If I could go back in time, I will still make all the same choices I already had made in life. This way I would already know the results of these choices and I need not spend time worrying about the results, being anxious about the uncertainties in life. Instead I will have all the time on earth to appreciate every finer aspect of life that we so often neglect or couldn't have afford the time. This would then be my second time in life, not a secon...

1

xiaokuku

liked

$GENTING HK(00678.HK$ hold up. the day is coming

37

My biggest mistake is that I can't seem to learn from past mistakes.

xiaokuku

liked

The hawkish Federal Reserve said it wants to taper faster than expected and raise rates next year. However, the market rallied on that news, as stocks had sold off too far into the event. Now falling again on Thursday, though, and it's a mixed bag. With all of that in mind, let's look at a few top stock trades. ![]()

![]()

![]()

![]() Top stock trades for today No. 1: Affirm Holdings

Top stock trades for today No. 1: Affirm Holdings![]()

Like the typical trend in growth, $Affirm Holdings(AFRM.US$ got crushed on the day.

Each rally has been sold in this one, as shares have crumbled lower since the November high. Now down almost 40% from Nov. 8, bulls are looking for some relief.

I almost have a bearish engulfing candle on the charts as Affirm blows through this week's low.

If the stock takes out this month's low at $96.44, it puts the gap-fill level at $92.29 in play, along with the 200-day moving average. That may generate a bounce.![]()

![]()

![]()

![]() Top stock trades for today No. 2: Adobe Systems

Top stock trades for today No. 2: Adobe Systems![]()

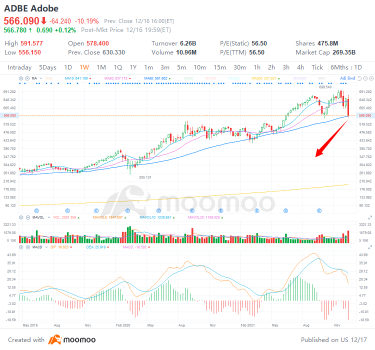

$Adobe(ADBE.US$ stock was hammered on the day too, down about 10% after reporting earnings.

So far the stock is finding its footing near the 50-week moving average and the $552 low from October. If we get some sort of bounce or reversal from this area, let's see if Adobe can reclaim the 200-day.

Above that key measure and the post-earnings high is on the table, followed by a gap-fill toward $600.

However, a break of $550 that's not quickly reclaimed could send shares down to the $525 breakout area.

![]() Top stock trades for today No. 3: Qualcomm

Top stock trades for today No. 3: Qualcomm![]()

$Qualcomm(QCOM.US$ got a nasty one on display yesterday. A close below $180 will cement it, as semiconductor stocks reverse hard on the day.

If it leads to further weakness, see how Qualcomm handles the daily VWAP measure, currently near $174.50 and trending higher. This stock has been trading great and even hit new highs by early yesterday.![]()

![]()

![]()

But let's see where the buyers step in. If it's not at the VWAP, the $168 area could draw some interest. That was the prior high and where the 10-week moving average comes into play.

On the upside, though, I want to see a move back over the 10-day and 21-day moving averages.![]()

![]()

![]() Top trades for today No. 4: Costco Wholesale

Top trades for today No. 4: Costco Wholesale![]()

Last but not least, let's see $Costco(COST.US$. I have been watching this one for a breakout over around $560. It actually got that breakout on Wednesday, but reversed lower on Thursday.

From here, let's see if Costco stock can hold the 10-day moving average. If it can, it may be a buying opportunity for bulls.

On the upside, I'm looking for another trigger over $560.78 — call it $561. That immediately puts the recent high back in play at $566.50. Above, that and bulls can start looking for a larger rally.

If this one can set up and start trending higher, the 161.8% extension could eventually be in play, up near $590.![]()

![]()

![]()

Source: InvestorPlace

Like the typical trend in growth, $Affirm Holdings(AFRM.US$ got crushed on the day.

Each rally has been sold in this one, as shares have crumbled lower since the November high. Now down almost 40% from Nov. 8, bulls are looking for some relief.

I almost have a bearish engulfing candle on the charts as Affirm blows through this week's low.

If the stock takes out this month's low at $96.44, it puts the gap-fill level at $92.29 in play, along with the 200-day moving average. That may generate a bounce.

$Adobe(ADBE.US$ stock was hammered on the day too, down about 10% after reporting earnings.

So far the stock is finding its footing near the 50-week moving average and the $552 low from October. If we get some sort of bounce or reversal from this area, let's see if Adobe can reclaim the 200-day.

Above that key measure and the post-earnings high is on the table, followed by a gap-fill toward $600.

However, a break of $550 that's not quickly reclaimed could send shares down to the $525 breakout area.

$Qualcomm(QCOM.US$ got a nasty one on display yesterday. A close below $180 will cement it, as semiconductor stocks reverse hard on the day.

If it leads to further weakness, see how Qualcomm handles the daily VWAP measure, currently near $174.50 and trending higher. This stock has been trading great and even hit new highs by early yesterday.

But let's see where the buyers step in. If it's not at the VWAP, the $168 area could draw some interest. That was the prior high and where the 10-week moving average comes into play.

On the upside, though, I want to see a move back over the 10-day and 21-day moving averages.

Last but not least, let's see $Costco(COST.US$. I have been watching this one for a breakout over around $560. It actually got that breakout on Wednesday, but reversed lower on Thursday.

From here, let's see if Costco stock can hold the 10-day moving average. If it can, it may be a buying opportunity for bulls.

On the upside, I'm looking for another trigger over $560.78 — call it $561. That immediately puts the recent high back in play at $566.50. Above, that and bulls can start looking for a larger rally.

If this one can set up and start trending higher, the 161.8% extension could eventually be in play, up near $590.

