Netflix Q1 2023 Preview: Can It Create Another Miracle After the Earnings Release?

$Netflix(NFLX.US$ is set to release its earnings report after the market closes on April 18, Eastern Time. In the previous two quarters, Netflix's stock price surged impressively by 16.1% and 10.7%, respectively, following their earnings announcements. Since the beginning of the year, Netflix's share price has risen by 26.83%, outperforming the S&P 500 index and reaching a new high for the first time in nearly two years.

After experiencing a stellar year in 2023, what kind of report card will Netflix deliver this quarter?

I. Two Key Factors in Forecasting Netflix's Performance: Subscriber Count and ARM

Netflix is the world's largest streaming media company, with its main source of revenue coming from streaming media paid subscription services, which account for a whopping 99.75% of its total revenue. The company's DVD income is so minimal it can almost be disregarded.

In the streaming media industry, which is primarily driven by content, high-quality film and television content is the fundamental guarantee for growth. Based on the principle that content is king, the growth in the number of subscribers and ARM (Average Revenue per Membership) will become the primary drivers of the company's performance growth.

Image: Revenue Composition

Therefore, for Netflix, the key to forecasting performance is to track the growth of subscription users and the growth of ARM.

II. Paid Subscribers Expected to Exceed Forecasts

Previously, due to its market positioning, continuous content innovation, measures to crack down on account sharing, lower-priced ad-supported plans, and the ongoing substitution effect of streaming media on traditional TV, the company's subscription user base has grown continuously. Therefore, we can analyze its user expectations from the following logic:

(1) Strong Content Lineup

In the first quarter, Netflix continued to provide high-quality content to users with a compelling content matrix. Noteworthy productions during the period included: "Avatar: The Last Airbender," "Fool Me Once," "Lift," "Society of the Snow," "The Gentlemen," and the adaptation of Liu Cixin's sci-fi epic "The Three-Body Problem," among others. These high-quality series attracted a wide audience, effectively driving an increase in user engagement and retention.

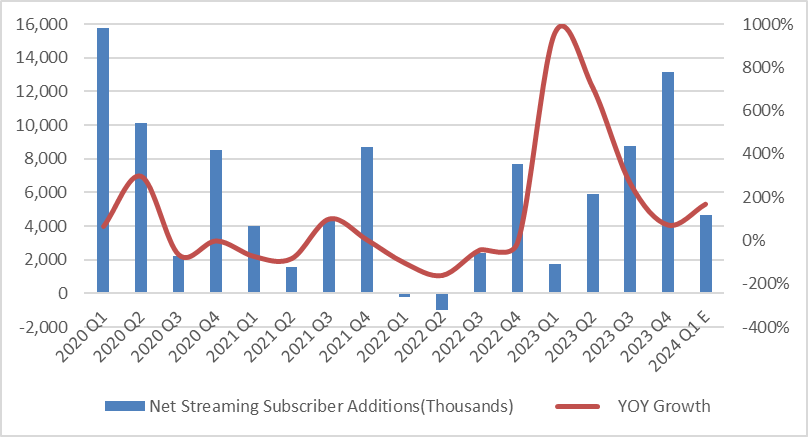

(2) Paid Sharing Continues to Drive User Growth

Data from early 2023 showed that Netflix had as many as 100 million shared accounts globally. Throughout the year, the company strengthened measures to combat this, adding approximately 29.53 million new subscription users, with Q1-Q4 seeing 1.75 million, 5.89 million, 8.76 million, and 13.12 million respectively, showing a clear quarter-over-quarter growth, with a significant portion stemming from the crackdown on shared accounts. At the same time, the number of users unsubscribing was minimal, with some shared accounts directly converting to full-paying subscribers, reflecting excellent user stickiness and a high retention rate.

Despite the market's belief that the traditional content off-season may lead to a slowdown in growth—like Bloomberg's consensus estimate that the company is expected to achieve a 167.5% year-over-year increase in paid users for Q1 of 2024, reaching 4.68 million—we believe that given the company's strong content in the first quarter and its continued strict implementation of the paid sharing policy on last year's basis, the growth in paid users will exceed this expectation.

Chart: Net New User Growth and Forecast

(3) Rapid Growth in Ad-supported Paying Users

According to the latest data disclosed by the company, as of the beginning of 2024, the number of monthly active users for ad-supported memberships has exceeded 23 million, an increase of 8 million in less than three months, with the growth rate accelerating. Among ad-supported members, 85% of users watch for more than two hours daily. As ad-supported memberships are more cost-effective for many people, it is expected that the number of users will continue to rise.

(4) Coverage and Replacement Potential

It is estimated that currently, there are 500 million households globally with internet-connected TVs, accounting for more than half of all broadband households. Netflix only covers about 50% of the currently available homes, and this number is still growing. Moreover, with the ongoing substitution effect of streaming media over traditional TV, there is still significant room for user growth for Netflix in the future.

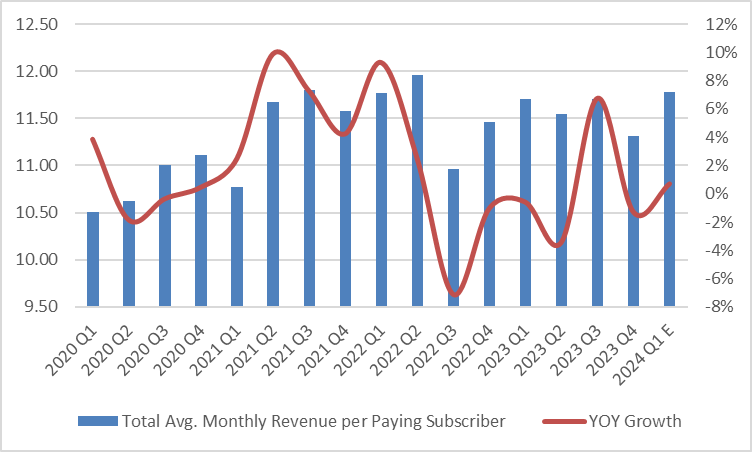

III. ARM Expected to Remain Steady

After Netflix adjusted the prices for its basic and premium plans by 11 to 22% in the US, France, and the UK last October, the first quarter of this year saw price increases for its services in Singapore and New Zealand, as well as hikes in Argentina, Chile, and Turkey to counteract unfavorable foreign exchange impacts. Even though the markets in Singapore and New Zealand are smaller, we believe this suggests potential price increases in more developed markets this year.

It is noteworthy that last year's price hikes triggered an interesting market response. According to data from YipitData, in the US market, after the announcement of the price increase, there was a significant rise in users opting for the cheaper ad-supported service, indicating an increased sensitivity to price compared to before. Therefore, our judgment on ARM is largely in line with market expectations, anticipating that ARM in the first quarter of 2024 will remain roughly on par year-over-year. The company's revenue will continue to be primarily driven by user growth.

Chart: ARM Situation and Forecast

IV. Cost and Profit Situation

(1) Revenue and Costs

According to Bloomberg consensus estimates, the company's revenue for Q1 2024 is expected to grow by 13.51% year-over-year to 9.26 billion yuan. Based on the analysis above, the performance is expected to exceed expectations.

In terms of costs, due to two consecutive strikes in the United States in recent years causing production halts, Netflix has actually reduced the number of new series releases overall, which is expected to affect its release plans for at least several years. Although production has been completed on several series initially planned for release in 2023, production on many series planned for 2024 and 2025 has just begun, with some projects being delayed or even canceled. This is expected to result in production costs remaining flat or slightly decreasing.

(2) Expenses and Profits

Due to the continually expanding number of paying users, the growth rates of marketing, research and development, and administrative expenses will all be lower than the revenue growth rate. According to Bloomberg consensus estimates, the operating profit margin for Q1 2024 is expected to be 25.6%. Based on the subscriber performance in 2023 and a higher revenue base, achieving this expectation is feasible. Additionally, the increased financial pressure on competitors is prompting the inflow of high-quality content on more favorable terms, which is also expected to further optimize the profit margin outlook for 2024.

V. Shareholder Returns

The company's current buyback program has $8.4 billion remaining in repurchase authorization. Assuming that the entire $8.4 billion buyback quota is utilized in 2024, the shareholder return rate would be around 4%;

However, based on financial report data, achieving a repurchase and cancellation of around $5-6 billion under stable performance conditions would generally meet expectations, with an estimated shareholder return of around 2.5%.

VI. Expected Stock Price Movement and Optional Option Trades

Let's predict the stock price movement:

The market valuation of Netflix is already not low: since the beginning of the year, Netflix's stock price has risen by 26.83%, continuously creating an upward "myth," with a current valuation of 51 times PE, which is somewhat expensive.

Looking back at history, the stock tends to fluctuate greatly after earnings reports, with the number of subscribers being a key factor in causing these fluctuations. If the company can continue to expand its subscriber base, steadily increase ARPU, and demonstrate strong operational leverage effects, then there is still a chance for the stock price to rise—this is also our judgment.

Therefore, with earnings likely to exceed expectations, Netflix could still achieve an increase in stock price.

However, if the performance does not meet market growth expectations, the current high valuation could also be risky.

So, in our optimistic expectation of performance and the probability of the stock price rising, how should options be traded?

1. Buying Call Options:

- Strategy Background: Faced with a company expected to have excellent performance or favorable market conditions, investors predict the stock price will rise.

- Method of Operation: Purchase call option contracts for the corresponding stock, giving the holder the right to buy the stock at an agreed exercise price on the expiration date.

- Profit Logic: If the stock price rises as expected, the value of the call option increases, and investors can profit by selling the option or exercising the right. Even if the stock price increase is less than expected, the investor's maximum loss is limited to the premium paid for buying the option.

The latest option data shows that the market is betting on a potential ±8.8% fluctuation in Netflix's stock price on earnings day, meaning there is a significant possibility of Netflix breaking upward or correcting downward in the coming days, hence call options carry certain risks.

2. Given the current high valuation of the company, if holding the underlying stock, one could consider a covered call strategy:

- Strategy Background: Considering the high valuation and that it won't rise too much, and wishing to limit downside risk while preserving current profits.

- Method of Operation: Corresponding to the held shares, sell call option contracts, giving the holder the right to sell the stock at an agreed exercise price on the expiration date.

- Profit Logic: If at expiration the stock price is below or only slightly above the exercise price, the option buyer may not exercise, and the investor retains the stock and earns the full premium income; if the stock price significantly exceeds the exercise price, the option buyer will choose to exercise, and the investor sells the stock at the exercise price. Although the profit exceeding the exercise price is lost, the premium and the part of the stock price rise up to the exercise price are retained.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Stock Buff : In your article, “According to the latest options data, the market is betting that Netflix's stock price may fluctuate ± 8.8% on the earnings day”. I would like to ask you what kind of options data did you get this conclusion based on?

Noah JohnsonOP Stock Buff: Here I have quoted the data from Market Chameleon in an article from moomoo news

Stock Buff Noah JohnsonOP: Thank you for your answers.