News Highlights

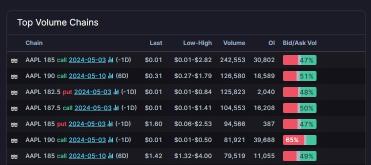

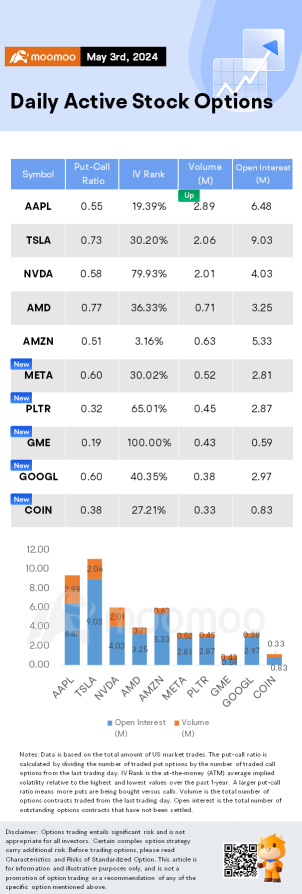

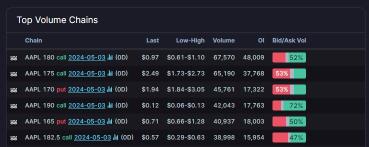

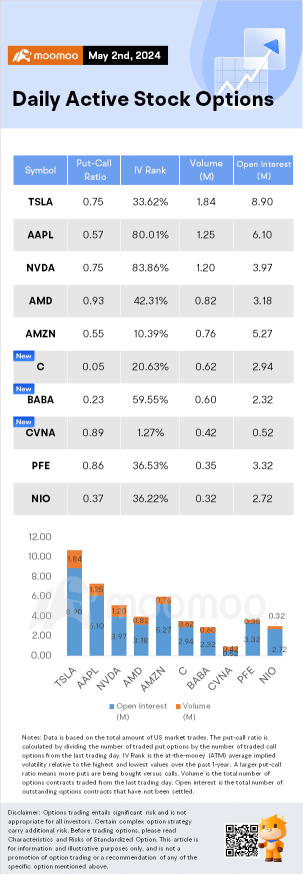

$Apple(AAPL.US$ shares ended 5.98% higher, with option volume of nearly 2.89 million contracts, and calls accounted for 64.7% of the volume. The $180 and 185 calls expiring May 10, 2024 were traded most actively.

Technology stocks experienced a rally as investors shifted their focus back to the major tech companies, often referred to as the "Magnificent Seven." Apple's shares saw a significant...

$Apple(AAPL.US$ shares ended 5.98% higher, with option volume of nearly 2.89 million contracts, and calls accounted for 64.7% of the volume. The $180 and 185 calls expiring May 10, 2024 were traded most actively.

Technology stocks experienced a rally as investors shifted their focus back to the major tech companies, often referred to as the "Magnificent Seven." Apple's shares saw a significant...

+2

14

News Highlights

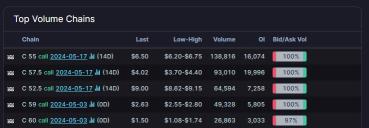

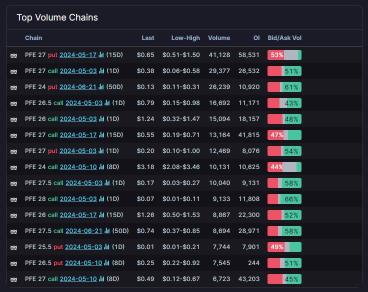

$Citigroup(C.US$ shares ended mostly flat. Its options trading volume was 0.62 million. Call contracts account for 95.4% of the total trading volume. The most traded contracts are $55, 57.5, and 52.5 calls strike price that expire on May 17th. The total volume reaches 138,816, 93,010, and 64594 contracts, respectively.

A confidential risk-management study prepared by Citigroup ...

$Citigroup(C.US$ shares ended mostly flat. Its options trading volume was 0.62 million. Call contracts account for 95.4% of the total trading volume. The most traded contracts are $55, 57.5, and 52.5 calls strike price that expire on May 17th. The total volume reaches 138,816, 93,010, and 64594 contracts, respectively.

A confidential risk-management study prepared by Citigroup ...

+2

19

News Highlights

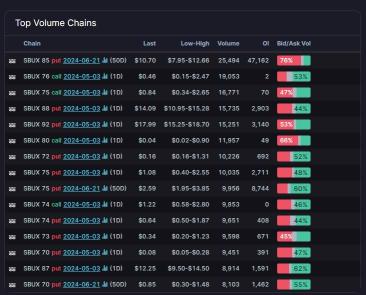

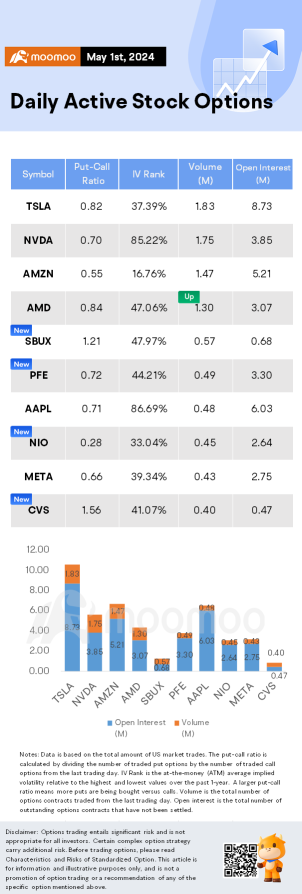

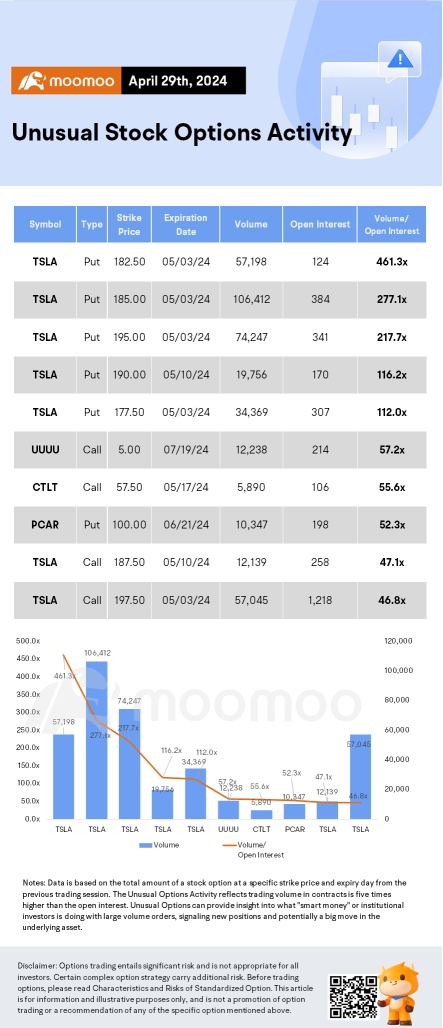

$Starbucks(SBUX.US$ shares fell by 15.88%, closing at $74.44. Its options trading volume was 1.21 million. Call contracts account for 45.2% of the total trading volume. The most traded contracts are $85 puts strike price that expire on May 3rd. The total volume reaches 25,494 with an open interest of 47,162.

Morgan Stanley reported that Starbucks delivered a weaker performance in fiscal Q2 t...

$Starbucks(SBUX.US$ shares fell by 15.88%, closing at $74.44. Its options trading volume was 1.21 million. Call contracts account for 45.2% of the total trading volume. The most traded contracts are $85 puts strike price that expire on May 3rd. The total volume reaches 25,494 with an open interest of 47,162.

Morgan Stanley reported that Starbucks delivered a weaker performance in fiscal Q2 t...

+2

19

ColumnsOptions Market Statistics: Tilray Brands Stock Jumps on DEA Reclassification News, Options Pop

News Highlights

$Amazon(AMZN.US$ shares fell by 3.29%, closing at $175. Its options trading volume was 1.27 million. Call contracts account for 61.9% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on May 3rd. The total volume reaches 51,932 with an open interest of 21,091. The most traded puts are contracts of a $160 strike price that expires on May 3r...

$Amazon(AMZN.US$ shares fell by 3.29%, closing at $175. Its options trading volume was 1.27 million. Call contracts account for 61.9% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on May 3rd. The total volume reaches 51,932 with an open interest of 21,091. The most traded puts are contracts of a $160 strike price that expires on May 3r...

20

News Highlights

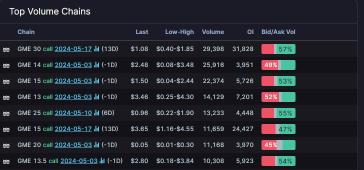

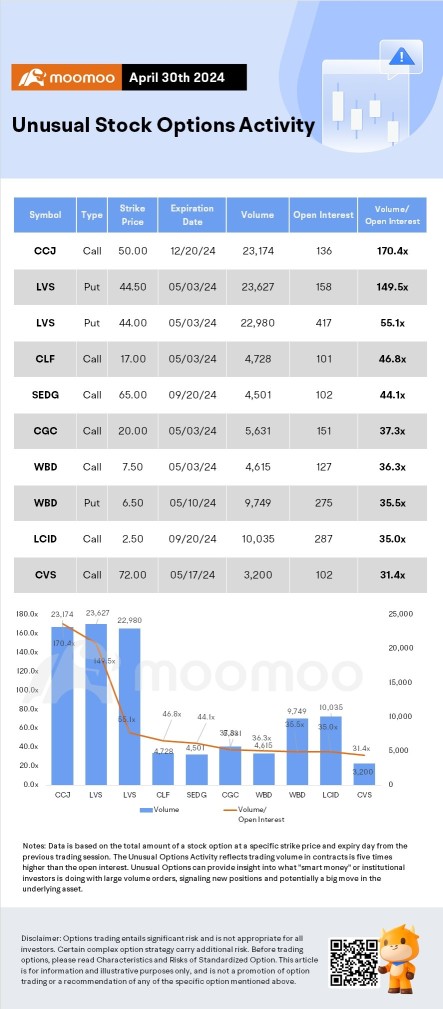

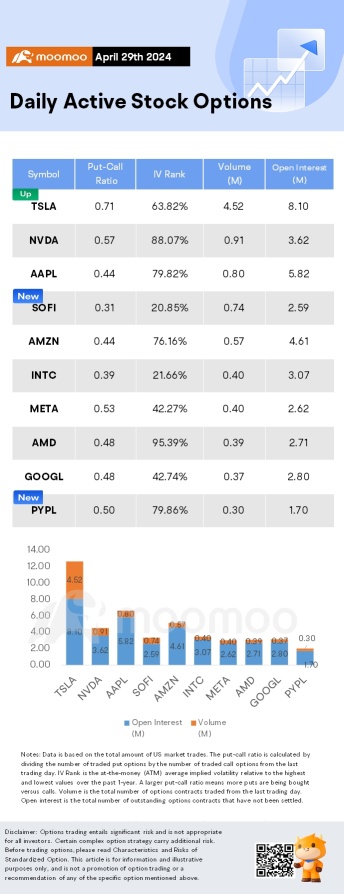

$Tesla(TSLA.US$ shares surged by 15.31%, closing at $194.05. Its options trading volume was 4.52 million. Call contracts account for 58.6% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on May 3rd. The total volume reaches 222,463 with an open interest of 12,220. The most traded puts are contracts of a $180 strike p...

$Tesla(TSLA.US$ shares surged by 15.31%, closing at $194.05. Its options trading volume was 4.52 million. Call contracts account for 58.6% of the total trading volume. The most traded calls are contracts of $200 strike price that expire on May 3rd. The total volume reaches 222,463 with an open interest of 12,220. The most traded puts are contracts of a $180 strike p...

24

ColumnsEarnings Volatility | Options Market Sees Big Move in Apple, AMD and Amazon Shares After Earnings

