keepingit100

liked

2021 is an unusual year for the stock market. Despite the worry of inflation and pandemic, the US stock market is on its longest bull-run in history. Kicked off with the mania of WSB, the market keeps heading north and ends at nearly all-time highs.

Event 1: WSB Beat Hedge Funds

Date: Jan 2021

At the beginning of this year, a group of millennials revolved around $GameStop(GME.US$, a retail company that struggled with selling video games, to fight against hedge funds. After WallStreetBets pumped GameStop's stock price to unprecedented heights, some institutional investors who shorted the company's stocks almost bankrupted. Following the rule of "Go big or go home", WSB turned to other "meme stocks" such as $AMC Entertainment(AMC.US$ , whose stock price soared by 455% in Q2.

Mooer's takeaways: What makes you profit or lose from the market?

@GT1982 shared two lingos in particular:

1) DYODD

Do your own due diligence as always. To summarise this, it means never copy or act on an investment idea based on hearsay without studying the company first.

2) FOMO.

Fear of missing out. Many investors, new and veteran alike, are guilty of this. Very often this leads to a painful loss. In short, do not chase a stock just because many are doing it. Study the company fundamentals first which essentially is related to lingo No. 1.

View More>>

Event 2: Global Chip Shortages

Date: May 2021

The global shortage of microchips has become a severe problem in 2021. The gap between insufficient supply and surging demand causes dilemmas for companies desperate for chips. Semiconductors are necessary for cars, PCs, smartphones, etc. Manufacturers of these products are facing an unprecedented situation. However, a crisis for one could be an opportunity for another. Since the market crashed in March 2020, the $PHLX Semiconductor Index(.SOX.US)$ has more than doubled.

Mooer's takeaways: What is the "DNA" of technology

@HuatLady said:

In this millennium, our reliance on the use of semiconductor for technological advances is undisputed worldwide. Automobiles, smartphones, home appliances and wireless networks depend heavily on the use of semiconductors. This is what "makes the world goes round", and is the "DNA" of technology.

The key challenges are:

1) The inability to meet the market's demands. Since 2019, there is an acute shortage of chips' supply globally. These high demands for chips may stretch into 2023. This will incur a 27% loss if there is a 3 months' delay in manufacturing.

2) Hence the cost of manufacturing may not meet planned budget. After weighing through both the positive and negative aspects of semiconductor investment, I opt to follow my heart and favours the trading of quality semiconductor shares as a long term investment.

View More>>

Event 3: S&P 500 Doubled amid a Pandemic Dip

Date: Aug2021

In August 2021, the $S&P 500 Index(.SPX.US$ rallied 100% from the pandemic dip since March 2020, becoming another milestone for the US stock market.

Mooer's takeaways: How to invest at a market high?

@Dadacai said:

There is a possibility of market correction and funds being stuck when investing during market highs so my approaches are as follows:

1) Choose stocks I have confidence in and don't mind holding for the long term.

2) Split the purchases into 3 or more lots at different timings to average out the cost.

3) For intraday trading, choose stocks which have a high volume of trading and set a stop loss.

4) Don't invest what I cannot afford to lose.

View More>>

Event 4: Metaverse, the Next Generation of the Internet

Date: Oct 2021

Metaverse is regarded as the next generation of the Internet by some institutions. It's a can't-miss concept in 2021 that may lead to an investing buzz in the next decade. To attract market attention, tech giants have laid out their versions of the metaverse. On October 28, Facebook $Meta Platforms(FB.US$ officially changed its corporate name to Meta as part of a major rebrand, shaking off the social media by launching new strategies to go "all in" to the metaverse.

Mooer's takeaways: Are Metaverse and playing games with VR the same?

@NANA123 said:

The reason why people distinguish the virtual world from the real world is because the virtual world generated by the platform-style Internet at this stage cannot carry people's asset rights and social identity. The identity achievements and assets acquired by people in the virtual world are in the hands of platform operators. If the operator chooses to close the platform or close the account forcefully, everything you've gained on the platform goes up in smoke. However, the rapid development of blockchain technology in recent years has derived a decentralized Internet form, which effectively guarantees the transparency and certainty of the virtual world rules generated under this form.

View More>>

Event 5: EV Mania

Date: Nov2021

On October 21, $Tesla(TSLA.US$ released the 2021 Q3 earnings that beat the market's expectations. Its stock price increased by 22% in a week. When Tesla's stock price hit a record high of 1243.49 dollars, the shareholders started to buckle up. Meanwhile, other EV stocks were also growing fast. Rivian, a rival of Tesla, saw its price soared by 120% five trading days after it got listed. Lucid also yielded good results.

