recently, possibly due to taking profit, Nansen tells CoinDesk.

So-called whale transaction counts, the number of SHIB transactions valued at more than $100K, have been increasing since the start of November, which could imply a rise in near-term selling pressure, CoinDesk notes, citing data from Santiment.

Meanwhile, $Bitcoin(BTC.CC$ and $Ethereum(ETH.CC$ also drift lower.

$Dogecoin(DOGE.CC$, the 10th largest crypto, extends losses and is down nearly 9% this week.

Previously, (Nov. 22) Shiba Inu tokens extend losses as retail frenzy eases.

22

7

yo5swZ8f6A

liked

$SPDR S&P 500 ETF(SPY.US$ $Bitcoin(BTC.CC$ Where do folks think investing money is going to end up? Gold? Bitcoin? Under a mattress? At Bank of America earning 0.25%???

The Fed can't meaningfully raise rates because the economy is now forever broken. 50 years of deficit spending, money printing, wars, raiding the alleged Social Security trust fund, an unintentional UBI experiment, and a new rush to spend trillions before the mid-terms mean that there's no alternative.

If the Fed raised rates to 5% the interest on the national debt would eat 30% of the annual federal budget. It can't happen. The Fed can't raise rates much more than 1%.

The "bubble" is is the new normal.

The Fed can't meaningfully raise rates because the economy is now forever broken. 50 years of deficit spending, money printing, wars, raiding the alleged Social Security trust fund, an unintentional UBI experiment, and a new rush to spend trillions before the mid-terms mean that there's no alternative.

If the Fed raised rates to 5% the interest on the national debt would eat 30% of the annual federal budget. It can't happen. The Fed can't raise rates much more than 1%.

The "bubble" is is the new normal.

15

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)