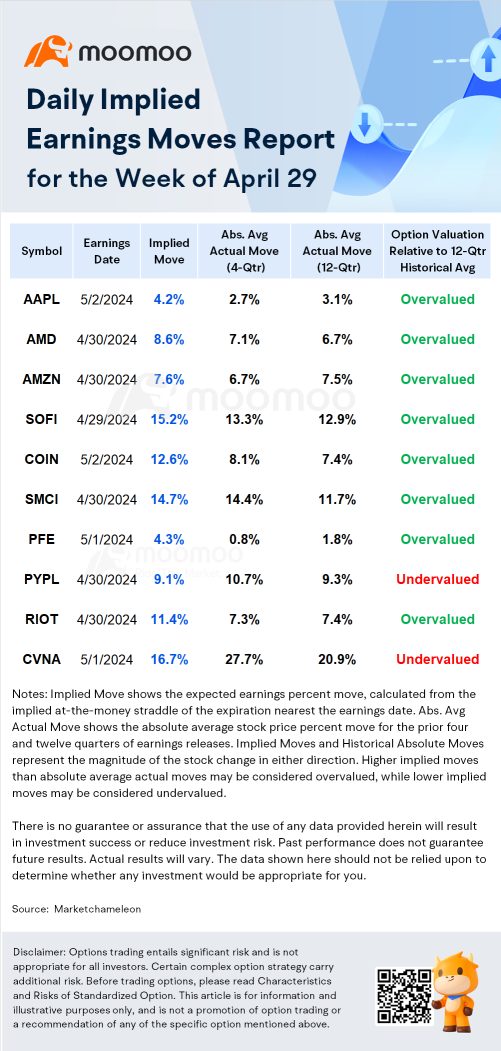

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

Here are the top earnings and volatility for the week:

- Stock: $Apple(AAPL.US$

- Earnings Date: 5/2 After the bell

- Earnings Consensus:...

Here are the top earnings and volatility for the week:

- Stock: $Apple(AAPL.US$

- Earnings Date: 5/2 After the bell

- Earnings Consensus:...

+1

28

News Highlights

$Intel(INTC.US$ shares fell by 9.20%, closing at $31.88. Its options trading volume was 0.97 million. Call contracts account for 64.8% of the total trading volume. The most traded calls are contracts of $36 strike price that expire on May 17th. The total volume reaches 7,280 with an open interest of 6,935. The most traded puts are contracts of a $64 strike price that expires on May 17th; the volu...

$Intel(INTC.US$ shares fell by 9.20%, closing at $31.88. Its options trading volume was 0.97 million. Call contracts account for 64.8% of the total trading volume. The most traded calls are contracts of $36 strike price that expire on May 17th. The total volume reaches 7,280 with an open interest of 6,935. The most traded puts are contracts of a $64 strike price that expires on May 17th; the volu...

