wallstreet wolf

liked

In honour of Anzac Day, we're hosting a special event for our Australian community members. Whether you're going to spend the morning at a dawn service, or commemorate in your own way - we wanted to foster camaraderie within the moomoo community.

Inspired by the Aussie classic you'll find at your local pub on Anzac day, we are playing two-up - with a trading twist!

If you aren't familiar with two-up, it is a traditional Australian gambling...

Inspired by the Aussie classic you'll find at your local pub on Anzac day, we are playing two-up - with a trading twist!

If you aren't familiar with two-up, it is a traditional Australian gambling...

36

49

wallstreet wolf

liked

$Nextracker(NXT.US$ pure price action look at this stock. Not much of history, still in price discovery phase, presumably following listing in Feb'23. The 1W shows it peaked momentarily at $62 region, cementing an immediate target. Pivot points at 49.5, 44.0, 36.4

Fair bit consolidation in zone between $36~$40 range; strong support zone. Perhaps in coming weeks will see another consolidation zone between $44~$50

This company has a sound business, offshoot from their association with $Flex Ltd(FLEX.US$ , good ha...

Fair bit consolidation in zone between $36~$40 range; strong support zone. Perhaps in coming weeks will see another consolidation zone between $44~$50

This company has a sound business, offshoot from their association with $Flex Ltd(FLEX.US$ , good ha...

+1

5

wallstreet wolf

liked

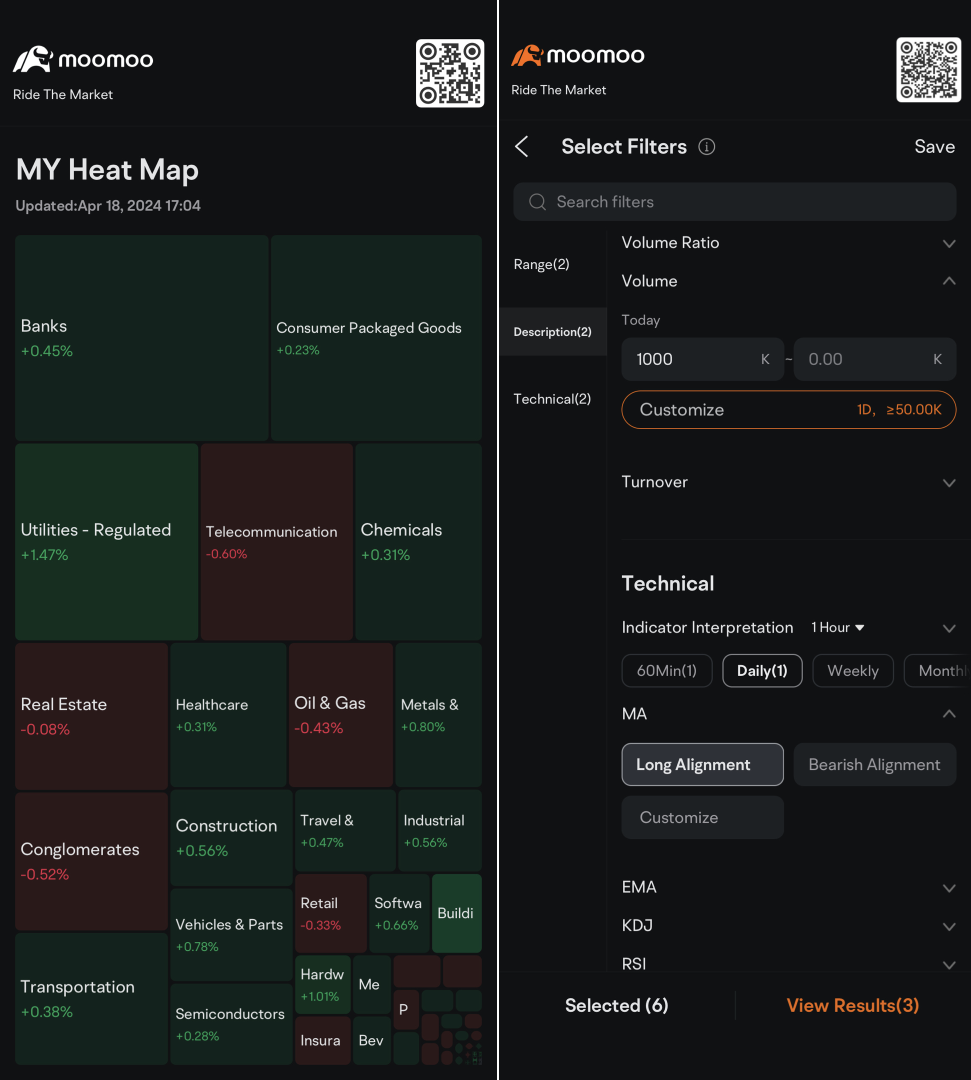

Hey all, Cici receives a lot of feedback from mates stating that moomoo has a lot of features that they simply don't know about without digging in, and newbies can get lost.🗺️

In fact, moomoo has always been committed to creating a professional investment platform with “rich markets,” “fast transactions,” and “perfect analytical tools” for investors, so there are lots of tools and information that investors may no...

