seekinglobang

voted

Ever dreamed of being at the Nasdaq bell ceremony? Eager to meet with the Nasdaq team and influential YouTubers? Don't miss out on this chance!

Moomoo partners with Nasdaq to bring you closer to the investment world. We're hosting a special event at the Nasdaq Market Site in the heart of New York. Be part of the bell-ring ceremony, gain insights from investment influencers, and connect with Nasdaq's professional traders! We're sending two lucky i...

Moomoo partners with Nasdaq to bring you closer to the investment world. We're hosting a special event at the Nasdaq Market Site in the heart of New York. Be part of the bell-ring ceremony, gain insights from investment influencers, and connect with Nasdaq's professional traders! We're sending two lucky i...

17

3

seekinglobang

voted

Hi, mooers!![]()

With the upcoming GST hike from 7% to 9% and the market's volatility as the Federal Reserve puts a pause on interest rate cuts, the question arises: How can we adapt our investment strategies to navigate these uncertainties? What's your take on the likely market trends?![]()

During these uncertain times, money market funds stand out as a smart investment, fighting off inflation and offering a steady source of income.

Looki...

With the upcoming GST hike from 7% to 9% and the market's volatility as the Federal Reserve puts a pause on interest rate cuts, the question arises: How can we adapt our investment strategies to navigate these uncertainties? What's your take on the likely market trends?

During these uncertain times, money market funds stand out as a smart investment, fighting off inflation and offering a steady source of income.

Looki...

42

24

seekinglobang

voted

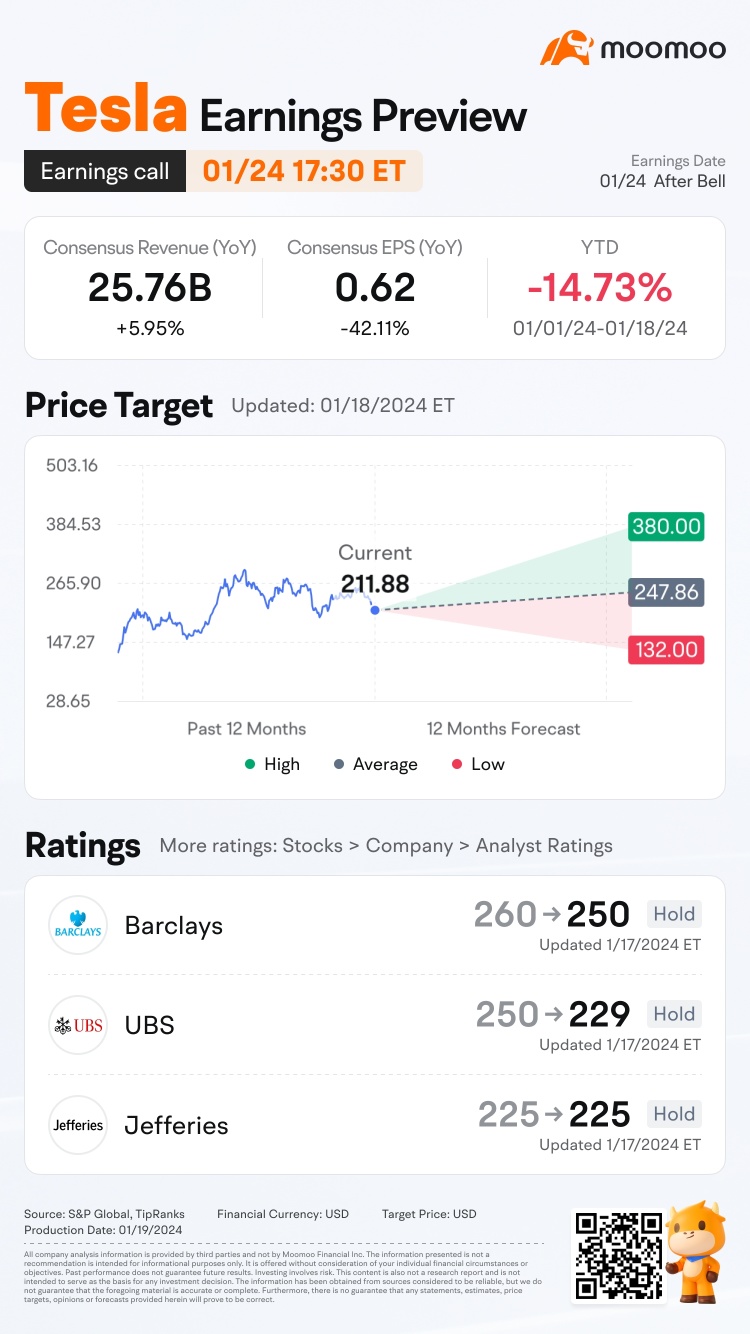

Tesla is releasing its Q4 2023 earnings on January 24, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla(TSLA.US$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla(TSLA.US$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

106

130

seekinglobang

voted

2023 was a year of uncertainty and adjustments for the US stock market, as investors navigated a complex landscape of economic and monetary policy changes. While the year saw periods of both optimism and pessimism, the overarching narrative remains focused on the Fed's actions and their impact on the broader economy.

To evaluate US stock market performance, let's review the $S&P 500 Index(.SPX.US$'s progress this year:

*Images prov...

To evaluate US stock market performance, let's review the $S&P 500 Index(.SPX.US$'s progress this year:

*Images prov...

146

213

seekinglobang

voted

Hello Mooers! ![]()

Back in 2021, Fractional Trading was one of the suggestions that I made to the MooMoo Products Managers.![]() It is also one of my Christmas 2021 wishes, besides other wishes such as the MooMoo Crypto Coin, Stocks & ETFs lending, Free X number of trade, and Allow SRS/IRA funding.

It is also one of my Christmas 2021 wishes, besides other wishes such as the MooMoo Crypto Coin, Stocks & ETFs lending, Free X number of trade, and Allow SRS/IRA funding. ![]()

In 2023, FUTU MooMoo ( $Futu Holdings Ltd(FUTU.US$ ) surprises Mooers with many new features, such as Fractional Trading. I feel so proud of yo...

Back in 2021, Fractional Trading was one of the suggestions that I made to the MooMoo Products Managers.

In 2023, FUTU MooMoo ( $Futu Holdings Ltd(FUTU.US$ ) surprises Mooers with many new features, such as Fractional Trading. I feel so proud of yo...

From YouTube

45

21

seekinglobang

liked

$Tencent(TCEHY.US$ $JD.com(JD.US$ Internet giant Tencent Holdings Ltd. is planning to distribute more than $16 billion worth of shares in JD.com Inc. to its shareholders, which will result in it no longer being the Chinese e-commerce firm’s biggest shareholder.

From March on, Tencent will give out around 457 million Class A shares in JD.com as a special interim dividend, representing about 86.4% of its total stake and 14.7% of the online retailer’s total issued shares, according to a filing to the Hong Kong Stock Exchange on Thursday. At Wednesday’s close, that many shares were worth HK$127.7 billion ($16.4 billion).

Tencent, which controls about 17% of JD.com, will hold roughly 2.3% of the e-commerce company’s shares after the handout, JD.com said in a separate statement. As part of the deal, Tencent President Martin Lau will exit JD.com’s board effective Thursday.

From March on, Tencent will give out around 457 million Class A shares in JD.com as a special interim dividend, representing about 86.4% of its total stake and 14.7% of the online retailer’s total issued shares, according to a filing to the Hong Kong Stock Exchange on Thursday. At Wednesday’s close, that many shares were worth HK$127.7 billion ($16.4 billion).

Tencent, which controls about 17% of JD.com, will hold roughly 2.3% of the e-commerce company’s shares after the handout, JD.com said in a separate statement. As part of the deal, Tencent President Martin Lau will exit JD.com’s board effective Thursday.

24

1

seekinglobang

liked

By Ander

Hey, mooers! Here are things you need to know before the opening bell:

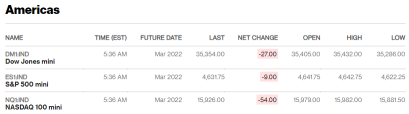

- Stock futures were muted early Wednesday morning after the major averages rebounded from a three-day losing streak spurred by fears about the omicron Covid variant.

- Higher prices, a worker shortage and a revitalized labor movement are bringing about the return of pay increases tied to inflation, known as cost-of-living adjustments, or COLAs.

Market Snapshot

Stock futures were muted early Wednesday morning after the major averages rebounded from a three-day losing streak spurred by fears about the omicron Covid variant.

Futures on the $Dow Jones Industrial Average(.DJI.US$ slipped 27 points, $S&P 500 Index(.SPX.US$ futures slipped 9 points and $Nasdaq Composite Index(.IXIC.US$ futures slipped 54 pionts.

Top News

U.S. to distribute free at-home tests to fight Omicron

President Biden also outlines other measures to combat the rapidly spreading variant, saying, "We have to do more. We have to do better-and we will."