42

6

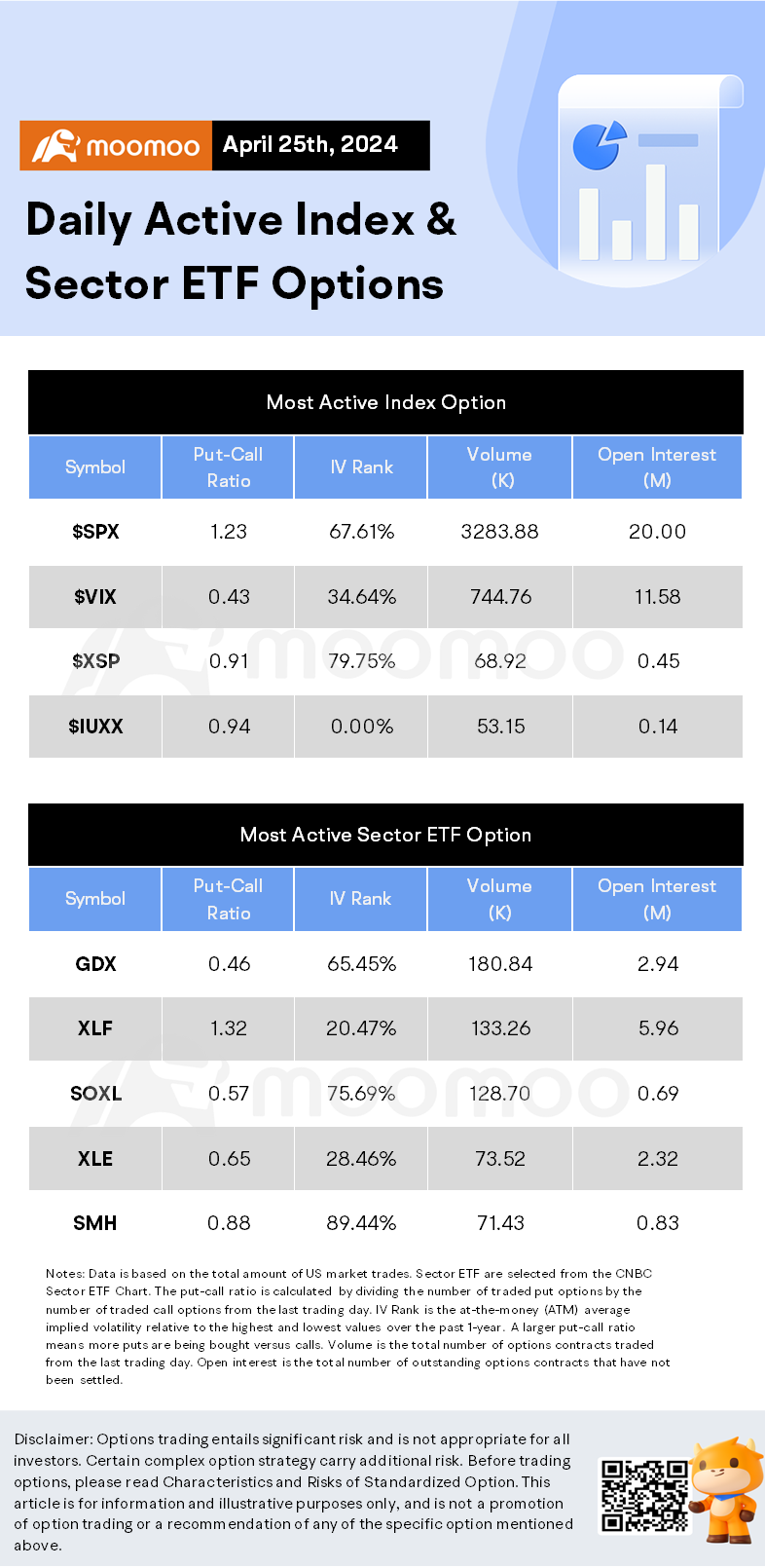

As the U.S. economy demonstrates its resilience and the fight against inflation encounters a plateau, interest rate traders are positioning for a new reality: the Federal Reserve may maintain its current stance, or possibly even tighten further, into the coming year.

Recent signals from Fed policymakers suggest a consensus for sustaining higher interest rates for an extended period. This expectation has cascaded thro...

Recent signals from Fed policymakers suggest a consensus for sustaining higher interest rates for an extended period. This expectation has cascaded thro...

10

ColumnsOptions Market Statistics: Alphabet Shares Jump, Options Pop on Earnings Beat, First-ever Dividend