In fact, moomoo has always been committed to creating a professional investment platform with “rich markets,” “fast transactions,” and “perfect analytical tools” for investors, so there are lots of tools and information that investors may no...

+6

198

96

wallstreet wolf

liked

A brief guide to two popular technical indicators

Introduction.

Day trading is a challenging and rewarding activity that requires skill, discipline, and a good understanding of the market. Technical analysis is one of the tools that day traders use to make informed decisions and execute profitable trades. In this document, I will introduce two of the most widely used technical indicators: MACD and KDJ. I will explain what they are, how they work, and how to...

Introduction.

Day trading is a challenging and rewarding activity that requires skill, discipline, and a good understanding of the market. Technical analysis is one of the tools that day traders use to make informed decisions and execute profitable trades. In this document, I will introduce two of the most widely used technical indicators: MACD and KDJ. I will explain what they are, how they work, and how to...

5

wallstreet wolf

liked

After a brief rebound in the US stock market, the S&P 500 index and the Dow Jones Industrial Average declined slightly, while the Nasdaq Composite rose slightly. Among the “Seven Sisters” in the tech sector, Tesla bucked the trend and recorded an increase of nearly 5%, while Meta retreated from its all-time high. The chip industry maintained a positive trend, and TSMC's shares in the US market closed up 1%, despite Nvidia falling 1%.

The strong performance of Tesla's stock price was attributed by some analysts to Elon Musk's urgent announcement of the upcoming autonomous taxi Robotaxi. This move is thought to be aimed at boosting stock prices. At the same time, in addition to its achievements in the graphics processing unit (GPU) performance competition, Nvidia also silently launched NVLink technology, which can significantly increase the data sharing speed between GPU and CPU by 5 to 12 times.

In terms of the US economy, a survey by the Federal Reserve Bank of New York shows that although US inflation expectations seem to remain stable in the short term, concerns about long-term debt have resurfaced. Crude oil prices ended six consecutive gains, while gold hit a record intraday high for seven consecutive days. In the metals market, London copper prices have rebounded to a two-year high, while tin prices have risen by nearly 3.7%, reaching a 14-month high. The price of the cryptocurrency Bitcoin has also risen, once close to a record high.

In the Chinese market, the China Securities Index ended a three-day downward trend. Ideal Auto's stock price rose by nearly 5%, while Baidu's stock price fell by more than 3%...

The strong performance of Tesla's stock price was attributed by some analysts to Elon Musk's urgent announcement of the upcoming autonomous taxi Robotaxi. This move is thought to be aimed at boosting stock prices. At the same time, in addition to its achievements in the graphics processing unit (GPU) performance competition, Nvidia also silently launched NVLink technology, which can significantly increase the data sharing speed between GPU and CPU by 5 to 12 times.

In terms of the US economy, a survey by the Federal Reserve Bank of New York shows that although US inflation expectations seem to remain stable in the short term, concerns about long-term debt have resurfaced. Crude oil prices ended six consecutive gains, while gold hit a record intraday high for seven consecutive days. In the metals market, London copper prices have rebounded to a two-year high, while tin prices have risen by nearly 3.7%, reaching a 14-month high. The price of the cryptocurrency Bitcoin has also risen, once close to a record high.

In the Chinese market, the China Securities Index ended a three-day downward trend. Ideal Auto's stock price rose by nearly 5%, while Baidu's stock price fell by more than 3%...

Translated

19

wallstreet wolf

reacted to and commented on

$Zoom Video Communications(ZM.US$ shares are dropping 3.5% to $203.94 as $Microsoft(MSFT.US$ unveiled a standalone version of Teams for small businesses.

Microsoft Team Essentials will cost $4 per user per month and get access to core features of Teams, without having to also subscribe to Office, The Verge notes.

In comparison, Zoom has a small business plan that costs $19.99 per month per license. Zoom Pro, which the company says is "great for small teams," costs $14.99 per month per license.

Small businesses previously had to pick a Microsoft 365 Business Basic plan, which cost $5 per month per user, or other platforms, such as Slack - owned by $Salesforce(CRM.US$, Google Workspace $Alphabet-A(GOOGL.US$, Workplace from $Meta Platforms(FB.US$ or others.

The standalone version of Microsoft Teams Essentials has a simpler chat interface and focuses on meetings and video calls, Jared Spataro, head of Microsoft 365, told the news outlet.

Microsoft Teams Essentials has 10GB of OneDrive storage, whereas Business Basic has 1TB worth of storage. Essentials also does not have the ability to record meetings, provide transcripts, translation, separate rooms or channels and other functions that the more expensive plan has.

