tanwww

liked

Dear mooers,

NIO $NIO Inc(NIO.US$ Q4 earnings conference call is to release on Mar.24 afterhours. The company expanded its product portfolio, increased its production footprint, and widen its market reach efficiently and effectively in recent years. Particularly, NIO has beaten analysts' revenue estimation over the last three quarters. Will the situation continue? The upcoming earnings results can cause a lot of volatility...

NIO $NIO Inc(NIO.US$ Q4 earnings conference call is to release on Mar.24 afterhours. The company expanded its product portfolio, increased its production footprint, and widen its market reach efficiently and effectively in recent years. Particularly, NIO has beaten analysts' revenue estimation over the last three quarters. Will the situation continue? The upcoming earnings results can cause a lot of volatility...

15

44

tanwww

liked

Weekly market recap

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

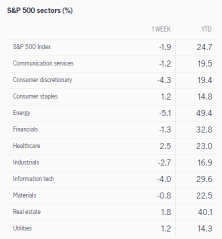

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

Stock futures fluctuated in overnight trading Sunday following a losing week as investors continued to grapple with the resurgence of Covid cases and an upcoming shift in the Federal Reserve's easy monetary policy.

The major averages are coming off a negative week, with the $S&P 500 Index(.SPX.US$ declining 1.9%. The tech-heavy $Nasdaq Composite Index(.IXIC.US$ dropped nearly 3% last week as investors dumped high-flying growth stocks on the prospect of higher interest rates, while the $Dow Jones Industrial Average(.DJI.US$ slipped 1.7%.

Here's a look at the return of S&P 500 sectors

The week ahead in focus

Stock and bond markets around the world will be closed Friday in observance of Christmas. Before the holiday break, Nike and Micron Technology report on Monday, BlackBerry and General Mills on Tuesday, and CarMax, Cintas, and Paychex on Wednesday.

It will be a busy week of economic data releases. On Monday, the Conference Board publishes its Leading Economic Index for November, followed by its Consumer Confidence Index for December on Wednesday.

On Thursday, the Bureau of Economic Analysis reports personal income and consumption expenditures for November. Consumer earnings are forecast to have risen 0.6% while spending is seen climbing 0.5%. The Federal Reserve's preferred measure of inflation, the core PCE price index, is expected to have spiked 4.5% in November.

Also Thursday, the Census Bureau releases the durable goods report for November, which will provide a window into investment spending in the economy. New orders are forecast to have risen 2.1%. Housing-market indicators out this week include existing-home sales for November on Wednesday and new-home sales for November on Thursday.

Monday 12/20

$Micron Technology(MU.US$ and $Nike(NKE.US$ report quarterly results.

The Conference Board releases its Leading Economic Index for November. Consensus estimate is for a 119 reading, which would be 0.6% more than October's level. The Conference Board currently projects a 5% growth rate for fourth-quarter gross domestic product and a slower but still robust 2.6% for 2022.

Tuesday 12/21

$BlackBerry(BB.US$, $FactSet Research Systems(FDS.US$, and $General Mills(GIS.US$ announce earnings.

Wednesday 12/22

The NAR reports existing-home sales for November. Economists forecast a seasonally adjusted annual rate of 6.4 million homes sold, slightly more than in October and the highest since the beginning of the year.

$CarMax(KMX.US$, $Cintas(CTAS.US$, and $Paychex(PAYX.US$ hold conference calls to discuss quarterly results.

The Bureau of Economic Analysis reports its third and final estimate for third-quarter GDP. Economists forecast a 2.1% seasonally adjusted annual growth rate, unchanged from November's second estimate.

The Conference Board releases its Consumer Confidence Index for December. Expectations are for a 110 reading, roughly even with the November data. The index is 15% lower than the postpandemic peak reached in June of this year, due to concerns about rising prices and, to a lesser degree, Covid-19 variants.