Turkey rolls out economic rescue plan, reversing Lira's spiral

Turkey's currency mounted a dramatic, partial reversal from a monthslong collapse after President Recep Tayyip Erdogan announced a rescue plan to encourage Turks to put their money back into the lira.

Surging inflation has workers demanding bigger raises

Higher prices, a worker shortage and a revitalized labor movement are bringing about the return of pay increases tied to inflation, known as cost-of-living adjustments, or COLAs.

Maersk to buy LF Logistics for around $3.6 billion

The shipping giant has agreed to buy LF Logistics for around $3.6 billion including lease liabilities, a move that would give the ocean shipping giant a network of warehouses. $A.P. Moller - Maersk A/S Unsponsored ADR(AMKBY.US$

Sony Group india unit, Zee Entertainment to merge

An Indian unit of $Sony(SONY.US$ and Zee Entertainment Enterprises said they agreed to merge in a bid to meet growing consumer demand for entertainment content and drive shareholder value.

SoftBank finalizing $4 billion Loan From Apollo-Led Group

The deal shows the Japanese conglomerate's ravenous need for cash and Apollo Global Management's push into lending, a territory traditionally dominated by banks.

Read More

The S&P 500 may replicate its 1997-1999 rally

The first U.S. Bitcoin ETF marked the crypto funds market explosion in 2021

Elon Musk and Jack Dorsey are talking about "Web3"

BlackBerry 3Q sales fall from year ago, but top expectations

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

Hey, mooers! Here are things you need to know before the opening bell:

- Stock futures were muted early Wednesday morning after the major averages rebounded from a three-day losing streak spurred by fears about the omicron Covid variant.

- Higher prices, a worker shortage and a revitalized labor movement are bringing about the return of pay increases tied to inflation, known as cost-of-living adjustments, or COLAs.

Market Snapshot

Stock futures were muted early Wednesday morning after the major averages rebounded from a three-day losing streak spurred by fears about the omicron Covid variant.

Futures on the $Dow Jones Industrial Average(.DJI.US$ slipped 27 points, $S&P 500 Index(.SPX.US$ futures slipped 9 points and $Nasdaq Composite Index(.IXIC.US$ futures slipped 54 pionts.

Top News

U.S. to distribute free at-home tests to fight Omicron

President Biden also outlines other measures to combat the rapidly spreading variant, saying, "We have to do more. We have to do better-and we will."

Turkey rolls out economic rescue plan, reversing Lira's spiral

Turkey's currency mounted a dramatic, partial reversal from a monthslong collapse after President Recep Tayyip Erdogan announced a rescue plan to encourage Turks to put their money back into the lira.

Surging inflation has workers demanding bigger raises

Higher prices, a worker shortage and a revitalized labor movement are bringing about the return of pay increases tied to inflation, known as cost-of-living adjustments, or COLAs.

Maersk to buy LF Logistics for around $3.6 billion

The shipping giant has agreed to buy LF Logistics for around $3.6 billion including lease liabilities, a move that would give the ocean shipping giant a network of warehouses. $A.P. Moller - Maersk A/S Unsponsored ADR(AMKBY.US$

Sony Group india unit, Zee Entertainment to merge

An Indian unit of $Sony(SONY.US$ and Zee Entertainment Enterprises said they agreed to merge in a bid to meet growing consumer demand for entertainment content and drive shareholder value.

SoftBank finalizing $4 billion Loan From Apollo-Led Group

The deal shows the Japanese conglomerate's ravenous need for cash and Apollo Global Management's push into lending, a territory traditionally dominated by banks.

Read More

The S&P 500 may replicate its 1997-1999 rally

The first U.S. Bitcoin ETF marked the crypto funds market explosion in 2021

Elon Musk and Jack Dorsey are talking about "Web3"

BlackBerry 3Q sales fall from year ago, but top expectations

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

41

2

seekinglobang

liked

The financial story of 2021 may be the 445 exchange trade funds that debuted this year as the U.S. ETF industry ballooned to $7 trillion. ![]()

![]()

The business has never known times like these. A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far.

--- according to Bloomberg

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

There's a lot of money being transferred from a generational standpoint. The stars are aligning right now for the ETF industry to a) evolve very quickly and b) take in flows.”

--- said Keith Buchanan, portfolio manager at Globalt Investments

All that means the number of ETFs Americans can choose from has jumped 19% since the end of 2020. About a quarter of all trading ETFs are less than two-years old, according to Bloomberg Intelligence -- another sign of industry boom times.

