FinancialFreedomASAP

Set a live reminder

[Brief description] More stable investors prefer to invest in dividends from banks, infrastructure, REIT, etc., because of the stable performance of this type of business, dividends are also quite generous. As a REIT writer, I'm certainly no exception. However, in addition to the above projects, there are other shares with generous dividends, one of which is preference shares (preference shares).

This type of stock has steady characteristics, and dividends are guaranteed, and declines are rare.

Regarding the characteristics of preferred stocks, I will explain the benefits of investing in preferred stocks on the upcoming live broadcast.

[Speaker] Yan Yue, a Malaysian financial writer, published “Buying an Industry Starting at RM100: How to Invest in Reits”, “Buying Stocks Starting at RM100: Making Money Automatically Come to the Door”, and “Malaysian Stocks Are Easy to Understand: Stock News”.

[Join us] Tailored for moomoo users! See you on March 24th at 8.00pm! Do you want to generate a steady passive income? Let's get to know it together!

[Disclaimer] All opinions expressed in the live broadcast and video are based on the independent opinions of the presenter (Yan Yue). Moomoo and its affiliates are not responsible for their content or opinions.

This type of stock has steady characteristics, and dividends are guaranteed, and declines are rare.

Regarding the characteristics of preferred stocks, I will explain the benefits of investing in preferred stocks on the upcoming live broadcast.

[Speaker] Yan Yue, a Malaysian financial writer, published “Buying an Industry Starting at RM100: How to Invest in Reits”, “Buying Stocks Starting at RM100: Making Money Automatically Come to the Door”, and “Malaysian Stocks Are Easy to Understand: Stock News”.

[Join us] Tailored for moomoo users! See you on March 24th at 8.00pm! Do you want to generate a steady passive income? Let's get to know it together!

[Disclaimer] All opinions expressed in the live broadcast and video are based on the independent opinions of the presenter (Yan Yue). Moomoo and its affiliates are not responsible for their content or opinions.

Translated

270

67

ColumnsMy investment sentiment!

Learning to invest is the same as learning to be a human being! It's all about refining people's thinking, people's ideas, and people's psychological quality, because in the face of interests, people show our evil side, greed, fear of death, fear of loss, impatience, and defeat, and how disgusting it is. If we learn to overcome these, we will also make great progress as human beings. If we learn to overcome these things on our investment path, we will also make great progress as human beings. We will see life more thoroughly, and live a more comfortable and easy life! Therefore, learning to invest and learning to be a human go hand in hand!

If you have the right ideas, then you will have perseverance and determination. Stay calm and be unaffected by the environment and rumors. It's the same as being human. Therefore, investing can be very lifestyle, and it can also be very simple.

If you have the right ideas, then you will have perseverance and determination. Stay calm and be unaffected by the environment and rumors. It's the same as being human. Therefore, investing can be very lifestyle, and it can also be very simple.

Translated

FinancialFreedomASAP

liked

$Apple(AAPL.US$

According to sources in the supply chain, Apple's M2 series processors are nearly complete and will be mass-produced using TSMC's 4nm process. In the future, Apple Silicon will upgrade them every 18 months. The M2 processor is expected in the second half of 2022, and the M2 Pro and M2 Max are expected in the first half of 2023. As for apple's new iPhone 14, which will be launched in the second half of 2022, according to industry sources, Apple will introduce two A16 Bionic processors, which will be six core processor architecture, but will be differentiated according to the number of graphics core, support 5G dual-band and the new generation of LPDDR5, WiFi6E and other technical specifications. All will use TSMC 4nm process.

According to sources in the supply chain, Apple's M2 series processors are nearly complete and will be mass-produced using TSMC's 4nm process. In the future, Apple Silicon will upgrade them every 18 months. The M2 processor is expected in the second half of 2022, and the M2 Pro and M2 Max are expected in the first half of 2023. As for apple's new iPhone 14, which will be launched in the second half of 2022, according to industry sources, Apple will introduce two A16 Bionic processors, which will be six core processor architecture, but will be differentiated according to the number of graphics core, support 5G dual-band and the new generation of LPDDR5, WiFi6E and other technical specifications. All will use TSMC 4nm process.

34

FinancialFreedomASAP

liked

2021 has been a wild and volatile year. I started trading late this year when my friends encourage me and told me that moomoo has sign up rewards. After trading a few months I realised that finding the proper entry point into a stock is crucial as it can determine how much you can gain.

Positions Stats

For stocks like $Meta Platforms(FB.US$ and $Pfizer(PFE.US$ I managed to have positive P/L after one week of acquiring the stock. For others like $NIO Inc(NIO.US$ and $Lucid Group(LCID.US$ it’s red for now however I believe in the coming years it will eventually break even and make some gains.

