MBDONG

liked

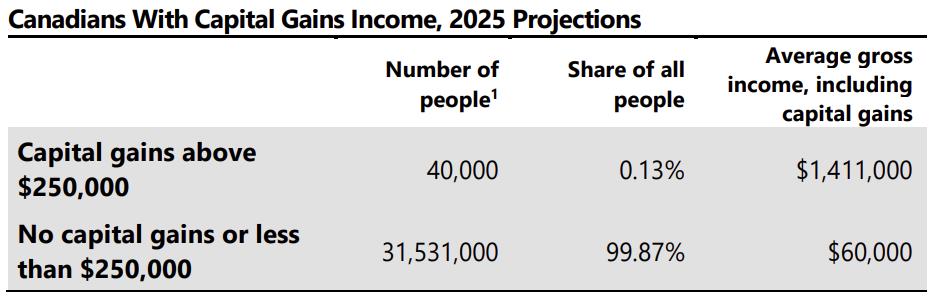

The biggest surprise of the latest federal budget was the proposed increase in the capital gains inclusion rate. The government claimed that raising taxes on the wealthy would enhance tax fairness. Only 0.1% of Canadians will be affected, but experts warned that it could also impact some middle-class taxpayers. Are you affected? How can you avoid paying high taxes?

What is the new policy on the capital gains inclusion rate?

Realized capital ...

What is the new policy on the capital gains inclusion rate?

Realized capital ...

26

MBDONG

liked

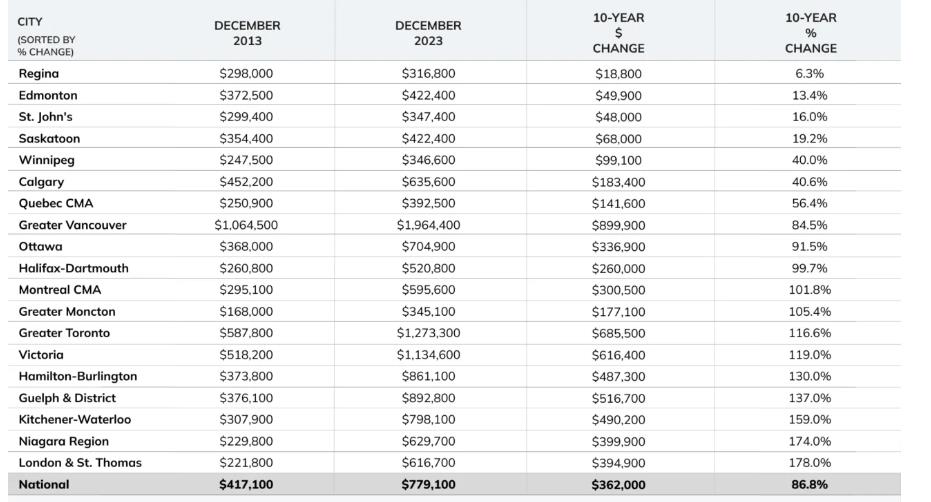

Dividend growth stocks are a time-honored tool for building wealth. With the right approach, these investments can offer a dual benefit of regular income and the potential for capital appreciation. The foundation of a sound dividend growth strategy rests on identifying companies that are not only well-managed but also boast solid financials and a track record of steadily climbing earnings.

A recent Nuveen report highlights...

A recent Nuveen report highlights...

47

MBDONG

liked

Hi all, apologies for the room temperature IQ question. I've focused most investing in Canadian based ETFs rather than in $Invesco QQQ Trust(QQQ.US$ , $SPDR S&P 500 ETF(SPY.US$ etc.

I wanted to ask about investing in stocks that are on the NYSE versus the CAD Hedged stock that appears.

The CAD hedged always appears at a much more purchasable price but is it better or worse for the long term?

Looking at some stocks like Eli Lilly (~$614USD vs $...

I wanted to ask about investing in stocks that are on the NYSE versus the CAD Hedged stock that appears.

The CAD hedged always appears at a much more purchasable price but is it better or worse for the long term?

Looking at some stocks like Eli Lilly (~$614USD vs $...

