kaya butter

liked

kaya butter

voted

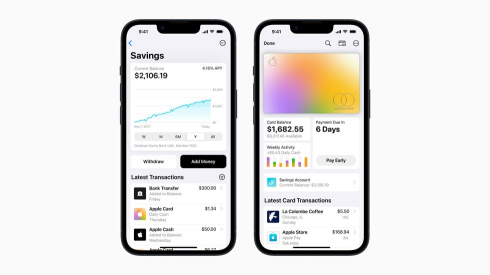

$Apple(AAPL.US$ has rolled out an Apple Card high-yield savings account from $Goldman Sachs(GS.US$ , the company said in a release dated Monday.

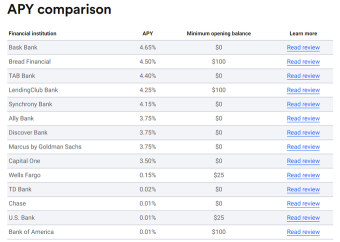

The account, which has no fees, no minimum deposits and no minimum balance requirements, offers an annual percentage yield of 4.15%, As of April 12, the national average yield for savings accounts is 0.24% APY, AAPL s offer would thus more than...

The account, which has no fees, no minimum deposits and no minimum balance requirements, offers an annual percentage yield of 4.15%, As of April 12, the national average yield for savings accounts is 0.24% APY, AAPL s offer would thus more than...

+1

12

1

kaya butter

commented on

Spoiler:

Reward points await at the end of this post. Don't miss it!

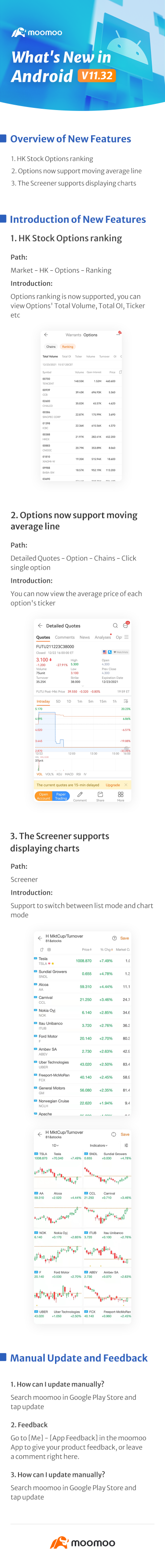

Hi, mooers!

Welcome back to "What's new in moomoo"!

This time we have some new features or optimizations from Android v11.32 ready for you, including HK Stock options ranking, the moving average line feature for options etc. Let's scroll down and take a glance at the new features one by one!

Let's vote!

Last but not least, question for today:

What m...

Reward points await at the end of this post. Don't miss it!

Hi, mooers!

Welcome back to "What's new in moomoo"!

This time we have some new features or optimizations from Android v11.32 ready for you, including HK Stock options ranking, the moving average line feature for options etc. Let's scroll down and take a glance at the new features one by one!

Let's vote!

Last but not least, question for today:

What m...

63

58

Reward those who join Moomoo as pioneer by giving free FUTU shares!

Rewards or Cashback for trading!

Rewards or Cashback for trading!

2

kaya butter

liked

$BNGO — STOCK & OPTION PLAY

NEED IT TO BREAK OVER: $6.26

key indicator for MORE uptrend $6.37

confirmation uptrend - $6.59

mini breakout - $6.63

full breakout - $7.03

SEMI PARABOLIC - $7.87

stop loss — $5.97

& support - $5.65. $Bionano Genomics(BNGO.US$

NEED IT TO BREAK OVER: $6.26

key indicator for MORE uptrend $6.37

confirmation uptrend - $6.59

mini breakout - $6.63

full breakout - $7.03

SEMI PARABOLIC - $7.87

stop loss — $5.97

& support - $5.65. $Bionano Genomics(BNGO.US$

10

3

kaya butter

liked

$Fortinet(FTNT.US$ Fortinet (FTNT) target raised by KeyCorp from $324 to $370 at Overweight. Stock currently around $331

$Goldman Sachs(GS.US$ Goldman Sachs (GS) target raised by Wells Fargo from $430 to $450 at Overweight. Stock currently around $415

$HCA Healthcare(HCA.US$ HCA Healthcare (HCA) with a host of target raises. Average price target $300 at Buy. Stock currently around $242

$JPMorgan(JPM.US$ JP Morgan (JPM) target raised by Wells Fargo from $200 to $210 at Overweight. Stock currently around $171

$Microsoft(MSFT.US$ Microsoft (MSFT) target raised by KeyCorp from $342 to $365 at Overweight. Stock currently around $309

$Goldman Sachs(GS.US$ Goldman Sachs (GS) target raised by Wells Fargo from $430 to $450 at Overweight. Stock currently around $415

$HCA Healthcare(HCA.US$ HCA Healthcare (HCA) with a host of target raises. Average price target $300 at Buy. Stock currently around $242

$JPMorgan(JPM.US$ JP Morgan (JPM) target raised by Wells Fargo from $200 to $210 at Overweight. Stock currently around $171

$Microsoft(MSFT.US$ Microsoft (MSFT) target raised by KeyCorp from $342 to $365 at Overweight. Stock currently around $309

5

1

kaya butter

commented on

Q&A is a session under a company's earnings conference that institutional and retail investors ask some most-concerned questions to the management. On this page, you can find out some valuable info that might affect the stock price in the following weeks. $Tesla(TSLA.US$

Key Takeaways:

Attitudes: management feel very optimistic in the long term, but there's also a lot of uncertainty right now.

Goals: the company's goal is to grow on an average pace of 50% per year, and ultimately be able to achieve 20 million cars per year.

Products: the company is working on a strategy to increase production rates as quickly as possible. Cybertruck is expected to launch by next year.

Do you still expect to start production of the $25,000 model in 2023. What are the biggest hurdles from now until then?

Yeah, we're working on a strategy to increase our production rates as quickly as possible. We don't want to add any new vehicles to our lineup when we're generally is in a cell constrained world. While there is still more runway to grow these existing products, we are focused on Model Y expansion and also in Berlin, ramping S&X further in Fremont to restore to pass levels, while also growing 3 and Y production in Fremont in Shanghai.

After Model Y in Austin, our next product launch will be Cybertruck. And that's time and course depend on increasing cell capacity and completing our currently full plate of products on the table.

What is Tesla 's goal for vehicle production capacity for the current factories?

Our goal as a Company here is to grow on an average pace of 50% per year. I think that will be a difficult goal, but that's the goal that the internal team has. And they're going to continue to push on that. We're trying to get to 5,000 cars a week as soon as we can. And then we'll continue to push beyond that, potentially even getting to 10,000 cars per week at those factories. And then we will add Cybertruck here in Austin and continue to grow from there. So, our goal is to get to millions of cars per year over the next couple of years. And then ultimately in the long term, be able to achieve 20 million cars per year.

Is Tesla considering any other ideas other than FSD with the real-world AI that can bring additional software revenue to Tesla?

Sure. At AI Day we did talk about potential future where Dojo could be used as a neural net training platform for other companies. It's not a focus of ours today as we are fully subscribed on Dojo with our internal uses, we do expect to continue to improve the in-car experience in the context of FSD

Elon said that we get an update on Cybertruck in November a year ago, but it hasn't happened and we know there are a lot of updates. Will you show off the new and improved Cybertruck?

We get a lot of questions on Cybertruck. We've been busy detailing the Cybertruck to achieve the prototype version we shared with customers awhile back. As you may have seen recently on social media, we've built a number of alphas and are currently testing those to further mature the design. We'll continue to work through the product in the beta stages that we're in now and look to launch that by next year.

You hit low-teens operating margins. That was your medium-term target. You're there now, despite the number of challenges and not full utilization to the plan. How are you thinking about that target now?

we've actually exceeded our long-term guidance on our operating margin target. As full self-driving matures, as take rates increase, if we are to raise pricing on that, there's considerable upside both on gross margins and operating margin as that comes to light, as the business starts to become more of a mix of a hardware-based Company and a software-based Company.

So, we feel optimistic about the journey --very optimistic about the journey as we look over into the long term, just a little bit difficult over the next 4 to 5 quarters. There's just a lot of uncertainty in the world right now.

This article is a script from the Q&A session of Tesla's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: management feel very optimistic in the long term, but there's also a lot of uncertainty right now.

Goals: the company's goal is to grow on an average pace of 50% per year, and ultimately be able to achieve 20 million cars per year.

Products: the company is working on a strategy to increase production rates as quickly as possible. Cybertruck is expected to launch by next year.

Do you still expect to start production of the $25,000 model in 2023. What are the biggest hurdles from now until then?

Yeah, we're working on a strategy to increase our production rates as quickly as possible. We don't want to add any new vehicles to our lineup when we're generally is in a cell constrained world. While there is still more runway to grow these existing products, we are focused on Model Y expansion and also in Berlin, ramping S&X further in Fremont to restore to pass levels, while also growing 3 and Y production in Fremont in Shanghai.

After Model Y in Austin, our next product launch will be Cybertruck. And that's time and course depend on increasing cell capacity and completing our currently full plate of products on the table.