Positions Stats

For stocks like $Meta Platforms(FB.US$ and $Pfizer(PFE.US$ I managed to have positive P/L after one week of acquiring the stock. For others like $NIO Inc(NIO.US$ and $Lucid Group(LCID.US$ it’s red for now however I believe in the coming years it will eventually break even and make some gains.

loading...

16

1

FinancialFreedomASAP

liked

I started using Moomoo just to check out the world of stocks, not wanting to spend any own money as I was too scared ![]() and I not little ideas of how to pick good stocks. The free APPL $Apple(AAPL.US$ stock given by Moomoo was a great encourager to try buying at least cheap stocks to see how it all works since even if I lose I can just sell off my precious 1 share of $Apple(AAPL.US$ at $145 which was the price when I received the stock. I started to then build up my portfolio and adding more stocks like $NIO Inc(NIO.US$ $Kaixin Holdings(KXIN.US$ and other biotech Pharma stocks some actually did really well as I bought them at the bottom and did cost averaging as it went down like $Axsome Therapeutics(AXSM.US$ which I achieved at least 39% profit😁😁. other stocks I picked up didn’t do quite so well today but had potential to fly the moon before the recent slump. I learning that this roller coaster 🎢 ride will have its ups and downs so I will hang on to see that high in due time! anyways it been a great learning experience with Moomoo without which I will still be standing outside in the world of investing. thank you Moomoo

and I not little ideas of how to pick good stocks. The free APPL $Apple(AAPL.US$ stock given by Moomoo was a great encourager to try buying at least cheap stocks to see how it all works since even if I lose I can just sell off my precious 1 share of $Apple(AAPL.US$ at $145 which was the price when I received the stock. I started to then build up my portfolio and adding more stocks like $NIO Inc(NIO.US$ $Kaixin Holdings(KXIN.US$ and other biotech Pharma stocks some actually did really well as I bought them at the bottom and did cost averaging as it went down like $Axsome Therapeutics(AXSM.US$ which I achieved at least 39% profit😁😁. other stocks I picked up didn’t do quite so well today but had potential to fly the moon before the recent slump. I learning that this roller coaster 🎢 ride will have its ups and downs so I will hang on to see that high in due time! anyways it been a great learning experience with Moomoo without which I will still be standing outside in the world of investing. thank you Moomoo![]()

![]()

![]()

Positions Details

Positions Details

loading...

41

1

FinancialFreedomASAP

liked

I started my investment journey in Aug 2021. Been there in both Moomoo and Tiger promotions. Moomoo's app GUI and typesetting won me over with the ease of use. The multitude of functions such as Options Trading, Level 2 quotes and Stock Analysis aided me tremendously in my trading journey. Allow me to recap my five months of learning journey:

****************************************

Chapter 1: Noob Start in Local and My 1st Option Trade - Aug 2021

My initial strategy is to invest into local market: (1) Invest in Bank and REITS.

"Could be better" Trade: FOMO into dividend bank stock $OCBC Bank(O39.SG$ and been bag-holding till now. Did not know that after ex-dividend, the stock will usually tank equivalent to dividend amount.

In the same month, I learnt about Options Trading. I made my 1st CSP on $Coinbase(COIN.US$, and closing early to make a tidy profit. I also learnt that I do not need to maintain full securities to cover CSP as Moomoo allows Margin account to cover the principal.

Transaction

Note: Moomoo is great to support both Cash Secured Puts (CSP) and Covered Calls (CC) which will allow the possible implementation of Wheel Strategy.

******************************************

Chapter 2: Options and it's danger - Sep to Oct 2021

Revised Strategy: (1) Invest in Bank & REITS (2) Income through Selling Puts

I intensified on Options trading specifically on selling puts to generate income. Although CSP provides premium as income stream, there is a risk of unlimited downside if the underlying stock price goes down quickly. This happened to me when $Adobe(ADBE.US$ tanked from 600+ to 500+.

Learning Point: Be cognisant of unlimited downside risk for selling puts. Learn how to roll down and out if needed. Disclaimer: DYODD

***************************************

Chapter 3: Discovering joy of Scalp Trading - Nov 2021

Enhanced Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading

I started day trading in Nov. I learnt about basics of technical analysis and uses candlesticks, EMA and VWAP for Scalp trade. In Nov, I made a total of 131 trades with ~1.65 mil in turnover![]() . However, I only made 0.18% in profits which is good enough for me.

. However, I only made 0.18% in profits which is good enough for me. ![]()

Transaction Stats

Good Trade: $BioNTech(BNTX.US$ Took the scalp trade on 3 green 🕯. Exited quickly after 3 mins trade

Learning Points: Separate investment and trading, Curb emotions, do not FOMO, set Stop Limits for both profits and losses, Accept losses gracefully.

