Protasco – better to return excess funds to shareholders

Some times companies look for new ventures because the existing ones are not able to scale up. But new venture use up funds.

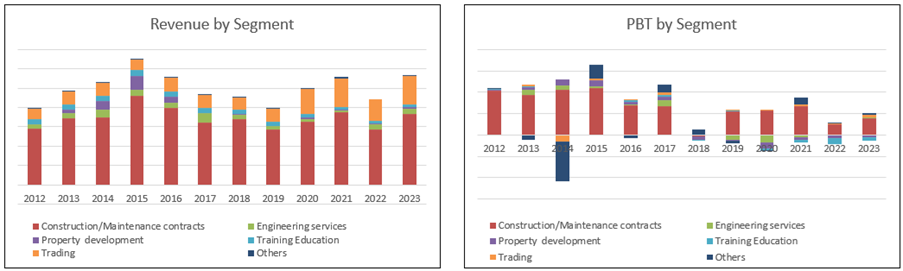

Take the case of Protasco. The company has reported 11 business segments even though the revenue for 2023 was only about 1 RM billion.

You may be forgiven for wondering whether management is just trying many things to see what works. When you look at the chart, you can see that only one segment is driving revenue and earnings.

It suggests that management is trying luck to see what else they can do. The worse part is that several of its historical ventures have lost money. And there are some which have ended up as legal cases as the company tried to recover what was paid.

I would think that it may be better for the company to return the excess funds to shareholders than try luck. Protasco is a cash cow. But the cash is not well deployed.

For more insights refer to Is Protasco an investment opportunity?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment