Up 10 Down 20

liked

With earnings around the corner, what's hot for the US market so far? Join Olivia Higgins as she reports live from the U.S. in the Moomoo Markets live show series. We will discuss current themes surrounding the U.S. Market, earnings season and how investing relates to hot topics tech, sports and even the Superbowl. Olivia ( @olivehiggo) will guide you towards key questions and analysis as we interview our experts fro...

42

3

Up 10 Down 20

voted

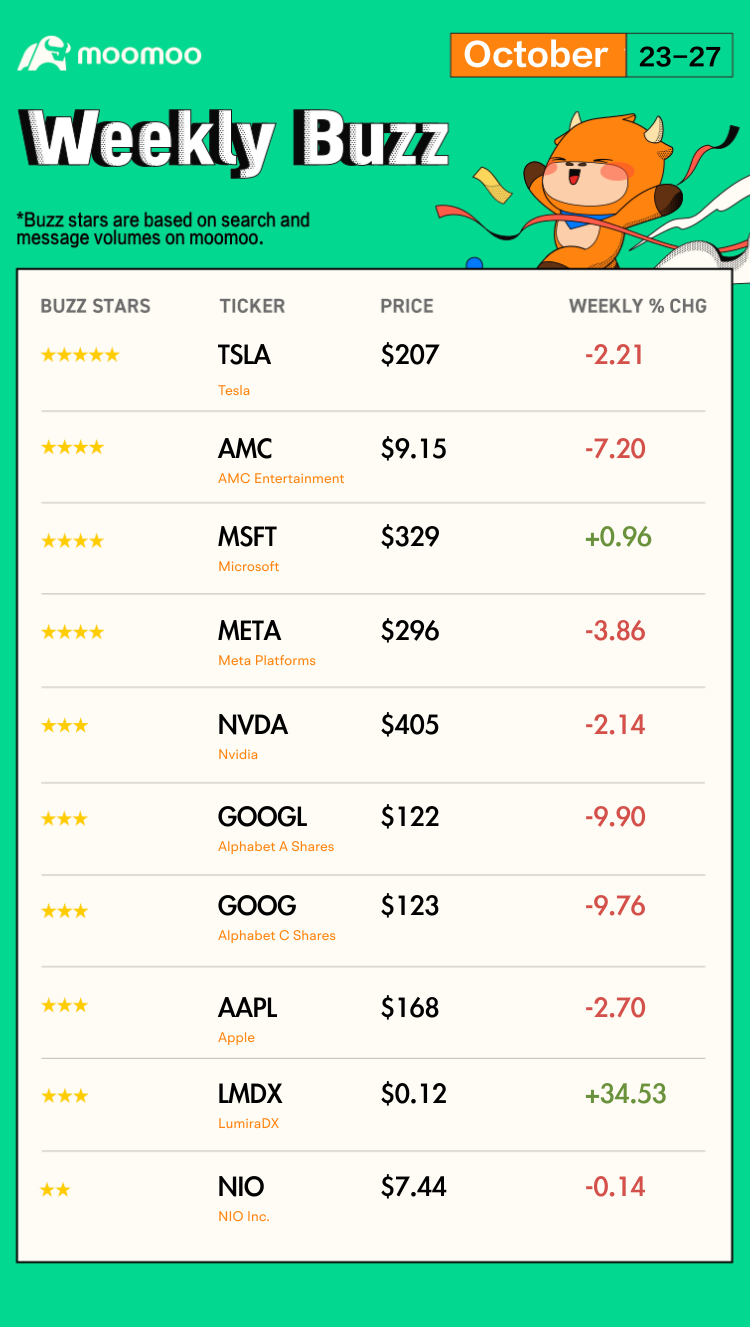

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

All prices and news updates as of 10/27

Make Your Choice

Weekly Buzz | Indexes Move Into Correction Territory on Earnings De...

All prices and news updates as of 10/27

Make Your Choice

Weekly Buzz | Indexes Move Into Correction Territory on Earnings De...

