102919416 RSCC

liked

$Tesla(TSLA.US$ $Futu Holdings Ltd(FUTU.US$ $UP Fintech(TIGR.US$

The biggest mistake I made is to join Moomoo. This app is so different from other ordinary apps, the interaction is so addictive and it keep consuming my life. So many crazy brothers and kuku sisters in moomoo family. Those moderator also don't need to sleep one, so many activities for us to play, those position, patterns and climax orgasm. I know is wrong that i a bit out of control, that why i going to divert my attention by visiting those Japanese AV website more to keep my illness under control. Wish those brothers and sisters can understand me.![]()

The biggest mistake I made is to join Moomoo. This app is so different from other ordinary apps, the interaction is so addictive and it keep consuming my life. So many crazy brothers and kuku sisters in moomoo family. Those moderator also don't need to sleep one, so many activities for us to play, those position, patterns and climax orgasm. I know is wrong that i a bit out of control, that why i going to divert my attention by visiting those Japanese AV website more to keep my illness under control. Wish those brothers and sisters can understand me.

64

23

102919416 RSCC

liked

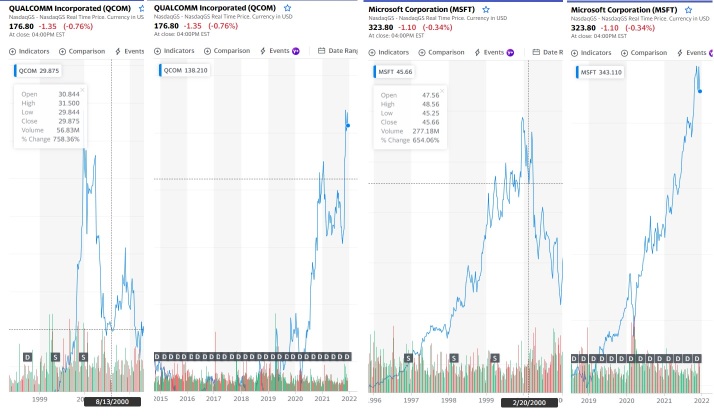

$Qualcomm(QCOM.US$ $Microsoft(MSFT.US$

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $Coca-Cola(KO.US$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

I am sure most of us, if not already, have been reading some analysts' reports about an almost similar situation of now vs 2000 dot.com/bust period. Many new investors here may not be faimilar with the dot.com burst. I was a local investor then as access to the US markets were very limited, and even in Singapore, the stocks followed similarly, especially the tech stocks.

First cavaet here is i am not spreading FUD, but this month's tech correction warrants a serious look at how next year shapes up, so I have to do more research on this. There are 3 signals which i thought warrant a good look.

1st - Very clear signal here is the dot.com crash happend in March 2000, when Alan Greenspan, then FED chair raised interest rates. If you can see what will happen next year, its that interest rate would be raise in March 2022.

2nd - The other signal is the unprecedented IPOs happend in 1999, when the bubble festered. The lock-in period of the institutions and owners is 6 months, and right after lock in, with rising interest rates, mass selling begin, resulting in the crash.

3rd - Many dot.com companies raise monies easily due to very low interest rates (easy money). Many were burning cash and had not reach profitability. In 2021, we too have many over-valued tech companies which haven't reach profitabilty yet are at unprecedented prices (although most have came down from their historical highs)

If you can read at the 3 signals above, won't you be worried?

I attached 2 companies that have survived the dot.com and boom. Similarly the prices fall is almost alarming. But we can see that they are profitabile and would be able to weather such storm. Value company like $Coca-Cola(KO.US$ went up instead

during the dot.com burst.

Of course, the situation then and now maybe different, as some tech corrections happened in Dec 21, and due to the Omicron issue, that may change the situation. But still, we need to be very nimble in our investments. Jan and Feb 2022, with quarterly reporting, may offer some window into the future to review if 2022 can continue this run.

I wish everyone a clear mind and even better focus. Don't get too emotional (a reminder to myself too) and cutting loss is not cutting a piece of flesh, its just an opportunity to come back better.

30

2

102919416 RSCC

liked

NFTs

If you've been with me awhile you know this is one of my favorites Industries to trade ❤️

I put $Dolphin Entertainment(DLPN.US$ on the Sunday watch list.

$Takung Art Co Ltd(TKAT.US$ is often the volume leader and you can catch the sympathy plays on the rest of the list.

$Liquid Media Group Ltd(YVR.US$ $Cinedigm Corp(CIDM.US$ $Oriental Culture(OCG.US$

If you've been with me awhile you know this is one of my favorites Industries to trade ❤️

I put $Dolphin Entertainment(DLPN.US$ on the Sunday watch list.

$Takung Art Co Ltd(TKAT.US$ is often the volume leader and you can catch the sympathy plays on the rest of the list.

$Liquid Media Group Ltd(YVR.US$ $Cinedigm Corp(CIDM.US$ $Oriental Culture(OCG.US$

8

2

102919416 RSCC

liked

$UP Fintech(TIGR.US$

A photo is worth thousand words

A photo is worth thousand words

10

102919416 RSCC

liked

$Twitter (Delisted)(TWTR.US$ Twitter would be better without Dorsey, they could actually monetize a grossly underrated platform. This should be incredibly bullish.

