Trouble Before the Halving Event?

Should We Sell the News of the Halving Event?

Technically speaking, Bitcoin is still experiencing a strong rally on the longer timeframes. There is a lot of hype surrounding the Bitcoin halving event that is just around the corner. So we may or may not get a good dip opportunity any time soon. This could make sense because BTC halving artificially reduces the supply growth of BTC through mining. The laws of supply and demand will tell you this is somewhat bullish for the asset price.

Then again past halving events were associated with a substantial selloff before the halving rally truly began. Some investors believe it will be a sell the news event like in the past. A lot of Altcoins seem to be crashing already. But the major coins, like ETH and BTC, are still holding up. Nobody truly knows what will happen. But if we do get any downside, then I think investors will be pounding the table while screaming, "Buy the dip!"

As for the crypto mining industry, the halving event will literally cut in half their current revenues from BTC mining operation. Without increased capital expenditures via upgrading mining equipment, mining companies will likely be hurt from this halving event.

Breakout or Breakdown?

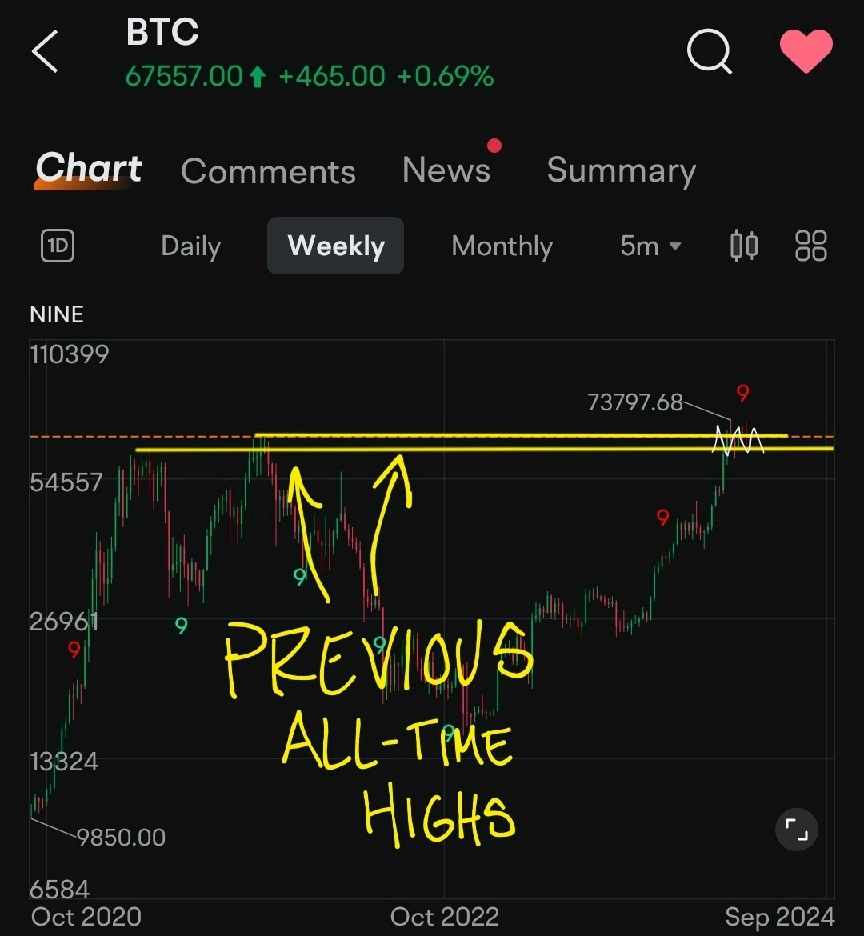

Bitcoin's price action has been consolidating ever since printing new all-time highs over 5 weeks ago. This friction in price movement is transpiring near previous all-time highs. This is normal to see on just about any chart. But how long will this consolidation last? Will BTC break out to the upside and make new all-time highs very soon? Or will we see the price break down below the ranging pattern?

When is the Next Good Dip?

I'm assuming a lot of investors are waiting for a good dip to buy. Especially since the price has rallied so sharply over the past several months. Even though I believe there is more upside in the crypto space, it is not always the best idea to be buying in near all-time highs while the price is in mid-consolidation.

Blow-Off Top?

You can see how the price melted up and out of its long-term price channel. We might be seeing a blow-off top as the price action is beginning to show possible signs of weakness. If it is a true blow-off top, then I would expect the price to have some degree of a pull back towards a previous demand zone.

Will We Ever See a Good Discount in BTC Again?

BTC is in a very strong rally, so if there is a pullback, then I would expect it to be short-lived. But if you are a long-term investor or you have a large amount of capital that you are waiting to deploy into BTC, then I would prefer to wait for a substantial dip rather than a short-term dip. With how crazy BTC can rally, this could possibly be the wrong strategy. But personally, for long-term investments, I like to wait for a very cheap discount.

I believe a good discount could be found near the long-term Fibonacci levels that coincide with previous highs or lows of past consolidation zones. You can see these levels in the chart below.