News Highlights

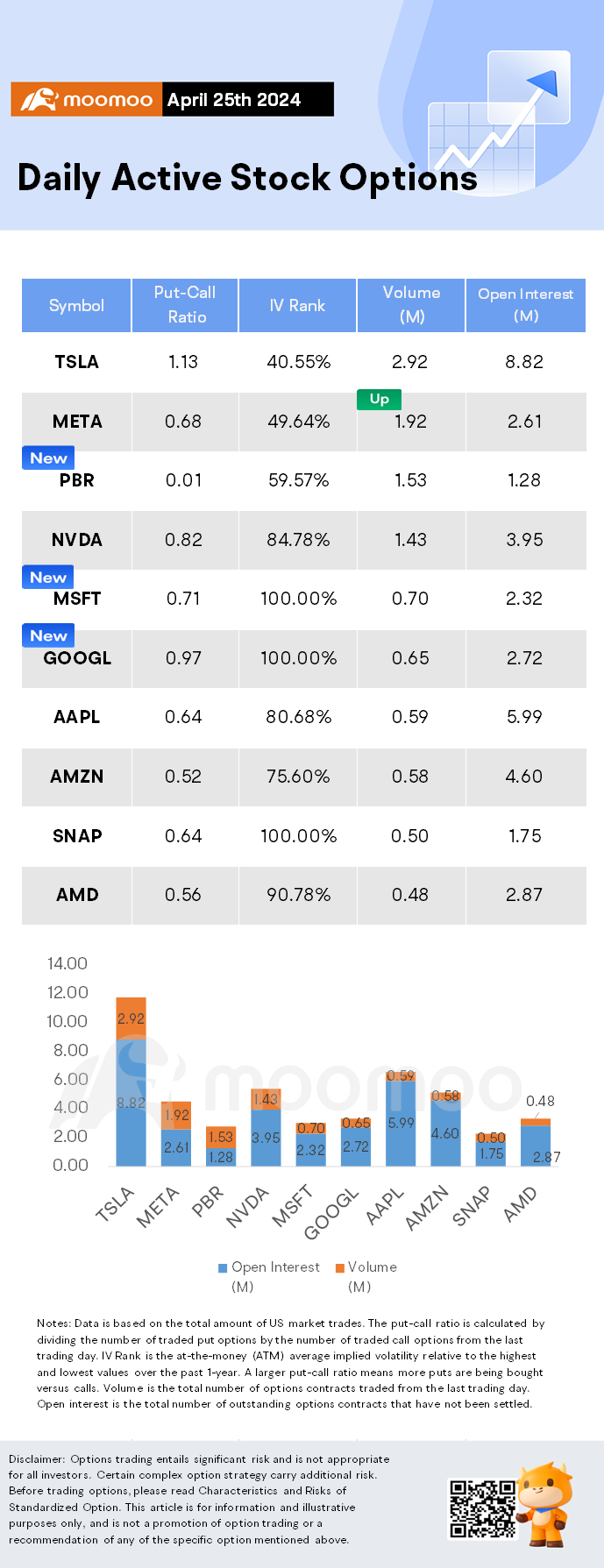

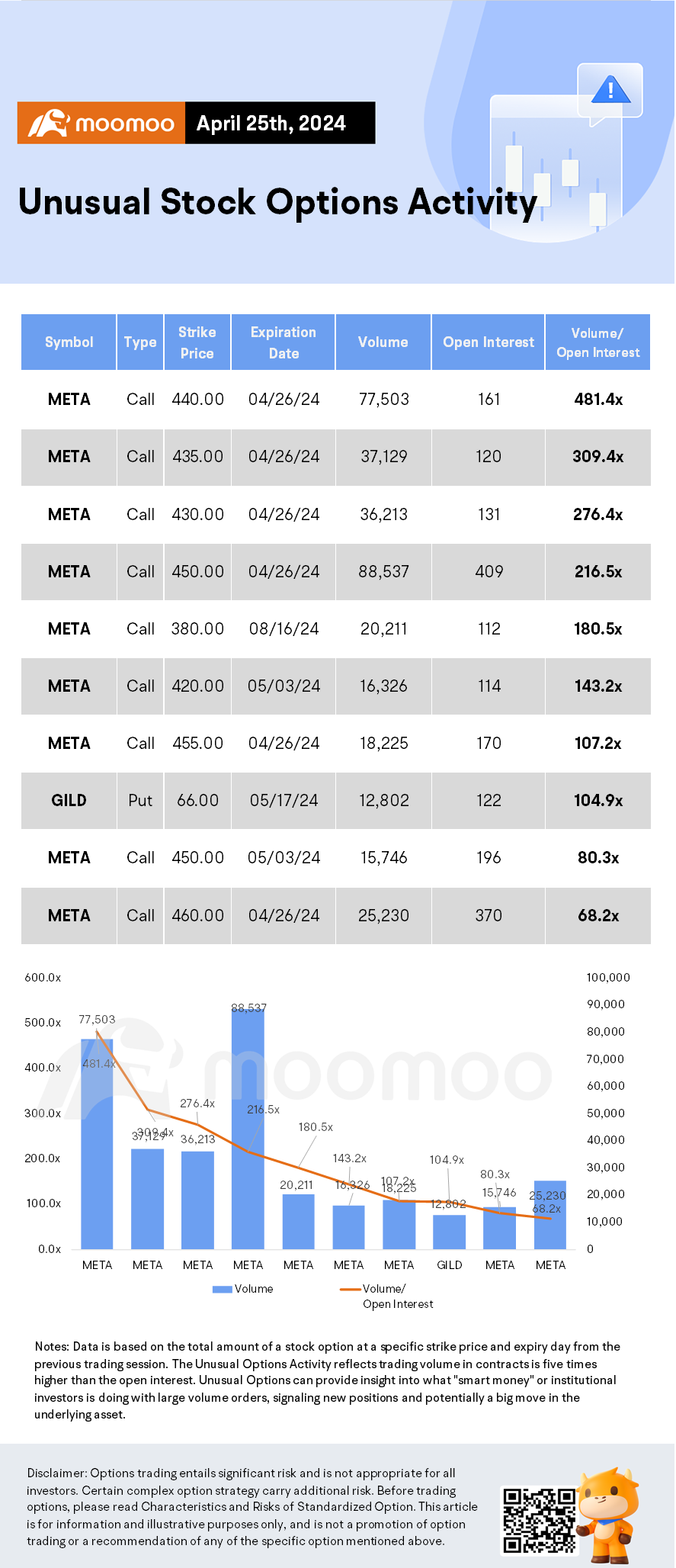

$Meta Platforms(META.US$ shares fell by 10.56%, closing at $441.38. Its options trading volume was 1.92 million. Call contracts account for 59.5% of the total trading volume. The most traded calls are contracts of $450 strike price that expire on Apr. 26th. The total volume reaches 88,537 with an open interest of 409. The most traded puts are contracts of a $420 strike price that ex...