4

102919416 RSCC

liked

$Cinedigm Corp(CIDM.US$ why suddenly drop

1

1

102919416 RSCC

liked

26

102919416 RSCC

liked

Semiconductors, automobiles and the potential for tie-ups between the two industries took the spotlight in the tech sector with seemingly everyone from $Apple(AAPL.US$ to $Qualcomm(QCOM.US$ getting behind the wheel this week.

Let's start with $Apple(AAPL.US$ which said...Absolutely nothing. But, reports that the company has developed a semiconductor "breakthrough", and will produce a fully autonomous electric car within four year were enough to send just about everyone wondering what companies might benefit from Apple putting a so-called "iCar" on the road.

Other chip companies involved into automotive industry actually did have a lot to say during the week. One of those was $NVIDIA(NVDA.US$, which got a big boost on Wall Street following its better-than-expected earnings report. Nvidia (NVDA) also said it was still pushing ahead with efforts to acquire British chip-technology company Arm Holdings despite more governmental inquiries into the proposed $40 billion acquisition.

$Qualcomm(QCOM.US$ wouldn't be outdone, as it said it secured a deal to provide its chip technology to BMW for a new generation of the automakers self-driving cars. Qualcomm Chief Executive Cristiano Amon also touted the company's automotive plans as part of its efforts to diversity into new industries for its chip products.

If that wasn't enough, $General Motors(GM.US$ also said it was working with Qualcomm and other chipmakers to supply semiconductors for its vehicles in an effort to get around chip industry supply shortages.

Back to Apple for a moment. Chief Executive Tim Cook said Apple employees should plan on returning to the office, at least part time, on February 1. Apple also started up a new service program that will let consumers perform their own repairs on some Apple products.

Streaming TV companies weren't being quiet this week, either. $Netflix(NFLX.US$ unveiled a new website where it will show its top-rated TV shows and movies every week.

$Disney(DIS.US$ said it is raising the price of its Hulu Live TV service by $5 to $69.99 a month, but will include ESPN+ and Disney+ as part of the streaming package.

$Roku Inc(ROKU.US$ took a hit after analyst Michael Nathanson cut his rating on the company's stock to sell due to slower advertising growth on the Roku Channel. There were also reports that Roku is developing more than 50 original shows for the Roku Channel.

After a bidding war between some of the largest TV broadcasters and streamers, $Comcast(CMCSA.US$managed to renew its deal to carry games of the English Premier League for another six years.

For people who use $Uber Technologies(UBER.US$ a lot, the ride-sharing leader unveiled its new Uber One program where, for a monthly or annual fee, subscribers can get discounts on ride and free food and grocery delivery from Uber Eats.

Let's start with $Apple(AAPL.US$ which said...Absolutely nothing. But, reports that the company has developed a semiconductor "breakthrough", and will produce a fully autonomous electric car within four year were enough to send just about everyone wondering what companies might benefit from Apple putting a so-called "iCar" on the road.

Other chip companies involved into automotive industry actually did have a lot to say during the week. One of those was $NVIDIA(NVDA.US$, which got a big boost on Wall Street following its better-than-expected earnings report. Nvidia (NVDA) also said it was still pushing ahead with efforts to acquire British chip-technology company Arm Holdings despite more governmental inquiries into the proposed $40 billion acquisition.

$Qualcomm(QCOM.US$ wouldn't be outdone, as it said it secured a deal to provide its chip technology to BMW for a new generation of the automakers self-driving cars. Qualcomm Chief Executive Cristiano Amon also touted the company's automotive plans as part of its efforts to diversity into new industries for its chip products.

If that wasn't enough, $General Motors(GM.US$ also said it was working with Qualcomm and other chipmakers to supply semiconductors for its vehicles in an effort to get around chip industry supply shortages.

Back to Apple for a moment. Chief Executive Tim Cook said Apple employees should plan on returning to the office, at least part time, on February 1. Apple also started up a new service program that will let consumers perform their own repairs on some Apple products.

Streaming TV companies weren't being quiet this week, either. $Netflix(NFLX.US$ unveiled a new website where it will show its top-rated TV shows and movies every week.

$Disney(DIS.US$ said it is raising the price of its Hulu Live TV service by $5 to $69.99 a month, but will include ESPN+ and Disney+ as part of the streaming package.

$Roku Inc(ROKU.US$ took a hit after analyst Michael Nathanson cut his rating on the company's stock to sell due to slower advertising growth on the Roku Channel. There were also reports that Roku is developing more than 50 original shows for the Roku Channel.

After a bidding war between some of the largest TV broadcasters and streamers, $Comcast(CMCSA.US$managed to renew its deal to carry games of the English Premier League for another six years.

For people who use $Uber Technologies(UBER.US$ a lot, the ride-sharing leader unveiled its new Uber One program where, for a monthly or annual fee, subscribers can get discounts on ride and free food and grocery delivery from Uber Eats.

306

9

102919416 RSCC

liked

$Cinedigm Corp(CIDM.US$ This is a good one !!

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)