B Russ

liked

Moomoo, a subsidiary of Nasdaq-listed Futu Holdings and a leading investment and trading platform, has inked a global strategic partnership agreement with financial powerhouse Nasdaq. The agreement solidifies their joint commitment to investor empowerment and enhancing market access for all.

Both Moomoo and Nasdaq share a common vision of democratizing access to financial markets and empowering retail investors worldwide. As a next-generation...

Both Moomoo and Nasdaq share a common vision of democratizing access to financial markets and empowering retail investors worldwide. As a next-generation...

25

2

B Russ

liked

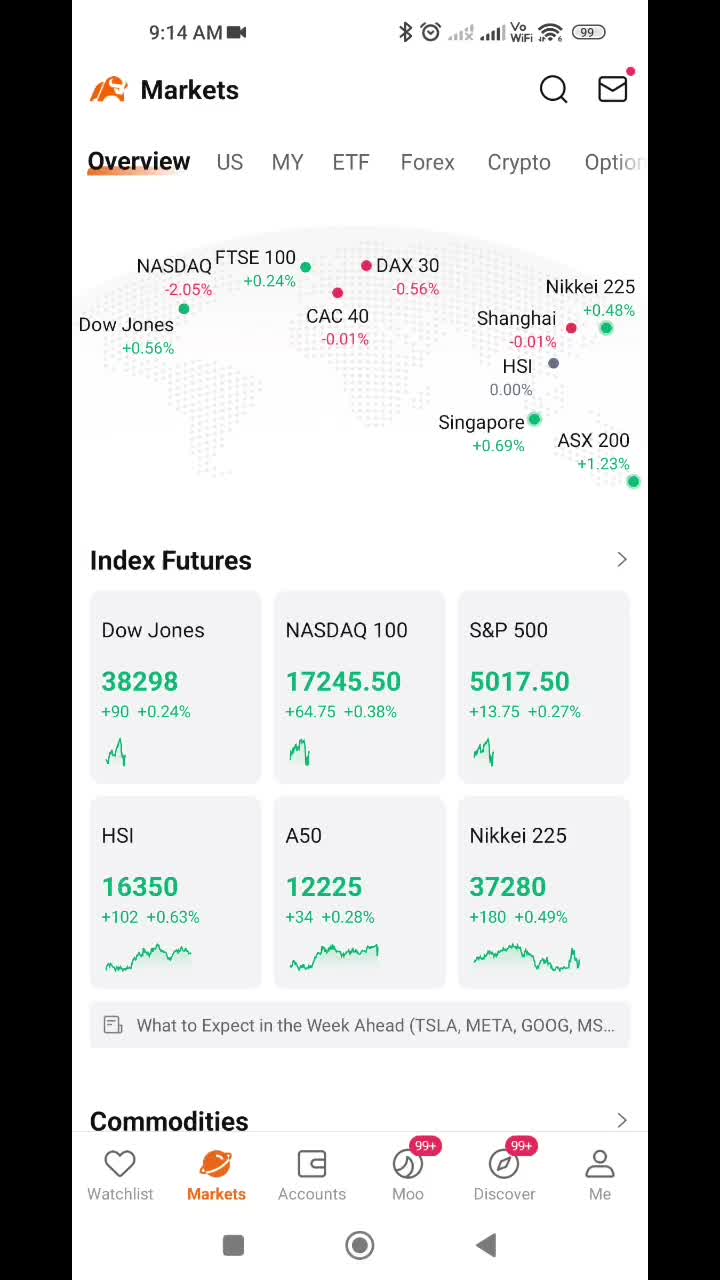

US Stock Market Review 15 - 19 Apr 2024

DJI -0.08%, SP500 -3.05%, NASDAQ -5.52%. Market experienced selloff from mainly tech stocks, with NVDA fell more than 10% on last Friday, expect to see more volatility ahead on big tech earnings

Four of the Magnificent Seven group of tech giants will report this week: TSLA, META, MSFT GOOGL

Event to watch: 23 Apr S&P PMI & New Home Sales, 24 Apr Durable Goods Orders, 25 Apr GDP QoQ & initial jobless Claims, 26 Apr Core PCE Pri...

DJI -0.08%, SP500 -3.05%, NASDAQ -5.52%. Market experienced selloff from mainly tech stocks, with NVDA fell more than 10% on last Friday, expect to see more volatility ahead on big tech earnings

Four of the Magnificent Seven group of tech giants will report this week: TSLA, META, MSFT GOOGL

Event to watch: 23 Apr S&P PMI & New Home Sales, 24 Apr Durable Goods Orders, 25 Apr GDP QoQ & initial jobless Claims, 26 Apr Core PCE Pri...

251

63

B Russ

liked

For me , nothing good below 50MA. $Invesco QQQ Trust(QQQ.US$ is slipping the 50MA here. Selling short now with very tighy stop @443.1.

I have $SPDR Dow Jones Industrial Average Trust(DIA.US$ short to protect my open position since last week. Looking forward to form another ledge near to the 10ma and break.

I have $SPDR Dow Jones Industrial Average Trust(DIA.US$ short to protect my open position since last week. Looking forward to form another ledge near to the 10ma and break.

30

1

B Russ

liked

1. The war situation in the Middle East has always been carried out in a “proxy war situation”. Pro-Iranian forces, such as Hezbollah in Lebanon, the Syrian government, Hamas, and Iraqi militias, have clashed with Israel's border

2. Iran has the largest armed army in the Middle East and is also seen as the supporter behind these “agents”

3. On April 1, 2024, Israel dropped several bombs on the Iranian consulate in the Syrian capital Damascus, killing some senior commanders and generals suspected of being in touch with “agents”

4. Iran says it will retaliate after the attack

5. According to reports, Iran's foreign minister notified the US a week ago that it would “proportionate and restraint” launch a “non-escalating” counterattack against Israel, and notified allies and Western countries

6. On Friday, the US said Israel would be attacked by Iran's drones within 24-48 hours. Iran issued an order asking the UN to condemn Israel to launch an attack otherwise

7. Iran attacked Israel as expected. Iran claimed that it had achieved the expected results and indicated that the punishment against Israel was over; at the same time, Israel also claimed that it had almost completely intercepted drones from Iran

8. Israel and neighboring countries, such as Jordan, Iraq, and Lebanon, announced the reopening of airspace

9. US says it condemns Iran but does not seek to get involved in war with Iran

Observation:

Judging from Iran's entire military operation, the early warning given in advance, plus the issuance...

2. Iran has the largest armed army in the Middle East and is also seen as the supporter behind these “agents”

3. On April 1, 2024, Israel dropped several bombs on the Iranian consulate in the Syrian capital Damascus, killing some senior commanders and generals suspected of being in touch with “agents”

4. Iran says it will retaliate after the attack

5. According to reports, Iran's foreign minister notified the US a week ago that it would “proportionate and restraint” launch a “non-escalating” counterattack against Israel, and notified allies and Western countries

6. On Friday, the US said Israel would be attacked by Iran's drones within 24-48 hours. Iran issued an order asking the UN to condemn Israel to launch an attack otherwise

7. Iran attacked Israel as expected. Iran claimed that it had achieved the expected results and indicated that the punishment against Israel was over; at the same time, Israel also claimed that it had almost completely intercepted drones from Iran

8. Israel and neighboring countries, such as Jordan, Iraq, and Lebanon, announced the reopening of airspace

9. US says it condemns Iran but does not seek to get involved in war with Iran

Observation:

Judging from Iran's entire military operation, the early warning given in advance, plus the issuance...

Translated

84

5

B Russ

liked

B Russ

liked

Some times companies look for new ventures because the existing ones are not able to scale up. But new venture use up funds.

Take the case of Protasco. The company has reported 11 business segments even though the revenue for 2023 was only about 1 RM billion.

You may be forgiven for wondering whether management is just trying many things to see what works. When you look at the chart, you can see that only one segment is driving revenue an...

Take the case of Protasco. The company has reported 11 business segments even though the revenue for 2023 was only about 1 RM billion.

You may be forgiven for wondering whether management is just trying many things to see what works. When you look at the chart, you can see that only one segment is driving revenue an...

22

B Russ

liked and commented on

$Amazon(AMZN.US$ Rising wages, labor shortages, supply chain bottlenecks leading to extra costs were the name of the game in Q3. This seems like it's a theme that will continue into, and probably beyond, the all-important Q4 holiday season for e-commerce. It will be difficult to pass costs on to consumers during this highly competitive quarter.

On a whole, the numbers were not awful, but they also were not impressive. Total revenue for the quarter was $110.8B, up 15% from Q3 2020 which came in at $96.1B. Costs were up significantly, however, and operating income for the quarter dropped to $4.9B from $6.2B a year ago. Cash from operations was also down from $12B in Q3 2020 to $7.3B in Q3 2021. Inventory, shipping, and labor costs are likely culprits. Diluted earnings per share were chopped in half to $6.12 from $12.37 a year ago.

Taken separately, the ecommerce figures were very discouraging. Product sales were up a mere 4% from Q3 2020. Yes, there is a COVID-19 effect to factor in, however, this is anemic any way one slices it. On a whole, the ecommerce segments of North America and International were net unprofitable for the quarter, losing $31M in operating income. The retail business has never been hugely profitable, however, investors have been hoping that scaling would lead to better profitability. Instead, AWS is the saving grace.

There is a great disparity between the revenue and income produced by AWS as compared to the bulky e-commerce segments.

As shown above, despite taking in only 13% of revenues, AWS was responsible for more than 50% of operating profits for the first two quarters of 2021. AWS as a segment has tremendous margins. This trend has been exacerbated in Q3.

Below I have updated the figures for Q3 2021 and the nine months then ended.

As we can see, the Q3 numbers are skewed as the e-commerce business posted an operating loss. However, this is no less telling. For the first three quarters of 2021, this trend has accelerated from over 50% to now well over 60% of operating profits being provided by AWS. With its impressive growth, the total revenue provided by AWS is also up from 13% to 15%.

It truly is a tale of two companies. However, it should be three.

On a whole, the numbers were not awful, but they also were not impressive. Total revenue for the quarter was $110.8B, up 15% from Q3 2020 which came in at $96.1B. Costs were up significantly, however, and operating income for the quarter dropped to $4.9B from $6.2B a year ago. Cash from operations was also down from $12B in Q3 2020 to $7.3B in Q3 2021. Inventory, shipping, and labor costs are likely culprits. Diluted earnings per share were chopped in half to $6.12 from $12.37 a year ago.

Taken separately, the ecommerce figures were very discouraging. Product sales were up a mere 4% from Q3 2020. Yes, there is a COVID-19 effect to factor in, however, this is anemic any way one slices it. On a whole, the ecommerce segments of North America and International were net unprofitable for the quarter, losing $31M in operating income. The retail business has never been hugely profitable, however, investors have been hoping that scaling would lead to better profitability. Instead, AWS is the saving grace.

There is a great disparity between the revenue and income produced by AWS as compared to the bulky e-commerce segments.

As shown above, despite taking in only 13% of revenues, AWS was responsible for more than 50% of operating profits for the first two quarters of 2021. AWS as a segment has tremendous margins. This trend has been exacerbated in Q3.

Below I have updated the figures for Q3 2021 and the nine months then ended.

As we can see, the Q3 numbers are skewed as the e-commerce business posted an operating loss. However, this is no less telling. For the first three quarters of 2021, this trend has accelerated from over 50% to now well over 60% of operating profits being provided by AWS. With its impressive growth, the total revenue provided by AWS is also up from 13% to 15%.

It truly is a tale of two companies. However, it should be three.

15

12

B Russ

commented on

$Advanced Micro Devices(AMD.US$on Tuesday reported better-than-expected third-quarter results fueled by data center sales that doubled from the same period a year ago.

After the close of trading AMD said that for the period ending Sept. 25, it eared 73 cents a share, excluding one-time items, on revenue of $4.3 billion, compared with earnings of 41 cents a share, on $2.8 billion in sales, in the third quarter of 2020. The results topped the forecasts of Wall Street analysts, who had forecast AMD to earn 66 cents a share on revenue of $4.11 billion.

AMD Chief Executive Lisa Su said in a statement that in adding to data center sales doubling from a year ago, the company saw particular strength from shipments of the newest version of its Epyc computer processors and business in general "significantly accelerated" during the quarter.

Computing and graphics segment revenue climbed 44% from a year ago, to $2.4 billion, on higher sales of AMD's Ryzen, Radeon and AMD Instinct processor sales. Enterprise, Embedded and Semi-Custom segment revenue totaled $1.9 billion, up 69% from last year's third quarter.

In late September, Su said she sees the component shortage impacting the semiconductor market to ease by next year.

After the close of trading AMD said that for the period ending Sept. 25, it eared 73 cents a share, excluding one-time items, on revenue of $4.3 billion, compared with earnings of 41 cents a share, on $2.8 billion in sales, in the third quarter of 2020. The results topped the forecasts of Wall Street analysts, who had forecast AMD to earn 66 cents a share on revenue of $4.11 billion.

AMD Chief Executive Lisa Su said in a statement that in adding to data center sales doubling from a year ago, the company saw particular strength from shipments of the newest version of its Epyc computer processors and business in general "significantly accelerated" during the quarter.

Computing and graphics segment revenue climbed 44% from a year ago, to $2.4 billion, on higher sales of AMD's Ryzen, Radeon and AMD Instinct processor sales. Enterprise, Embedded and Semi-Custom segment revenue totaled $1.9 billion, up 69% from last year's third quarter.

In late September, Su said she sees the component shortage impacting the semiconductor market to ease by next year.

32

16

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)