TSLA Q1 Earnings Call Summary

$Tesla(TSLA.US$ Quick summary:

- Elon announced an affordable model by early 2025 (possibly end 2024).

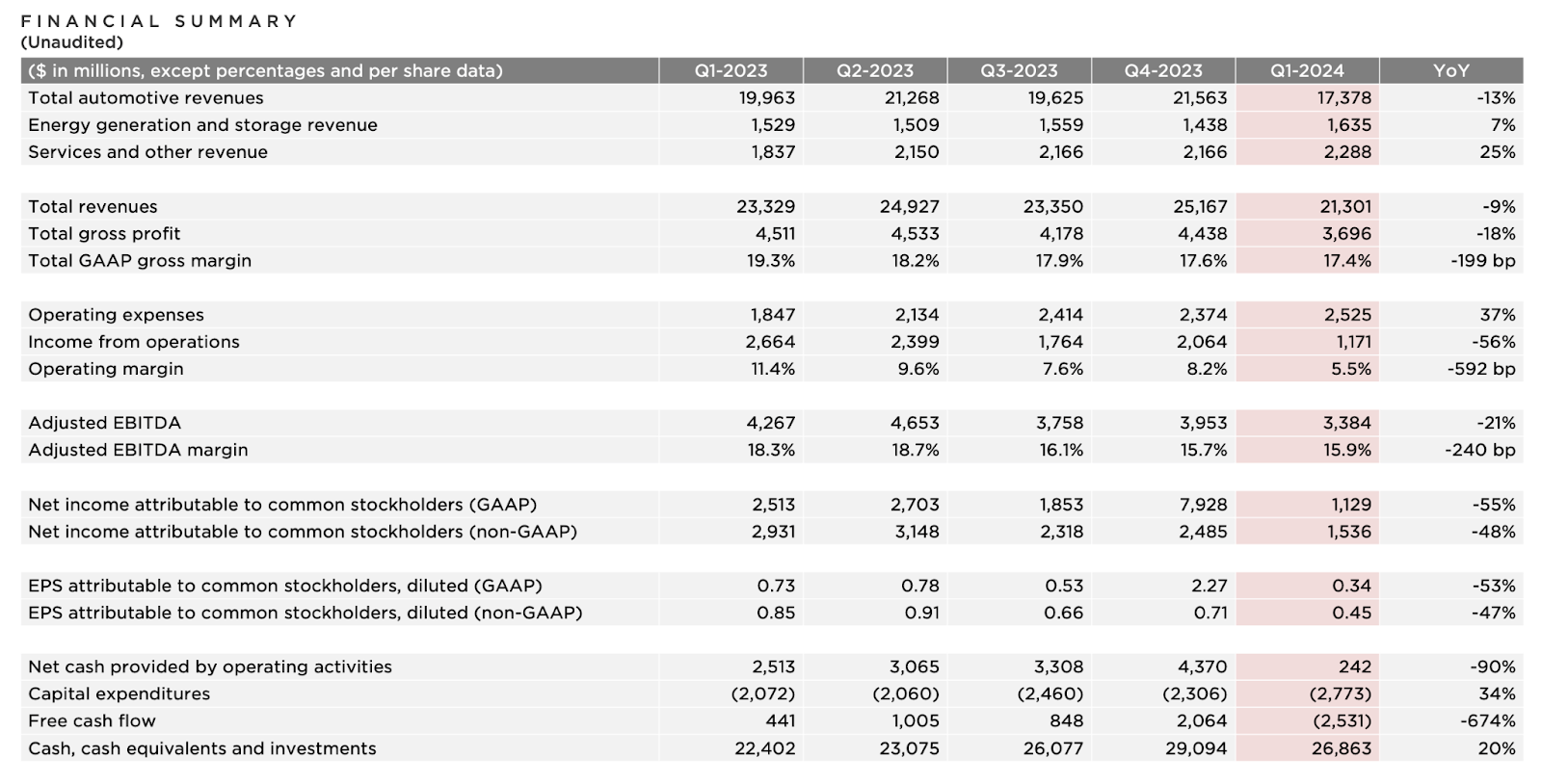

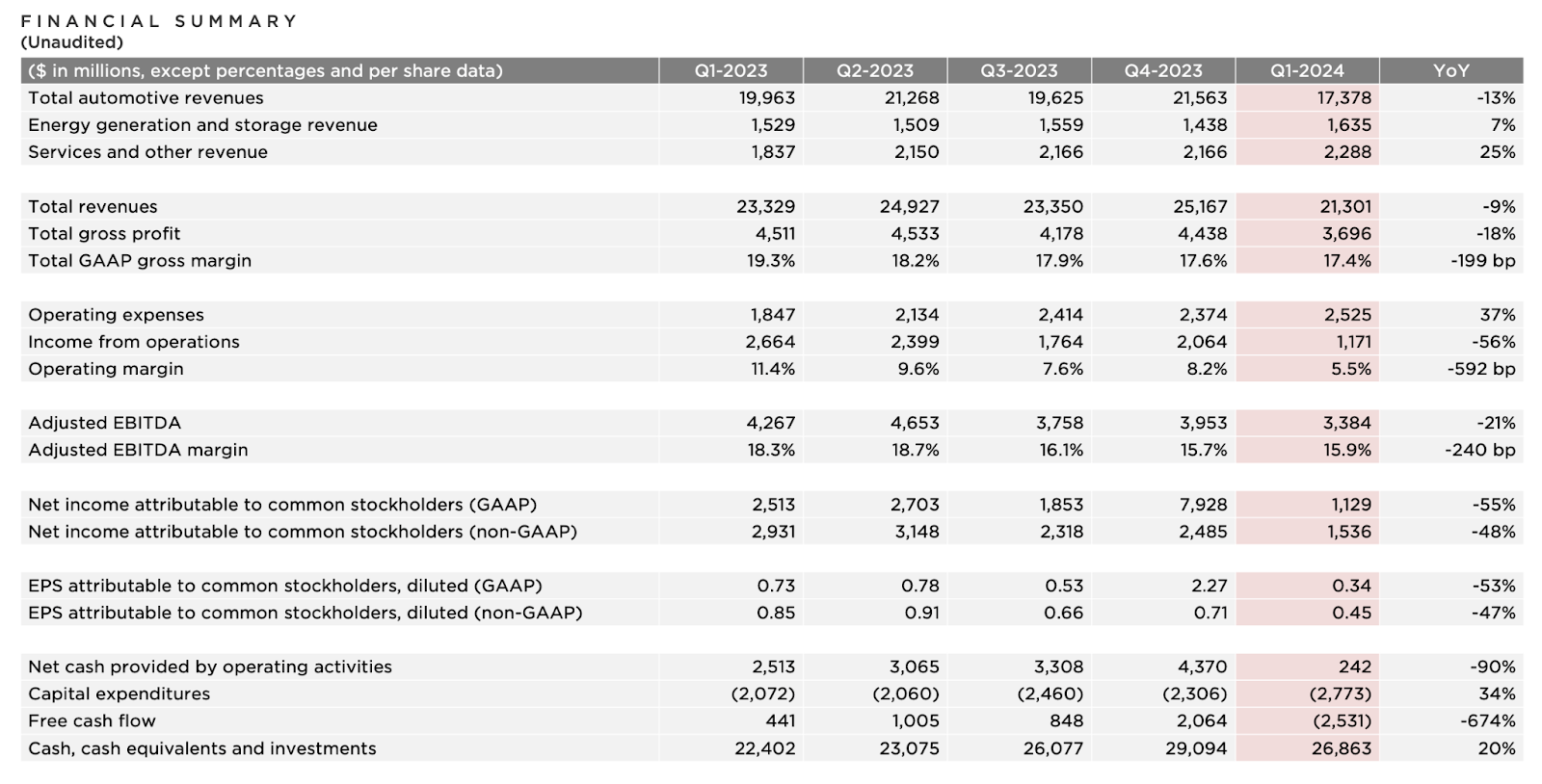

- Q1 profit, revenue, and margins drop way below forecasts.

- Global vehicle inventory increases to 28 days (from 15 days).

- TSLA rallied upon optimism on new models, despite an underwhelming quarter.

