Interest Rate Traders Bet Against Fed Cuts, Eye Steady or Higher Rates into 2024

As the U.S. economy demonstrates its resilience and the fight against inflation encounters a plateau, interest rate traders are positioning for a new reality: the Federal Reserve may maintain its current stance, or possibly even tighten further, into the coming year.

Recent signals from Fed policymakers suggest a consensus for sustaining higher interest rates for an extended period. This expectation has cascaded through hedging instruments, influencing traders ahead of the Federal Reserve's decision on May 1.

Options tied to the Secured Overnight Financing Rate (SOFR) — a benchmark mirroring the Fed's primary rate — have seen a build-up of positions that anticipate steady interest rates persisting beyond the December policy meeting. Some of the more audacious bets go further, hedging against the chance of a rate hike as far out as 2024.

This positioning is notably more hawkish than the consensus reflected in swaps.

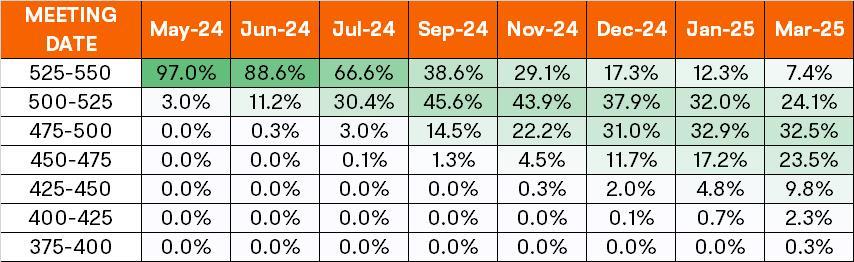

"Swap traders now price in the first rate cut to December, which suggests any lingering equity-valuation premium related to near-term rate cuts is likely gone after the report. This will put the onus on earnings trends to drive market outcomes in the near term," Bloomberg Intelligence Director of Equity Strategy Gina Martin Adams says.

This expectation of an eventual pivot toward easing has been a key factor underpinning the strong demand seen in Tuesday's historic $69 billion two-year Treasury auction.

Despite this, the possibility of a downturn in Treasury bonds remains on the table for some traders, particularly after a recent sell-off propelled yields on various maturities to their 2024 highs. One significant option trade on Tuesday involved an $11 million bet that 10-year yields could surpass 5% within a month, a notable increase from the current level of around 4.6%.

In the cash market, JPMorgan Chase & Co. has reported that neutral positioning among its clients hit a two-month peak. Additionally, futures markets have been shaken by inflation data that came in hotter than expected. Asset managers, as indicated by Commodity Futures Trading Commission data, have moved to record net longs in 2- and 5-year note futures. Bank of America Corp. analysts suggest this shift likely represents a retreat from short positions as yields have spiked.

Key indicators of the latest rates market positioning include:

1. SOFR Traders Target Higher Policy Rates Over the past week, options strikes such as the 94.375 have seen significant risk additions, particularly in hawkish configurations like the SFRZ4 94.50/94.375/94.125/94.00 put condor. This strategy is geared toward a year-end yield between roughly 5.625% and 5.875%, surpassing the current fed effective rate of 5.33%.

However, the positioning has not been uniformly hawkish, with notable risk added in the 96.00 and 97.00 strikes. This follows trades such as the Dec24 96.00/97.00 call spread, which anticipates a more aggressive trajectory of Fed rate cuts by year-end.

1. SOFR Options Heat Map

The 95.00 strike level, corresponding to a 5% rate, is densely populated with open interest in SOFR options extending to the Dec24 tenor. The Jun24 calls at this strike, and similarly heavy open interest at the 95.50 strike, indicate significant attention to this scenario. Other notable positions include open interest in Jun24 puts at the 94.75, 94.875, and 94.9375 strikes.

2. Premium Remains to Hedge Long-End Selloff

While the cost to hedge against a downturn in the long end of the yield curve has eased slightly from recent highs, it remains pricier relative to the short and middle segments. Current options market flows are skewed towards betting on a larger Treasury selloff, as exemplified by Tuesday's $11 million wager. Last week also saw a buyer of long-bond puts targeting 30-year yields to reach 4.9% by week's end, compared to a last quote of around 4.73%.

Source: Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment