Options Market Statistics: Tech Rallies as Apple Buyback Plans Boost Stock, Options Pop

News Highlights

$Apple(AAPL.US$ shares ended 5.98% higher, with option volume of nearly 2.89 million contracts, and calls accounted for 64.7% of the volume. The $180 and 185 calls expiring May 10, 2024 were traded most actively.

Technology stocks experienced a rally as investors shifted their focus back to the major tech companies, often referred to as the "Magnificent Seven." Apple's shares saw a significant increase following the announcement of an additional $110 billion share buyback plan. Despite a reported decline in iPhone sales for the fiscal second quarter, Apple's stock surged by more than 5% and approached record high levels. Investors remain optimistic about Apple's future, particularly with the anticipation of new iPhone models featuring generative artificial intelligence. Other large tech companies, such as $NVIDIA(NVDA.US$ and $Microsoft(MSFT.US$, also reached all-time highs during this period.

$GameStop(GME.US$ shares ended 29.08%. Its options trading volume was 0.19 million. Call contracts account for 84.1%% of the total trading volume. The most traded contracts are $30 calls strike price that expire on May 17th. The total volume reaches 29,398 contracts.

GameStop Corp. shares experienced a significant surge, jumping 51% over a two-day rally without any clear news driving the movement. The stock closed Friday with a 29.1% gain, marking the largest daily increase since a 35.2% rise on March 22, 2023. This rally followed a 17% rise on Thursday, which ended a three-day losing streak for the videogame retailer, often regarded as the original meme stock. The short interest in GameStop is currently at 22.5% of its public float, and the trading volume during the rally was substantially higher than the average, with 36.17 million shares traded compared to the 65-day average volume of 4.64 million shares.

The stock's performance has sparked extensive discussion and speculation on social media platforms.

"Someone wanna explain this one to me," wrote @amitisinvesting on X, formerly known as Twitter. "$GME Gamestop +45% this week. They don't even do an earnings call."

Unusual Stock Options Activity

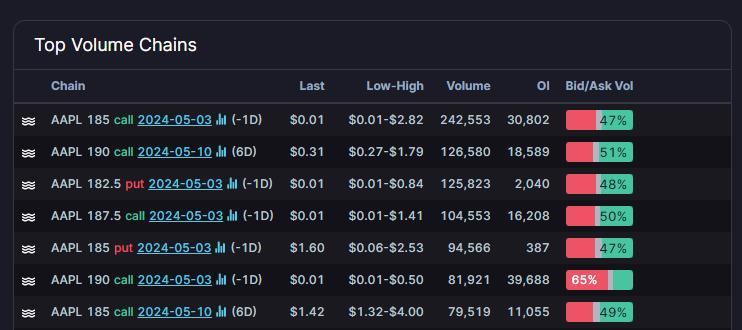

There was a noteworthy activity in $Apple(AAPL.US$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 244.4x with nearly 94,566 contracts.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment