Options Market Statistics: EV Maker Rivian Shares Have Record Drop After Convertible Bond Offering Launched, Options Pop

News Highlights

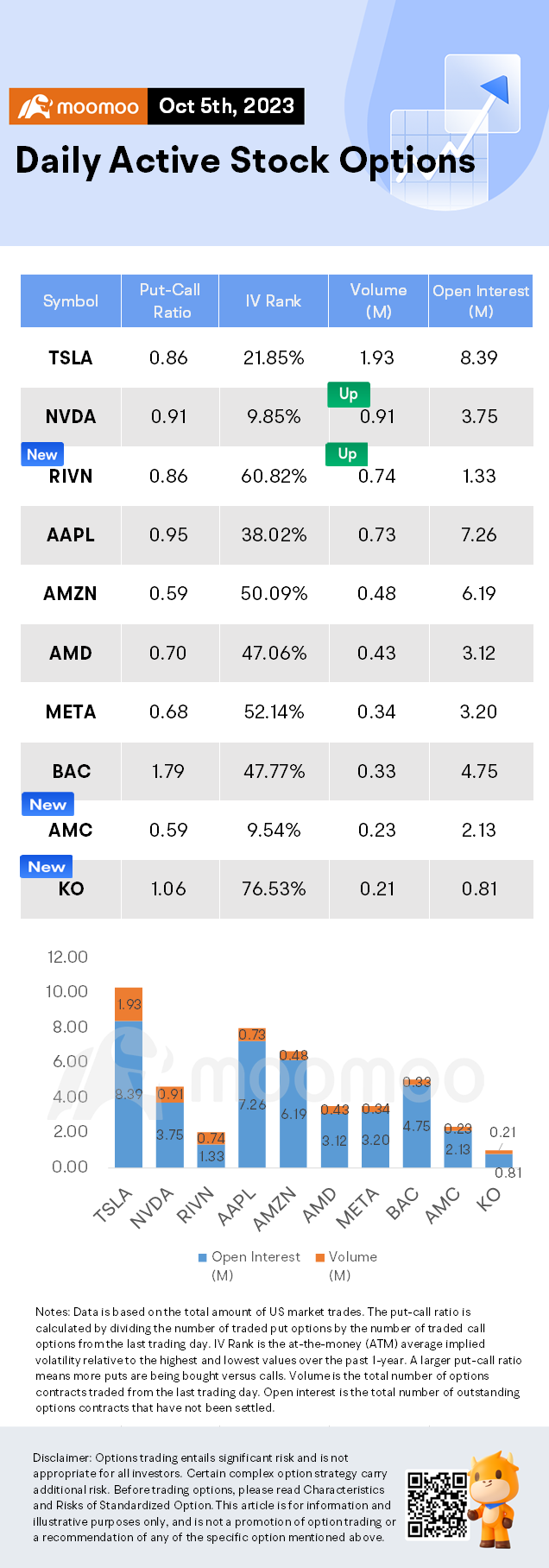

$Tesla(TSLA.US$ shares fell by 0.43%, closing at $260.05. Its options trading volume is 1.93 million. Call contracts account for 53.9% of the whole trading volume. The most traded calls are contracts of $250 strike price that expire on October 6th. The total volume reaches 95,450 with an open interest of 14,924. The most traded puts are contracts of a $245 strike price that expires on October 6th; the volume is 89,481 contracts with an open interest of 16,487.

Tesla's electric vehicle charging port will be adopted by Hyundai Motor and Kia, the South Korean companies said in two separate statements on Thursday.

Kia said it plans to incorporate the North American Charging Standard port into new electric vehicles sold in the US, Canada and Mexico beginning in Q4 of 2024.

Hyundai said that all-new or refreshed Hyundai EVs will be available with a NACS port in the US starting in Q4 of next year, with Canada following in the first half of 2025.

Hyundai and Kia said their NACS-equipped EVs will gain access to more than 12,000 Tesla Superchargers in the US, Canada, and Mexico. Additionally, the companies said owners of present and future Kia and Hyundai EVs with the current Combined Charging System will have access to the Tesla Supercharging Network beginning in Q1 of 2025 with an additional adaptor.

$Rivian Automotive(RIVN.US$ shares fell by 22.88%, closing at $18.27. Its options trading volume is 0.74 million. Call contracts account for 53.7% of the whole trading volume. The most traded calls are contracts of $30 strike price that expire on November 17th. The total volume reaches 4,826 with an open interest of 10,695. The most traded puts are contracts of a $22 strike price that expires on October 6th; the volume is 4,452 contracts with an open interest of 2,009.

Rivian, in a filing, gave a preliminary third-quarter sales estimate of between $1.29 billion and $1.33 billion. Analysts polled by FactSet expected sales of $1.31 billion. The company estimated it had cash, cash equivalents and short-term investments of $9.1 billion as of Sept. 30.

Rivian also said it plans to offer, subject to market and other conditions, $1.5 billion worth of "green" convertible senior notes due in 2030. That would be in a private offering to "qualified institutional buyers," Rivian said.

The plan would give buyers the option to purchase up to an additional $225 million in notes. The notes will be senior, unsecured obligations of Rivian. Noteholders will have the right to convert their notes in certain circumstances and during specified periods, the company said.

$Coca-Cola(KO.US$ shares fell by 4.83%, closing at $52.38. Its options trading volume is 0.21 million. Call contracts account for 48.5% of the whole trading volume. The most traded calls are contracts of $62.5 strike price that expire on January 19th 2024. The total volume reaches 2,730 with an open interest of 11,173. The most traded puts are contracts of a $80 strike price that expires on January 19th 2024; the volume is 6,351 contracts with an open interest of 1,509.

Shares of Coca-Cola Co. were suffering their worst day in 17 months Thursday, amid a broad selloff in their consumer-staples peers and the broader stock market, amid growing fears that high interest rates and a slowing job market will derail the U.S. economy. The beverage giant's stock slumped more than 4% in afternoon trading, enough to lead the $Dow Jones Industrial Average(.DJI.US$'s losers. That would be the biggest one-day decline since it dropped 7.0% on May 18, 2022. The stock was also headed for its lowest close since Dec. 1, 2021. The $Consumer Staples Select Sector SPDR Fund(XLP.US$ was down 1.97% toward a one-year low. Earlier Thursday, branded consumer foods company $Conagra Brands(CAG.US$, which is also a component of the consumer staples ETF, reported quarterly sales that fell short of expectations, amid an "industry-wide slowdown in consumption and recent consumer behavior shifts."

Unusual Stock Options Activity

Some notable call activity is being seen in $Rivian Automotive(RIVN.US$,which is primarily being driven by activity on the October 6th 20.00 call. Volume on this contract is 35,550 versus open interest of 663, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : ok .just for me

safri_moomoor : ok thanks