16

5

MBDONG

liked

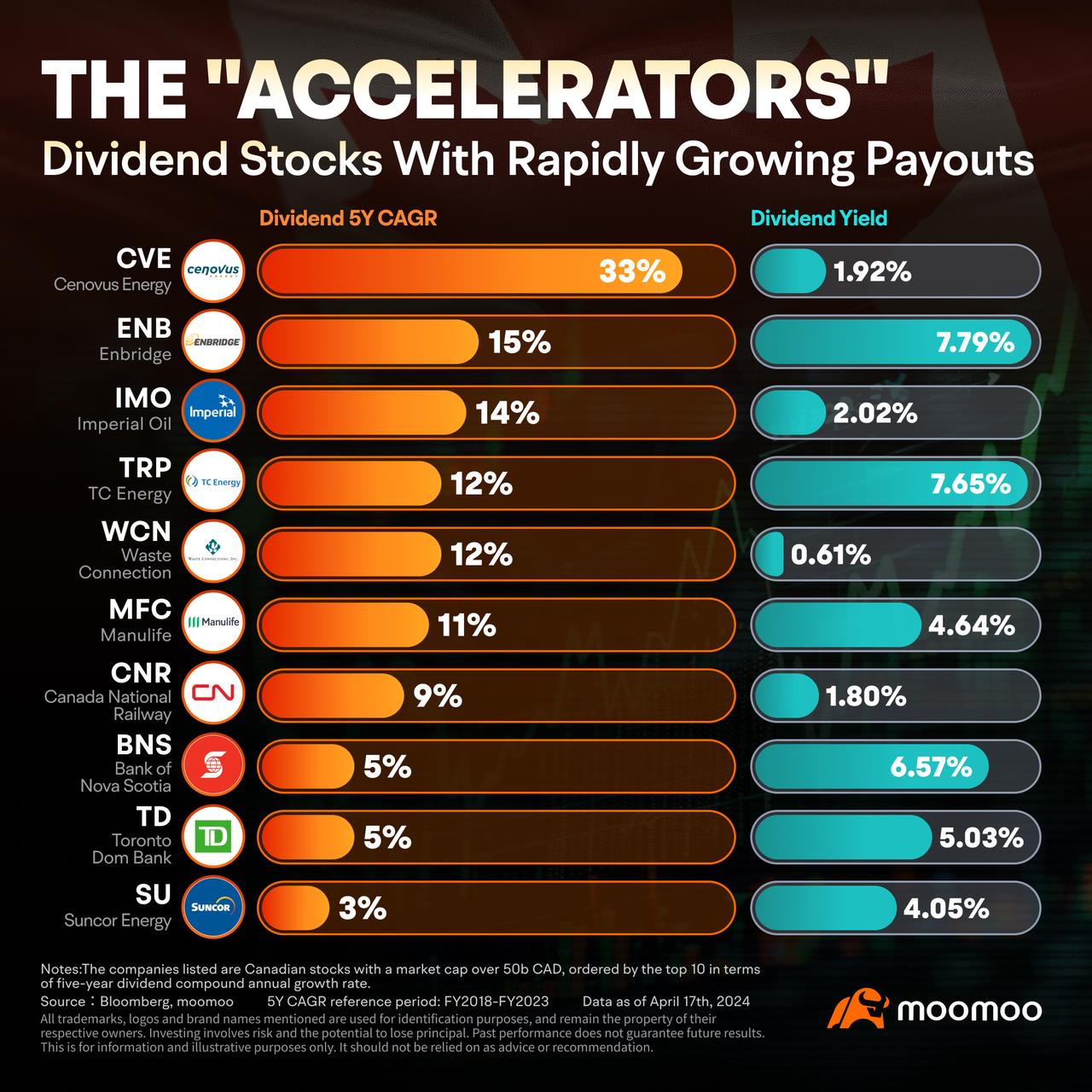

$Bitcoin(BTC.CC$

Should We Sell the News of the Halving Event?

Technically speaking, Bitcoin is still experiencing a strong rally on the longer timeframes. There is a lot of hype surrounding the Bitcoin halving event that is just around the corner. So we may or may not get a good dip opportunity any time soon. This could make sense because BTC halving artificially reduces the supply growth of BTC through mining. The laws of supply and demand will tell you this ...

Should We Sell the News of the Halving Event?

Technically speaking, Bitcoin is still experiencing a strong rally on the longer timeframes. There is a lot of hype surrounding the Bitcoin halving event that is just around the corner. So we may or may not get a good dip opportunity any time soon. This could make sense because BTC halving artificially reduces the supply growth of BTC through mining. The laws of supply and demand will tell you this ...