Mooer's takeaways: How much risk are you comfortable with?

@HopeAlways said:

The stock market appears to be giving incredibly high valuations to EV stocks, whether the companies have proven themselves effective manufacturers or not. As with the EV stocks, there will be winners and losers, and these investments seem to belong to the more speculative portion of a stock portfolio. Understanding individual risk tolerance level is an important step in determining which EV stock is suitable for investors.

View More>>

Which event do you like the most? Does any of the events above ring the bell?

Feel free to leave your comments below!

Click for More>>

+3

137

25

keepingit100

reacted to

Elon Musk doesn't think his tweets have the power to move markets.![]()

![]()

In an interview on Monday, Musk discussed his $Twitter (Delisted)(TWTR.US$ habit, a pastime that makes him easily the most famous CEO on the planet and probably the most adored and most criticized in equal measure.

Markets move themselves all the time, based on nothing as far as I can tell. So the statements that I make, are they materially different from random movements of the stock that might happen anyway? I don't think so.

—— Musk told Time.

However, there are several examples of $Tesla(TSLA.US$'s stock moving following a Musk tweet.![]()

![]()

In 2018, Musk faced the ire of the SEC over a tweet claiming he had "funding secured" to take Tesla private at $420 per share — the share price being a drug reference and a joke to impress his then-girlfriend, Grimes. The tweet sent Tesla's share price skyrocketing 14%.

In 2020, Musk tweeted that he thought Tesla's stock price was "too high," shares of the automaker dropped by about 9%.

Last month, Tesla shares dipped after Musk tweeted that the company hadn't yet signed a deal with Hertz, despite the car-rental firm announcing it had ordered 100,000 Tesla Model 3 sedans, the largest-ever electric vehicle purchase.

Also last month, Tesla dropped 7% after Musk asked his Twitter followers whether he should sell 10% of his Tesla stock — 3.5 million people voted in the poll in 24 hours.

Source: businessinsider

In an interview on Monday, Musk discussed his $Twitter (Delisted)(TWTR.US$ habit, a pastime that makes him easily the most famous CEO on the planet and probably the most adored and most criticized in equal measure.

Markets move themselves all the time, based on nothing as far as I can tell. So the statements that I make, are they materially different from random movements of the stock that might happen anyway? I don't think so.

—— Musk told Time.

However, there are several examples of $Tesla(TSLA.US$'s stock moving following a Musk tweet.

In 2018, Musk faced the ire of the SEC over a tweet claiming he had "funding secured" to take Tesla private at $420 per share — the share price being a drug reference and a joke to impress his then-girlfriend, Grimes. The tweet sent Tesla's share price skyrocketing 14%.

In 2020, Musk tweeted that he thought Tesla's stock price was "too high," shares of the automaker dropped by about 9%.

Last month, Tesla shares dipped after Musk tweeted that the company hadn't yet signed a deal with Hertz, despite the car-rental firm announcing it had ordered 100,000 Tesla Model 3 sedans, the largest-ever electric vehicle purchase.

Also last month, Tesla dropped 7% after Musk asked his Twitter followers whether he should sell 10% of his Tesla stock — 3.5 million people voted in the poll in 24 hours.

Source: businessinsider

+1

32

10

keepingit100

liked

$Bitcoin(BTC.CC$ $Dogecoin(DOGE.CC$ $Ethereum(ETH.CC$ $Coinbase(COIN.US$ Cryptocurrency mining has risen in popularity in recent times, given the massive interest from regular folks.

However, as more people are trooping in to join the crypto mining network, does that make it any easy for someone without prior knowledge in the crypto space?

What is Crypto Mining?

In the absence of the jargon terminologies, crypto mining in simple terms refers to the process by which a new digital asset (say Bitcoin, for instance) is being injected into circulation. Likewise, crypto mining could also mean the process by which new crypto transactions are validated within a blockchain by the network nodes or validators.

How does mining work?

Mining can be performed using different approaches including cloud mining, CPU mining, GPU mining and ASIC mining. However, while these approaches employ different mechanisms and facilities, they all achieve the same purpose.

Notably, a miner deploys different computational machines (as listed above) to solve complex mathematical equations using cryptographic hashes.

How easy is it to mine cryptocurrency?

Contrary to the general opinion, mining is not rocket science, and it’s not only reserved for developers or people with software development skills alone. On the other hand, anyone can become a miner, provided that you are willing to acquire basic crypto knowledge.

Part of the content is taken from Yahoo.

However, as more people are trooping in to join the crypto mining network, does that make it any easy for someone without prior knowledge in the crypto space?