If we see the price actually fall that low, then I think we will all be very lucky. I think it will be very difficult for BTC to get back down to those low prices without some sort of crypto black swan event.

Rallying Support

The long-term picture still looks very strong. Before we can even consider any kind of long-term dip, we must see some kind of long-term weakness. There is a trending support level to watch in case of a true dip. This support line almost perfectly coincides with the 100-day SMA. These two technical support lines are key levels as they have propped up the current rally.

If the price drops below this support line, then that would be the first sign of long-term weakness. At that point, those good discounts I mentioned would seem a lot more attainable. But based on the current state of the crypto markets, I think a rebound near this area is more probable than a breakdown.

Short-Term Weakness

The long-term trend is still good. But the smaller timeframes are already showing signs of weakness. Aside from the fact that the strong rally has essentially stalled for 5 weeks, the price has recently dipped below the 50-day moving average. This is the first sign of weakness in the short term.

Last time this happened, the price reverted back to the 100-day moving average. This would be the key support zone to watch as it is the moving average that has held up the current rally. Dipping below the 100-day moving average would change the short-term weakness into long-term weakness.

More short-term weakness is apparent as the price has recently dipped below support of the short-term price channel seen in the chart directly below. If you are a short-term swing trader like me, then you might be looking for a short-term dip to buy at this point. Which is why I'm writing these comments.

Near-Term Support Zones

As I've mentioned, BTC is in a strong rally that has stalled recently. You can see this in the chart below. The price action has been consolidating around previous all-time highs.

This ranging pattern can last a while. But since the crypto market is showing signs of weakness, it would be wise to take note of the short-term support levels just in case we get a good dip to buy. In a strong rally, the more local or near-term support levels catch the rebounds.

We can't consider any dip until the price drops below previous lows. That would officially put an end to the consolidation pattern as new lows will have been printed. As a matter of fact, the previous lows would possibly be a good entry for a short-term dip buy if the price were to stay within the consolidating range it has been in for several weeks.

There is somewhat of a gap in price below the previous lows. So, I would expect there to be little support within this area. Although there is a Fib level to watch that passes through the gap.

Fibonacci Support

You can see the long-term Fibonacci levels in the chart below. Along with the previous consolidation zone and a long-term support line, these would be the ares to watch for a potential rebound if we do get a pullback.

It seems like a lot to pay attention to but these areas are hundreds of dollars apart.

Update: 4/13/2024 5:50 Eastern U.S.

I almost forgot to mention the near-term Fib levels. The levels I have highlighted are in the same areas as other levels I have highlighted in this post. This confluence only adds to the validity of the potential support zones.

So what do you think Moo'ers? Will we see a pullback before the halving event? Will we see a pullback after the event? Will we see a the rally return very soon? Or will it be just business as usual following the halving event?

Good Luck Trading

As always, I am not a financial professional, and this is not investment advice. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Don't invest money that you can't afford to lose. Give some of your investments time and know when to cut your losses.

Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. Do your own due diligence. And just follow the trends. A trend is your friend. Good luck trading.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SpyderCallOP : @digimonX

Check it out. This is how I am looking at the charts. I have some short and long-term levels mapped out. BTC is still strong so a substantial long-term pullback is unlikely. But we could possibly see a short-term dip soon since the rally has stalled and the price action has begun to consolidate.

101750182 : Better hold or sell? Halving meant not good situation for miners company like Mara ryt?

EZ_money : half the people can't understand some of that. I'm sorry but a bullish rally? that kinda ended after hitting ATH. supply and demand? you are still adding to the overall existing numbers being traded that's called inflation which technically lowers the value just like everything else. does not matter if the miners can only collect half. there is no supply and demand law on the market you're always going to have buyers and sellers. there's also no law stating that they can't create more Bitcoin if they wanted to. if i print more money it deflates the value because it's always being traded as a promise note that it's worth something. still adding more no matter how you try spinning the bullshite

SpyderCallOP 101750182: Supposedly that is the case. They will obviously make more money when BTC's price rises. But they will only be able to mine half as much. So BTC needs to double for them to get back to their pre-halving margins. Or they need to upgrade their mining equipment somehow to mine BTC faster. If they don't do any of this, then it will definitely be trouble for crypto miners.

101750182 : Then better to hold? Or get rid this stock asap?

EZ_money SpyderCallOP: that's easy the ones who can afford to upgrade will dominate and others will fall. just like the banking system

ACQUAcoin Fib786 : The 2020 yearly candle is going to retrace down further than 50% #Hindsight is 2020 * I picked after to be different.

SpyderCallOP ACQUAcoin Fib786: You could be right. A lot of people are comparing now to previous halving events.

SpyderCallOP ACQUAcoin Fib786: but a 50% retracement would be massive. You could definitely be right, though. Who knows?

SpyderCallOP 101750182: No reason to let go just yet. If the selling gets more momentum then I would worry. But if you like to swing trade some crypto, the. you might get a good dip buy soon if the current selling continues. I mean bitcoin is down over a percent in the last 24 hours.

View more comments...