24

7

Up 10 Down 20

liked

$ContextLogic(WISH.US$ Using IPO cash to buy? That’s sell high buy low right there 😂

1

Up 10 Down 20

commented on

I'm sure everyone has heard of it, Buffett's $Berkshire Hathaway-B(BRK.B.US$ , I have already sold the one I opened before $Taiwan Semiconductor(TSM.US$ Although it also made quite a bit of money, the selling price was not high. Stock owners have always advocated heavy purchases and long-term holdings. There are basically three possibilities for this shipment. Which do you think they are? Let's vote first:

My personal opinion: Gods don't change their personality in order to cut everyone's chives![]() If it was done by a temporary worker under his command, he himself didn't know; this is also impossible; I haven't heard that his body is itchy. So I think either the stock company made a mistake, or TSMC is currently not working.

If it was done by a temporary worker under his command, he himself didn't know; this is also impossible; I haven't heard that his body is itchy. So I think either the stock company made a mistake, or TSMC is currently not working.

I've always thought that current popular semiconductor stocks are seriously overvalued, especially $Taiwan Semiconductor(TSM.US$, $NVIDIA(NVDA.US$ , $Advanced Micro Devices(AMD.US$ as well $ASML Holding(ASML.US$ . Among them, NVDA is the most seriously overrated. Will the overestimation fall? Not necessarily; as long as no one feels like they are the taker, hitting the drums will continue.

If NVDA hits the drum and spreads, even if you accidentally take over, you'll still have a bouquet of flowers![]() Well, a lot of junk stocks are just drumming 💩. If you accidentally take over, you can only keep yourself and eat them. So I won't touch this crap...

Well, a lot of junk stocks are just drumming 💩. If you accidentally take over, you can only keep yourself and eat them. So I won't touch this crap...

My personal opinion: Gods don't change their personality in order to cut everyone's chives

I've always thought that current popular semiconductor stocks are seriously overvalued, especially $Taiwan Semiconductor(TSM.US$, $NVIDIA(NVDA.US$ , $Advanced Micro Devices(AMD.US$ as well $ASML Holding(ASML.US$ . Among them, NVDA is the most seriously overrated. Will the overestimation fall? Not necessarily; as long as no one feels like they are the taker, hitting the drums will continue.

If NVDA hits the drum and spreads, even if you accidentally take over, you'll still have a bouquet of flowers

Translated

2

6

Up 10 Down 20

liked and commented on

At last, Japan was unable to withstand it, making it difficult to maintain a loose monetary policy. China wants to ease things, but RMB is not a free currency. Currently, all developed countries are collecting water to curb the expansion through.

I personally think that global inflation is mainly due to two factors, both of which are difficult to eliminate. This also makes it difficult to return to loose monetary policy in the next few years:

1. Anti-globalization. Driven by global markets, material production will automatically shift to labor-rich, low-cost regions, such as China and Southeast Asia. The prices of resource-based commodities will also be automatically optimized to a minimum due to the globalized market. In the anti-globalization process, neither aspect can be optimized. For example, inflation 40 years ago and today is related to crude oil's inability to trade freely. Changes in the relationship between China and the US have also caused some production capacity to flow out of China, making it necessary to seek higher cost alternatives. Things that cost $1 in the US may only be produced in a few minutes in China, while Southeast Asia may achieve low costs, but they may not replace China's production capacity or the integrity of the industrial chain. Anti-globalization will inevitably lead to an irreversible rise in inflation.

2. population. Since the outbreak of the epidemic, the number of people involved in labor in the US has declined sharply. For details, see Powell's original statement; I just brought it. China's lifting of the blockade will also cause the same problems. As the labor force shrinks, the labor market is bound to be tight, and the spiral rise in wages and prices is difficult to control.

Unless inflation is left unchecked, we will continue to be in an environment of high interest rates for the next few years. So, vote...

I personally think that global inflation is mainly due to two factors, both of which are difficult to eliminate. This also makes it difficult to return to loose monetary policy in the next few years:

1. Anti-globalization. Driven by global markets, material production will automatically shift to labor-rich, low-cost regions, such as China and Southeast Asia. The prices of resource-based commodities will also be automatically optimized to a minimum due to the globalized market. In the anti-globalization process, neither aspect can be optimized. For example, inflation 40 years ago and today is related to crude oil's inability to trade freely. Changes in the relationship between China and the US have also caused some production capacity to flow out of China, making it necessary to seek higher cost alternatives. Things that cost $1 in the US may only be produced in a few minutes in China, while Southeast Asia may achieve low costs, but they may not replace China's production capacity or the integrity of the industrial chain. Anti-globalization will inevitably lead to an irreversible rise in inflation.

2. population. Since the outbreak of the epidemic, the number of people involved in labor in the US has declined sharply. For details, see Powell's original statement; I just brought it. China's lifting of the blockade will also cause the same problems. As the labor force shrinks, the labor market is bound to be tight, and the spiral rise in wages and prices is difficult to control.

Unless inflation is left unchecked, we will continue to be in an environment of high interest rates for the next few years. So, vote...

Translated

5

4

Up 10 Down 20

liked

I'm heavy on the Chinese stock market, or leveraged ETF. Yesterday, I guessed that US stocks were going to fall, but I forgot that everyone in the motherland stock market falls like it. Basically, there hasn't been much reduction in positions![]()

![]()

![]() I paid back some profits today, but I still had to endure the pain and reduce my positions. Currently, the remaining positions left when going long in China are about 15%. tqqq has only 5% left. If it is drawn back tomorrow, it will be cleared. ERY I drastically reduced my position and transferred to FNGD and SOXS for the reason I mentioned before. Currently, the short position is close to 50%, so no more. 20% long, 20% tlt.

I paid back some profits today, but I still had to endure the pain and reduce my positions. Currently, the remaining positions left when going long in China are about 15%. tqqq has only 5% left. If it is drawn back tomorrow, it will be cleared. ERY I drastically reduced my position and transferred to FNGD and SOXS for the reason I mentioned before. Currently, the short position is close to 50%, so no more. 20% long, 20% tlt.

Furthermore, I exchanged my 401k pension from money market funds to bonds (S&P to money market in August), so it doesn't count as a position.

The domestic epidemic is progressing a bit rapidly; I really thought it would be this fast. The outbreak of the epidemic is bad news. The funds have found an excuse to withdraw, and this wave of rebound is about to turn around. As I mentioned before, this wave is definitely a rebound in the bear market, not a reversal. If the Chinese stock market wants to reverse the trend, it is estimated that it will bottom out again and not fall below. At that time, the epidemic should have run out of steam.

I held onto the take-profit money first; I didn't buy all of the TLT. Let's check it out first; tlt will probably call back. But I don't think it will fall below the previous low. I also mentioned TLT's investment logic in a previous article. Even if it falls, the risk is much less than the stock market.

$iShares 20+ Year Treasury Bond ETF(TLT.US$

On the Chinese side, wait for the big market...

Furthermore, I exchanged my 401k pension from money market funds to bonds (S&P to money market in August), so it doesn't count as a position.

The domestic epidemic is progressing a bit rapidly; I really thought it would be this fast. The outbreak of the epidemic is bad news. The funds have found an excuse to withdraw, and this wave of rebound is about to turn around. As I mentioned before, this wave is definitely a rebound in the bear market, not a reversal. If the Chinese stock market wants to reverse the trend, it is estimated that it will bottom out again and not fall below. At that time, the epidemic should have run out of steam.

I held onto the take-profit money first; I didn't buy all of the TLT. Let's check it out first; tlt will probably call back. But I don't think it will fall below the previous low. I also mentioned TLT's investment logic in a previous article. Even if it falls, the risk is much less than the stock market.

$iShares 20+ Year Treasury Bond ETF(TLT.US$

On the Chinese side, wait for the big market...

Translated

3

Up 10 Down 20

voted

the housing market and the auto market haven't tumbled yet, not even a quick shake, but it's incoming. So many people are close to tapped out and can't afford an unforeseen divorce, job loss, car breakdown, medical issue, etc. They would have been able to handle those variables under good economic times, but not under record gas prices, record food prices, etc, on top of record high mortgage and auto loan payments.![]()

Will t...

Will t...

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)