What is Crypto Mining?

In the absence of the jargon terminologies, crypto mining in simple terms refers to the process by which a new digital asset (say Bitcoin, for instance) is being injected into circulation. Likewise, crypto mining could also mean the process by which new crypto transactions are validated within a blockchain by the network nodes or validators.

How does mining work?

Mining can be performed using different approaches including cloud mining, CPU mining, GPU mining and ASIC mining. However, while these approaches employ different mechanisms and facilities, they all achieve the same purpose.

Notably, a miner deploys different computational machines (as listed above) to solve complex mathematical equations using cryptographic hashes.

How easy is it to mine cryptocurrency?

Contrary to the general opinion, mining is not rocket science, and it’s not only reserved for developers or people with software development skills alone. On the other hand, anyone can become a miner, provided that you are willing to acquire basic crypto knowledge.

Part of the content is taken from Yahoo.

22

1

keepingit100

liked

Neuralink, cofounded by Musk in 2016, is developing a chip that would be implanted in people's brains to simultaneously record and stimulate brain activity. It is intended to have medical applications such as treating serious spinal cord injuries and neurological disorders. ![]()

![]()

![]()

Neuralink hopes to have their first implant devices in humans by 2022, pending FDA approval, Elon Musk said in an interview with the Wall Street Journal, hoping they could restore full-body functionality to quadriplegics.![]()

![]()

![]()

On Twitter, the billionaire entrepreneur clarified that "I am definitely not saying that we can for sure do this, but I am increasingly confident that this is possible."![]()

![]()

![]()

Neuralink made waves in the spring of 2021 when a video of a monkey implanted with a Neuralink implant was seen playing a video game telepathically.![]()

![]()

![]()

Neuralink's working well in monkeys and we're actually doing just a lot of testing and just confirming that it's very safe and reliable and the Neuralink device can be removed safely. We hope to have this in our first humans — which will be people that have severe spinal cord injuries like tetraplegics, quadriplegics — next year, pending FDA approval."

—— Musk said.

Mooers, do you think whether the Neuralink's brain chips could be successfully implanted in humans in 2022? Will you accept such brain implants?![]()

![]()

![]()

Source: THEJERUSALEM POST, INSIDER

Neuralink hopes to have their first implant devices in humans by 2022, pending FDA approval, Elon Musk said in an interview with the Wall Street Journal, hoping they could restore full-body functionality to quadriplegics.

On Twitter, the billionaire entrepreneur clarified that "I am definitely not saying that we can for sure do this, but I am increasingly confident that this is possible."

Neuralink made waves in the spring of 2021 when a video of a monkey implanted with a Neuralink implant was seen playing a video game telepathically.

Neuralink's working well in monkeys and we're actually doing just a lot of testing and just confirming that it's very safe and reliable and the Neuralink device can be removed safely. We hope to have this in our first humans — which will be people that have severe spinal cord injuries like tetraplegics, quadriplegics — next year, pending FDA approval."

—— Musk said.

Mooers, do you think whether the Neuralink's brain chips could be successfully implanted in humans in 2022? Will you accept such brain implants?

Source: THEJERUSALEM POST, INSIDER

100

49

keepingit100

liked

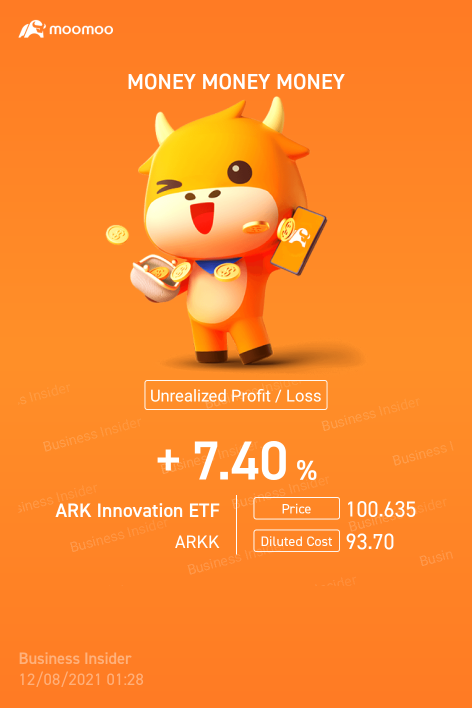

$Palantir(PLTR.US$

Is in the green. But will this last?

As usual, DCA is the best strategy in the long run.

$ARK Innovation ETF(ARKK.US$

Is in the green. But will this last?

As usual, DCA is the best strategy in the long run.