+7

18

27

MBDONG

liked

After a brief rebound in the US stock market, the S&P 500 index and the Dow Jones Industrial Average declined slightly, while the Nasdaq Composite rose slightly. Among the “Seven Sisters” in the tech sector, Tesla bucked the trend and recorded an increase of nearly 5%, while Meta retreated from its all-time high. The chip industry maintained a positive trend, and TSMC's shares in the US market closed up 1%, despite Nvidia falling 1%.

The strong performance of Tesla's stock price was attributed by some analysts to Elon Musk's urgent announcement of the upcoming autonomous taxi Robotaxi. This move is thought to be aimed at boosting stock prices. At the same time, in addition to its achievements in the graphics processing unit (GPU) performance competition, Nvidia also silently launched NVLink technology, which can significantly increase the data sharing speed between GPU and CPU by 5 to 12 times.

In terms of the US economy, a survey by the Federal Reserve Bank of New York shows that although US inflation expectations seem to remain stable in the short term, concerns about long-term debt have resurfaced. Crude oil prices ended six consecutive gains, while gold hit a record intraday high for seven consecutive days. In the metals market, London copper prices have rebounded to a two-year high, while tin prices have risen by nearly 3.7%, reaching a 14-month high. The price of the cryptocurrency Bitcoin has also risen, once close to a record high.

In the Chinese market, the China Securities Index ended a three-day downward trend. Ideal Auto's stock price rose by nearly 5%, while Baidu's stock price fell by more than 3%...

The strong performance of Tesla's stock price was attributed by some analysts to Elon Musk's urgent announcement of the upcoming autonomous taxi Robotaxi. This move is thought to be aimed at boosting stock prices. At the same time, in addition to its achievements in the graphics processing unit (GPU) performance competition, Nvidia also silently launched NVLink technology, which can significantly increase the data sharing speed between GPU and CPU by 5 to 12 times.

In terms of the US economy, a survey by the Federal Reserve Bank of New York shows that although US inflation expectations seem to remain stable in the short term, concerns about long-term debt have resurfaced. Crude oil prices ended six consecutive gains, while gold hit a record intraday high for seven consecutive days. In the metals market, London copper prices have rebounded to a two-year high, while tin prices have risen by nearly 3.7%, reaching a 14-month high. The price of the cryptocurrency Bitcoin has also risen, once close to a record high.

In the Chinese market, the China Securities Index ended a three-day downward trend. Ideal Auto's stock price rose by nearly 5%, while Baidu's stock price fell by more than 3%...

Translated

19

MBDONG

liked and commented on

$Sunnova Energy International(NOVA.US$ $Dow Jones Industrial Average(.DJI.US$ As I watch solar farms sprawling up around me I can only think it is time to rethink what they are doing. I am seeing some of our most productive real farms being taken permanently out of service all the while more and more people are food insecure. Why can't they strategically place the solar panels on elevated poles at varying heights in a straight row so that they do not permanently block the sunlight and the tractors can still get up and down the rows between them?

17

2

MBDONG

liked

$Microsoft(MSFT.US$ Corporate governance is a total joke nowadays. If every founder/mgmt team rigs the share count so that they maintain voting power no matter what, the incentives are totally misaligned.

Put up or shut up. If you don’t deliver for the shareholder base, they should be able to fire your a** or change management.

And what’s with the share count here? How did that even happen? 4.6 billion? Dear God why? This may be a great business I really have no idea but good luck moving a stock consistently with a float that big.

Put up or shut up. If you don’t deliver for the shareholder base, they should be able to fire your a** or change management.

And what’s with the share count here? How did that even happen? 4.6 billion? Dear God why? This may be a great business I really have no idea but good luck moving a stock consistently with a float that big.

14

5

MBDONG

liked and commented on

$Microsoft(MSFT.US$ I know you people are trying to use "regular investor guy" mentality to justify the CEO selling ½ his shares, but a CEO is not a regular guy. It shows a lack of confidence in his company and his management to sell that much all at once. Selling now to avoid paying a 7% tax later means he doesn't think the stock will go up 7% in the next year. It also lacks class, since that kind of money is just a scorecard. You don't actually spend it. So talking about tax management like you're some kind of regular guy who's saving up to buy a house is silly. He chose to sell shares because he could see that the price today is higher than it will be in the future. This is terrible optics and is a clear sign that something bad is coming. A CEO has a pretty good idea what business looks like for the next 12 months & this is a huge sell signal. Invest if you want, but don't say I didn't warn you.

17

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)