Options Market Statistics: Nvidia Drops 10% as Investors See Risk in Big Tech Shares, Options Pop

News Highlights

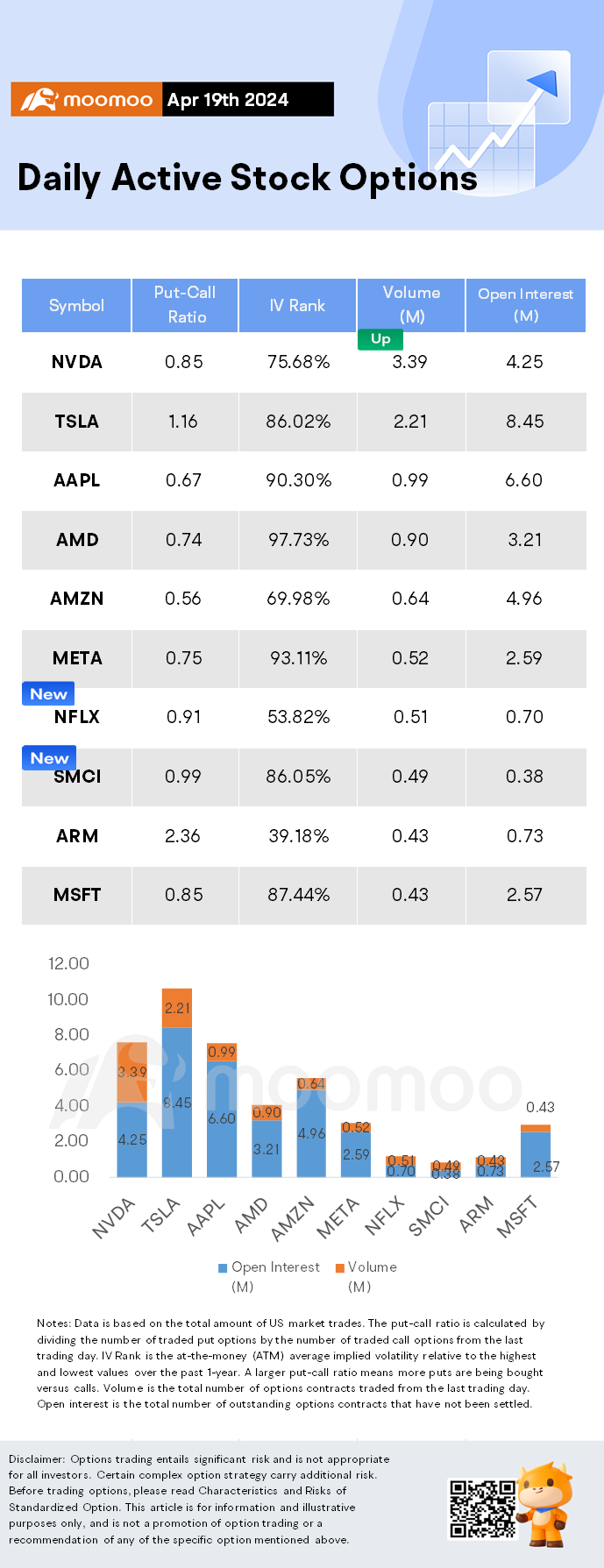

$NVIDIA(NVDA.US$ shares fell by 10%, closing at $762. Its options trading volume was 3.39 million. Call contracts account for 53.9% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Apr.19th. The total volume reaches 76,492 with an open interest of 23,392. The most traded puts are contracts of a $850 strike price that expires on Apr.19th; the volume is 49,944 contracts with an open interest of 18,446.

Nvidia's share price plunged by 10 per cent on Friday, helping to seal the worst run for US stock markets since October 2022, as investors shunned risky assets ahead of a flurry of Big Tech earnings next week.

The chipmaker endured its worst session since March 2020, losing more than $200bn of its market value on the day. The decline accounted for roughly half of the 0.9 per cent fall in Wall Street's S&P 500, according to Bloomberg data.

$Netflix(NFLX.US$ shares fell by 9.09%, closing at $555.04. Its options trading volume was 0.51 million. Call contracts account for 52.4% of the total trading volume. The most traded calls are contracts of $650 strike price that expire on Apr.19th. The total volume reaches 1,775 with an open interest of 2,398. The most traded puts are contracts of a $550 strike price that expires on Apr.19th; the volume is 2,047 contracts with an open interest of 4,262.

Netflix shed about 9 per cent a day after the streaming service’s announcement that it would stop regularly disclosing its subscriber numbers overshadowed stronger than expected earnings. The tech-heavy Nasdaq Composite ended the session down 2.1 per cent.

$Super Micro Computer(SMCI.US$ shares fell by 23.14%, closing at $713.65. Its options trading volume was 0.49 million. Call contracts account for 50.2% of the total trading volume. The most traded calls are contracts of $1350 strike price that expire on May.17th. The total volume reaches 6,234 with an open interest of 297. The most traded puts are contracts of a $900 strike price that expires on Apr.19th; the volume is 4,766 contracts with an open interest of 1,772.

Super Micro Computer stock crashed as much as 23% on Friday as investors worry about the strength of its upcoming earnings report.

Super Micro Computer announced it would release its third-quarter earnings results on April 30, but it didn't preannounce earnings as it did for its second-quarter earnings results in January.

That lack of an earnings preannouncement from Super Micro Computer sparked concerns on Wall Street that the company's upcoming earnings report won't be as robust as it was last quarter and could ultimately miss analyst expectations.

Super Micro Computer did not offer Wall Street "a positive preannouncement, which is being considered a negative," Wells Fargo Securities wrote on Friday, according to Bloomberg.

The company has experienced insane growth over the past year, as demand for its AI-equipped servers has soared. The stock, which surged more than 1,000% in a year, was catapulted into the S&P 500 from the small-cap Russell 2000 index earlier this year.

Nvidia chips are installed in Super Micro Computer's server solutions, so investors appear to be extrapolating the potential weakness in Super Micro Computer's upcoming earnings report to Nvidia.

Shares of Nvidia plunged as much as 10%, resulting in a market cap decline of $183 billion.

Unusual Stock Options Activity

Some notable call activity is being seen in $DraftKings(DKNG.US$, which is primarily being driven by activity on the May 10 Call. Volume on this contract is 14,995 versus open interest of 204.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, WSJ, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : ok nvda us option

103492747 : Good morning

On Paris : THANKS YOU

103492747 : TQ INFO

On Paris : Nice