![]() Active ETF is growing

Active ETF is growing

The details of the launches tell a deeper story: From the 445 new arrivals, 75 target fixed income. For the first time, new actively managed ETFs outnumber their passive counterparts with 298 debuts versus 147.

The letters ETF used to spell passive to most investors. Now more and more advisors are realizing that ETFs are no longer just about gaining passive exposure and that active ETFs, particularly within fixed income, make sense because they can gain exposure to experienced bond managers.”

--- said Allison Bonds, head of private wealth management at State Street Global Advisors

At the same time, launches of low-cost, broad equity-index trackers are dwindling. Traditional core or "beta vehicles" made up only 8% of total equity ETF launches from the start of.

--- according to Bloomberg Intelligence

Partly, that's because such core strategies are well represented by big, established and very cheap funds from the major issuers. The popularity of the likes of the $SPDR S&P 500 ETF(SPY.US$ and the $Vanguard S&P 500 ETF(VOO.US$ mean they still claim the lion's share of new cash.

![]() Thematic ETF become popular

Thematic ETF become popular

Thematic ETF target trends like automation or electric vehiclesrather than traditional industry segments. They've proved hugely popular with the retail-investing crowd, which has been a growing force in markets since the pandemic hit. The high-profile success of Cathie Wood's Ark Investment Management $ARK Innovation ETF(ARKK.US$ $ARK Autonomous Technology & Robotics ETF(ARKQ.US$ has also helped fuel a wave of copycats $ProShares Bitcoin Strategy ETF(BITO.US$ $Valkyrie Bitcoin and Ether Strategy ETF(BTF.US$.

![]() Complex Categories

Complex Categories

Aligned with this specialization, funds have been getting more complex. Over 30 ESG ETFs have launched in the U.S. this year. There have been 56 new ETFs this year investing in derivatives to amplify bets, make them inverse or deliver protection. A major driver of this has been the development of defined-outcome ETFs, also know as buffers. They seek to provide capped exposure to gains in exchange for limiting losses.

Source: TheStreet, Bloomberg

The business has never known times like these. A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far.

--- according to Bloomberg

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

There's a lot of money being transferred from a generational standpoint. The stars are aligning right now for the ETF industry to a) evolve very quickly and b) take in flows.”

--- said Keith Buchanan, portfolio manager at Globalt Investments

All that means the number of ETFs Americans can choose from has jumped 19% since the end of 2020. About a quarter of all trading ETFs are less than two-years old, according to Bloomberg Intelligence -- another sign of industry boom times.

The details of the launches tell a deeper story: From the 445 new arrivals, 75 target fixed income. For the first time, new actively managed ETFs outnumber their passive counterparts with 298 debuts versus 147.

The letters ETF used to spell passive to most investors. Now more and more advisors are realizing that ETFs are no longer just about gaining passive exposure and that active ETFs, particularly within fixed income, make sense because they can gain exposure to experienced bond managers.”

--- said Allison Bonds, head of private wealth management at State Street Global Advisors

At the same time, launches of low-cost, broad equity-index trackers are dwindling. Traditional core or "beta vehicles" made up only 8% of total equity ETF launches from the start of.

--- according to Bloomberg Intelligence

Partly, that's because such core strategies are well represented by big, established and very cheap funds from the major issuers. The popularity of the likes of the $SPDR S&P 500 ETF(SPY.US$ and the $Vanguard S&P 500 ETF(VOO.US$ mean they still claim the lion's share of new cash.

Thematic ETF target trends like automation or electric vehiclesrather than traditional industry segments. They've proved hugely popular with the retail-investing crowd, which has been a growing force in markets since the pandemic hit. The high-profile success of Cathie Wood's Ark Investment Management $ARK Innovation ETF(ARKK.US$ $ARK Autonomous Technology & Robotics ETF(ARKQ.US$ has also helped fuel a wave of copycats $ProShares Bitcoin Strategy ETF(BITO.US$ $Valkyrie Bitcoin and Ether Strategy ETF(BTF.US$.

Aligned with this specialization, funds have been getting more complex. Over 30 ESG ETFs have launched in the U.S. this year. There have been 56 new ETFs this year investing in derivatives to amplify bets, make them inverse or deliver protection. A major driver of this has been the development of defined-outcome ETFs, also know as buffers. They seek to provide capped exposure to gains in exchange for limiting losses.

Source: TheStreet, Bloomberg

69

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)