$ARK Innovation ETF(ARKK.US$

16

keepingit100

commented on and voted

In trading on Friday, shares of $AMC Entertainment(AMC.US$ and $GameStop(GME.US$ crossed below their 200-day moving average.

AMC shares were trading lower last week after the CDC confirmed the first Omicron case in the US. Theaters shut down in 2020 amid the start of the pandemic and variant uncertainty has driven fears of possible lockdown measures.

AMC closed Friday’s session lower by 4.2% at $29.01, well off the stock's intraday low of $25.31.

Shares of GameStop, were trading lower as well, following worse-than-expected US job growth data.

GameStop closed Friday’s session lower by 5.1% at $172.39, off the intraday low of $159.05.

If you had $1,000 right now, would you buy the dip in AMC or GME?

AMC shares were trading lower last week after the CDC confirmed the first Omicron case in the US. Theaters shut down in 2020 amid the start of the pandemic and variant uncertainty has driven fears of possible lockdown measures.

AMC closed Friday’s session lower by 4.2% at $29.01, well off the stock's intraday low of $25.31.

Shares of GameStop, were trading lower as well, following worse-than-expected US job growth data.

GameStop closed Friday’s session lower by 5.1% at $172.39, off the intraday low of $159.05.

If you had $1,000 right now, would you buy the dip in AMC or GME?

79

83

keepingit100

liked

Weekly market recap

S&P 500 futures were higher even after a losing week on Wall Street as investors ditched equities amid concerns over the new omicron Covid variant and the Federal Reserve's move to tighten policy.

Nasdaq stock futures were the underperformer on Sunday following a big drop in bitcoin over the weekend and as investors continued to rethink owning tech stocks with high valuations.

Futures contracts tied to the $Dow Jones Industrial Average(.DJI.US$ gained 163 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures were 0.35% higher. $NASDAQ 100 Index(.NDX.US$ futures hovered around the flatline.

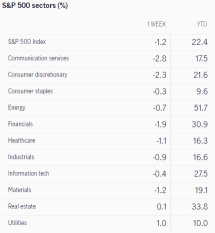

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Meme stock darling GameStop headlines next week's earnings report lineup. The videogame retailer reports results after the market closes on Wednesday. AutoZone, Casey's General Stores, and Toll Brothers report earnings on Tuesday, followed by Brown-Forman and Campbell Soup on Wednesday. Broadcom, Costco Wholesale, and Hormel Foods round things out on Thursday.

On Monday, Union Pacific will hold a conference call to discuss its climate action plan. McKesson and Southwest Airlines host their 2021 investor days on Wednesday, followed by CVS Health and Tyson Foods on Thursday.

The Federal Reserve's report on consumer credit data for October will be released on Tuesday. On Thursday, the U.S. Labor Department reports initial jobless claims for the week ending on Dec. 4.

The Bureau of Labor Statistics releases the consumer price index for November on Friday. The consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously.

Monday 12/6

$Union Pacific(UNP.US$ holds a conference call to discuss its climate action plan.

Tuesday 12/7

$AutoZone(AZO.US$ , $Caseys General Stores(CASY.US$, and $Toll Brothers(TOL.US$ announce quarterly results.

The Federal Reserve reports on consumer credit data for October. After falling slightly last year, total outstanding consumer debt has risen an average of $20 billion a month through September, and stands at a record $4.37 trillion.

Wednesday 12/8

The BLS releases the Job Openings and Labor Turnover Survey. Economists forecast 10.5 million job openings on the last business day of October, only 600,000 less than the record high of 11.1 million in July.

$Brown-Forman-A(BF.A.US$, $Campbell Soup(CPB.US$, and $GameStop(GME.US$ report earnings.

$McKesson(MCK.US$ and $Southwest Airlines(LUV.US$ host their 2021 investor days.

$Edwards Lifesciences(EW.US$ holds an investor conference in Irvine, Calif. The company will discuss its product pipeline as well as its financial outlook for 2022.

The Bank of Canada announces its monetary-policy decision. The central bank is expected to keep its key short-term interest rate unchanged at 0.25%. At its late-October meeting, the bank ended its quantitative-easing program and signaled that its first interest-rate hike would be earlier in 2022 than had been expected.

Thursday 12/9

$Broadcom(AVGO.US$, $Costco(COST.US$, and $Hormel Foods(HRL.US$ hold conference calls to discuss quarterly results.

$CVS Health(CVS.US$ and $Tyson Foods(TSN.US$ host their annual investor days.

The Department of Labor reports initial jobless claims for the week ending on Dec. 4. Jobless claims averaged 238,750 in November, the lowest since the beginning of the pandemic, and just 24,750 more than in February of 2020.

