Wall Street Gears Up for Rough Ride as Trader Bets on Volatility Ahead

Investors who reaped substantial gains from one of the most robust first quarters in decades for the S&P 500 Index are now bracing for what may lie ahead, as the potential for a further market rally contends with the prospect of a precipitous retreat.

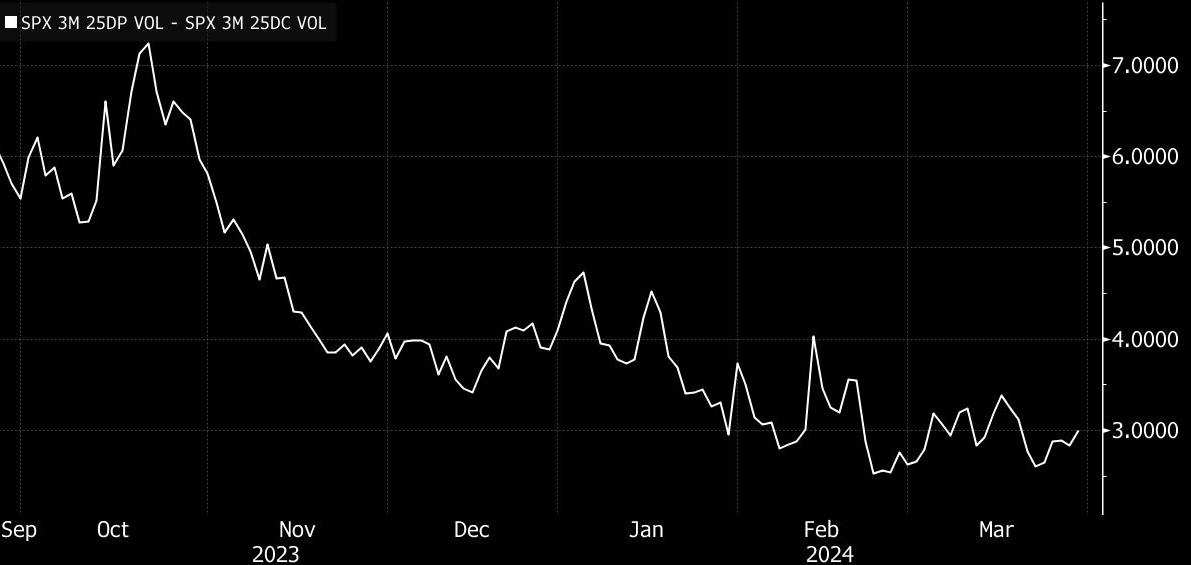

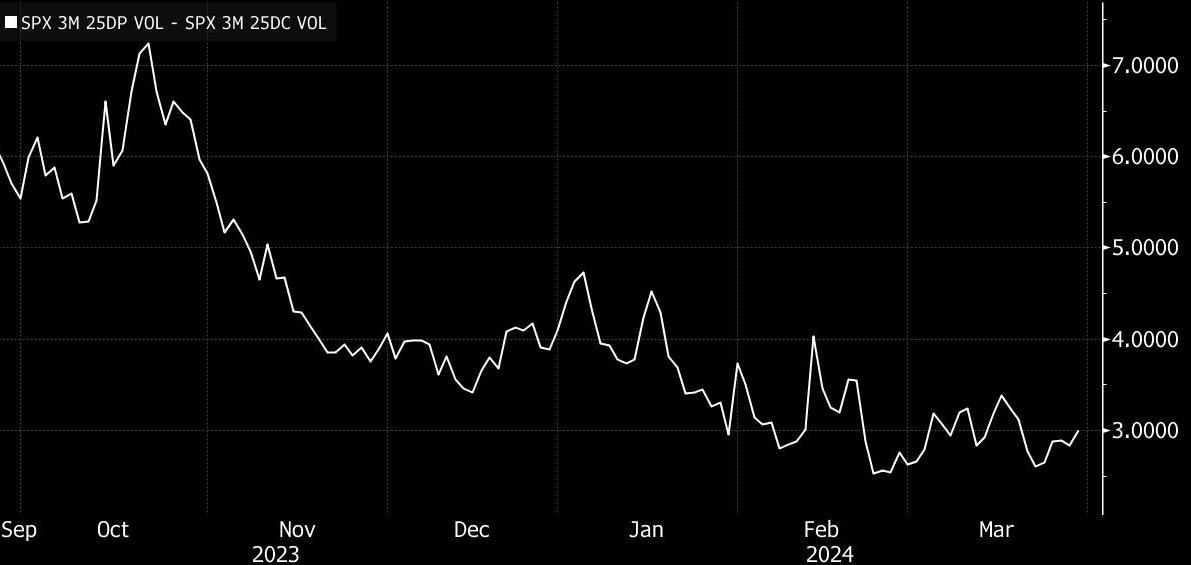

Amid this backdrop of optimism, many market participants have been quietly hedging against modest market declines. Notably, the premium for one-year bullish call options on the $S&P 500 Index(.SPX.US$—those with a 25% likelihood of expiring in-the-money, or 25-delta calls—has risen. Conversely, the cost for equivalent bearish put options has decreased, signaling a collective readiness for sustained market advances over concerns of a slight downturn.

However, the specter of significant market upheaval has not been dismissed, as evidenced by increased protective positioning for potential volatility spikes. According to data from Bloomberg, the $CBOE Volatility S&P 500 Index(.VIX.US$ saw average daily call volumes in the first quarter outpace the previous two quarters, pushing the Vix index elevated 16.64% year-to-date. Additionally, the index's two-month skew—comparing prices of 25-delta calls to equivalent puts—has hovered near a five-year peak.

As the stock market embarks on the second quarter from the lofty perch of all-time highs, the options market provides insights into trader sentiment. The demand for put options, which offer a payout in the event of a minor market correction, is near historic lows. In contrast, traders are discreetly increasing tail-risk hedges—financial instruments that provide substantial protection in the event of extreme market fluctuations.

According to Mandy Xu, a strategist at Cboe Global Markets Inc., investors are "not so concerned with valuations, earnings, or any of the other traditional catalysts that could prompt a correction. However, there's a palpable apprehension about potential black swan events that could cause volatility to surge markedly."

Amid decelerating inflation and the Federal Reserve's openness to interest rate reductions this year, the volatility of rates has plunged to its lowest point since February 2022. This has created an overall supportive environment for equities, as evidenced by the S&P 500's 10% surge in the first quarter—the index's most robust start since 2019. Moreover, it achieved 22 record highs in the initial three months of 2024.

With market gains largely driven by a select few stocks, investors are increasingly exploring opportunities in sectors that have been out of favor. Small-cap stocks are showing signs of resurgence, and the Nasdaq 100 Index, which is rich in technology stocks, lagged behind the more expansive S&P 500 in the first quarter—a reversal of its previous year's performance. To gauge market breadth, consider that over 70% of S&P 500 companies consistently traded above their 200-day moving averages—a streak not seen since 2021.

There are a number of tail risks that you can point to, and the market has moved a lot, so I'm not surprised to see demand for tail hedges," said Rocky Fishman, founder of derivatives analytical firm Asym 500, "I'm more surprised to see the lack of demand for basic hedges."

For the moment, such fears remain muted, and the anticipation of another robust earnings season may propel valuations to increasingly lofty levels. This is one reason why protective puts have fallen out of favor, and the pursuit of further rallies has taken precedence.

Source: Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment