灵秀的科克

commented on

Previous Hightlight

Technology stocks drove the equity market to a record in a volatile session ahead of previous Friday's option expiration. Last Friday was the expiration date for both the monthly and weekly options.

$Apple(AAPL.US$ Gurman pointed to the Apple Watch software chief Kevin Lynch leading the company's car efforts in recent weeks and his push to accelerate the development of the electric vehicle. "Now he's pushing the team behind the project to accelerate its development, with an eye on debuting a car as early [as] 2025," wrote Gurman in his weekly newsletter.

$Micron Technology(MU.US$ finished the week with a gain of almost 8% on last Friday, as analysts at Citi and Evercore/ISI had some upbeat comments about the semiconductor company and the market for memory chips.

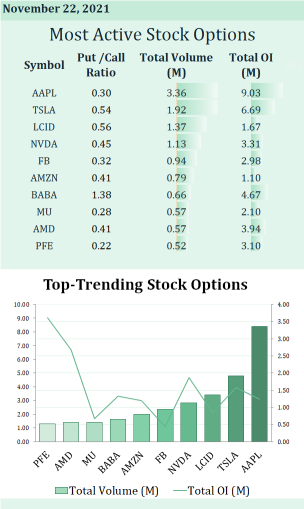

How to read the chart

· The chart shows stocks with the most option activities of the previous trading day.

· Put/Call ratio >0.7 means more the stock attract more bears than bulls.![]()

![]()

![]() Put/Call ratio<0.7 means the stock attract more bulls than bears.

Put/Call ratio<0.7 means the stock attract more bulls than bears.![]()

![]()

![]()

· Option volume indicates the shares of contracts traded for the day.

· Open interest indicates the total number of option contracts that are currently open – that means they are not yet exercised or offset.![]()

![]()

![]()

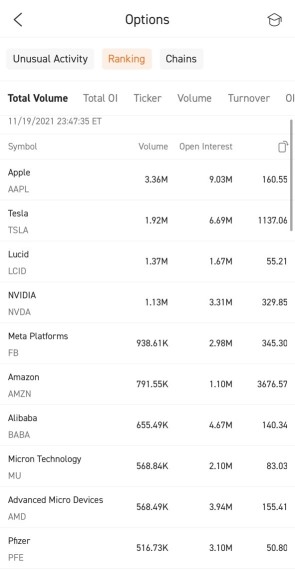

Want to know more info on trending option?

This function could be found by selecting "Quotes – Markets – Option". You would need access to "option real-time quotes" to access this function.

Explore the world of option trading with: Intro to options.

Improve your option trading knowledge: Key elements on the table

Have you ever roll over a option before it expired? $Advanced Micro Devices(AMD.US$ $Pfizer(PFE.US$ $Lucid Group(LCID.US$

Technology stocks drove the equity market to a record in a volatile session ahead of previous Friday's option expiration. Last Friday was the expiration date for both the monthly and weekly options.

$Apple(AAPL.US$ Gurman pointed to the Apple Watch software chief Kevin Lynch leading the company's car efforts in recent weeks and his push to accelerate the development of the electric vehicle. "Now he's pushing the team behind the project to accelerate its development, with an eye on debuting a car as early [as] 2025," wrote Gurman in his weekly newsletter.

$Micron Technology(MU.US$ finished the week with a gain of almost 8% on last Friday, as analysts at Citi and Evercore/ISI had some upbeat comments about the semiconductor company and the market for memory chips.

How to read the chart

· The chart shows stocks with the most option activities of the previous trading day.

· Put/Call ratio >0.7 means more the stock attract more bears than bulls.

· Option volume indicates the shares of contracts traded for the day.

· Open interest indicates the total number of option contracts that are currently open – that means they are not yet exercised or offset.

Want to know more info on trending option?

This function could be found by selecting "Quotes – Markets – Option". You would need access to "option real-time quotes" to access this function.

Explore the world of option trading with: Intro to options.

Improve your option trading knowledge: Key elements on the table

Have you ever roll over a option before it expired? $Advanced Micro Devices(AMD.US$ $Pfizer(PFE.US$ $Lucid Group(LCID.US$

62

12

灵秀的科克

reacted to

When it comes to stopping loss, I think it's more important than taking profit. If you don't take profit, the worst thing is the restoration of the profit account.![]() However, not stopping the loss is equivalent to cutting the meat with a blunt knife, sooner or later will bleed down.