Friday 12/10

$Archer Daniels Midland(ADM.US$ holds its global investor day.

$Centene(CNC.US$ holds an investor meeting and will provide financial guidance for 2022.

The Bureau of Labor Statistics releases the consumer price index for November. Consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously. October's 6.2% increase was the hottest the CPI has run in more than 30 years, and this past week Federal Reserve Chairman Jerome Powell finally ditched "transitory" when discussing inflation before the Senate Banking Committee.

The University of Michigan releases its Consumer Sentiment index for December. Economists forecast a 66 reading, slightly less than the November data.

Source: CNBC, Dow Jones Newswires, jhinvestments

S&P 500 futures were higher even after a losing week on Wall Street as investors ditched equities amid concerns over the new omicron Covid variant and the Federal Reserve's move to tighten policy.

Nasdaq stock futures were the underperformer on Sunday following a big drop in bitcoin over the weekend and as investors continued to rethink owning tech stocks with high valuations.

Futures contracts tied to the $Dow Jones Industrial Average(.DJI.US$ gained 163 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures were 0.35% higher. $NASDAQ 100 Index(.NDX.US$ futures hovered around the flatline.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Meme stock darling GameStop headlines next week's earnings report lineup. The videogame retailer reports results after the market closes on Wednesday. AutoZone, Casey's General Stores, and Toll Brothers report earnings on Tuesday, followed by Brown-Forman and Campbell Soup on Wednesday. Broadcom, Costco Wholesale, and Hormel Foods round things out on Thursday.

On Monday, Union Pacific will hold a conference call to discuss its climate action plan. McKesson and Southwest Airlines host their 2021 investor days on Wednesday, followed by CVS Health and Tyson Foods on Thursday.

The Federal Reserve's report on consumer credit data for October will be released on Tuesday. On Thursday, the U.S. Labor Department reports initial jobless claims for the week ending on Dec. 4.

The Bureau of Labor Statistics releases the consumer price index for November on Friday. The consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously.

Monday 12/6

$Union Pacific(UNP.US$ holds a conference call to discuss its climate action plan.

Tuesday 12/7

$AutoZone(AZO.US$ , $Caseys General Stores(CASY.US$, and $Toll Brothers(TOL.US$ announce quarterly results.

The Federal Reserve reports on consumer credit data for October. After falling slightly last year, total outstanding consumer debt has risen an average of $20 billion a month through September, and stands at a record $4.37 trillion.

Wednesday 12/8

The BLS releases the Job Openings and Labor Turnover Survey. Economists forecast 10.5 million job openings on the last business day of October, only 600,000 less than the record high of 11.1 million in July.

$Brown-Forman-A(BF.A.US$, $Campbell Soup(CPB.US$, and $GameStop(GME.US$ report earnings.

$McKesson(MCK.US$ and $Southwest Airlines(LUV.US$ host their 2021 investor days.

$Edwards Lifesciences(EW.US$ holds an investor conference in Irvine, Calif. The company will discuss its product pipeline as well as its financial outlook for 2022.

The Bank of Canada announces its monetary-policy decision. The central bank is expected to keep its key short-term interest rate unchanged at 0.25%. At its late-October meeting, the bank ended its quantitative-easing program and signaled that its first interest-rate hike would be earlier in 2022 than had been expected.

Thursday 12/9

$Broadcom(AVGO.US$, $Costco(COST.US$, and $Hormel Foods(HRL.US$ hold conference calls to discuss quarterly results.

$CVS Health(CVS.US$ and $Tyson Foods(TSN.US$ host their annual investor days.

The Department of Labor reports initial jobless claims for the week ending on Dec. 4. Jobless claims averaged 238,750 in November, the lowest since the beginning of the pandemic, and just 24,750 more than in February of 2020.

Friday 12/10

$Archer Daniels Midland(ADM.US$ holds its global investor day.

$Centene(CNC.US$ holds an investor meeting and will provide financial guidance for 2022.

The Bureau of Labor Statistics releases the consumer price index for November. Consensus estimate is for a 6.7% year-over-year jump, half a percentage point more than in October. The core CPI, which excludes volatile food and energy prices, is expected to rise 4.8% versus 4.6% previously. October's 6.2% increase was the hottest the CPI has run in more than 30 years, and this past week Federal Reserve Chairman Jerome Powell finally ditched "transitory" when discussing inflation before the Senate Banking Committee.

The University of Michigan releases its Consumer Sentiment index for December. Economists forecast a 66 reading, slightly less than the November data.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

86

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)