Last month, Zoom's shares plunged after the company reported fiscal third-quarter results that disappointed Wall Street and acknowledged that it would face headwinds in 2022 as more employees return to offices around the globe.

Microsoft Team Essentials will cost $4 per user per month and get access to core features of Teams, without having to also subscribe to Office, The Verge notes.

In comparison, Zoom has a small business plan that costs $19.99 per month per license. Zoom Pro, which the company says is "great for small teams," costs $14.99 per month per license.

Small businesses previously had to pick a Microsoft 365 Business Basic plan, which cost $5 per month per user, or other platforms, such as Slack - owned by $Salesforce(CRM.US$, Google Workspace $Alphabet-A(GOOGL.US$, Workplace from $Meta Platforms(FB.US$ or others.

The standalone version of Microsoft Teams Essentials has a simpler chat interface and focuses on meetings and video calls, Jared Spataro, head of Microsoft 365, told the news outlet.

Microsoft Teams Essentials has 10GB of OneDrive storage, whereas Business Basic has 1TB worth of storage. Essentials also does not have the ability to record meetings, provide transcripts, translation, separate rooms or channels and other functions that the more expensive plan has.

Last month, Zoom's shares plunged after the company reported fiscal third-quarter results that disappointed Wall Street and acknowledged that it would face headwinds in 2022 as more employees return to offices around the globe.

34

11

wallstreet wolf

reacted to

$Grab Holdings(GRAB.US$ When it comes to food delivery, I wonder if any comparisons to China are entirely valid. So much of SEA's food tends to be home-cooked, often with gravies, which is a likely natural competitor to 'drier' foods preferred by Chinese customers, from fast food chains to their own cuisines.

Going forward, isn't increased fuel costs a major headwind for Grab?

Going forward, isn't increased fuel costs a major headwind for Grab?

18

3

wallstreet wolf

reacted to and commented on

$Salesforce(CRM.US$ shares slumped as much as 6% in after-hours trading, Tuesday, as the cloud-based business software company gave a fourth-quarter outlook that proved an immediate disappointment on Wall Street.

Salesforce said that for its fourth quarter, it expects to earn between 72 cents and 73 cents a share, excluding one-time items, on revenue in a range of $7.22 billion to $7.23 billion. Those forecasts fell short of analysts' estimates for earnings of 82 cents a share on $7.24 billion.

The outlook came along with Salesforce touting its third-quarter results and announcing some changes in it executive ranks and board room.

Salesforce reported a third-quarter profit of $1.27 a share, excluding one-time items, on $6.86 billion, compared to earnings of $1.72 a share, on $5.42 billion in sales in the same period a year ago. Analysts had forecast Salesforce to earn 92 cents a share on $6.8 billion in revenue.

It was Salesforce's first full quarterly report since completing its $27.7 billion acquisition of Slack Technologies. While Salesforce didn't break out contributions from Slack, Chief Financial Officer Amy Weaver said "we are pleased with Slack’s representation in our largest deals."

The company's results were highlighted by its subscription revenue, which rose 25% from a year ago, to $6.38 billion. Professional services and other revenues total $480 million, an increase of 45% from last year's third quarter.

Separately, Salesforce said company president Bret Taylor will become its co-Chief Executive and serve alongside current CEO Marc Benioff. Taylor was also named to Salesforce's board of directors along with $Williams-Sonoma(WSM.US$ CEO Laura Alber, and former United Airlines (NASDAQ:UAL) $United Airlines(UAL.US$ CEO Oscar Munoz.

Salesforce said that for its fourth quarter, it expects to earn between 72 cents and 73 cents a share, excluding one-time items, on revenue in a range of $7.22 billion to $7.23 billion. Those forecasts fell short of analysts' estimates for earnings of 82 cents a share on $7.24 billion.

The outlook came along with Salesforce touting its third-quarter results and announcing some changes in it executive ranks and board room.

Salesforce reported a third-quarter profit of $1.27 a share, excluding one-time items, on $6.86 billion, compared to earnings of $1.72 a share, on $5.42 billion in sales in the same period a year ago. Analysts had forecast Salesforce to earn 92 cents a share on $6.8 billion in revenue.

It was Salesforce's first full quarterly report since completing its $27.7 billion acquisition of Slack Technologies. While Salesforce didn't break out contributions from Slack, Chief Financial Officer Amy Weaver said "we are pleased with Slack’s representation in our largest deals."

The company's results were highlighted by its subscription revenue, which rose 25% from a year ago, to $6.38 billion. Professional services and other revenues total $480 million, an increase of 45% from last year's third quarter.

Separately, Salesforce said company president Bret Taylor will become its co-Chief Executive and serve alongside current CEO Marc Benioff. Taylor was also named to Salesforce's board of directors along with $Williams-Sonoma(WSM.US$ CEO Laura Alber, and former United Airlines (NASDAQ:UAL) $United Airlines(UAL.US$ CEO Oscar Munoz.

14

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)