Tesla recently reported a significant 55% drop in Q1 profits and a 9% decline in revenue, and it caused mixed emotions within investors. However, during the earnings call, Elon shifted focus towards promising developments, including an affordable car model (by end 2024?!) and a fully autonomous "Cybercab," alongside nearly $1 billion in projected cost savings from workforce reductions.

Despite the challenging quarter, marked by a 20% reduction in vehicle deliveries compared to the previous quarter, Tesla's stock saw a notable recovery in after-hours trading, increasing over 10%. This rebound was fueled by Elon's optimistic projections for improved sales and Tesla's ongoing strategic shift towards artificial intelligence and autonomous driving technology.

Elon emphasized Tesla's identity as an AI and robotics company, suggesting that those doubtful of Tesla's ability to achieve full autonomy might reconsider their investment. This pivot appears to be a strategic move to reframe the company’s business model away from traditional hardware margins towards more lucrative, tech-driven goals.

Here are some of the key points made during the earnings call:

- Tesla faced multiple challenges in Q1 but successfully ramped up the updated Model 3 production in Fremont and reached record profitability in its energy storage business, notably with the Megapack.

- Global EV adoption is facing pressures as competitors shift focus to plug-in hybrids, but Tesla remains committed to fully electric vehicles.

- AI and autonomy are central to Tesla's strategy, with significant advances in AI training capacity achieved by more than doubling training compute.

- Tesla plans to accelerate the production of new, more affordable vehicle models, potentially launching as early as late this year or early 2025, utilizing both current and next-generation technology platforms.

- Full Self-Driving (FSD) v12 has been deployed across approximately 1.8 million vehicles in North America, with Tesla aiming for autonomous driving to surpass human reliability soon.

- Tesla has expanded its AI infrastructure and is no longer constrained by training capabilities, with substantial increases in its hardware and computing resources planned.

- Tesla has reduced the subscription price for FSD to $99/month to increase accessibility and plans to unveil a purpose-built robotaxi, the Cybercab, in August.

- Financially, Tesla has observed a seasonal decline in auto revenues and a slight decrease in auto margins, attributed to various factors including pricing actions and cost reduction initiatives.

- Tesla's energy business continues to grow, with energy storage deployments expected to increase significantly, contributing to overall profitability.

- Tesla anticipates positive free cash flow in Q2, reversing the first quarter's negative flow due to inventory build-up and high capital expenditures.

- Tesla is reducing its workforce by over 10% to achieve more than $1 billion in annual cost savings and improve CapEx efficiency.

- Tesla is undergoing organizational changes to streamline operations and prepare for future growth phases, likening the process to biological development where structures evolve to support new stages of growth.

- The company is not eliminating any significant aspects of its operations; instead, it focuses on addressing inefficiencies accumulated over prosperous years.

- Elon emphasized the need for Tesla to evolve its organizational structure continuously as it scales, to prevent stagnation and failure.

- These changes are part of a broader strategy to ensure Tesla remains agile and well-positioned to capitalize on future opportunities, particularly in scaling its production and technological innovations.

In summary, while Tesla faces significant hurdles, the company is positioning itself for a future centered around technological innovation in AI and autonomous driving, aiming to reignite its growth trajectory and stabilize its stock performance.

Hope you enjoyed the read! Took me a bit more time to summarise the earnings call I hope this update gave you more clarity on their recent volatile share price ;)

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Loss Trader : just curious what’s your opinion on this

Ziet InvestsOP Loss Trader: My stance never changed, invested in them throughout the years and never sold a single one.

- FSD is bound to release to non-US countries (Elon even mentioned it)

- Optimus could be a huge dealbreaker for the manufacturing industry (could make or break)

- Robotaxi (M2?) is gonna disrupt the e-hailing business; of course pending regulatory approvals etc which is a long way to go

- Tesla Energy q-o-q and y-o-y growth, its a segment bound to explode when AI grow > more energy required

Overall a script written for the long-term, but definitely not for the faint hearted in the short term.

Loss Trader Ziet InvestsOP: Alright thanks for the great information !! 🫡

madhatter69 : Too cool