Source: InvestorPlace

+3

62

xiaokuku

liked

$The Health Care Select Sector SPDR® Fund(XLV.US$

This is the major healthcare ETF

A look at the top chart and you can see the nearly 5 months of consolidation and a breakout to the upside

The second MACD (used here as a momentum trend indicator) shows the red/green trend bars, (notice how the trend lines are in line with the bars). Now look back to the start of the indicator and you can see how the trend lines up with the price rise (the current indicator is much much stronger). Indicators lag by design (if they could predict future movement that would be a crystal ball) but they show us this has been set up to explode higher.

Now the DMA (Displaced Moving Average used to spot trend reversals) on the bottom. The middle of the 3 horizontal lines is the trend, notice the break out (or up)! The blue line is the Moving Average and gives no indication it only tells you what is. The yellow is a forward shifted indicator (magic crystal ball). Notice once again a breakout!

Now why is it breaking out? The majors in healthcare have NEVER had more money (I will avoid the why's just know they do). Now inflation is here and cash loses value everyday you hold it, but you know what doesn't??? Drugs!... tell me are your healthcare costs going down!? So now these companies have hundreds of billions of dollars losing value the longer they hold it (not to mention the tax man cometh). At this very same time we have the most drugs EVER trying to get approval/trials but the costs are going up and their limited cash on hand is losing value, see where this is going??? Mergers acquisitions and product agreements on a level NEVER seen before!

Why am I writing this on a cold Saturday? Well you could buy this ETF (and limit your risk by its shear volume of assets BUT also limiting your possible gains in the right individual stocks) and make a lot of gains!... Or you could see this as a big ol' buy signal 🚀🚀🚀 for individual stocks in the healthcare sector. Some of my picks are

$Deciphera Pharmaceuticals(DCPH.US$

$ChemoCentryx(CCXI.US$

$Cortexyme(CRTX.US$

$180 Life Sciences(ATNF.US$

$CorMedix(CRMD.US$

$Aurinia Pharmaceuticals(AUPH.US$

$Citius Pharmaceuticals(CTXR.US$

$Coherus BioSciences(CHRS.US$

edit

oh hahaha I forgot $Biofrontera(BFRI.US$ I keep thinking of it as more of a meme and less as a pharma play😄

This is the major healthcare ETF

A look at the top chart and you can see the nearly 5 months of consolidation and a breakout to the upside

The second MACD (used here as a momentum trend indicator) shows the red/green trend bars, (notice how the trend lines are in line with the bars). Now look back to the start of the indicator and you can see how the trend lines up with the price rise (the current indicator is much much stronger). Indicators lag by design (if they could predict future movement that would be a crystal ball) but they show us this has been set up to explode higher.

Now the DMA (Displaced Moving Average used to spot trend reversals) on the bottom. The middle of the 3 horizontal lines is the trend, notice the break out (or up)! The blue line is the Moving Average and gives no indication it only tells you what is. The yellow is a forward shifted indicator (magic crystal ball). Notice once again a breakout!

Now why is it breaking out? The majors in healthcare have NEVER had more money (I will avoid the why's just know they do). Now inflation is here and cash loses value everyday you hold it, but you know what doesn't??? Drugs!... tell me are your healthcare costs going down!? So now these companies have hundreds of billions of dollars losing value the longer they hold it (not to mention the tax man cometh). At this very same time we have the most drugs EVER trying to get approval/trials but the costs are going up and their limited cash on hand is losing value, see where this is going??? Mergers acquisitions and product agreements on a level NEVER seen before!

Why am I writing this on a cold Saturday? Well you could buy this ETF (and limit your risk by its shear volume of assets BUT also limiting your possible gains in the right individual stocks) and make a lot of gains!... Or you could see this as a big ol' buy signal 🚀🚀🚀 for individual stocks in the healthcare sector. Some of my picks are

$Deciphera Pharmaceuticals(DCPH.US$

$ChemoCentryx(CCXI.US$

$Cortexyme(CRTX.US$

$180 Life Sciences(ATNF.US$

$CorMedix(CRMD.US$

$Aurinia Pharmaceuticals(AUPH.US$

$Citius Pharmaceuticals(CTXR.US$

$Coherus BioSciences(CHRS.US$

edit

oh hahaha I forgot $Biofrontera(BFRI.US$ I keep thinking of it as more of a meme and less as a pharma play😄

26

2

xiaokuku

liked

$AMC Entertainment(AMC.US$ We've seen two hedge funds fall. We know without a doubt that we have are foot in the door and that our strategy is working. So why not just give up ? Eventually you got to pull the arrow out and clean the wound ! You might as well do it now before it gets worst.

16

1

xiaokuku

liked

37

3

xiaokuku

liked

$Biofrontera(BFRI.US$ let's go....squuureeezzzzeee them

5

xiaokuku

liked

$Hepion Pharmaceuticals(HEPA.US$ Recent searches on CRV-431 found that the company has chosen the marketing name for the drug. Which, at this early stage, makes you wonder what else isn't the company telling us? Naming a drug now, still within clinical trials, seems early. I'm used to seeing that type of thing done after Phase 3 or upon FDA approval. That said, there are a ton of indications that this drug can apply to on its own or paired with another drug. One of those indications is Covid-19. Maybe we are about to hear of a partnership there and an emergency use application?

The name is Rencofilstat. The company has purchased the .com and .ca related to the name. This all seems very bullish to me!

https://www.godaddy.com/whois/results.aspx?checkAvail=1&domain=rencofilstat.com&domainName=rencofilstat.ca

The name is Rencofilstat. The company has purchased the .com and .ca related to the name. This all seems very bullish to me!

https://www.godaddy.com/whois/results.aspx?checkAvail=1&domain=rencofilstat.com&domainName=rencofilstat.ca

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)