However, not stopping the loss is equivalent to cutting the meat with a blunt knife, sooner or later will bleed down.

Almost all losses are related to two points: "not seeing the trend, not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

1. for companies that understand the fundamentals

My stop-loss strategy for holding positions is based on the fundamentals of the company. As for marvelous company, we don't need to stop loss due to familiar enough. For company which has a certain degree of understanding and more floating profits, we can moderately relax the stop-loss points, such as the 120 moving average; if it's not ripe enough, the 20-day moving average may trigger the stop-loss. $Tesla(TSLA.US$

2. The operation of short-term betting

For an unfamiliar company, the stock price will rise as soon as I sell it. Gambling operation is not supported by long-term logic, so stopping loss can avoid making big mistakes. But it also depends on execution, sometimes I will get trapped.![]() Anyway, it matters with my ability circle. Many newbies look back and think they could have made a profit if not stop-loss, but such hindsight mentality is not allowed in the stock market.

Anyway, it matters with my ability circle. Many newbies look back and think they could have made a profit if not stop-loss, but such hindsight mentality is not allowed in the stock market.

3. Buy bottom with Long Call

In a slumping market, if you feel the bottom with no scientific basis for judgment, you'd better not to buy the bottom directly. Figure out how much you want to buy and use long Call to get the bottom at that time.

Usually option is the price of 1/10 of the underlying stock. Buying it properly, you can make a profit equivalent to a certain percentage of the underlying stock. Otherwise, it at most let the option float (maybe 10% loss). $Nasdaq Composite Index(.IXIC.US$

Therefore, you must make a quota that you can afford at first, the expiration date depends on your confidence. If you lack confidence, set the expiry date longer.![]()

4. Why should funds need to be fixed invest?

Human greed, not only lies in the high more than win, but also lies in the low dare not to buy, always waiting for the lower position.

To sum up, I'm not afraid of losing a good stock and generally don't chase high. I will not touch an unsure stock. If I encounter a judgment error, I will stop the loss unconditionally. $Camber Energy(CEI.US$

@HopeAlways @ATS A trade sniper

Almost all losses are related to two points: "not seeing the trend, not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

1. for companies that understand the fundamentals

My stop-loss strategy for holding positions is based on the fundamentals of the company. As for marvelous company, we don't need to stop loss due to familiar enough. For company which has a certain degree of understanding and more floating profits, we can moderately relax the stop-loss points, such as the 120 moving average; if it's not ripe enough, the 20-day moving average may trigger the stop-loss. $Tesla(TSLA.US$

2. The operation of short-term betting

For an unfamiliar company, the stock price will rise as soon as I sell it. Gambling operation is not supported by long-term logic, so stopping loss can avoid making big mistakes. But it also depends on execution, sometimes I will get trapped.

3. Buy bottom with Long Call

In a slumping market, if you feel the bottom with no scientific basis for judgment, you'd better not to buy the bottom directly. Figure out how much you want to buy and use long Call to get the bottom at that time.

Usually option is the price of 1/10 of the underlying stock. Buying it properly, you can make a profit equivalent to a certain percentage of the underlying stock. Otherwise, it at most let the option float (maybe 10% loss). $Nasdaq Composite Index(.IXIC.US$

Therefore, you must make a quota that you can afford at first, the expiration date depends on your confidence. If you lack confidence, set the expiry date longer.

4. Why should funds need to be fixed invest?

Human greed, not only lies in the high more than win, but also lies in the low dare not to buy, always waiting for the lower position.

To sum up, I'm not afraid of losing a good stock and generally don't chase high. I will not touch an unsure stock. If I encounter a judgment error, I will stop the loss unconditionally. $Camber Energy(CEI.US$

@HopeAlways @ATS A trade sniper

15

2

灵秀的科克

reacted to

good stock to hold for longer terms.

5

1

$Spotify Technology(SPOT.US$ see good growth opportunities

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

灵秀的科克 : but Moomoo don’t support roll over yet right?