$Meta Platforms(META.US$ shares fell by 10.56%, closing at $441.38. Its options trading volume was 1.92 million. Call contracts account for 59.5% of the total trading volume. The most traded calls are contracts of $450 strike price that expire on Apr. 26th. The total volume reaches 88,537 with an open interest of 409. The most traded puts are contracts of a $420 strike price that ex...

17

1

News Highlights

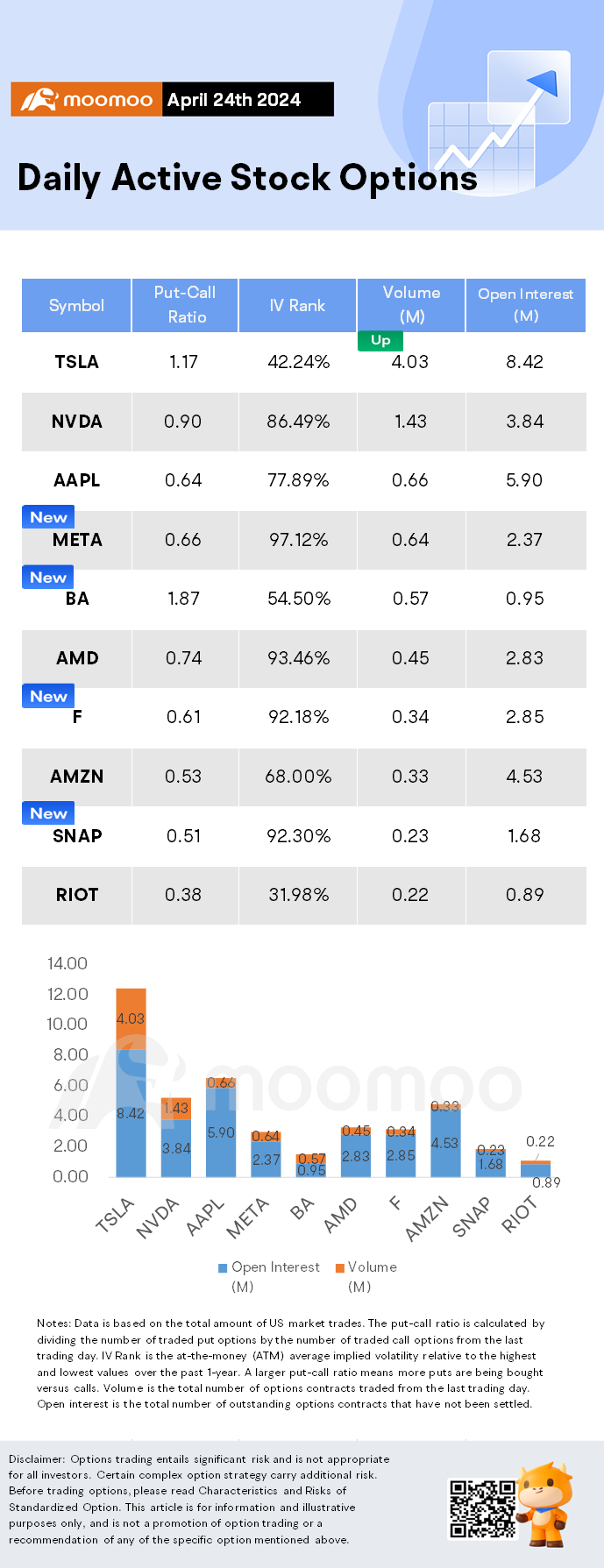

$Tesla(TSLA.US$ shares rose by 12.06%, closing at $162.13. Its options trading volume was 4.03 million. Call contracts account for 46.1% of the total trading volume. The most traded calls are contracts of $165 strike price that expire on Apr. 26th. The total volume reaches 196,809 with an open interest of 36,733. The most traded puts are contracts of a $160 strike price that expires on Apr. 26th; ...

$Tesla(TSLA.US$ shares rose by 12.06%, closing at $162.13. Its options trading volume was 4.03 million. Call contracts account for 46.1% of the total trading volume. The most traded calls are contracts of $165 strike price that expire on Apr. 26th. The total volume reaches 196,809 with an open interest of 36,733. The most traded puts are contracts of a $160 strike price that expires on Apr. 26th; ...

30

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)