***************************************

Chapter 4: Leaps into the future - Dec 2021

Tweaked Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading and (4) Control future with LEAPS

The last month of 2021 saw extreme volatilities in equity market. My long-term portfolio shrank by 15%. I added another option strategy: LEAPS into my investment plan. LEAPS entails buying long option calls deep into future (1 year or more). I added two stocks that I feel that will rise by Jan 2023: $Palantir(PLTR.US$ $SoFi Technologies(SOFI.US$

Tips: Buy ITM LEAPS when the underlying stock price is low or reached certain pressure lines. Disclaimer: DYODD

***************************************

In Summary

It has been a rewarding and fruitful learning journey in investing. Although I missed out the initial QE ride last year, the painful lessons I learnt now in 2021 will be useful for my future trades. I will continue to fine-tune my investment strategy to improve my expertise in 2022.

Many thanks to Moomoo for the great contents such as News, Courses, Seminars etc and not forgetting the selfless sharing of experiences by fellow Moo-ers!!

"Looking forward from Moomoo":

(1) Advanced options strategy such as Iron Condor and Credit Spreads

(2) Crypto Trading![]()

****************************************

Chapter 1: Noob Start in Local and My 1st Option Trade - Aug 2021

My initial strategy is to invest into local market: (1) Invest in Bank and REITS.

"Could be better" Trade: FOMO into dividend bank stock $OCBC Bank(O39.SG$ and been bag-holding till now. Did not know that after ex-dividend, the stock will usually tank equivalent to dividend amount.

In the same month, I learnt about Options Trading. I made my 1st CSP on $Coinbase(COIN.US$, and closing early to make a tidy profit. I also learnt that I do not need to maintain full securities to cover CSP as Moomoo allows Margin account to cover the principal.

Transaction

Note: Moomoo is great to support both Cash Secured Puts (CSP) and Covered Calls (CC) which will allow the possible implementation of Wheel Strategy.

******************************************

Chapter 2: Options and it's danger - Sep to Oct 2021

Revised Strategy: (1) Invest in Bank & REITS (2) Income through Selling Puts

I intensified on Options trading specifically on selling puts to generate income. Although CSP provides premium as income stream, there is a risk of unlimited downside if the underlying stock price goes down quickly. This happened to me when $Adobe(ADBE.US$ tanked from 600+ to 500+.

Learning Point: Be cognisant of unlimited downside risk for selling puts. Learn how to roll down and out if needed. Disclaimer: DYODD

***************************************

Chapter 3: Discovering joy of Scalp Trading - Nov 2021

Enhanced Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading

I started day trading in Nov. I learnt about basics of technical analysis and uses candlesticks, EMA and VWAP for Scalp trade. In Nov, I made a total of 131 trades with ~1.65 mil in turnover

Transaction Stats

Good Trade: $BioNTech(BNTX.US$ Took the scalp trade on 3 green 🕯. Exited quickly after 3 mins trade

Learning Points: Separate investment and trading, Curb emotions, do not FOMO, set Stop Limits for both profits and losses, Accept losses gracefully.

***************************************

Chapter 4: Leaps into the future - Dec 2021

Tweaked Strategy: (1) Invest in Bank & REITS; (2) Income through Selling Puts; (3) Scalp Trading and (4) Control future with LEAPS

The last month of 2021 saw extreme volatilities in equity market. My long-term portfolio shrank by 15%. I added another option strategy: LEAPS into my investment plan. LEAPS entails buying long option calls deep into future (1 year or more). I added two stocks that I feel that will rise by Jan 2023: $Palantir(PLTR.US$ $SoFi Technologies(SOFI.US$

Tips: Buy ITM LEAPS when the underlying stock price is low or reached certain pressure lines. Disclaimer: DYODD

***************************************

In Summary

It has been a rewarding and fruitful learning journey in investing. Although I missed out the initial QE ride last year, the painful lessons I learnt now in 2021 will be useful for my future trades. I will continue to fine-tune my investment strategy to improve my expertise in 2022.

Many thanks to Moomoo for the great contents such as News, Courses, Seminars etc and not forgetting the selfless sharing of experiences by fellow Moo-ers!!

"Looking forward from Moomoo":

(1) Advanced options strategy such as Iron Condor and Credit Spreads

(2) Crypto Trading

+2

loading...

64

2

FinancialFreedomASAP

liked

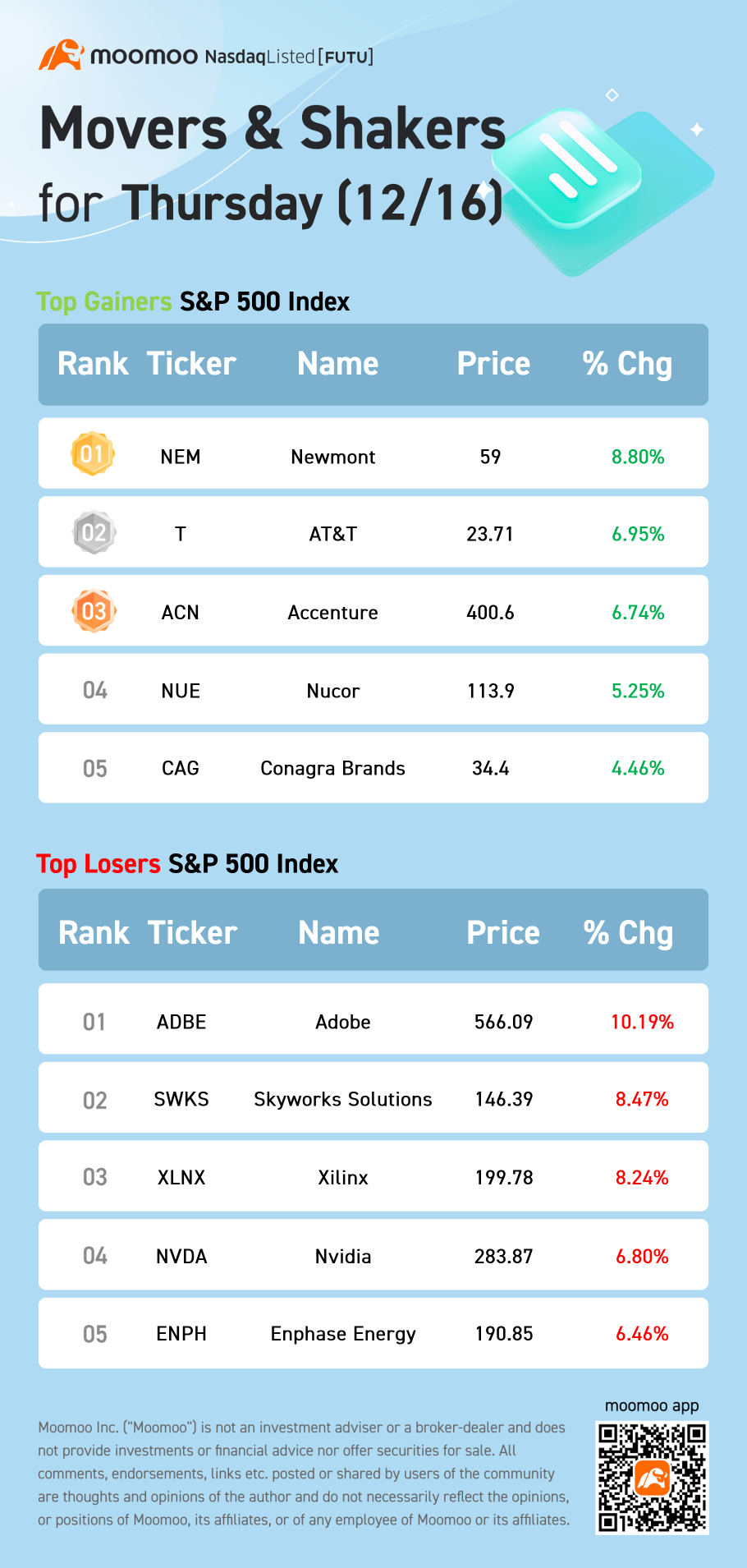

U.S. stock futures were slightly lower Thursday evening as investors digested a trading day in which tech names struggled and dragged the rest of the market down with them.

In regular trading, the tech-focused $Nasdaq Composite Index(.IXIC.US$ fell 2.47% for its worst day since September. The other averages saw more modest losses. The $Dow Jones Industrial Average(.DJI.US$ fell 0.08%, while the $S&P 500 Index(.SPX.US$ lost 0.8%.

$Accenture(ACN.US$ $Adobe(ADBE.US$ $NVIDIA(NVDA.US$ $Newmont(NEM.US$ $AT&T(T.US$

In regular trading, the tech-focused $Nasdaq Composite Index(.IXIC.US$ fell 2.47% for its worst day since September. The other averages saw more modest losses. The $Dow Jones Industrial Average(.DJI.US$ fell 0.08%, while the $S&P 500 Index(.SPX.US$ lost 0.8%.

$Accenture(ACN.US$ $Adobe(ADBE.US$ $NVIDIA(NVDA.US$ $Newmont(NEM.US$ $AT&T(T.US$

30

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)