Thursday 12/23

The Department of Labor reports initial jobless claims for the week ending on Dec. 18. Jobless claims have averaged 225,667 a week in November and December, and have finally reached prepandemic levels.

The Census Bureau reports new-home sales for November. Consensus estimate is for a seasonally adjusted annual rate of 770,000 new single-family houses sold, 25,000 more than in October. The median sales price of new houses sold in October was $407,700, while the average sales price was $477,800 -- both record highs.

The BEA reports personal income and consumption expenditures for November. Economists forecast a 0.6% monthly increase for income and 0.5% for consumption. This compares with gains for 0.5% and 1.3%, respectively, in October. The Federal Reserve's preferred inflation gauge, the core PCE price index, jumped 4.1% year over year in October, the fastest rate since 1991. Predictions are for it to spike 4.6% in November.

The Census Bureau releases the durable goods report for November. New orders for durable manufactured goods are expected to increase 2.1%, to $265.6 billion. Excluding transportation, new orders are seen gaining 0.6%, compared with a 0.5% rise in October.

Friday 12/24

U.S. equity and fixed-income markets are closed in observance of Christmas.

Source: CNBC, jhinvestments, Dow Jones Newswires

+2

113

7

tanwww

liked

tanwww

liked

17

1

tanwww

liked

honestly speaking, when your peers are talking about crypto, shares trading etc etc, you naturally tend to be interested and inevitably you will also venture into it.

my Best Buy so far is $BlackBerry(BB.US$ back then got it 7 plus a share and managed to unload it at 13ish. all these based on feelings and also Reddit. lucky for me.

my Best Buy so far is $BlackBerry(BB.US$ back then got it 7 plus a share and managed to unload it at 13ish. all these based on feelings and also Reddit. lucky for me.

36

3

tanwww

liked

$NeuroMetrix(NURO.US$ so lazy, pls get up! 😁😁😁

13

tanwww

liked

$ChemoCentryx(CCXI.US$

$Futu Holdings Ltd(FUTU.US$

$Camber Energy(CEI.US$

$Grab Holdings(GRAB.US$

$UP Fintech(TIGR.US$

$BlackBerry(BB.US$

Welcome to the cycle of stocks, i believe your portfolio look like a bed of RED roses for now.

Well, u can keep on picking up the same rose & get pricked by its thorns.

OR, u put them aside, go smell other flowers.

What I'm trying to say is,

- if u don't plant your seed, there won't be a plant.

- but if u take some time to select a few tough crop, u will harvest your food in a few weeks/months time.

- or u can pick some cherry to temporary quench your thirst.

Hit & Run (small play) may be a good strategy for now, but with Risk Management in place.

Else you need to stop laying on your bed of Red roses & get a break elsewhere.

QUOTE :

“Every once in a while, the market does something so stupid it takes your breath away.” – By Jim Cramer

$Futu Holdings Ltd(FUTU.US$

$Camber Energy(CEI.US$

$Grab Holdings(GRAB.US$

$UP Fintech(TIGR.US$

$BlackBerry(BB.US$

Welcome to the cycle of stocks, i believe your portfolio look like a bed of RED roses for now.

Well, u can keep on picking up the same rose & get pricked by its thorns.

OR, u put them aside, go smell other flowers.

What I'm trying to say is,

- if u don't plant your seed, there won't be a plant.

- but if u take some time to select a few tough crop, u will harvest your food in a few weeks/months time.

- or u can pick some cherry to temporary quench your thirst.

Hit & Run (small play) may be a good strategy for now, but with Risk Management in place.

Else you need to stop laying on your bed of Red roses & get a break elsewhere.

QUOTE :

“Every once in a while, the market does something so stupid it takes your breath away.” – By Jim Cramer

50

tanwww

liked

$NeuroMetrix(NURO.US$ I can't pull it. There's a lot of resistance up to 8. The clean-up is almost complete; wait for the right time to take it back.

Translated

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)