What is Tesla 's goal for vehicle production capacity for the current factories?

Our goal as a Company here is to grow on an average pace of 50% per year. I think that will be a difficult goal, but that's the goal that the internal team has. And they're going to continue to push on that. We're trying to get to 5,000 cars a week as soon as we can. And then we'll continue to push beyond that, potentially even getting to 10,000 cars per week at those factories. And then we will add Cybertruck here in Austin and continue to grow from there. So, our goal is to get to millions of cars per year over the next couple of years. And then ultimately in the long term, be able to achieve 20 million cars per year.

Is Tesla considering any other ideas other than FSD with the real-world AI that can bring additional software revenue to Tesla?

Sure. At AI Day we did talk about potential future where Dojo could be used as a neural net training platform for other companies. It's not a focus of ours today as we are fully subscribed on Dojo with our internal uses, we do expect to continue to improve the in-car experience in the context of FSD

Elon said that we get an update on Cybertruck in November a year ago, but it hasn't happened and we know there are a lot of updates. Will you show off the new and improved Cybertruck?

We get a lot of questions on Cybertruck. We've been busy detailing the Cybertruck to achieve the prototype version we shared with customers awhile back. As you may have seen recently on social media, we've built a number of alphas and are currently testing those to further mature the design. We'll continue to work through the product in the beta stages that we're in now and look to launch that by next year.

You hit low-teens operating margins. That was your medium-term target. You're there now, despite the number of challenges and not full utilization to the plan. How are you thinking about that target now?

we've actually exceeded our long-term guidance on our operating margin target. As full self-driving matures, as take rates increase, if we are to raise pricing on that, there's considerable upside both on gross margins and operating margin as that comes to light, as the business starts to become more of a mix of a hardware-based Company and a software-based Company.

So, we feel optimistic about the journey --very optimistic about the journey as we look over into the long term, just a little bit difficult over the next 4 to 5 quarters. There's just a lot of uncertainty in the world right now.

This article is a script from the Q&A session of Tesla's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

190

29

kaya butter

liked and commented on

Is it still the right time to buy these stocks? Are they cheap or expensive ?

We will use stock's PE ratio to answer these questions. It is an indicator to help investors measure the stock price.

By comparing the stock's current PE with its historical average PE, we can simply see whether the current share price is high or low.

Generally, a low PE might indicate that the current stock price is low relative to earnings.

1. $Apple(AAPL.US$

- Current Stock Price: 143

- Current PE: 27.97

- Average PE: 27.44

Conclusion:

- Apple's current PE(27.97) is close to the average(27.44), it's a fair price.

2. $Alphabet-A(GOOGL.US$

- Current Stock Price: 2763

- Current PE: 29.99

- Average PE: 29.96

Conclusion:

- Google's current PE(29.99) is close to the average(29.96), it's a fair price.

3. $Facebook(FB.US$

- Current Stock Price: 356

- Current PE: 26.39

- Average PE: 29.42

Conclusion:

- Facebook's current PE(26.39) is lower than the average(29.42), it's may undervalued.

Tips: You can find the PE ratio at here in Moomoo

PE is not the only way to valuate stocks, but past average PE can work as a benchmark when comparing with current PE. This will help us get an idea on whether the stock is 'cheap or expensive'.

And PE is a long-term indicator, so it cannot provide much help for short-term transactions.

If there is anything else you would like to know, ask me in the comment section below!![]()

We will use stock's PE ratio to answer these questions. It is an indicator to help investors measure the stock price.

By comparing the stock's current PE with its historical average PE, we can simply see whether the current share price is high or low.

Generally, a low PE might indicate that the current stock price is low relative to earnings.

1. $Apple(AAPL.US$

- Current Stock Price: 143

- Current PE: 27.97

- Average PE: 27.44

Conclusion:

- Apple's current PE(27.97) is close to the average(27.44), it's a fair price.

2. $Alphabet-A(GOOGL.US$

- Current Stock Price: 2763

- Current PE: 29.99

- Average PE: 29.96

Conclusion:

- Google's current PE(29.99) is close to the average(29.96), it's a fair price.

3. $Facebook(FB.US$

- Current Stock Price: 356

- Current PE: 26.39

- Average PE: 29.42

Conclusion:

- Facebook's current PE(26.39) is lower than the average(29.42), it's may undervalued.

Tips: You can find the PE ratio at here in Moomoo

PE is not the only way to valuate stocks, but past average PE can work as a benchmark when comparing with current PE. This will help us get an idea on whether the stock is 'cheap or expensive'.

And PE is a long-term indicator, so it cannot provide much help for short-term transactions.

If there is anything else you would like to know, ask me in the comment section below!

+1

84

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)